What Is The Hottest Trend In Fintech?

Fintech, or financial technology, is an ever-evolving industry that is changing the way individuals and businesses manage and interact with their finances. As more and more people become tech-savvy, the demand for innovative fintech solutions increases. In recent years, the hottest trend in fintech has been the emergence of non-traditional financial services such as digital banking, online payment processing, and cryptocurrency. This trend has allowed more individuals and businesses to access financial services without relying on traditional banks or other financial institutions. Additionally, the rise in popularity of mobile payment apps and digital wallets has made it easier for people to make payments and transfer money without having to use cash or cards. This has made fintech more accessible to a larger number of people, and it is likely that this trend will continue as technology advances.

Definition of Fintech

Fintech, short for financial technology, is an ever-evolving industry that combines technology with traditional finance to create innovative products and services. Fintech companies leverage technology to provide solutions that reduce the cost and complexity of financial services, while also creating opportunities for more people to access financial services. This has brought about a new wave of disruption in the banking and financial services sector, with the rise of digital-only banks, peer-to-peer payments, and cryptocurrency services.

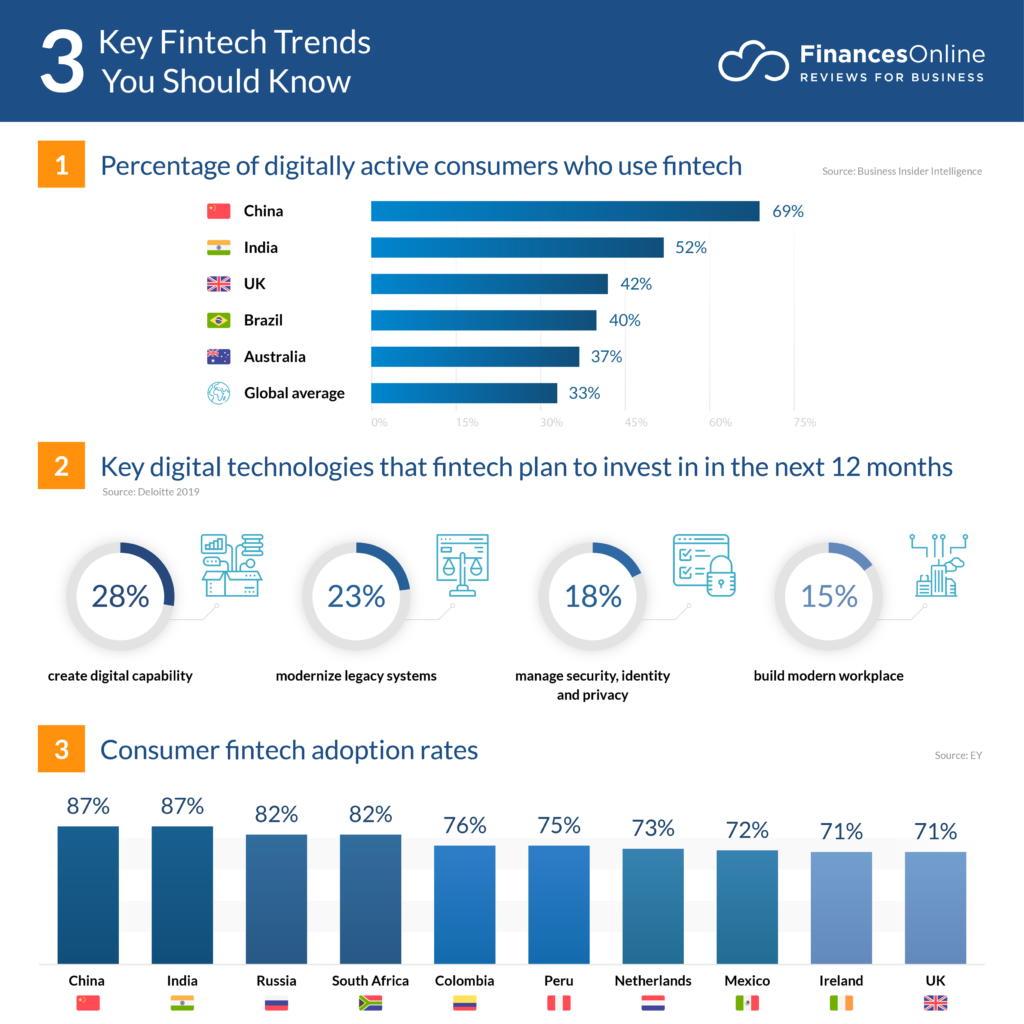

The fintech industry is full of opportunities for entrepreneurs and innovators, with new startups popping up all the time offering solutions to the challenges posed by traditional banking. As the industry continues to grow, there are a few key trends that are currently dominating the sector. Many of these trends have been driven by the rise of mobile technology, the increased use of data analytics, and the emergence of artificial intelligence. Here are some of the hottest trends in fintech right now:

1. Mobile Payments: Mobile payments are becoming increasingly popular as more people use their phones to make purchases. This trend has been driven by the rise of digital-only banks, peer-to-peer payments, and cryptocurrency services.

