What Is Cybersecurity In Financial Institutions?

Cybersecurity in financial institutions is the practice of protecting and safeguarding sensitive financial data from unauthorized access or attack by malicious actors. It is a critical component of financial institutions’ overall security strategy and is essential to ensure the security, integrity, and availability of customer data, financial transactions, and other proprietary information. Cybersecurity solutions typically include encryption, two-factor authentication, application security, data loss prevention, and penetration testing. By implementing these and other measures, financial institutions can help protect themselves and their customers from the increasing threats of cybercrime.

Definition of Cybersecurity in Financial Institutions

Cybersecurity in financial institutions is an incredibly important concept to grasp. It is essentially the practice of protecting the computer networks, systems, and data of an organization from unauthorized access, use, disclosure, destruction, or modification. This is especially important for financial institutions, as they handle and store sensitive information about customers, accounts, and transactions that could be extremely valuable to malicious actors. Cybersecurity in financial institutions encompasses a wide range of activities including risk assessment, system hardening, incident response, and employee security awareness. It is essential for financial institutions to have a comprehensive cybersecurity strategy in place in order to protect their networks, systems, and data from potential cyber threats.

The Scope of Cybersecurity in Financial Institutions

Cybersecurity is an ever-evolving and increasingly important aspect of financial institutions. As the world shifts towards a more digital economy, financial institutions must ensure they are protected from cyber threats. Cybersecurity in financial institutions involves protecting all aspects of their digital assets including computers, networks, emails, customer data, and more. It also involves protecting against fraud, identity theft, and other malicious activities. To ensure they are secure, financial institutions must have robust cybersecurity measures in place such as firewalls, antivirus software, and secure coding practices. Additionally, financial institutions should have procedures in place for responding to cyber incidents and regularly conduct risk assessments. It is also important for financial institutions to educate their staff about the importance of cybersecurity and how to protect their customer data. By doing so, financial institutions can reduce the risk of cyber attacks and protect their customers’ data.

Different Types of Cybersecurity Threats

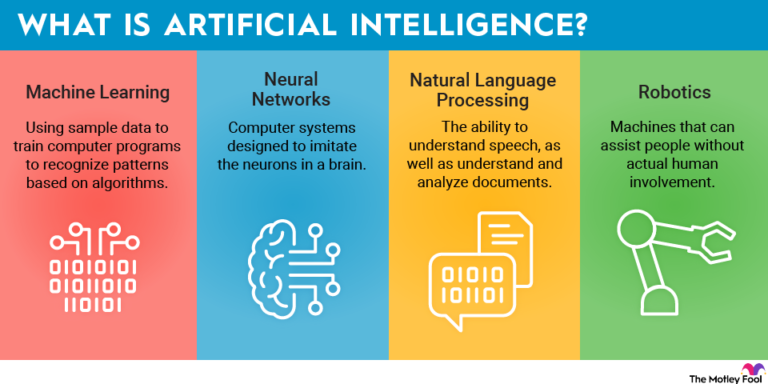

Financial institutions are increasingly vulnerable to cyber-attacks and other malicious activities due to the rapid growth and adoption of digital technologies. As such, cybersecurity is an increasingly important priority for these organizations. Cybersecurity is the practice of protecting networks, systems, and data from malicious activities and unauthorized access. It involves the use of security measures such as encryption, authentication, and access control to protect confidential data and ensure the safety of the institution’s systems.

