Why Is Insurance Technology Important?

Insurance technology, or insurtech, is a rapidly growing industry that is revolutionizing how insurance companies do business. Insurtech refers to technological innovations that are being used to streamline and improve the insurance industry in terms of customer service, cost savings, and more efficient processes. Insurtech is particularly important in today’s digital age, where customers expect quick responses and personalized service. Insurtech can help insurance companies better understand their customers’ needs and provide better services. It can also provide access to new markets and customers, and reduce overhead costs. Ultimately, insurtech helps insurance companies remain competitive and improve their business operations.

Definition of Insurance Technology

Insurance technology, or insurtech, is the use of technology to improve insurance operations. It encompasses a wide range of topics, from the development of new products and services to digital transformation initiatives and the application of data and analytics. Insurtech is rapidly changing the way insurance companies operate and serve their customers. By leveraging technological advancements, insurers are able to provide more comprehensive, personalized coverage, improved customer service, and better management of insurance risk. Furthermore, insurtech enables insurers to reach more customers, reduce costs, and increase efficiency. With insurtech, insurers can leverage data and analytics to better understand their customers and develop better products. In addition, insurers can use technology to deploy new products and services faster, allowing them to stay ahead of the competition. Finally, insurtech enables insurers to quickly respond to changes in the market and customer needs with greater agility. In short, insurance technology is revolutionizing the insurance industry and transforming the way insurers do business.

Benefits of Insurance Technology

Insurance technology, or InsurTech, is revolutionizing the way businesses and individuals purchase and manage insurance. This new wave of technology provides a range of tools, from policy comparison and quote management to automated claims processing and fraud detection. InsurTech can save time, money, and resources, while providing a higher level of customer service. In this article, we’ll explore the benefits of InsurTech, from cost-savings to improved customer service.

First, InsurTech can help reduce the cost of insurance by automating processes such as policy comparison and claims processing. Automating these processes eliminates costly and time-consuming manual processes, which can lead to significant cost-savings. Additionally, InsurTech can provide businesses and individuals with access to more competitive rates and policies, as well as tools to help them make more informed decisions.

InsurTech can also provide improved customer service. By automating processes, InsurTech can provide customers with faster service, more accurate information, and easier access to the services they need. Additionally, InsurTech can provide customers with more personalized service, as the technology is able to identify customer needs and provide tailored solutions.

Finally, InsurTech can provide businesses and individuals with better protection against fraud. InsurTech can detect potential fraudulent activity and help businesses and individuals take steps to protect themselves. Additionally, InsurTech can provide businesses with access to tools that can help them better manage their risk and protect their assets.

In conclusion, InsurTech can provide a range of benefits, from cost-savings to improved customer service. By taking advantage of InsurTech, businesses and individuals can save time, money, and resources, while ensuring better protection against fraud.

Challenges of Implementing Insurance Technology

In the ever-changing world of insurance, technology has become an invaluable tool for managing risk. As insurers face rising customer expectations and the need to remain competitive, technology is playing an increasingly important role in providing better customer service and managing risk. However, implementing insurance technology can be a challenge for insurers.

The key challenge for insurers is the cost and complexity of integrating new systems into their existing infrastructure. While technology can help insurers streamline processes, reduce costs, and improve customer service, the cost of implementing and maintaining these systems can be high. Additionally, insurers must also factor in the need for training staff to use the new systems.

Another challenge with implementing insurance technology is the need to comply with industry regulations. As insurers strive to meet the regulatory requirements of their industry, they must ensure that their technology solutions are compliant. This can be a challenge for insurers, as new regulations are constantly being introduced and existing regulations can be complex and difficult to interpret.

Finally, insurers must also consider the security of their data when implementing insurance technology. As insurers collect and store large amounts of customer data, they must ensure that their systems are secure and any sensitive information is protected.

Overall, implementing insurance technology can be a challenge for insurers. From the cost and complexity of integrating new systems into their existing infrastructure, to the need to comply with industry regulations and ensure the security of data, insurers must take all these factors into consideration when looking to implement new technology solutions.

Impact of Insurance Technology on the Insurance Industry

Insurance technology, or Insurtech, is a rapidly growing industry that has revolutionized the way insurers do business. From automated underwriting and claims processing to customer relationship management and risk management, Insurtech has enabled insurers to increase their efficiency, reduce costs, and improve customer service. Insurtech has also enabled insurers to offer tailored products and services to meet the needs of customers from all walks of life. As a result, insurers are now able to better serve their customers and provide more value for their money.

Insurtech has also had a significant impact on the insurance industry. Insurtech has created new opportunities for insurers to expand their customer base and increase their market share. By leveraging data and analytics, insurers can better understand their customers and offer them better products and services. Additionally, Insurtech has helped insurers to better manage risk and reduce premiums. As a result, insurers are now better able to compete in the market and offer competitive rates.

