Which City Has The Most Fintech Companies?

Fintech, or financial technology, is a rapidly growing industry that is revolutionizing the way people save, spend, access, and invest their money. With the rise of digital banking, mobile payments, and cryptocurrency, more and more companies are emerging to meet the demands of the ever-changing financial world. Which city has the most fintech companies? London, England is currently the global leader in the fintech industry, followed by New York City, Silicon Valley, Singapore, and Hong Kong. London has a long-established financial sector and is home to some of the world’s largest financial companies. This has created a strong foundation for the fintech industry, with many of the world’s largest fintech companies having headquarters or offices in London. New York City is also a major hub for financial services, with the Wall Street and financial district providing an ideal base for fintech companies. Silicon Valley is home to many of the world’s most innovative fintech companies, while Singapore and Hong Kong are becoming increasingly attractive locations due to their low tax rates and pro-business policies.

Overview of Fintech

Companies

Fintech companies are rapidly popping up in cities around the world, offering the latest financial services and technology solutions for consumers and businesses alike. With the sheer number of fintech companies operating in various cities, it can be hard to determine which city has the most. To answer this question, it’s important to look at both the number of fintech companies in a given city and the services they offer.

New York City is considered the world’s fintech hub, with numerous companies offering a variety of services. Companies such as Robinhood, Plaid, and Transferwise provide access to stock trading, personal finance, and international money transfers. Other companies such as Kabbage, Square, and Stripe focus more on the B2B side of fintech, offering products and services such as lending, payments, and digital banking.

London is also a major hub for fintech, with established companies such as Atom Bank, Funding Circle, and WorldRemit. The city is known for its innovative start-ups, such as Monzo, Starling Bank, and Tide, which are transforming the banking and financial services industry. Additionally, London is home to a number of venture capital firms that invest in fintech companies.

San Francisco is another city with a strong fintech presence. Companies such as Stripe, Square, and Affirm have established a foothold in the city, offering services such as payments, digital banking, and consumer finance. Additionally, a number of venture capital firms are based in San Francisco, providing capital for fintech start-ups.

Overall, it’s clear that fintech companies are popping up in cities all over the world. While New York, London, and San Francisco are the most prominent cities for fintech, there are numerous other cities with a strong presence. With the rapid growth of fintech, it’s likely that new cities will become hubs for the industry in the near future.

Fintech Hotspots Around the World

Fintech – or financial technology – is one of the fastest-growing industries in the world, with new companies popping up in cities all over the globe. But which cities are the biggest hubs for fintech companies? To answer that question, we’ve taken a closer look at some of the major global fintech hotspots.

London has been at the forefront of the fintech revolution for some time. The UK capital is home to some of the world’s largest and most successful fintech startups, including TransferWise, Funding Circle, and Monzo. London also boasts an impressive range of established fintech firms, such as Atom Bank and WorldRemit.

The US is home to many of the world’s leading fintech companies, including Robinhood, Stripe, and Square. The country also has a thriving startup culture, with cities like San Francisco, New York, and Los Angeles being the primary fintech hotspots.

Other major fintech hubs include Singapore, Paris, and Berlin. Singapore has become a popular destination for fintech companies, thanks to its excellent infrastructure and favorable tax environment. Meanwhile, Paris and Berlin are home to a number of successful fintech firms, such as N26 and Spotcap.

The number of fintech companies is growing rapidly around the world, and it’s clear that the industry is here to stay. While there is no definitive answer to the question of which city has the most fintech companies, it’s clear that London, the US, Singapore, Paris, and Berlin are all key players in the global fintech landscape.

What Makes a City a Fintech Hub?

As the world moves toward an increasingly digital future, the number of Fintech companies is rapidly growing. But which city has the most Fintech companies? What makes a city a Fintech hub and why are some cities more successful in attracting Fintech companies than others?

To answer these questions, we must first understand what makes a city an attractive hub for Fintech companies. The most important factor is access to talent. A city must have a pool of highly-skilled and knowledgeable professionals who have the skills to develop innovative Fintech products and services. Additionally, Fintech companies need access to capital. This means that venture capital firms, banks, and other financial institutions must be present in the city to provide funding for Fintech startups.

In addition to access to talent and capital, a city must also have a supportive regulatory environment. This means that regulations must be in place to protect customers and businesses, while also allowing Fintech firms to operate and innovate. Finally, a city must have a supportive network of Fintech professionals who can help to foster innovation and collaboration.

By looking at these factors, it’s easy to see why some cities have become Fintech hubs. London, for example, is home to a large number of highly-skilled professionals, as well as a well-developed venture capital ecosystem. Similarly, New York City is home to many banks and financial institutions, and a supportive regulatory environment.

Ultimately, a city must have the right combination of talent, capital, regulations, and collaboration to become a successful Fintech hub. By understanding what it takes to attract Fintech companies, cities can better position themselves to become Fintech hubs in the future.

The Top 10 Cities for Fintech

In the ever-changing world of finance, fintech companies are at the forefront of innovation. With so many cities vying for the title of “fintech hub,” it can be difficult to know which cities have the most fintech companies. To answer this question, we’ve compiled a list of the top 10 cities for fintech, based on the number of fintech companies headquartered there.

