What Is The World’s First Fintech?

The world’s first Fintech, or financial technology, was introduced in the 1970s. Fintech is a combination of technology and finance, which is used to improve the delivery of financial services. Fintech has revolutionized the way people access and manage their finances, and it has enabled more people to participate in the global economy. Fintech has allowed people to access financial services more quickly and easily, and it has enabled the growth of e-commerce and online banking. Additionally, Fintech has enabled the development of digital currencies, such as Bitcoin, and has allowed for the development of innovative financial products, such as peer-to-peer lending and crowdfunding. Fintech has also enabled the development of more secure and efficient payment systems, as well as the use of big data and analytics to gain insights into consumer behavior.

Defining Fintech: An Overview

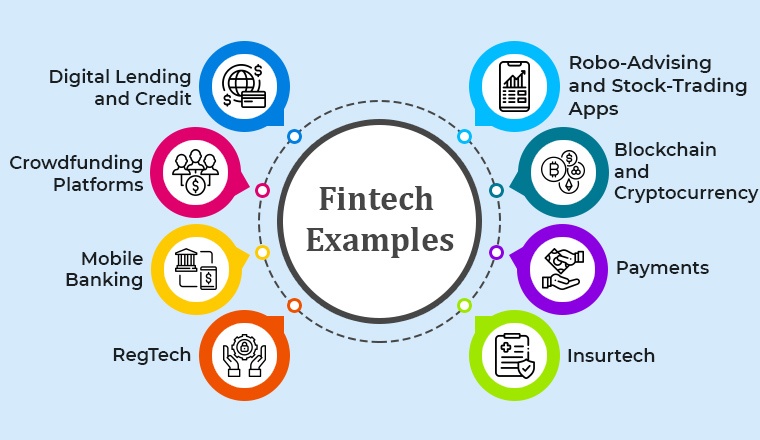

Fintech, short for financial technology, is the industry of utilizing technology to make financial services more efficient and accessible. It is a rapidly growing sector and is transforming the way people access, use, and manage their money. Fintech can include anything from digital banking platforms to cryptocurrency exchanges, payment systems, and investment services. It has revolutionized the way we interact with money, allowing us to manage our finances more easily and securely than ever before.

The world’s first fintech was the banking industry, which has been around since the 16th century. Banking services began to use computers in the 1950s, and the internet revolutionized the industry in the 1990s. This allowed banks to offer online services such as online banking, mobile banking, and payments. Today, banks are using more advanced technology such as artificial intelligence, blockchain, and machine learning to build better services.

In the past decade, fintech has evolved to include services such as peer-to-peer lending, robo-advisors, and cryptocurrency exchanges. These services are disrupting legacy financial institutions and providing more accessible and affordable services to a wider range of customers.

Fintech is transforming the financial services industry and creating a new era of financial inclusion. With its innovative technology, fintech is creating new opportunities for people around the world to access financial services and manage their money in more efficient and secure ways.

The History of Fintech

Fintech is a relatively new term, but it’s been around for much longer than you might think. The world’s first fintech was created in the early days of the internet, when the first online banking services and money transfer systems were developed. Since then, the industry has exploded, with new innovations and technologies being developed every day.

The world’s first fintech companies focused on providing customers with the ability to manage their finances online. This allowed them to transfer funds, pay bills, and make investments all from the comfort of their own home. As the industry grew, so did the range of services offered by fintech companies. Today, there are platforms that offer everything from cryptocurrency trading to automated investing.

