What Is The Future Of Fintech?

Fintech is a rapidly growing field that is transforming the way financial services are delivered. It combines the power of technology with traditional finance practices to create innovative solutions for financial institutions, businesses, and individuals. The future of Fintech is bright, as it is expected to revolutionize the financial sector with its innovative products and services. It is expected to drive efficiency and provide new opportunities for customers, allowing them to access financial services quickly and securely. Additionally, Fintech is expected to create more competition in the market, allowing consumers to benefit from better services and lower costs. This will also lead to increased job opportunities in the field of finance as Fintech companies create more jobs. Ultimately, Fintech is set to shape the future of finance and create a more secure and convenient financial system.

Overview of Fintech

Financial technology, commonly referred to as Fintech, is an umbrella term used to describe a wide variety of technological innovations in the financial industry. Fintech is revolutionizing the way we pay, borrow, save, and invest. It has become a key driver of financial innovation and inclusion as it enables faster, cheaper, and more accessible financial services.

From mobile banking to peer-to-peer lending, Fintech is transforming the way we interact with financial institutions and services. Banks, credit unions, and other traditional financial institutions are leveraging the power of Fintech to provide efficient, cost-effective services to customers. Fintech is also providing innovative solutions for financial institutions to manage risk and increase profitability.

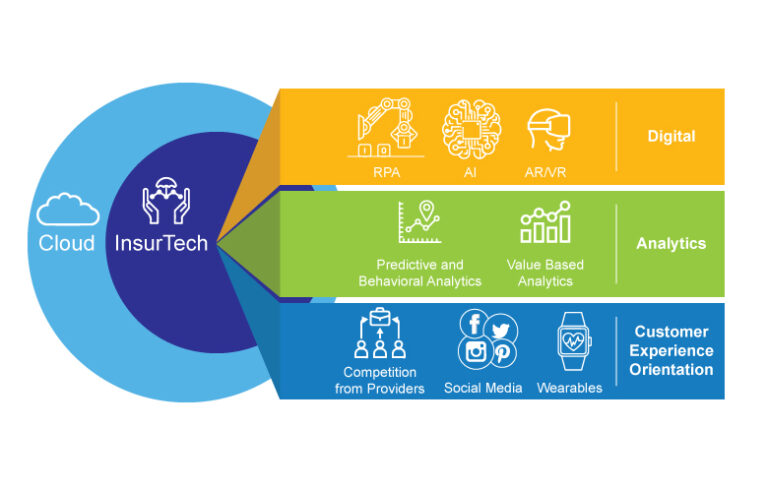

With the rise of digital currencies, automation, artificial intelligence, and blockchain, Fintech is ushering in a new era of financial technology. Automation is making financial processes more efficient, reducing costs, and lowering the barriers to entry. Artificial intelligence is enabling banks and other financial institutions to better identify fraud and assess credit risk. Blockchain is allowing for faster, more secure, and more transparent transactions.

The future of Fintech looks increasingly bright. As technology continues to evolve, so too will the opportunities and innovations that Fintech provides. As Fintech continues to grow, it will continue to revolutionize the way we interact with financial services, making them more efficient, cost-effective, and accessible.

Recent Trends in Fintech

The future of FinTech is one of the most talked-about topics in the financial industry. FinTech, or financial technology, is the use of technology to improve and streamline the financial services industry. This rapidly growing sector has experienced significant growth over the past decade and continues to be a major driving force in the global financial system. As FinTech continues to expand and evolve, it is important to understand the recent trends that are shaping the future of this industry.

One of the most visible trends in the FinTech space is the proliferation of digital currencies such as Bitcoin, Ethereum, and Litecoin. These digital currencies are becoming increasingly popular and are being used to facilitate transactions and investments. Another trend is the rise of mobile banking and payment services. Mobile banking and payment services allow users to manage their finances and make payments from their smartphones and other devices. This trend is expected to continue to grow in the coming years as more people switch to digital banking solutions.

In addition to these trends, the FinTech industry is also seeing the emergence of artificial intelligence and machine learning technologies. AI and ML technologies are being used to automate financial processes and to improve the accuracy and speed of financial services. This trend is expected to continue to grow as more companies turn to these technologies to streamline their operations.

These trends all point to an exciting future for FinTech. As the industry continues to evolve and grow, it is important to stay informed on the latest developments and trends in order to ensure that your business is prepared for the future.

Challenges Facing Fintech

Fintech, or financial technology, is a rapidly growing industry that is rapidly transforming the financial services industry. However, as with any industry, it’s not without its challenges. The most pressing challenge facing Fintech is the need to ensure consumer privacy and security, as well as the need to comply with existing regulations. As the industry continues to grow, it’s important to understand the challenges that Fintech faces in order to ensure that it can continue to innovate and evolve in a secure and compliant manner.

One of the major challenges facing Fintech companies is cybersecurity. With more and more financial data being stored digitally, the risk of cyberattacks increases. Fintech companies must ensure that their systems are secure and that they are able to detect any potential threats. They must also ensure that their data is encrypted and that their systems are regularly updated to protect against any emerging threats.

