Which Is The Fastest Growing Fintech Market In The World?

The financial technology (fintech) sector is one of the fastest-growing industries in the world. Fintech companies are leveraging advancements in technology to develop innovative products, services, and solutions that are transforming the way financial services are delivered. According to an Accenture report, the global fintech market is expected to grow to $309 billion by 2022.

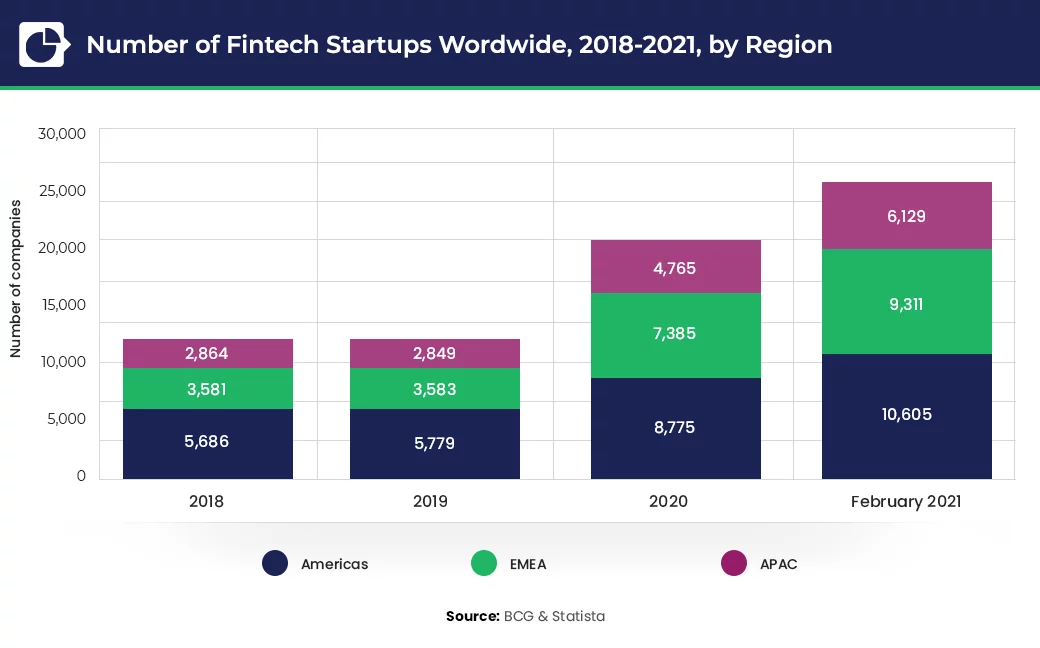

The Asia-Pacific region is leading the way in terms of fintech growth. China, India, and Japan are some of the biggest markets in the region, and they are seeing significant investments in fintech. In China, for example, the total fintech investment was $25 billion in 2018, a massive increase from just $7.3 billion in 2017. This makes China the fastest-growing fintech market in the world.

With governments in the region actively promoting the development and adoption of fintech, the Asia-Pacific region is well positioned to maintain its lead in the fintech space over the coming years.

Overview of the Fintech Market

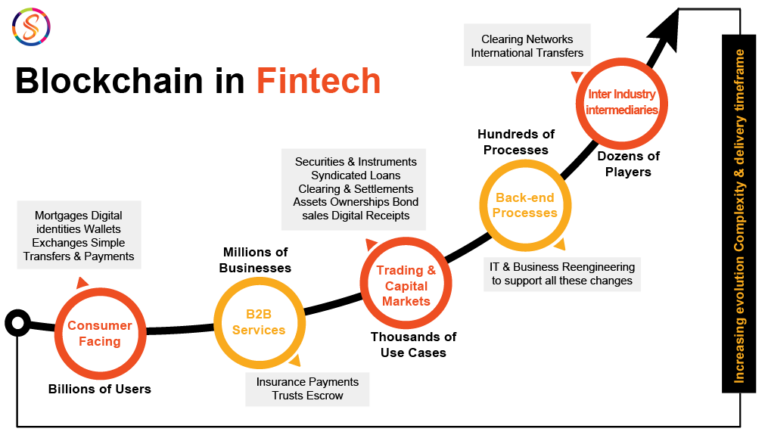

The financial technology (fintech) industry is rapidly evolving and has become one of the most lucrative markets in the world. Fintech firms are leveraging the latest technologies, such as artificial intelligence, machine learning, blockchain, and the internet of things, to revolutionize the traditional banking and financial services. Fintech firms are quickly becoming the preferred choice for individuals and businesses alike, as they can provide faster and more secure financial services, with improved customer experience.