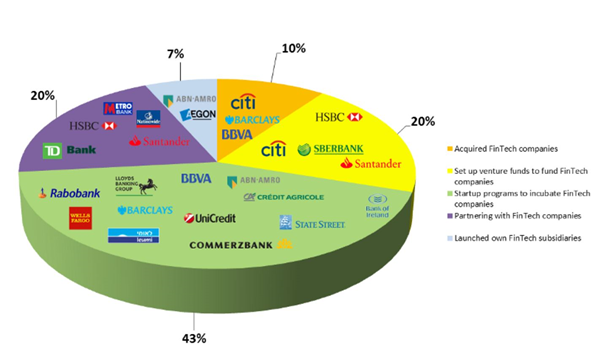

The rise of fintech has also changed the way banks and financial institutions operate. Traditional banks are increasingly turning to fintech companies to provide services such as mobile payments, online lending, and digital currencies. This allows them to keep up with the changing demands of customers and remain competitive in a rapidly evolving financial landscape.

With the rise of fintech, it is clear that the industry is here to stay. As the technology continues to evolve, so too will the range of services offered, making it easier and more secure for customers to manage their finances. It is clear that the world’s first fintech companies have paved the way for a new era of financial technology.

Current Trends in the Fintech Industry

Fintech, or financial technology, is an innovative and rapidly growing industry that is transforming the way people manage their finances. It is no surprise that fintech is quickly becoming a global phenomenon, with the global market estimated to be worth over $127 billion by 2025.

As the technology continues to advance, the fintech industry is rapidly evolving. Recent trends in fintech include the emergence of mobile banking, peer-to-peer payments, blockchain technology, artificial intelligence, and digital currencies such as Bitcoin.

The world’s first fintech company, Ant Financial, was founded in 2014 in China. It has since grown to become one of the largest fintech companies in the world with over 1 billion users. Ant Financial offers a range of financial services, including payments, loans, investments, and insurance.

The rise of fintech has had a profound impact on the traditional banking system. Banks are now offering more digital solutions to compete with the emerging players in the space, such as online banking, mobile banking, and digital payments.

Overall, the fintech industry is becoming increasingly competitive and it is important to stay up to date on the latest trends in order to remain competitive. As the industry continues to expand, we can expect to see more innovative solutions for managing finances, as well as increased competition among fintech companies.

The Benefits of Fintech

Fintech, or financial technology, has revolutionized the financial services industry over the past decade. From automated investing to payment processing, fintech has changed the way people access, manage, and invest their money. But what was the world’s first fintech?

The answer to this question depends on exactly what you mean by “fintech.” For some, the world’s first fintech is the Automated Teller Machine (ATM), which first appeared in 1967. Others might point to the introduction of online banking in the early 1990s as the first fintech innovation.

But no matter when it began, one thing is certain: fintech has had a major impact on the way people manage their finances. For example, automated investing has made it easier for people to invest without needing to commit a lot of time or energy to their investments. Similarly, payment processing has simplified the way people pay for goods and services, making it easier to shop online or in person.

Fintech also has the potential to make banking and investing more accessible to those who may have previously been excluded from these services. For instance, companies like SoFi, Kabbage, and Acorns are creating fintech solutions tailored to low-income or underbanked communities, allowing them to access financial services they may not have had access to before.

In short, the world’s first fintech may be difficult to determine, but the benefits of fintech are clear. Fintech has revolutionized the financial services industry, making it easier for people to access, manage, and invest their money. It has also opened up financial services to those who may have been previously excluded from them. With so many advantages, it’s no wonder that fintech is here to stay.

Challenges and Risks Posed by Fintech

Fintech, short for financial technology, is a rapidly growing sector of the global economy. It is a rapidly changing landscape, with new technologies, products, and services emerging and rapidly evolving. As with any new and rapidly evolving industry, there are a number of challenges and risks that accompany it.

One of the primary challenges posed by fintech is the need to stay on top of the changing technology. Financial institutions must ensure they are up to date with the latest trends and developments in the industry. As new technologies emerge, financial institutions must be able to adapt and incorporate them into their operations in order to remain competitive.

Another challenge relates to the regulatory environment. Financial institutions must ensure they are compliant with the relevant laws and regulations in order to protect customer data and ensure the integrity of their operations. Additionally, fintech companies must be aware of the legal implications of their activities and ensure they are compliant with applicable laws and regulations.

