What Is The Difference Between Finance And Fintech?

Finance and Fintech are two terms that are often used interchangeably, but they have distinct differences that should be noted. Finance is a broad term that encompasses all aspects of a company’s financial activities, such as budgeting, investing, and managing debt. Fintech, on the other hand, is a field of technology that is used to facilitate financial activities. Fintech is typically associated with digital payment systems and other forms of online banking. To put it simply, finance refers to the way money is managed, while Fintech refers to the technology used to make that management easier.

What is Finance?

Finance is the study of money management and the process of acquiring and deploying capital. It encompasses a wide range of topics that include investments, financial planning, banking, and risk management. It also involves understanding the behavior of markets and the financial systems that govern them. Financial professionals use a variety of tools, techniques, and models to analyze and manage financial assets. Financial institutions such as banks, insurance companies, and asset managers use financial strategies to ensure the efficient and profitable use of their resources. Finance is a broad field that also includes economics, accounting, and law.

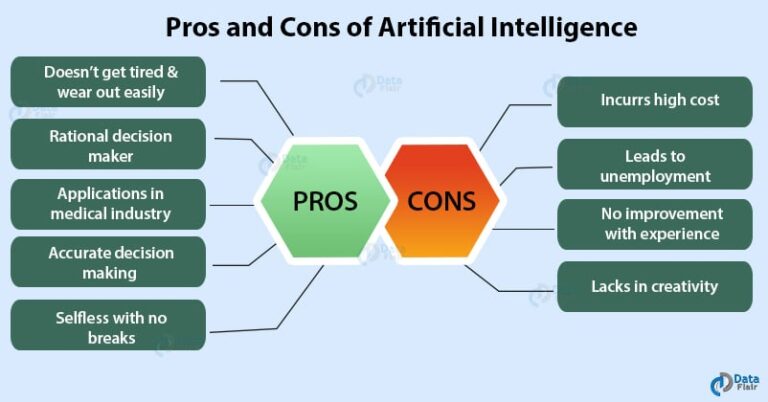

Fintech, on the other hand, is a relatively new field that combines the principles of finance with cutting-edge technology. Fintech is an umbrella term that covers a range of financial services, products, and technologies. It includes the use of mobile banking apps, digital payments, online banking, blockchain, and artificial intelligence. Fintech companies have revolutionized the financial services industry, providing customers with more efficient and secure ways to manage their finances. Fintech has also enabled companies to offer new products and services, such as peer-to-peer lending and automated investment advice.

What is Fintech?

Fintech is short for financial technology which is a rapidly growing industry that uses technology to improve and automate the delivery and use of financial services. Fintech companies are often focused on providing financial services to consumers and businesses, and use technology to do so more efficiently, cost effectively, and securely. This can include providing more accessible banking services, such as mobile banking, online payments, and automated investment advice. Fintech companies are also involved in developing new products and services such as cryptocurrency, robo-advisors, and digital wallets. Fintech is not only transforming the financial services industry, but is also playing an important role in driving innovation and economic growth. As the world continues to move towards a digital economy, Fintech is likely to remain an important part of the financial landscape.

Similarities between Finance and Fintech

The world of finance and fintech have many similarities. They both involve the use of technology, data, and financial instruments to help individuals and businesses achieve their financial goals. Finance and fintech share the same underlying principles, such as financial planning, risk management, and investment analysis.

Finance and fintech both use data-driven tools to assess and analyze financial risk, as well as to identify opportunities and make financial decisions. Both use financial models and algorithms to predict and manage risk, and to identify and capitalize on opportunities. They use both traditional and new technologies to provide financial services, such as online banking, mobile banking, and electronic payments.

Perhaps the biggest similarity between finance and fintech is the end goal – to help individuals and businesses reach their financial goals. Both use data-driven technology and analytics to identify the best strategies and implement them.