The growing popularity of fintech companies has resulted in an exponential growth in the global fintech market. According to industry experts, the global fintech market is expected to reach a value of $305 billion by 2025.

The world’s fastest-growing fintech market is China, which is currently the largest fintech market in the world. China is leading the way in fintech innovation, due to its vast population, its growing middle-class, and its rapidly advancing technological infrastructure. According to a recent report, China’s fintech market is expected to grow at a staggering compound annual growth rate (CAGR) of 15.7% between 2020 and 2025.

The US is the second-largest fintech market in the world, with a market value of $141 billion in 2020. The US fintech market is expected to grow at a CAGR of 10.3% between 2020 and 2025, driven by increasing investments in technology and the growing demand for digital banking services.

India is the third-largest fintech market in the world, with a market value of $73 billion in 2020. India is expected to be the fastest-growing fintech market in the world, with a CAGR of 18.9% between 2020 and 2025.

The UK is the fourth-largest fintech market in the world, with a market value of $59 billion in 2020. The UK fintech market is expected to grow at a CAGR of 12.3%, driven by increasing investments in technology and the growing demand for digital banking services.

The European Union is the fifth-largest fintech market in the world, with a market value of $50 billion in 2020. The European fintech market is expected to grow at a CAGR of 9.9%, driven by increasing investments in technology and the growing demand for digital banking services.

Overall, the fintech industry is experiencing explosive growth, and the fastest-growing fintech markets are China, the US, India, the UK, and the European Union. As the industry continues to evolve, these markets are expected to continue to be the most lucrative for fintech investments.

Global Fintech Market Analysis

The fintech industry is rapidly growing around the world, as an increasing number of businesses are opting to adopt technological solutions to improve their operations. To understand the dynamics of the industry, it is important to analyze the fastest growing fintech markets in the world. According to research conducted by the World Economic Forum, the Asia-Pacific region is the fastest-growing fintech market in the world.

The region is home to strong economies such as Japan, China, and India. These countries have invested heavily in fintech startups and have seen huge growth in their fintech sectors. China has become the leading fintech market with a market size of $1.9 trillion. Japan and India are also making great strides in the sector and are expected to be the top contributors in the near future.

The US is another key market for fintech. The US has a strong financial system and is home to numerous financial institutions. The country also has a vibrant startup culture and has seen a surge in the number of fintech companies in the country. The US is expected to remain the top fintech market in the world for the foreseeable future. Other countries such as the UK, Canada, and Australia are also catching up and are expected to be leading players in the sector soon.

The global fintech market is growing at a rapid pace. The trend is expected to continue in the near future as more businesses opt to utilize technological solutions to improve their operations. Governments are also investing heavily in the sector and are creating favorable conditions for fintech startups to thrive. As the industry grows, it is important for businesses to keep an eye on the emerging trends and take advantage of the opportunities available in the market.

Regional Factors Affecting Fintech Growth

Fintech markets are growing faster than ever before, as technological advances continue to open up new opportunities for financial service providers. But which region is experiencing the most rapid growth in the fintech sector? Regional factors are playing a major role in determining the growth of fintech in different parts of the world.

The most obvious factor is the availability of financial infrastructure. In developed countries such as the United States and Europe, traditional financial institutions have been in operation for many decades. This means that there is already an established infrastructure in place for the development of new fintech services. On the other hand, emerging markets such as China and India have only just begun to develop their financial systems, leaving ample room for fintech to flourish.

Regulations also have a huge impact on the growth of fintech in different countries. Countries with more permissive regulations tend to have higher levels of fintech adoption. For example, the United Kingdom has seen a tremendous amount of growth in the fintech sector due to its progressive regulatory framework. On the other hand, countries such as China and India are much more restrictive in their regulations, which has resulted in slower growth in the fintech sector.

Finally, consumer demand is a key factor in determining the growth of fintech markets. In countries where financial services are not traditionally accessible, there is often a large untapped demand for innovative solutions. This demand can be seen in markets such as India and Africa, where fintech services are becoming increasingly popular.