Finally, fintech companies face the risk of cyberattacks. As more financial institutions and fintech companies move operations online, they become more vulnerable to cyberattacks. Financial institutions must ensure they have the necessary security measures in place to protect customer data and operations from potential cyber threats.

Overall, fintech is a rapidly evolving sector of the global economy, and there are a number of challenges and risks that accompany it. Financial institutions must ensure they stay up to date with the latest trends and developments, remain compliant with relevant laws and regulations, and have the necessary security measures in place to protect customer data and operations from potential cyber threats.

The Future of Fintech

Fintech has come a long way since its inception. Initially a disruptive force in the financial services industry, it has grown to become a major player in the global economy. As technology advances, so too does the scope of fintech. We are now seeing a wide range of new and innovative products being released, with the potential to revolutionize the way we interact with our finances. With the rise of fintech, the world is quickly becoming a much more connected place.

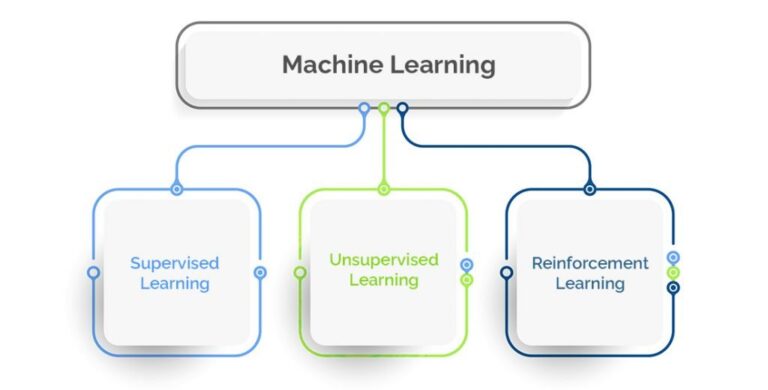

The future of fintech is bright. With advancements in blockchain technology, artificial intelligence, and machine learning, the possibilities for financial services are becoming ever-more expansive. Companies are utilizing these technologies to create more efficient systems and products, allowing them to offer better services at a lower cost. By harnessing the power of the latest technologies, fintech companies are revolutionizing the way we interact with our finances.

The world’s first fintech is often credited to be the PayPal payment system. PayPal was the first to introduce a digital wallet system, allowing for payments to be made through the internet. Since then, the fintech industry has grown exponentially, with new startups and established companies introducing new products and services on a daily basis. With the ever-evolving landscape of fintech, there are no limits to the products and services that can be created.

The future of fintech is exciting and the possibilities are endless. From digital wallets to automated investment platforms, the world of fintech is constantly growing and evolving. As technology continues to advance, we can expect to see more innovative products being released and more efficient services being offered. Fintech is the future and it is here to stay.

FAQs About the What Is The World’s First Fintech?

1. What is the world’s first fintech?

Answer: The world’s first fintech is a broad term that encompasses a variety of digital financial services that use technology to streamline and automate financial processes. Examples of this technology include mobile banking, online payment systems, peer-to-peer lending, crowdfunding, and more.

2. What is the history behind the world’s first fintech?

Answer: The history of fintech dates back to the late 1970s, when the first automated teller machines (ATMs) were introduced. Since then, the technology has evolved and expanded to include a wide range of financial services, from online banking to peer-to-peer lending.

3. How does the world’s first fintech benefit people?

Answer: Fintech helps people save time by providing easy access to financial services, such as mobile banking, online payment systems, peer-to-peer lending, and crowdfunding. It also helps to reduce costs and increase the security of financial transactions.

Conclusion

The world’s first fintech is a revolutionary technology that has revolutionized the way we manage our personal finances. It has enabled us to access financial services more efficiently and securely, providing access to a wide range of services from banks, credit card companies, and other financial institutions. Fintech has also enabled us to make payments digitally, reducing the need for physical transactions and making it easier to track our spending and saving habits. Overall, the world’s first fintech has been a major success and has opened the doors for even more financial innovations in the future.