Why Fintech Is Difficult?

Fintech is a rapidly evolving sector of the financial services industry and represents a disruptive force in the traditional financial services landscape. It is a relatively new concept, and many of its technologies and services are still being developed. As a result, it can be difficult to understand and assess the potential benefits and risks associated with fintech.

The complexity of fintech is due to its multiple layers of technology, which require a high level of expertise. Fintech involves integrating technology with traditional financial services, which requires a deep understanding of both fields. Additionally, there are regulatory and compliance considerations that must be taken into account when developing and deploying fintech products and services. This can be a challenging and time-consuming process for those unfamiliar with the industry.

Finally, because of its newness, there is still a great deal of uncertainty surrounding fintech and its potential impact on the industry. This lack of clarity can make it difficult for organizations to plan for the future and make informed decisions about how to use fintech to their advantage.

In summary, fintech is a complex field that requires a deep understanding of both technology and financial services. Additionally, there are a number of regulatory and compliance issues that must be addressed when deploying fintech products and services. Finally, the lack of clarity about the future of fintech can make it difficult to plan for the future.

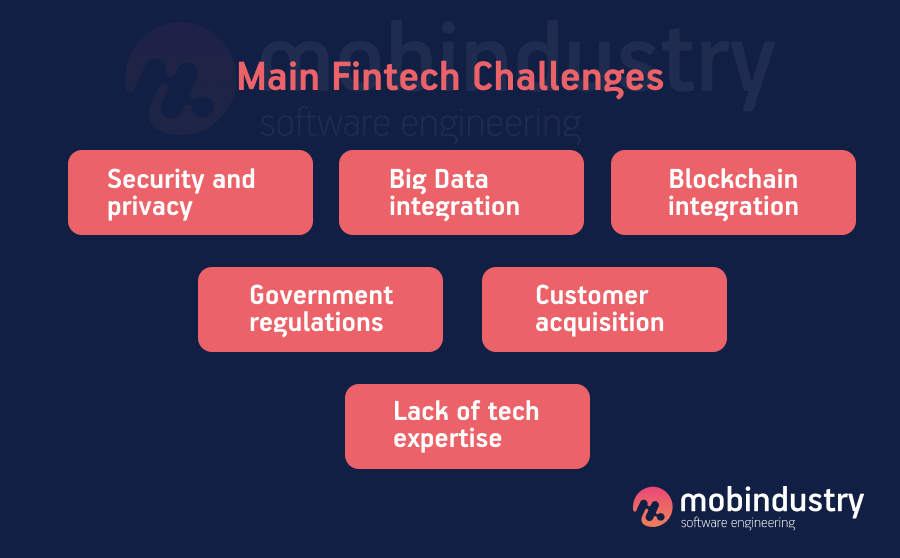

Challenges Fintech Presents

Fintech, or financial technology, is an emerging and rapidly changing field that is evolving the finance industry as we know it. It is the use of technology to drive financial services innovation and provide access to financial services to people who may not have had access before. This technology is revolutionizing the way financial products and services are delivered, and this comes with a unique set of challenges.

There are several challenges that Fintech presents, including the need for a deep understanding of the finance industry and its regulations, the requirement for specialized technical skills, and the ability to provide secure and reliable services. Fintech companies must also ensure they are compliant with all applicable laws and regulations, which can be difficult to keep up with given the rapid pace of change in the industry. Additionally, Fintech companies must also be aware of the potential for fraud and security breaches, which can be a major challenge for companies trying to provide secure and reliable services.

Fintech is a fast-paced and ever-changing environment, which presents its own unique challenges. Companies must be able to stay on top of the latest trends and technologies, while also ensuring they remain compliant with all applicable laws and regulations. Additionally, companies must also be sure to provide secure and reliable services, as well as prevent fraud and other security breaches. The challenges presented by Fintech are difficult, but with the right approach, companies can overcome these challenges and be successful in the industry.

Regulation and Compliance Issues

Fintech, or financial technology, has become increasingly popular in recent years with companies striving to make financial services more accessible. However, the industry is not without its challenges. One of the biggest issues facing fintech companies is the need to adhere to complex regulations and compliance requirements. Companies must ensure that their products, services, and practices comply with laws and regulations, and this can be a difficult and time-consuming process. Regulatory compliance is also a key concern due to the nature of fintech, as companies often handle sensitive customer data and must take measures to protect it. Companies must also be proactive in keeping up with the constantly changing regulations and laws, as failure to do so can lead to hefty fines and penalties. In order to remain compliant, fintech companies must have a clear understanding of the applicable regulations and must be prepared to adapt quickly to any changes.

