Which Is The 3rd Largest Fintech Ecosystem Globally?

The 3rd largest fintech ecosystem globally is the United Kingdom, an established hub for financial technology innovation. London, the UK’s financial and technology center, is home to over 5,000 fintech companies, including some of the world’s leading players in this sector. The UK is a leading destination for venture capital investment in fintech, with the sector having attracted over £3 billion in the last five years. The UK government has provided significant support for the fintech industry, with initiatives such as the launch of the London-based Fintech Innovation Lab accelerator program. The UK also has a comprehensive regulatory framework for fintech, making it an attractive destination for companies in this sector.

Introduction

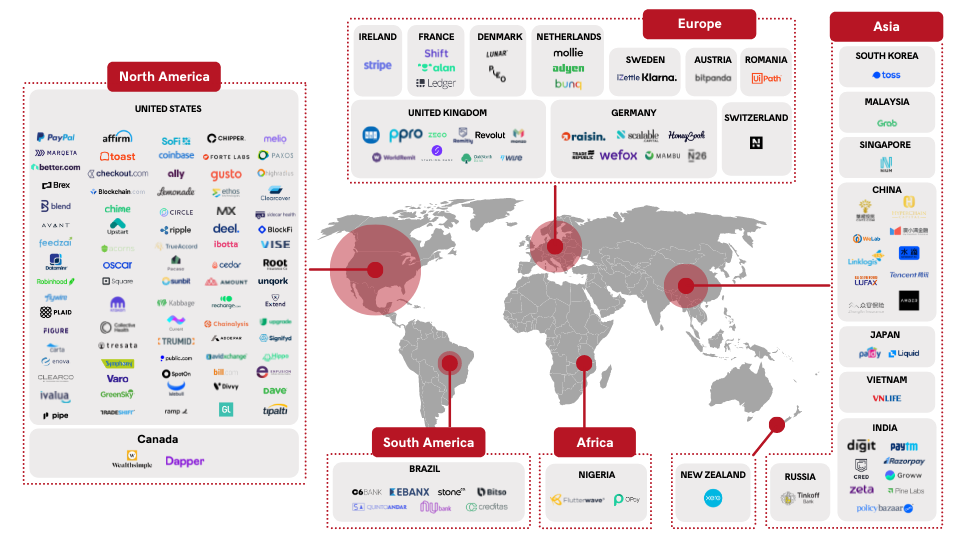

The financial technology (fintech) industry is rapidly transforming the world of finance. For consumers, fintech services offer more efficient and convenient ways to manage their money, and for businesses, these services provide opportunities to reduce costs, increase profits, and streamline operations. With the increasing popularity of fintech, it can be difficult to keep track of which countries have the biggest and most influential fintech ecosystems. According to a recent report, the United States and China are the two largest fintech ecosystems in the world. But what about the third largest fintech ecosystem? That title belongs to the United Kingdom.

The UK has established itself as a global leader in fintech, boasting the third-largest fintech ecosystem in the world. This is due in part to the country’s strong regulatory environment and supportive government initiatives, as well as its position as a hub for innovative financial services. The UK is home to a number of world-leading fintech companies, including Monzo, Transferwise, and Revolut, and the country has seen a surge in venture capital investment in recent years, with £11.3 billion invested between 2017 and 2018 alone.

Overview of the Global Fintech Ecosystem

Fintech is an ever-expanding industry that has revolutionized the way we conduct financial transactions. Every day, new and innovative technologies are released that have the potential to revolutionize the financial services sector. But what is the current landscape of the fintech ecosystem? Which countries are leading the way when it comes to fintech innovation?

The United Kingdom is currently considered to be the largest fintech ecosystem globally. It is home to a variety of fintech firms, banks, and other financial services providers. This has led to the emergence of a vibrant and dynamic fintech industry that is making waves in the sector.

The United States is the second-largest fintech ecosystem globally. It is home to some of the world’s most influential financial services providers, including the likes of Goldman Sachs, JP Morgan Chase, and Citigroup. The US also has a number of well-established fintech firms, such as Stripe, Plaid, and Coinbase.

China is the third-largest fintech ecosystem globally. It is home to a variety of fintech firms, such as Ant Financial, Tencent, and JD Finance. China is also home to a thriving venture capital sector that is supporting the growth of the fintech industry.

The global fintech ecosystem is an ever-evolving industry. As new technologies emerge and new companies enter the market, the landscape is constantly changing. By understanding the current landscape and analyzing the latest trends, we can gain a better understanding of the fintech industry and its potential for future growth.

Identifying the Third Largest Fintech Ecosystem

Globally

The global fintech industry is rapidly growing due to the increasing demand for innovative financial services. While the United States remains the leader in the global fintech space, other countries such as India, China, Singapore, and the United Kingdom are also emerging as significant players. Among these countries, which is the third largest fintech ecosystem globally?