2. Artificial Intelligence: Artificial intelligence (AI) is being used to automate and optimize financial processes, making it easier for businesses to manage their finances. AI-powered solutions are also being used to provide personalized advice to customers.

3. Data Analytics: Data analytics is being used to provide insights into customer behavior, helping businesses to improve their services and create better customer experiences.

4. Blockchain: Blockchain technology is being used to create secure and transparent financial transactions. This technology is being used by banks, financial institutions, and cryptocurrency companies to provide secure and reliable digital payments.

These are just a few of the hottest trends in fintech right now. As technology continues to evolve, we can expect to see more exciting developments in the sector.

Emergence of Fintech

is transforming the way financial services are delivered.

The global fintech landscape has seen an exponential rise in recent years, with several key trends gaining traction in the industry. As more organizations adopt digital solutions, the fintech industry is rapidly evolving to meet the needs of customers and businesses alike. With the rise of digital technologies, the fintech sector is becoming an increasingly attractive option for financial services providers.

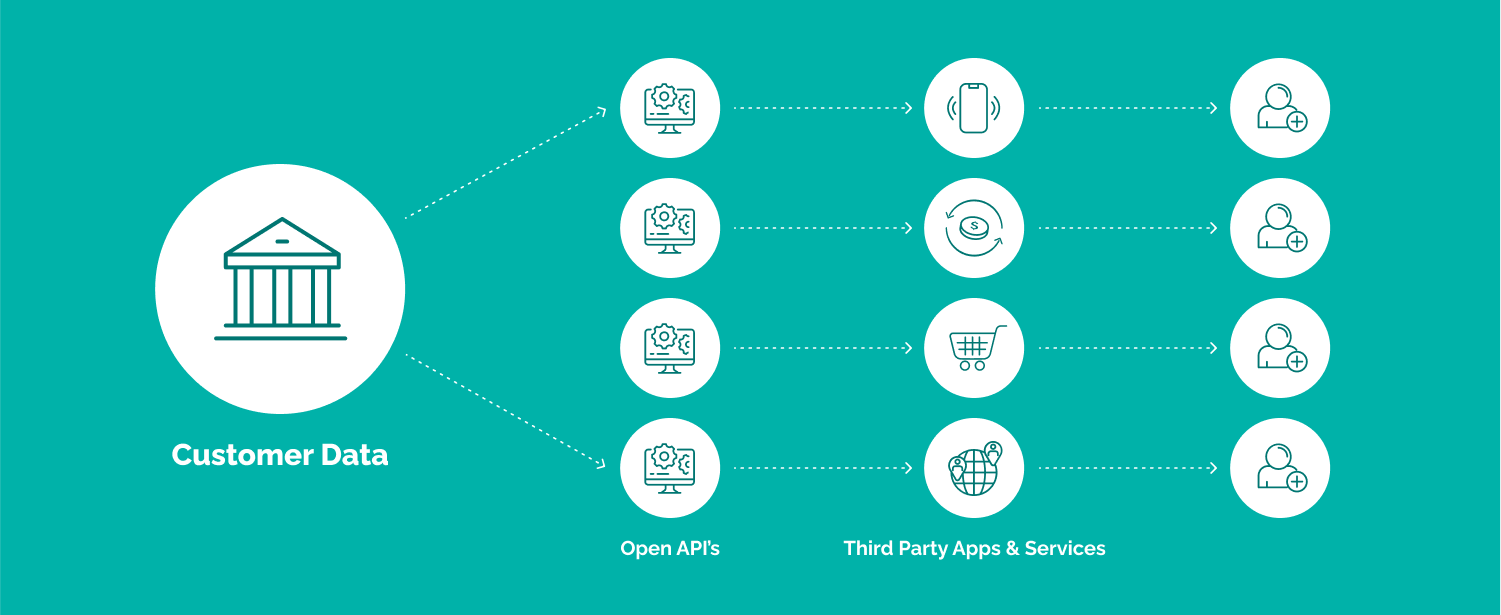

One of the hottest trends in fintech is the emergence of open banking. Open banking allows customers to securely share their financial data with third-party providers, enabling them to access better and more personalized services. This trend is gaining traction as it allows financial institutions to provide more streamlined and efficient services to customers, while also boosting their bottom line.

Another trend that’s gaining traction in the fintech world is the use of artificial intelligence and machine learning. AI-powered applications are being used to automate and streamline various processes, from customer service to financial analysis. This is enabling financial institutions to create more personalized experiences for their customers, while improving efficiency and reducing costs.

In addition, blockchain technology is also beginning to make a significant impact in the fintech industry. Blockchain-based solutions are being used to facilitate payments, reduce fraud, and improve the security and transparency of financial transactions.

Overall, the emergence of fintech is transforming the way financial services are delivered. As more organizations embrace digital solutions, the industry is expected to continue to grow and evolve to meet the needs of the modern customer.

Current Fintech Landscape

The fintech landscape is constantly evolving and adapting to the changing needs of the public. As digital banking and payments become more pervasive in our lives, the financial technology industry is on the cusp of a new era. From artificial intelligence-driven investments, to cryptocurrency and blockchain technology, the latest trends in fintech are revolutionizing the way financial services are delivered.