Consumer Protection

Fintech is a rapidly growing sector, but it also poses significant risks to consumers. Consumer protection is a key concern for regulators and companies alike, as it is a major factor in ensuring that customers receive fair and transparent services. Companies must adhere to strict guidelines when providing financial services and products to their customers. This includes ensuring that customers are aware of the risks associated with certain products or services and that customers have the opportunity to give informed consent. Additionally, companies must be able to protect customers’ personal data, as well as provide accurate and up-to-date information about the services they offer. Companies must also provide clear and robust dispute resolution and complaint procedures and be willing to resolve any customer issues in a timely manner. Fintech companies must also comply with all applicable laws and regulations, including those related to anti-money laundering and consumer protection. As the sector continues to evolve, it is important that companies keep up with the latest trends and ensure that they are meeting the highest standards of consumer protection.

Security and Data Protection

Fintech is a complex and rapidly evolving industry, and it is essential to ensure that the data and security of consumers is maintained. Data security is a major challenge for fintech companies, due to the highly sensitive nature of the data they handle. This means that companies must be aware of the various regulations and compliance standards they must follow to ensure that their customers’ data is kept secure. Additionally, companies must have the necessary infrastructure and technologies in place to protect against external threats, and must regularly monitor their systems for any unauthorized access or breaches. Fintech companies must also be aware of the various data privacy laws and regulations that apply to their business, and must ensure that they are compliant with these laws. With the ever-increasing risk of cyber-attacks, fintech companies must take additional steps to protect their customers’ data and ensure that their data is secure.

The Technical Side of Fintech

Fintech is challenging due to its complexity. It involves a multitude of technologies, applications, and processes that must be carefully managed to ensure a successful financial technology solution. The technical aspects of fintech can be difficult to comprehend, as they involve a variety of cross-functional activities. From integration with existing systems to data security, there are many considerations that must be taken into account when implementing a fintech solution.

Besides the complexity of fintech, the technology is constantly evolving and new technologies are being introduced on a regular basis. This means that companies must stay on top of the latest trends and technologies in order to remain competitive. The ability to keep up with the changing landscape can be difficult, as it requires a deep understanding of the technology and the implications of new developments.

Furthermore, fintech solutions must meet the stringent requirements of financial institutions, such as compliance with financial regulations, data privacy, and security. This can be difficult to achieve, as the technology must be designed in such a way that it meets these requirements without compromising on features or performance.

In order to successfully implement a fintech solution, companies must have a deep understanding of the technical aspects of the technology. This includes understanding the implications of new technologies, the ability to integrate with existing systems, and the ability to meet the regulatory requirements of financial institutions.

The Future of Fintech

Fintech, or financial technology, has seen tremendous growth in recent years, and is expected to continue to grow in the foreseeable future. The term “fintech” encompasses a wide array of technologies and methods that are used to improve and streamline financial services and processes. This includes the use of financial software, data analysis, and digital payment systems, among other advancements. As the sector develops further, it is becoming increasingly difficult for companies to keep up with the ever-evolving technology and regulations.

Competition is also intense, as many traditional financial institutions are now entering the fintech space in order to stay ahead of the competition. There is also a growing need for companies to develop strategies that will help them remain competitive and remain profitable. This means that companies must continuously innovate and adapt in order to stay ahead of the competition.

In addition, the complexity of the fintech space can make it difficult to develop successful strategies. Companies must understand the nuances of the technology and regulations, as well as the changing customer preferences and demands. Additionally, companies must also consider the cost of implementing and maintaining the technology, as well as the potential risks associated with it.

Finally, the regulatory environment can be a major barrier to success in the fintech sector. Companies must be aware of the various regulations that apply and be prepared to navigate them in order to remain compliant.

All of these factors make the fintech space an incredibly difficult one to navigate. Companies must remain agile and constantly innovate in order to remain competitive and successful in the sector. It is clear that the future of fintech will be a difficult one, but those that are able to navigate these challenges will be the ones that succeed.

FAQs About the Why Fintech Is Difficult?

Q. What makes fintech so difficult?

A. Fintech is a complex field that involves a combination of financial, technology, and legal concepts. This complexity means that there is a lot to learn and understand before you can successfully develop and deploy a fintech product.

Q. What types of skills are needed to work in fintech?

A. Depending on the role, you may need a combination of technical, financial, and legal skills. Technical skills can include programming, data analysis, and cybersecurity. Financial skills can include understanding of markets, regulations, and financial products. Legal skills can include understanding of contracts, corporate law, and regulatory compliance.

Q. What are the biggest challenges for fintech companies?

A. Fintech companies face a number of challenges, including complicated regulations, customer data security, and rapidly changing technology. Additionally, fintech companies must also navigate a competitive landscape with established players and new entrants.

Conclusion

In conclusion, Fintech is a challenging and complex field to navigate, as it requires a strong understanding of technology, finance, and regulations. It can be difficult to stay on top of the ever-changing regulations and the technical challenges that come with creating and maintaining financial technology. Furthermore, it requires a certain level of risk-taking and innovation that not all companies are comfortable with. Despite the difficulty, Fintech is a necessary component of the financial industry that is here to stay, and the companies that are able to succeed will be those that can develop and implement the best solutions.