Leading the pack is London, with over 500 fintech companies based in the city. London has become the leading global hub for fintech innovation, with a supportive regulatory environment and a thriving startup ecosystem. New York City follows closely behind, with nearly 400 fintech companies calling it home. Other cities with notable fintech presence include Hong Kong, Singapore, Toronto, and San Francisco.

These top 10 cities are home to some of the world’s most innovative fintech companies, offering a range of services from payments to wealth management. These cities also boast strong talent pools, generous support from investors, and a wide range of government initiatives to encourage fintech innovation.

Ultimately, these top 10 cities prove that fintech is a global industry with a presence in multiple cities around the world. As the industry continues to grow and expand, the number of fintech companies in each city is sure to increase in the coming years.

An Analysis of the Top Cities

in the FinTech Industry

The financial technology industry, or FinTech, is a rapidly growing sector of the economy. It combines traditional financial services with cutting-edge technology to provide new services and solutions to customers. FinTech companies are popping up all over the world, but which cities are leading the way? In this blog, we will take a look at the top cities in the FinTech industry and analyze what makes them so attractive to entrepreneurs and investors.

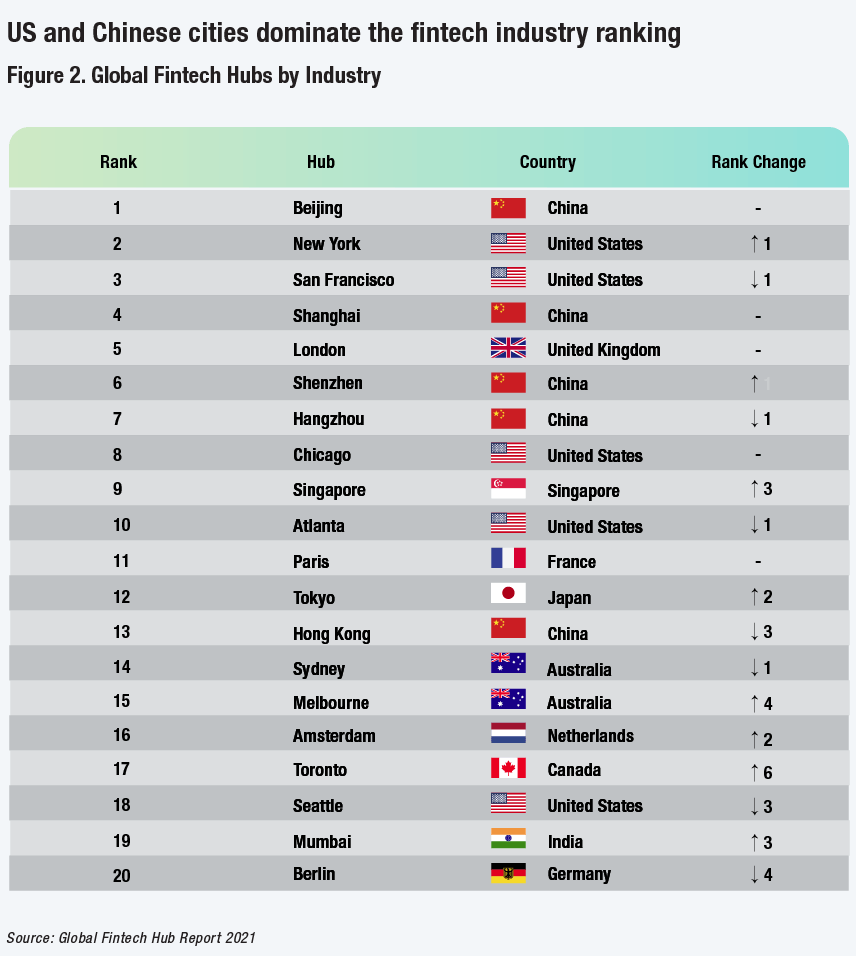

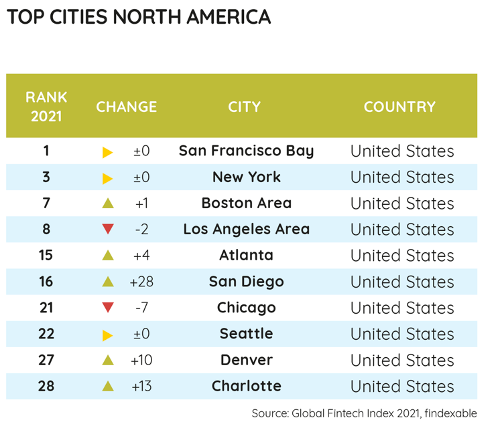

We’ll start by looking at the global concentration of FinTech companies. According to data from Crunchbase, the United States is home to the most FinTech companies, followed by the United Kingdom and India. Within the US, the top cities for FinTech companies are New York City, San Francisco, and Los Angeles. These cities are known for their vibrant tech ecosystems and access to venture capital.

