What Is The Future Of Insurance Industry?

The insurance industry is a vital part of the global economy, providing financial protection to individuals, businesses, and other entities. As the world continues to evolve, so too does the insurance industry, with new technologies and innovative solutions that are changing the way people purchase, manage, and use insurance. As the industry moves into the future, there are numerous changes and advances that will shape its growth and development. These include the use of predictive analytics, digital transformation, and the increasing demand for personalized products and services. The insurance industry is likely to continue to grow and expand as these trends take hold, creating new opportunities for insurers, customers, and the global economy.

Overview of Insurance Industry

The insurance industry has experienced tremendous growth in the past few decades, and the future of insurance is only expected to expand. The industry is constantly evolving and innovating, and insurance companies are being forced to keep up with the latest trends and technologies. Insurance policies are now increasingly digital, making them more accessible and user-friendly. The industry is also becoming more customer-centric, with a focus on providing personalized services that meet customer needs. Additionally, insurers are leveraging analytics and artificial intelligence to develop more sophisticated risk management strategies and pricing models. As the industry continues to grow and evolve, it is becoming increasingly important for insurance companies to stay ahead of the curve and remain competitive in the market.

Current Trends in Insurance

Insurance is an ever-evolving industry with new technologies, customer demands, and regulatory changes driving the industry forward. The industry is constantly shifting and adapting to the changing environment, so it’s important to understand the current trends in insurance. From the rise of digitalization to the emergence of new customer segments, there are a number of key trends that are helping to shape the future of insurance.

Digitalization is transforming the way that customers interact with their insurance providers, allowing them to access information and make payments from anywhere. This has opened up the industry to new customer segments, such as millennials and small business owners, who are more likely to take out policies online. Additionally, the use of data and analytics has allowed insurers to gain a better understanding of customer needs and preferences, enabling them to tailor policies and create more personalized experiences.

Another trend in the insurance industry is an increased focus on customer experience. Insurers are investing in customer service and digital tools to make the process of buying and managing policies easier and more convenient. Additionally, insurers are increasingly using artificial intelligence (AI) to automate complex processes and provide faster, more accurate service.

Finally, the emergence of InsurTech has allowed for the development of innovative new products and services, such as on-demand insurance and usage-based policies. These new models are making insurance more accessible and affordable, while also driving competition in the industry.

As the insurance industry continues to evolve, it’s important for insurers to stay ahead of the curve and understand the current trends. By embracing digitalization, focusing on customer experience, and leveraging InsurTech, insurers can stay ahead of the competition and better serve their customers.

Impact of Technology on Insurance

Industry

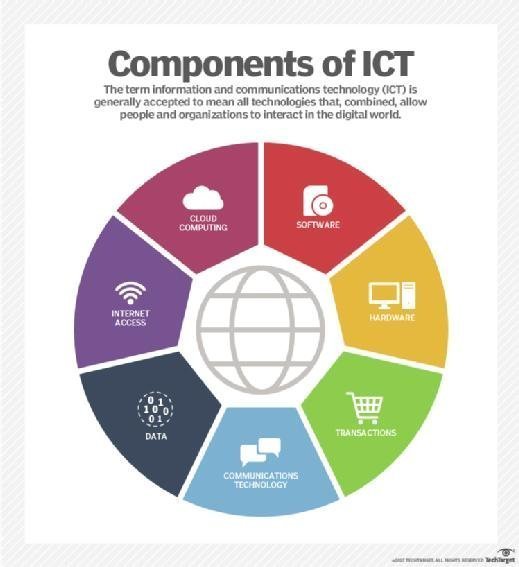

The insurance industry is on the cusp of a massive transformation, with technology playing an increasingly important role in the development of new, innovative products and services. As technology continues to evolve, it will have an undeniable and far-reaching impact on the insurance industry.

The use of technology in the insurance sector is expected to create a more efficient and cost-effective way of doing business. Through the use of advanced analytics, artificial intelligence, and machine learning, insurers are able to process large amounts of data quickly and accurately. This allows them to identify patterns and trends that can be used to better understand customer needs and preferences, as well as develop new products and services.

The use of blockchain technology is also expected to revolutionize the industry. By using decentralized ledgers, insurers can securely store and share data, reducing the need for manual, paper-based processes. This will reduce costs and increase efficiency, while also allowing for faster and more accurate payments.

In addition, the use of the Internet of Things (IoT) devices and sensors is expected to provide insurers with a wealth of valuable data that can be used to gain insights into customer behavior. This will enable insurers to better identify risks and create more tailored products and services that meet the needs of their customers.

The insurance industry is undergoing a major transformation due to the impact of technology. Through the use of advanced analytics, blockchain technology, and the Internet of Things, insurers are able to create more efficient and cost-effective ways of doing business. This will enable them to better understand customer needs and preferences, as well as develop new products and services that are tailored to their customers.