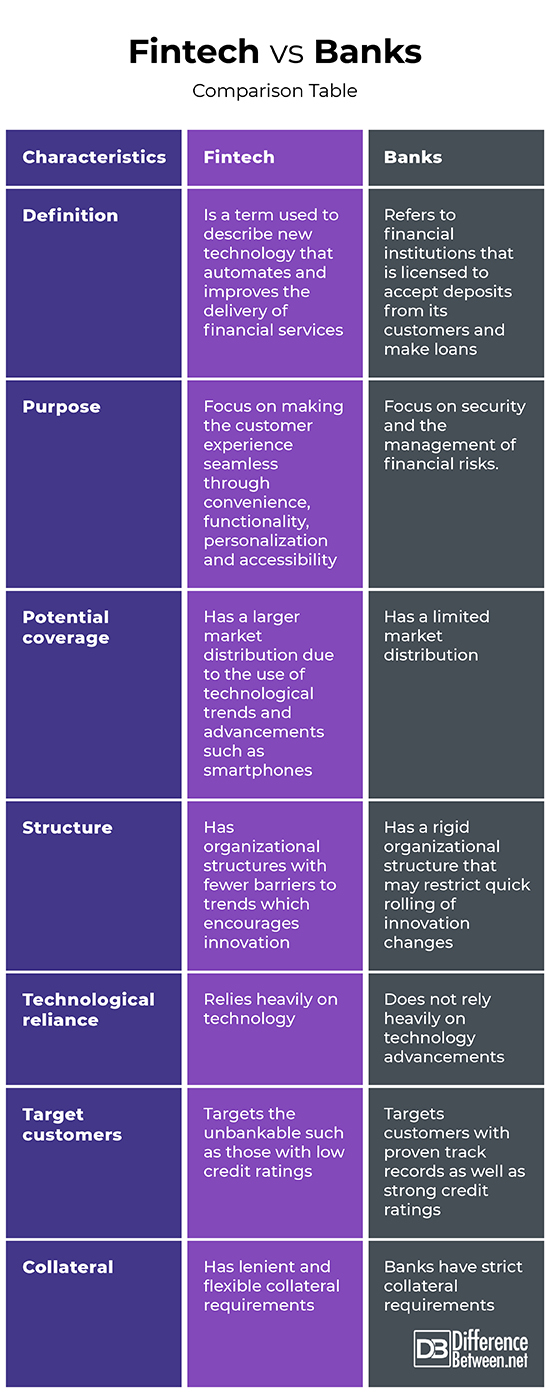

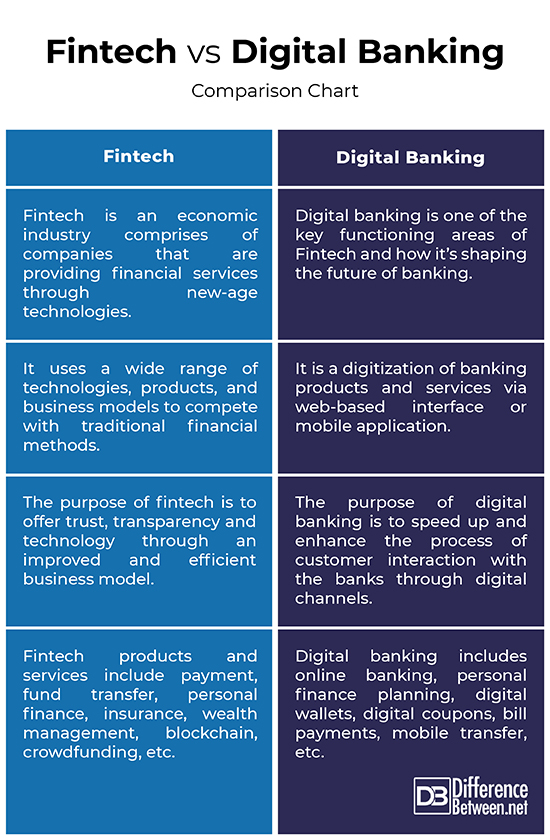

At the same time, the differences between finance and fintech are quite vast. Finance typically relies on traditional methods, such as banking, insurance, and investments, while fintech relies on innovative technologies such as blockchain, machine learning, and artificial intelligence to provide financial services. Fintech is also much more focused on technology-driven services, such as cryptocurrency, online payments, and digital wallets. Finance, on the other hand, is more focused on traditional financial services, such as loans, mortgages, and investments.

In summary, while the world of finance and fintech have many similarities, the differences between the two are quite vast. They both use data-driven technology and analytics to provide financial services, but fintech is more focused on technology-driven services while finance is more focused on traditional financial services.

Differences between Finance and Fintech

Finance and Fintech have revolutionized the way businesses and individuals manage their money. While both are integral to the financial industry, there are some key differences between the two that can help you understand the impact each can have.

Finance is the traditional approach to managing money. It allows businesses and individuals to save, invest, and protect their assets. It also includes the use of financial services, such as banking, credit cards, and insurance. These tools are designed to help people make informed decisions about their money.