Next, we’ll take a look at the European market. London has long been a hub for financial services, but it is also becoming a major center for FinTech. Other cities with growing FinTech scenes include Berlin, Paris, and Amsterdam. These cities have vibrant tech scenes and attract entrepreneurs from all over the world.

Finally, we’ll look at the Asian market. India is home to the second-largest number of FinTech companies, followed by China. In India, the cities of Bangalore and Mumbai are leading the way in FinTech, while in China, Shenzhen and Beijing are the top cities for FinTech companies.

In conclusion, cities around the world are embracing FinTech and becoming major hubs for innovation. The US, UK, India, and China have the largest number of FinTech companies, with New York, San Francisco, Los Angeles, London, Bangalore, Mumbai, Shenzhen, and Beijing at the forefront. Each of these cities has a unique set of advantages that makes them attractive to entrepreneurs and investors, and they are leading the way in the FinTech industry.

What the Future Holds for Fintech

?

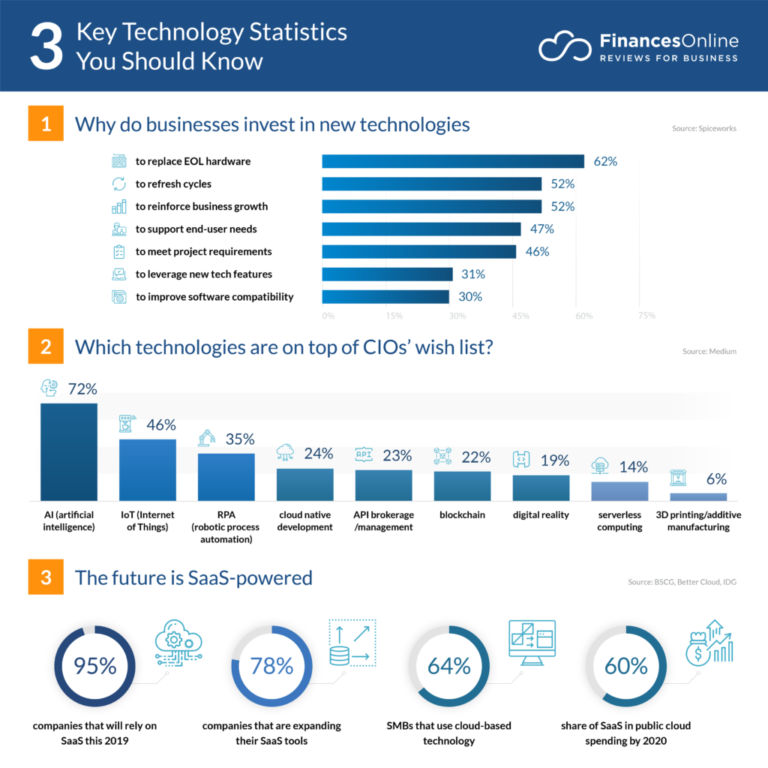

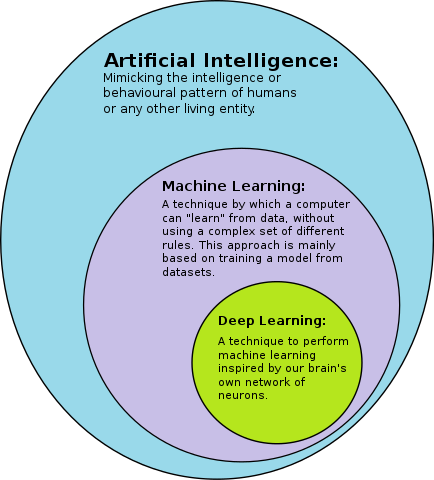

The future of fintech looks brighter than ever. As the industry grows, so too does the potential for new technologies and services. In the coming years, we can expect to see more sophisticated solutions that offer more efficient and secure processing of financial transactions. With the emergence of blockchain technology, the capacity for data-driven decision making will grow, allowing fintech companies to tailor personalized services to their customers. On the consumer side, the continued development of peer-to-peer and mobile payments platforms will make it easier than ever to move money around the world, while improved cybersecurity measures will help protect customers from fraud. As the industry continues to evolve, it will be interesting to see which cities emerge as leaders in the fintech space.

FAQs About the Which City Has The Most Fintech Companies?

1. How many fintech companies are there in the world?

Answer: According to estimates from Statista, there are over 12,000 fintech companies in the world.

2. What city has the most fintech companies?

Answer: London is the city with the most fintech companies, followed by New York City, San Francisco, and Singapore.

3. What are the benefits of having a fintech company in a certain city?

Answer: Having a fintech company in a city can bring a variety of benefits, including increased access to capital, new jobs, and improved access to financial services. Additionally, it can lead to economic growth and development in the local area.

Conclusion

The answer to the question of which city has the most fintech companies is difficult to answer definitively, as it depends on the criteria used to measure the presence of such companies. However, it appears that London is the city that currently leads in the number of fintech companies, followed by San Francisco, New York, Berlin, and Hong Kong. These cities are home to some of the largest and most influential fintech companies in the world, making them attractive destinations for entrepreneurs and investors alike.