Regulatory compliance is another challenge that Fintech companies must face. With the increasing complexity of the financial services industry, it’s important that Fintech companies understand the regulations that apply to them and ensure that they comply with them. This can be a challenge, as new regulations are constantly being introduced, and ensuring compliance can be time-consuming and costly.

Finally, Fintech companies must also be aware of the ethical considerations of their business. As the industry continues to grow, it’s important to ensure that the technology is being used responsibly and ethically. This includes ensuring that data is being collected and used responsibly and that the technology is not being used to exploit people or to manipulate markets.

The future of Fintech is bright, but it faces many challenges that must be addressed. Companies must ensure that consumer privacy and security is maintained, that they comply with existing regulations, and that their technology is used ethically. By understanding the challenges and taking steps to address them, Fintech can continue to grow and innovate in a secure and responsible manner.

Impact of Fintech on Financial Services

Fintech, or financial technology, has revolutionized the financial services industry in recent years. By leveraging the latest advancements in technology, Fintech has enabled banks, payment services, and other financial services firms to provide customers with better services at lower costs. As Fintech continues to develop and evolve, it is important to consider its potential impact on the financial services industry as a whole.

One of the most notable impacts of Fintech is the increased speed and efficiency of financial transactions. By utilizing cloud-based systems and other technologies, Fintech firms are able to process payments and other transactions more quickly than traditional banking institutions. This faster processing time can lead to increased customer satisfaction and improved customer loyalty. Additionally, Fintech firms are able to provide customers with a wide range of services, such as digital wallets, online banking, and money transfers, that are more convenient and secure than traditional banking methods.

Fintech has also enabled banks to offer customers greater access to their financial data. By using advanced analytics and AI technologies, Fintech firms can provide customers with personalized insights about their financial habits and activities. This can help customers make better decisions about their finances and ultimately lead to increased financial literacy.

As Fintech continues to develop and expand, it is important to consider how it will continue to impact the financial services industry. From increased efficiency and access to data to greater convenience and security, Fintech is likely to continue reshaping the way financial services are provided. It is also likely to open new opportunities for both businesses and customers to benefit from the latest advancements in technology.

Opportunities for Fintech

Advancements

Fintech (Financial Technology) is revolutionizing the global financial services industry, offering consumers and businesses more efficient, secure, and cost-effective ways to manage their money. The industry is quickly growing, with investments in Fintech more than doubling from 2016 to 2017. As the sector continues to expand, it is becoming increasingly clear that there are great opportunities for Fintech advancements.

As the demand for financial services continues to grow, Fintech is uniquely positioned to help meet the needs of consumers and businesses. In fact, many of the world’s leading financial institutions are already utilizing Fintech solutions to provide better services to their customers. From improved mobile banking tools to more secure online payment systems, Fintech is enabling banks, credit unions, and other financial companies to provide more personalized services and products.

In addition, Fintech is also providing opportunities for entrepreneurs and innovators to develop new financial solutions. With access to data, analytics, and the latest in technology, individuals and companies can create new products and services that have the potential to disrupt the traditional banking industry. In the future, Fintech may even help to shape the future of finance in ways that we cannot yet imagine.

The future of Fintech is undoubtedly bright, and its potential for empowering individuals and businesses is immense. By leveraging the latest in technology, Fintech companies can provide improved services to consumers and businesses alike, while also creating new opportunities for innovation. As the sector continues to evolve, the possibilities are limitless.

Conclusion

The future of fintech is full of potential. As technology continues to evolve, financial services are becoming increasingly digitised. Fintech is revolutionising the way we interact with money and transforming financial services for the better. From AI and blockchain-based payments to advanced data analytics and customer service, fintech is transforming the banking and finance industry with innovative solutions that make financial services more accessible, convenient and secure. As the industry matures, we can expect to see more disruption, new products and services, and increased consumer choice. With the right strategies and partnerships, fintech can be a key driver of economic growth and a catalyst for financial inclusion.

FAQs About the What Is The Future Of Fintech?

1. What are the main challenges facing the fintech industry in the future?

Answer: The main challenges facing the fintech industry in the future are related to ensuring compliance with regulatory requirements, increasing security, and developing new and innovative technologies that can expand the scope of services.

2. How will fintech impact traditional financial services?

Answer: Fintech is already having an impact on traditional financial services. It is making it easier for consumers to access financial products and services, as well as improving the efficiencies of existing services. Fintech is also creating new opportunities for businesses to offer innovative products and services.

3. What new opportunities will fintech create for businesses?

Answer: Fintech is set to create a range of new opportunities for businesses. These could include new payment systems, faster and more secure money transfers, improved customer service, and more efficient analysis of customer data.

Conclusion

The future of fintech looks very promising as technology continues to advance and the world’s financial systems become increasingly interconnected. Fintech has already revolutionized the way we store, transfer, and access money, and its potential is only just beginning to be tapped. With the development of new technologies like blockchain, artificial intelligence, and machine learning, fintech will continue to expand and evolve, making it easier and more secure to manage our finances. In the future, fintech will become an even more integral part of our lives, facilitating the exchange of money, goods, and services around the world with unprecedented speed and security.