The answer is India. India has the world’s third largest fintech ecosystem, which is currently valued at over $33 billion and is projected to reach $73 billion by 2022. This is due to the country’s booming digital economy, which has seen significant growth over the past few years. India’s fintech industry has attracted major investments from both domestic and international investors, including SoftBank, Tiger Global, and Sequoia Capital.

India’s fintech ecosystem is largely driven by the country’s booming digital payments market, which is projected to reach $1 trillion in value by 2023. This is supported by the government’s digital initiatives, such as the Unified Payments Interface (UPI) and the Aadhar program, which have helped to increase the adoption of digital payments in the country. India’s digital banking sector has also seen significant growth in recent years, with the emergence of several new banks and fintech startups.

Overall, India is home to the world’s third largest fintech ecosystem, which is expected to continue to grow in the coming years. The country’s booming digital economy, supportive government policies, and favorable investment climate make it an attractive destination for both domestic and international investors. As such, India is likely to remain an important player in the global fintech industry for the foreseeable future.

Key Players in the Third Largest Fintech Ecosystem

Globally

Fintech is a rapidly growing industry that is revolutionizing the way people access and manage their finances. With the growth of the industry, it’s no surprise that the third-largest fintech ecosystem globally is becoming increasingly competitive. In this blog, we’ll examine the key players in this sector and explore how they are helping to shape the future of fintech.

The three biggest players in the third-largest fintech ecosystem globally are China, India, and the United States. In China, Ant Financial and Tencent are leading the way with their innovative payment and investment services. In India, Paytm has created a booming digital payments ecosystem and is making strides in the online lending space. In the United States, the list of large fintech companies includes the likes of PayPal, Square, and Robinhood.

These companies are not only revolutionizing the way people access and manage their finances but also helping to drive innovation in other areas such as fraud prevention, data security, and artificial intelligence. For example, Ant Financial has developed a facial recognition system to help reduce fraud and protect users. Similarly, Paytm has invested heavily in AI and machine learning to create a more secure and reliable payments experience.

The third-largest fintech ecosystem globally is an exciting space for both established and emerging companies. With the right strategy and resources, these companies can continue to help shape the future of the industry and provide valuable services to millions of people all over the world.

Advantages of Being the Third Largest Fintech Ecosystem

The world of financial technology (fintech) is growing rapidly, and many countries are vying for the top spot as the largest fintech ecosystem. So, which country is the third-largest fintech ecosystem globally? The answer is India. India has been a leader in the fintech space for several years now, and it has many advantages that place it in the top spot as the third-largest fintech ecosystem globally.

First, India has a large population of over 1.3 billion people, making it a potential goldmine for fintech companies. This population is also highly educated, with many of them working in the technology industry. This provides a great base of talent for fintech companies, and makes launching a successful fintech product in India much easier.

Second, India is a leader in digital payments, with the Unified Payments Interface (UPI) becoming a widely accepted form of payment. This has made digital payments much easier and more accessible for many people in India, and has provided a great boost to the fintech industry.

Third, India has a large number of startups that are working to create innovative fintech solutions. These startups are also receiving support from the government, which is providing them with access to capital, resources, and expertise. This has helped to accelerate the growth of the fintech industry in India.

Finally, India has a strong regulatory framework in place that provides protection to both customers and fintech companies. This ensures that fintech companies are operating within the legal framework and are providing customers with protection and security.

These advantages have helped India become the third-largest fintech ecosystem globally, and it is expected to keep growing in the coming years. The fintech industry in India is poised to become even more successful, and it is sure to be a key player in the global fintech landscape.

Conclusion

In conclusion, the fintech ecosystem is a rapidly growing sector that has the potential to revolutionize the financial industry. It is also becoming increasingly competitive as more and more players enter the market. While the US is currently the largest fintech ecosystem, China and India are quickly catching up. China is the second-largest fintech market, while India is the third. Both countries have seen tremendous growth in recent years, and this trend is expected to continue in the future. As the competition becomes more intense, the sector will see further innovation and development.

FAQs About the Which Is The 3rd Largest Fintech Ecosystem Globally?

Q1. What is the 3rd largest fintech ecosystem globally?

A1. The 3rd largest fintech ecosystem globally is India.

Q2. What makes India’s fintech ecosystem stand out?

A2. India’s fintech ecosystem stands out due to its high number of startups, its large customer base, and its government initiatives that promote innovation and collaboration.

Q3. What are some of the challenges facing the Indian fintech ecosystem?

A3. Some of the challenges facing the Indian fintech ecosystem include inadequate infrastructure, lack of access to capital, and regulatory hurdles.

Conclusion

Based on the latest data, China is the third largest fintech ecosystem globally. With a total venture capital investment of $2.7 billion, the Chinese fintech sector is the largest in the Asia-Pacific region and second largest globally. China is home to many of the world’s leading fintech companies such as Ant Financial, Tencent, and WeBank, and the country’s rapid adoption of digital technologies has led to the emergence of a strong and vibrant fintech industry. The Chinese fintech ecosystem is growing rapidly and is expected to continue to expand in the coming years, providing new and innovative financial services for both consumers and businesses.