Fintech, on the other hand, is a more modern approach to managing finances. It uses technology to streamline banking processes and provide more efficient ways of managing money. This includes using mobile apps, artificial intelligence, and blockchain to make financial processes easier and faster.

The primary difference between finance and Fintech is how they help manage money. Finance is a more traditional approach that focuses on the fundamentals of money management, such as budgeting, investing, and protecting assets. Fintech is more of a technology-driven approach that streamlines the financial process and helps individuals and businesses make more informed decisions about their money.

Ultimately, both finance and Fintech offer valuable tools and services to help individuals and businesses manage their money. By understanding the differences between the two, you can determine which approach is best for your financial needs.

Impact of Fintech on Finance

Fintech has revolutionized the financial services industry, bringing with it a wave of innovation and disruption. It has enabled businesses and consumers to access financial services in ways that weren’t possible before. From online banking to automated investment services, Fintech has disrupted the traditional banking and investor landscape. But what is the real impact of Fintech on the finance industry?

Fintech has enabled businesses to provide a range of services that weren’t possible before, such as automated trading, mobile payments, and peer-to-peer lending. This has allowed businesses to compete with traditional banks and other financial service providers, creating more competition in the market. Additionally, Fintech has enabled consumers to access financial services in more efficient and cost-effective ways. For example, consumers can now access financial services online, which allows them to compare different services quickly and easily.

Fintech has also changed the way that financial services are provided. For example, Fintech companies are leading the way in terms of using machine learning and artificial intelligence to provide more personalized services to customers. By using data and insights from customer behavior, Fintech companies are able to offer more tailored services to customers, such as personalized financial advice.

Fintech has also helped to reduce the cost of providing financial services. By eliminating the need for expensive physical infrastructure, such as bank branches and ATMs, Fintech companies are able to offer services to customers at lower costs. Additionally, Fintech companies are able to utilize technology in order to offer more efficient services, which can result in cost savings for customers.

In conclusion, Fintech has had a significant impact on the finance industry, from allowing businesses to compete with traditional players to providing more cost-effective and efficient services to customers. As Fintech continues to evolve, its impact on the finance industry is only expected to increase.

The Future of Finance and Fintech

The world of finance is changing rapidly, and the integration of fintech is a driving force behind it. Fintech (financial technology) is the term used to describe the use of technology to improve, automate, and streamline financial services and processes. It is a rapidly evolving field that has seen significant growth in recent years. The use of fintech has revolutionized the way traditional finance is conducted, and its impact on the industry is undeniable.

Fintech is focused on using technology to create new products, services, and business models in the financial sector. This includes online banking, peer-to-peer lending, digital currencies, and more. Fintech companies are constantly coming up with innovative solutions to old problems and are transforming the way we access and use financial services.

Finance, on the other hand, is the traditional method of conducting financial operations. It is focused on the management of money, investments, and financial markets. It involves the use of a variety of tools and techniques to identify and analyze potential investments, manage risk, and protect and grow wealth.

The difference between finance and fintech is that finance is a more traditional approach to managing money, while fintech is focused on using technology to innovate and improve the financial sector. While both are integral to the financial world, fintech is a newer and more modern approach that is opening up new opportunities and possibilities for the future of finance.

FAQs About the What Is The Difference Between Finance And Fintech?

Q1: What is the main difference between finance and fintech?

A1: The main difference is that finance traditionally involves financial institutions such as banks and other lenders providing services and products, while fintech is a relatively new industry that uses technology to provide financial services to consumers and businesses.

Q2: How do finance and fintech affect each other?

A2: Finance and fintech are intertwined in many ways. Fintech is providing more efficient ways for financial institutions to operate, while traditional finance is providing a stable foundation for fintech to build upon and innovate.

Q3: What are some examples of fintech products?

A3: Examples of fintech products include online banking, mobile payment solutions, cryptocurrency exchanges, peer-to-peer lending, and automated investment services.

Conclusion

The difference between finance and fintech is that finance is the traditional system of managing money, whereas fintech is the use of technology to improve the traditional financial system. FinTech is used to increase efficiency, reduce costs, and provide new and innovative services. Fintech also offers a more secure and convenient way to manage financial transactions. Ultimately, finance and fintech are both important for managing money, but the key difference is that fintech is more focused on improving the traditional financial system with the help of technology.