Changes in Customer Expectations

The insurance industry is constantly evolving to meet the needs of its customers, but in recent years, there have been remarkable changes in customer expectations. Customers have become more savvy and demand more value for their money. They are now more likely to compare prices and shop around for the best deal, which has placed increased pressure on insurance companies to be more competitive. In addition, customers are now expecting more personalized services and products that are tailored to their individual needs. They are also looking for more transparency and convenience in their dealings with insurance companies. As a result, insurers must adapt to these changes in order to remain competitive in the future.

The insurance industry must also keep up with the latest technology and use it to their advantage. Advances in technology have made it easier for customers to compare prices and find the best deal, and this has made it more difficult for insurers to remain competitive. Additionally, customers now expect more customization and convenience when it comes to their insurance policies. They want to be able to access their policies online, receive notifications of changes, and be able to customize their coverage to fit their specific needs.

Insurers must also address the demand for more transparency by providing customers with more information about their policies, claims processes, and customer service. Additionally, they must also provide customers with the tools they need to make informed decisions about their coverage. This could include providing customers with detailed information about their policies, as well as access to online tools that can help them better understand their coverage.

The insurance industry must continue to evolve in order to remain competitive in the future. By understanding and responding to the changing customer expectations, insurers can successfully meet the demands of their customers and remain competitive.

Regulatory and Governance Considerations

As the world continues to evolve, so does the insurance industry. In order to remain competitive and financially sound, insurers must consider the impact of legislative, regulatory, and compliance changes. Compliance with the ever-evolving regulations, consumer protection, data security, and new technology and product development are all factors that must be taken into account when looking to the future of the insurance industry.

Regulation of the insurance industry is essential to protect customers and ensure the stability of the industry. Governments must ensure that insurers comply with laws and regulations to ensure that customers are not taken advantage of and that insurers have sufficient capital reserves to cover potential losses. Many countries have implemented laws and regulations such as Solvency II to protect consumers, promote competition, and promote financial stability.

Insurers must also stay up to date with the latest technological developments. Artificial intelligence, predictive analytics, and blockchain are all technologies that are transforming the insurance industry. AI and predictive analytics can help insurers assess risk and make more accurate decisions, while blockchain can be used to securely store and transfer data. In addition, insurers are turning to the internet of things and data-driven solutions to create personalized products and services for their customers.

The insurance industry is an ever-evolving sector that requires continuous monitoring and adaptation to changing environments. Regulatory and governance considerations are essential for insurers to remain competitive and ensure that their customers are protected. By staying up to date with new regulations, technologies, and customer trends, insurers can ensure that they remain ahead of the curve and remain relevant in the future.

Implications for Insurance Companies

The insurance industry is in a state of flux, with new technologies and regulations having a major impact on the way that companies conduct business. As a result, insurance companies must be prepared to adapt to the changing landscape and adjust their strategies to ensure that they remain competitive in the future. One of the most important implications for insurance companies is the need to embrace digital transformation and adopt new technologies. This will allow companies to streamline processes, reduce costs, and improve the customer experience. Additionally, insurance companies must also be prepared to comply with stricter regulations, such as those related to data privacy and cyber security. These regulations can be costly and time-consuming to implement, but they are essential for companies to remain compliant. Finally, insurance companies must also focus on developing innovative products and services to meet the changing demands of customers. This includes providing more personalized coverage options, leveraging data analytics to predict customer needs, and utilizing technology to improve customer service. By taking these steps, insurance companies can ensure that they remain competitive and profitable in the future.

FAQs About the What Is The Future Of Insurance Industry?

Q1: How is technology transforming the insurance industry?

A1: Technology is transforming the insurance industry by improving customer experience, increasing operational efficiency, and driving innovation. Examples of technology impacting the insurance industry include automation, predictive analytics, artificial intelligence, and blockchain.

Q2: What are the key challenges the insurance industry is facing?

A2: The key challenges the insurance industry is facing are the increasing customer expectations, the need for digitalization, and the competition from new market entrants. Additionally, regulatory changes and the adoption of new technologies are causing disruption in the insurance market.

Q3: What are the opportunities for the insurance industry?

A3: There are many opportunities for the insurance industry, such as the digitization of processes, offering new products to meet customer needs, and leveraging technology to drive innovation. Additionally, insurers can focus on customer experience and develop personalized products and services.

Conclusion

The future of the insurance industry is highly promising. With the continued development of technology and data, insurers have the ability to more accurately assess risk and offer more personalized and affordable products to customers. Additionally, the growing demand for digital services, including online channels and mobile applications, is likely to drive more efficient and cost-effective processes, allowing insurers to better serve their customers and increase their market share. Ultimately, the future of the insurance industry looks bright and insurers are well-positioned to capitalize on the opportunities of the future.