Overall, regional factors have a major influence on the growth of the fintech sector. The availability of financial infrastructure, regulations, and consumer demand are all key factors that will determine the success of fintech markets in different parts of the world.

Key Players in the Fintech Market

The global fintech market is rapidly expanding, and the competition is fierce. With the world’s leading financial institutions investing heavily in the sector, it is no surprise that the fastest-growing fintech markets are in the U.S., China, India, and the U.K. Each of these countries has its own unique ecosystem of financial technology companies, and the competition in each of these markets is intense.

In the U.S., the fintech market is dominated by established players like PayPal, Square, and Stripe, but there is also a growing number of startups that are shaking up the sector. In China, WeChat, Alipay, and Ant Financial are leading the way, while India is home to startups like Paytm and MobiKwik. The U.K. is also a hotbed of fintech activity, with the likes of Revolut and Monzo leading the way.

These companies are leveraging the latest technologies to revolutionize the way we manage our money, from digital banking and payments to financial investing and insurance. They are also driving innovation in areas such as artificial intelligence, blockchain, and data analytics, creating new opportunities for consumers and businesses alike.

As the global fintech market continues to expand, the competition among the world’s leading markets is only going to intensify. It will be interesting to see which players emerge as the frontrunners in the coming years.

Emerging Trends in the Fintech Market

Fintech has grown exponentially in the past decade, and the market is expected to continue to expand in the years to come. As financial technology becomes more advanced, the need for more sophisticated services and products is on the rise. As such, it is important to understand the current trends in the fintech market and which markets are experiencing the most growth.

One of the primary trends in the fintech market is the increasing prevalence of mobile banking services. Mobile banking has become increasingly popular as more people are opting for the convenience of banking on the go. Additionally, the emergence of digital wallets and cryptocurrency have allowed users to make payments and transfers with greater ease and security.

Another trend in the fintech market is the rise of AI and machine learning technologies. AI and machine learning have allowed for more efficient data analysis and predictive analytics, and this has enabled financial institutions to better understand customer needs and provide more personalized services.

The Asia-Pacific region has experienced the most growth in the fintech market with China, India, and Japan leading the way. These countries have seen rapid economic growth and have vast populations, making them ideal for the implementation of fintech services. Additionally, governments in these countries have been supportive of fintech initiatives due to the potential for job creation and economic expansion.

Overall, the fintech market is expected to continue to grow and evolve in the years to come. With the emergence of new technologies and the growing demand for financial services, fintech provides a platform for businesses to innovate and create new ways to serve their customers. As such, it is essential for financial institutions to stay informed about the latest trends and developments in the fintech market in order to remain competitive.

Conclusion

Fintech markets are rapidly growing around the world as more and more individuals and businesses incorporate digital financial services into their lives. With the rise of digital banking, payments, and investments, the industry is expected to only become more profitable in the future. While the US and UK are the two biggest Fintech markets in the world, Asian countries are quickly gaining ground. China, India, South Korea, and Japan are all leading the charge with high rates of technological advancement, investment, and consumer adoption. Each of these countries is experiencing rapid growth in the Fintech space and is set to become a major player in the global market. As the Fintech industry continues to evolve, it will be interesting to see which markets come out on top.

FAQs About the Which Is The Fastest Growing Fintech Market In The World?

1. What factors make a fintech market grow quickly?

Answer: Factors that contribute to the growth of a fintech market include increased consumer demand for financial services, technological advancements, and supportive government policies.

2. What is the current fastest growing fintech market in the world?

Answer: The current fastest growing fintech market in the world is the Asia Pacific region, with China, India, and Indonesia leading the way.

3. How can I take advantage of the fastest growing fintech markets?

Answer: You can take advantage of the fastest growing fintech markets by researching and investing in the market, or by partnering with a company that specializes in the field. Additionally, you can consider setting up a business in the region and taking advantage of the favourable policies for fintech companies.

Conclusion

The answer to which is the fastest growing fintech market in the world is China. There are several reasons for this, such as the rapid growth in consumer demand for new and innovative financial services, as well as the country’s strong regulatory environment that encourages the development of fintech. China is also home to some of the world’s leading fintech companies, such as Ant Financial, which is a global leader in mobile payments and digital banking. In addition, Chinese consumers are increasingly turning to digital wallets and other digital payment solutions, which has further fueled the growth of fintech in the country. As such, China is set to remain the fastest growing fintech market in the world for the foreseeable future.