Finally, Insurtech has enabled insurers to better understand the needs of their customers. By providing an enhanced customer experience, insurers are now able to better serve their customers and build long-term relationships with them. This has enabled insurers to increase customer loyalty and retention, resulting in increased revenues and profitability.

In summary, Insurtech has had a profound impact on the insurance industry. Insurtech has enabled insurers to improve efficiency, reduce costs, and offer better products and services. Additionally, Insurtech has improved insurers’ ability to manage risk and build customer loyalty. As a result, insurers are now better able to compete in the market and offer competitive rates.

Examples of Insurance Technology

Insurance technology, or insurtech, refers to the use of innovative technology to improve the efficiency and effectiveness of insurance services. The advent of insurtech has made it easier for insurers to access and process information, as well as reduce costs and expand operations. Examples of insurance technology include predictive analytics, mobile payments, digital document storage and customer relationship management (CRM) tools.

Predictive analytics is a powerful tool that enables insurers to analyze data and make accurate predictions about customer behavior, risk exposure, and financial performance. This technology helps insurers assess and manage risk more effectively, allowing them to provide better coverage at lower prices. Mobile payments, meanwhile, allow customers to pay their premiums quickly and conveniently.

Digital document storage is another example of insurtech that is quickly becoming a standard for insurers. This technology allows insurers to store customer data securely, while also providing customers with easier access to their documents. Additionally, digital document storage can reduce the time and cost associated with filing and retrieving documents.

Finally, CRM tools provide insurers with the ability to track customer interactions and segment customers into different groups based on their needs and preferences. This technology allows insurers to provide personalized services and build relationships with customers.

Overall, insurance technology is transforming the industry, making it easier for insurers to manage risk, streamline operations, and provide better services to customers. By leveraging the latest technology, insurers can reduce their costs and expand their operations.

Future of Insurance Technology

Advancements in technology have revolutionized the insurance industry. Insurance technology (InsurTech) is the application of technology to insurance processes and operations. InsurTech has become an essential part of the insurance industry as it enables insurers to provide more efficient, cost-effective, and customer-friendly services.

InsurTech enables insurers to streamline their operations, reduce overhead costs, process claims faster, and improve customer service. With the help of InsurTech, insurers can also access large amounts of data, analyze it in real-time, and use the insights to make more informed decisions. InsurTech is being used in areas such as automated underwriting, customer service automation, fraud detection, pricing, and personalized customer experience.

In the near future, InsurTech is expected to become even more important as the industry continues to develop. InsurTech can help insurers to identify and mitigate risks, offer better products and services, reduce costs, and provide improved customer experiences. InsurTech can also help insurers to remain competitive in the market by offering innovative products and services that are tailored to their customers’ needs.

InsurTech is paving the way for a more efficient, cost-effective, and customer-centric insurance industry. As the industry continues to evolve, InsurTech is likely to become even more important and play a major role in the future of the insurance industry.

FAQs About the Why Is Insurance Technology Important?

1. What are the benefits of insurance technology?

Answer: Insurance technology provides a number of benefits including increased efficiency, improved customer service, improved accuracy, reduced time to market, and reduced costs.

2. How does insurance technology help insurers?

Answer: Insurance technology can help insurers by automating processes, streamlining workflows, and providing access to real-time data. This can help insurers make informed decisions quickly and accurately, allowing them to better serve their customers.

3. What are the key components of insurance technology?

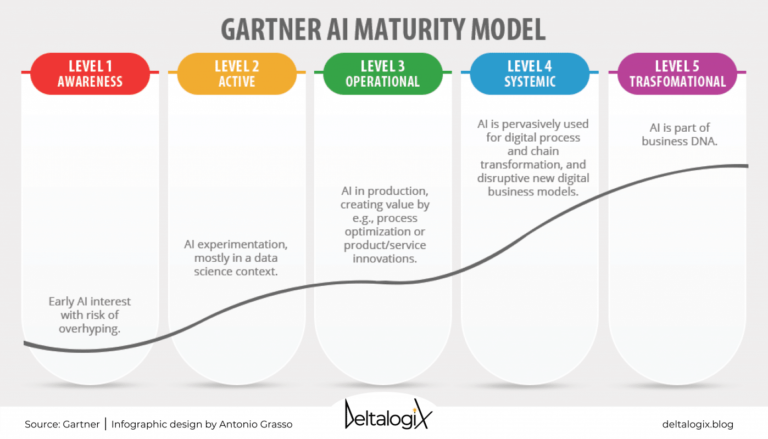

Answer: The key components of insurance technology include automation, data analytics, artificial intelligence, and cloud computing. These tools can help insurers to better manage their data and processes, improve customer service, and reduce costs.

Conclusion

Insurance technology is an incredibly important tool for the insurance industry as it provides numerous advantages to both insurers and customers. It enables insurers to process claims faster and more accurately, while also enabling them to provide customers with more tailored and personalized services. Furthermore, it helps insurers better manage their risks, protect their assets, and increase their efficiency and profitability. As such, insurance technology is an essential tool for the insurance industry and its customers.