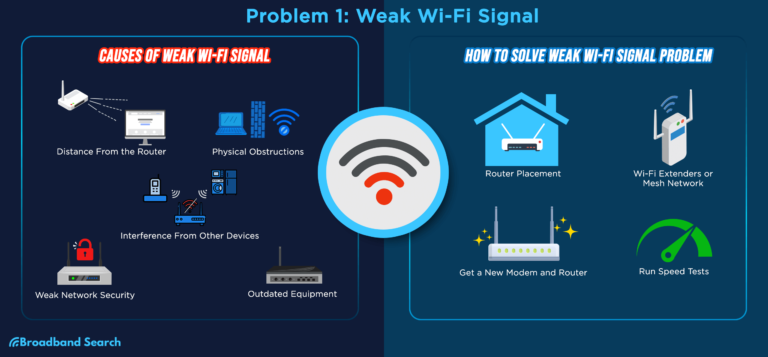

When it comes to financial institutions, there are a variety of different types of cybersecurity threats to be aware of. Some of the most common threats include phishing attacks, malware, ransomware, SQL injection attacks, and distributed denial of service (DDoS) attacks. Phishing attacks involve sending fraudulent emails or messages to trick users into giving up personal information or account credentials. Malware is malicious software that is designed to damage networks or systems, while ransomware is a form of malware that holds data or systems hostage until a ransom is paid. SQL injection attacks involve exploiting a website’s security vulnerabilities to gain access to sensitive information in its database. Lastly, DDoS attacks involve flooding a network with traffic to overwhelm its ability to function.

Financial institutions must be aware of all of these threats and take the necessary measures to protect their data and systems from attack. This includes implementing strong authentication protocols, encrypting all data, and regularly scanning for vulnerabilities. By taking the appropriate steps to protect their networks, systems, and data, financial institutions can reduce the risk of a cyber-attack and ensure the safety of their customers’ information.

Cybersecurity Regulations and Policies in Financial Institutions

Financial institutions are responsible for safeguarding customers’ data and assets, and are subject to stringent regulations. Cybersecurity regulations and policies are an important factor in ensuring the safety and integrity of financial systems. Cybersecurity regulations and policies are designed to protect financial institutions from cyber threats and malicious actors. These regulations and policies are generally divided into three categories: (1) Data Protection and Privacy; (2) Access Control and Authentication; and (3) Security Vulnerability Management.

Data Protection and Privacy policies are designed to ensure that customer data is stored securely and is not exposed to unauthorized access. These policies require financial institutions to implement measures such as encryption and access control to protect customer data. Access Control and Authentication policies require financial institutions to use strong authentication methods, such as multi-factor authentication, to ensure only authorized users can access customer data. Security Vulnerability Management policies require financial institutions to regularly monitor and patch any security vulnerabilities.

In addition to the regulations and policies, financial institutions are also required to develop and maintain a comprehensive cybersecurity strategy. This strategy should include a risk assessment process, incident response plans, and a system for monitoring and responding to cyber threats. Cybersecurity strategies should be regularly updated to ensure they remain effective in protecting customer data and assets.

Financial institutions must adhere to the regulations and policies set forth by government and industry bodies in order to maintain a safe and secure environment. By following these regulations and policies, financial institutions can better protect their customers’ data and assets from cyber threats.

Cybersecurity Strategies in Financial Institutions

In the modern digital world, cybercrime is a major concern for financial institutions. Attacks on financial networks and services can have devastating consequences, resulting in significant financial losses, theft of personal data, and reputational damage. Cybersecurity strategies are essential for protecting financial institutions from such attacks.

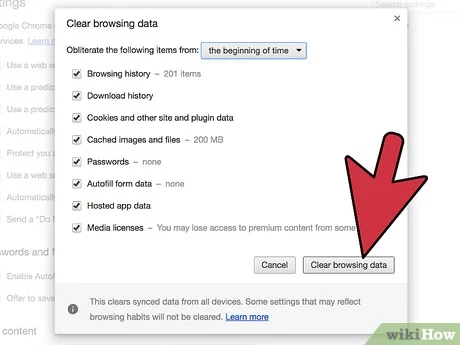

Financial institutions must implement a comprehensive cybersecurity program that includes risk assessment, system audits, employee training, and regular software updates. Risk assessment is a process of identifying potential security risks and their associated threats. System audits involve analyzing existing systems to identify weaknesses and vulnerabilities. Employee training is also important in order to reduce the risk of malicious activity. Regular software updates are necessary to ensure that systems remain secure and up-to-date.

