What Is The Fastest Growing Type Of Insurance?

Insurance is an important part of protecting your financial security, and it can be difficult to know which type is right for you. The fastest growing type of insurance is life insurance, which provides financial protection to your family in the event of your death. Life insurance policies are designed to provide a lump sum of money to your beneficiaries upon your death, allowing them to cover the costs of funeral expenses, living expenses, and other expenses that may arise. Life insurance can provide peace of mind and financial stability for your family, and is often the most affordable form of insurance available.

Overview of Insurance Types

Insurance is a contract between two parties, insured and insurer, in which the insurer agrees to cover losses or damages that the insured incurs from an unexpected event such as an accident, natural disaster, or theft. Insurance plays an important role in our society as it provides financial protection and security against financial losses. There are numerous types of insurance available to consumers, each of which offers different levels of protection and coverage. The fastest growing type of insurance is health insurance.

Health insurance is a form of insurance that covers medical expenses incurred by the insured. It pays for medical and hospitalization costs, prescription drugs, preventive care, mental health care, and other services. Health insurance has become increasingly popular as the cost of medical care continues to rise, making it difficult for many individuals and families to pay for their medical expenses without help. Health insurance helps individuals and families manage the financial burden of medical costs and protect their financial security.

Life insurance is another type of insurance that is becoming increasingly popular. Life insurance provides a lump sum of money to the beneficiary of the policy upon the death of the insured. It is used to provide financial security to the family of the deceased and to cover any outstanding debts or funeral expenses.

Auto insurance is a form of insurance that provides coverage for damages caused to a vehicle in the event of an accident. It pays for medical costs, repair costs, and rental car costs, as well as other expenses related to an accident. It also covers liability for damages caused to another vehicle or property.

Property insurance is a form of insurance that covers damages or losses to property caused by an unexpected event. It pays for repairs, replacements, and legal costs related to property damage. It is commonly used to cover homes, businesses, and other types of real estate.

These are just a few of the many types of insurance available to consumers. With so many options, it is important to understand the different types of insurance and how they can help protect you and your family from financial losses. Each type of insurance has its own advantages and disadvantages, so it is important to understand the risks and benefits of each type before making a decision.

What Is Fast Growing Insurance?

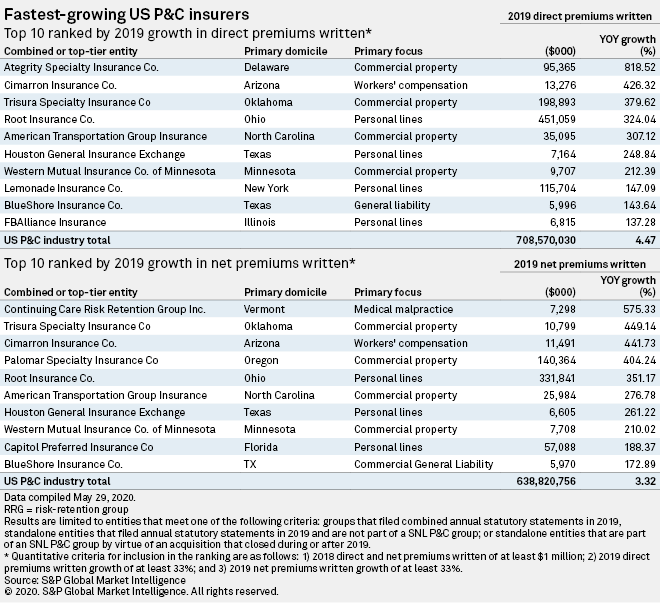

Insurance is a key component of financial security and peace of mind, it is important to understand which types of insurance are growing the fastest. Insurance provides protection against unexpected losses, and the right type of insurance can help individuals and businesses protect their assets and income. The fastest growing type of insurance is life insurance, with premiums increasing at an estimated rate of 6.3% per year worldwide. Health insurance is the second fastest growing type of insurance, with premiums estimated to increase at a rate of 5.7% annually. Property and casualty insurance is the third fastest growing type of insurance, with premiums rising at an estimated rate of 4.7% per year.

In addition to the three fastest growing types of insurance, there are other forms of insurance that are gaining in popularity. For example, cyber insurance is becoming increasingly popular as businesses and individuals face increasing risks from cyber attacks. Pet insurance is also growing in popularity, as individuals look for ways to protect their pets from the unexpected. Auto insurance is also becoming more popular as the number of drivers increases.

No matter what type of insurance an individual or business chooses to purchase, it is important to understand the coverage and terms of the policy. Knowing what type of insurance is the fastest growing can help individuals and businesses make informed decisions when selecting the right policy. By understanding the fastest growing types of insurance, individuals and businesses can better protect their assets and income.

Benefits of Fast Growing Insurance

Insurance is an essential part of our lives, protecting us from unanticipated financial losses due to accidents, illnesses, and other unexpected events. With the right coverage, individuals and businesses can safeguard their financial future and have peace of mind knowing that they are taken care of in the event of a misfortune. But which type of insurance is the fastest growing?

In recent years, there has been a surge in the demand for health, life, and disability insurance. This is due to a variety of factors such as the rising cost of medical care, an aging population, and changing labor markets. Additionally, more people are turning to insurance to cover specialized risks such as pet insurance, cyber security insurance, and travel insurance.