AI-driven investments are becoming increasingly popular, allowing the average investor to make more informed decisions. AI-powered algorithms can identify patterns and trends in financial markets, providing investors with more accurate and timely information for their investments. Cryptocurrency and blockchain technology are also gaining traction, allowing for more efficient and secure transactions. These technologies have the potential to revolutionize the way financial institutions and consumers transact with each other.

The changing face of fintech is blurring the lines between traditional and digital banking, creating opportunities for companies to offer innovative solutions to their customers. As the industry develops, financial institutions will need to adapt to the changing environment and develop new products and services to meet the demands of their customers. The future of fintech is bright, and the possibilities are endless.

Examples of Fintech Technologies

Fintech, or financial technology, is a rapidly growing field that is transforming the way individuals and businesses manage their finances. It is one of the hottest trends in the world of technology, with companies investing heavily in developing and deploying new financial technologies. Examples of these technologies include mobile banking, blockchain-based payments, artificial intelligence-driven financial advice, and digital currencies.

Mobile banking, also known as mobile payments, has revolutionized the way people manage their money. It allows users to make payments, transfer funds, and access their accounts from their mobile devices, making financial transactions faster and easier. Blockchain-based payments, which are secure and cryptographically-backed, allow users to make instantaneous payments with near-zero transaction fees.

Artificial intelligence-based financial advice is another example of fintech technology. AI-driven advice helps users make more informed decisions on how to manage their finances, such as when to invest or when to take out a loan. Digital currencies, such as Bitcoin, are also becoming increasingly popular as they offer users an alternative to traditional money.

Fintech is set to continue growing and evolving in the future, with a variety of technological advancements that will revolutionize the way people manage their finances. With the right investments and the right technologies, businesses and individuals can take advantage of the opportunities offered by the latest fintech trends and technologies.

Benefits of Fintech

Fintech is fast becoming the hottest trend in the financial industry. This technology is revolutionizing the way people manage their money and make payments. It has made it easier for businesses and individuals to access financial services such as loans, investments, and payments. Fintech offers a number of benefits, including faster processing times, easier access to financial services, and lower costs.

For customers, Fintech can provide more efficient and cost-effective services. For example, online banking services can be used to make payments quickly and securely, without the need to visit a bank or wait in line. Furthermore, many Fintech services are accessible via mobile devices, making it easier for customers to access their accounts and manage their finances on the go.

For businesses, Fintech can help streamline processes and reduce costs. For example, payment processing and other financial services can be automated, eliminating the need for manual labor. Additionally, Fintech can help businesses access new markets and customers, as well as providing insights into customer behavior and preferences.

Overall, Fintech offers a wide range of benefits to businesses and customers alike. It is an effective way to streamline financial processes, reduce costs, and access new markets. Fintech is quickly becoming a popular choice for businesses and individuals looking to optimize their financial services.

Challenges of Fintech

In recent years, the world of finance has been revolutionized with the emergence of fintech. The term “fintech” refers to the utilization of technology to improve financial services. Fintech has grown exponentially due to its ability to provide a more streamlined, efficient way of providing financial services. Fintech has enabled a host of innovative products, services, and solutions, and is quickly becoming a key player in the world of finance.

However, with the rise of fintech comes a number of challenges. The technology is still in its infancy, and there is still much to learn about how to safely and securely use the technology. Additionally, there is a lack of standardization across the industry, resulting in varying levels of security and trust. Furthermore, there are concerns about the potential for data breaches and fraud.

In order to address these challenges, it is essential for fintech companies to ensure that they are taking the necessary steps to protect their customers’ data. This includes implementing robust security measures, such as encryption and authentication. Additionally, it is important for fintech companies to remain up-to-date on the latest developments in the industry, in order to remain competitive and ensure their customers are getting the best possible experience.

Overall, the challenges of fintech can be daunting, but with the right approach, they can be overcome. With the right security measures in place, fintech companies can ensure their customers’ data is safe and secure, and can continue to provide innovative solutions to the industry.

FAQs About the What Is The Hottest Trend In Fintech?

1. What is the definition of fintech?

Fintech is a term used for any technology that is used to automate, streamline, or otherwise improve the processes involved in providing financial services.

2. What are some of the hottest trends in fintech?

Some of the hottest trends in fintech include open banking, artificial intelligence, blockchain, and cryptocurrency.

3. How can I stay up-to-date with the latest fintech trends?

You can stay up-to-date with the latest fintech trends by following industry experts and reading industry news and publications. Additionally, attending industry events and conferences can provide you with valuable insight into the current state of the fintech market.

Conclusion

The hottest trend in fintech is the use of artificial intelligence (AI) and machine learning. AI and machine learning have enabled the development of innovative products and services such as robo-advisors, automated payments, and automated trading. AI and machine learning are also being used to improve customer experience, reduce fraud, and improve the accuracy of financial data analysis. As the use of AI and machine learning continues to grow, the potential for fintech to revolutionize how we manage our money is becoming increasingly clear.