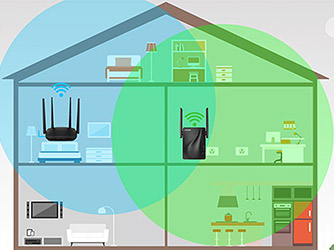

In addition, financial institutions should consider deploying additional security measures such as two-factor authentication, log monitoring, and encryption. Two-factor authentication provides an additional layer of security by requiring additional authentication, such as a code sent to a user’s mobile device, before granting access. Log monitoring allows for the monitoring of user activity on a network, while encryption ensures that data is securely stored and transmitted.

The implementation of effective cybersecurity strategies is essential for protecting financial institutions from cybercrime. By implementing a comprehensive cybersecurity program, financial institutions can ensure that their networks and services are secure and that their customers’ personal data is protected.

The Impact of Cybersecurity on Financial Institutions

The financial sector is no stranger to cyber threats. Hackers and cybercriminals are constantly looking for new ways to infiltrate the security systems of financial institutions, making cybersecurity an essential component of protecting customer data and preventing financial losses. Cybersecurity in financial institutions is a multi-faceted concept that covers a wide range of topics, from data protection to risk management. It is essential for financial institutions to have a comprehensive approach to cybersecurity that encompasses all aspects of their operations. This includes everything from developing robust security policies and procedures to regularly testing their systems for vulnerabilities.

When it comes to the impact of cybersecurity on financial institutions, the most obvious concern is the protection of customer data. Financial institutions are responsible for safeguarding customer information, including banking details, passwords, and other sensitive data. It is critical for them to have the appropriate measures in place to protect data and to ensure that customers are not exposed to any potential security risks.

Additionally, by having a strong cybersecurity strategy in place, financial institutions can help reduce the risk of financial losses due to cyber-attacks. Cyber-attacks can lead to significant losses as a result of stolen funds, disrupted operations, and reputational damage. Having a comprehensive cybersecurity strategy in place can help to minimize the risk of such losses.

Finally, financial institutions must also be aware of the implications of cybersecurity on their regulatory compliance. Many countries have laws and regulations in place to protect customer data and to ensure the security of financial systems. Financial institutions must ensure that they are in compliance with these regulations in order to avoid any potential legal issues.

Overall, cybersecurity is an essential tool for protecting customer data and preventing financial losses in the financial sector. Financial institutions must have a comprehensive approach to cybersecurity that encompasses all aspects of their operations in order to ensure the safety of their customers and the security of their systems.

FAQs About the What Is Cybersecurity In Financial Institutions?

1. What measures are used to protect financial institution data from cyber threats?

Answer: Cybersecurity measures used by financial institutions include data encryption, multi-factor authentication, and secure server infrastructure. Financial institutions also use anti-virus software, firewalls, and other security protocols to protect their data.

2. What is the purpose of cybersecurity in financial institutions?

Answer: The purpose of cybersecurity in financial institutions is to protect confidential customer data and financial information from unauthorized access or malicious attacks. This helps ensure the safety and security of customer funds and financial transactions.

3. What should customers do to protect themselves from cyber threats?

Answer: Customers should always use strong passwords and two-factor authentication when accessing their financial accounts. They should also ensure their operating system and anti-virus software are always up to date. Additionally, customers should never share their personal or financial information with anyone, and should always be aware of phishing scams and other cyber threats.

Conclusion

Cybersecurity in financial institutions is an essential measure to protect the assets of the institution, the customers, and the employees from cyber-attacks. By implementing the latest technologies, security protocols, and training programs, financial institutions can help ensure that their systems remain secure and their customers’ data remains safe. Cybersecurity in financial institutions is an ongoing process that requires regular updates, training, and maintenance. With the ever-evolving cyber threats, it is important for financial institutions to stay ahead of the game and remain vigilant in safeguarding their systems and data.