The fast-growing nature of these types of insurance is beneficial for both individuals and businesses. With the right coverage, individuals can make sure they are financially protected in case of an unexpected illness, accident, or death. Businesses, on the other hand, can protect their profits with the right insurance policies and minimize their risk of financial loss.

The benefits of fast-growing insurance extend beyond financial protection. Insurance can also provide peace of mind and confidence knowing that you and your loved ones are taken care of in case of an emergency. Additionally, insurance policies can provide access to quality healthcare and other benefits, such as discounts on prescriptions and medical procedures.

The fast-growing nature of insurance is a positive development for both individuals and businesses alike. With the right coverage, individuals can protect their financial future and businesses can safeguard their profits. Additionally, insurance provides peace of mind and access to quality healthcare and other benefits. As such, it is no surprise that the fastest-growing type of insurance is becoming increasingly popular.

Challenges of Fast Growing Insurance

When it comes to insurance, there is no one-size-fits-all solution. Different types of insurance products have become popular in different markets. But what is the fastest-growing type of insurance?

To answer this question, it’s important to understand the various challenges that come with fast-growing insurance products. Insurance providers must stay on top of changing customer needs, the latest technological developments, and the ever-evolving regulatory landscape. It’s also important to note that the speed of growth of each type of insurance product is different.

For example, health insurance has grown rapidly in recent years due to the rising cost of healthcare and an increase in demand for coverage. Auto insurance has also seen significant growth due to the introduction of autonomous vehicles and the increased popularity of ride-sharing services. Life insurance has also seen a surge in popularity due to the increasing cost of living and the need for financial protection.

In addition, insurers must keep up with changing customer demands and trends. From the rise of digital-first insurance to the need for personalized services, insurers must be able to adapt quickly to stay ahead of the competition.

Overall, understanding the challenges of fast-growing insurance is key to staying ahead in the insurance market. Insurers must be prepared to meet changing customer needs, stay up-to-date with the latest technology, and remain compliant with regulations. By doing so, insurers can ensure that they remain competitive and can continue to grow their business.

How to Choose the Right Fast Growing Insurance

Choosing the right type of insurance to meet your needs is key to having the financial security you need in the future. With the ever-changing insurance landscape, it can be hard to keep up. The fastest growing type of insurance can help you make the best decisions for your needs.

When it comes to choosing the right type of insurance, there are several factors to consider. First, consider your budget. Different types of insurance can come with different premiums and deductibles. Make sure you understand the cost of the coverage before making a decision.

Next, consider the type of coverage you need. Different types of insurance provide different types of protection. For example, life insurance can provide a death benefit, while health insurance can protect you financially in the event of an illness or injury. Make sure you understand the coverage you are purchasing before you make a decision.

Finally, consider the fastest growing type of insurance. The type of insurance with the most growth potential can provide financial stability and peace of mind in the future. It’s important to research different types of insurance and compare options before making a decision.

By understanding the fastest growing type of insurance, you can make an informed decision that best meets your needs. Make sure to evaluate your budget, coverage needs, and growth potential to make the best decision for your future.

Conclusion

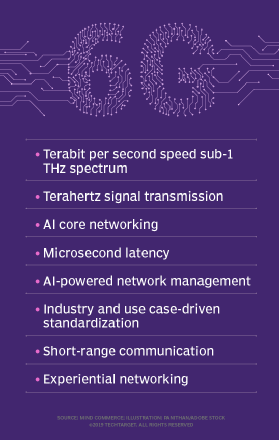

Insurance is an ever-evolving industry that caters to the needs of its customers. With the increasing demand for different types of policies, insurance companies have had to innovate and offer new products to keep up with the changing times. One type of insurance that has seen rapid growth in recent years is Cyber Insurance. This insurance type covers the risks associated with technology, such as data breaches, cyber attacks, and malicious hacking. Cyber Insurance is becoming increasingly popular as the digital world expands and consumers become more reliant on technology. Additionally, the insurance industry is responding to the growing need for more comprehensive coverage, allowing for greater protection for individuals and businesses alike. As technology continues to advance, the demand for Cyber Insurance is expected to increase further in the years to come.

FAQs About the What Is The Fastest Growing Type Of Insurance?

1. What are some of the fastest-growing types of insurance?

Cyber liability, home sharing, and pet insurance are some of the fastest-growing types of insurance.

2. What factors have caused the increase in demand for the fastest-growing types of insurance?

The increased use of technology and the sharing economy, as well as an increased awareness of the need for specialized insurance coverage, have contributed to the growth of the fastest-growing types of insurance.

3. What are the benefits of investing in the fastest-growing types of insurance?

Investing in the fastest-growing types of insurance can help protect customers from liability, provide specialized coverage for their needs, and help them manage their risk.

Conclusion

The fastest growing type of insurance is cyber insurance. Cyber insurance policies are designed to protect businesses from the financial losses associated with cyberattacks, data breaches, and other cyber-related incidents. As the world becomes increasingly digital, so does the need for cyber insurance. Businesses of all sizes are recognizing the necessity of such policies and are investing in them to protect their businesses from the potentially devastating financial losses that can result from cyber attacks.