What Is The Biggest Fintech Company?

Fintech, or financial technology, is fast becoming one of the most important sectors of the modern economy. The biggest fintech companies are those that provide the technology and services that are enabling the banking and finance industry to move into the digital age. These companies are pioneering cutting edge solutions to enable customers to access financial services faster, more conveniently, and at a lower cost. Examples of the biggest fintech companies in the world include Ant Financial, Square, Stripe, Robinhood, and TransferWise. These companies are driving innovation in the banking and finance industry and are transforming the way people access and use financial services.

Definition of Fintech

Fintech, short for financial technology, is a rapidly evolving industry that has revolutionized the way financial services are provided. It leverages advancements in technology such as artificial intelligence, cloud computing, and mobile applications to provide faster, more secure, and more efficient financial services. Fintech companies are disrupting traditional financial services by offering innovative products and services that provide customers with greater access, convenience, and control over their finances. As the fintech industry continues to grow, it has become increasingly difficult to determine which companies are the biggest players in the space.

The biggest fintech companies are those that have the ability to capture a large market share and provide their customers with the best products and services. Some of the most prominent players in the market include the likes of Ant Financial, Square, Revolut, and Nubank. These companies have made the fintech landscape more competitive and have enabled customers to access more financial services than ever before. Additionally, these companies have created new business models such as peer-to-peer lending, cryptocurrency, and robo-advisors that have further disrupted the traditional banking sector.

The biggest fintech companies are those that are well-funded, have the right expertise, and have the ability to innovate quickly. They are also those that can create long-term value for their customers and the industry as a whole. As fintech continues to advance, the biggest players will be those that can successfully navigate the ever-changing landscape and remain ahead of the competition.

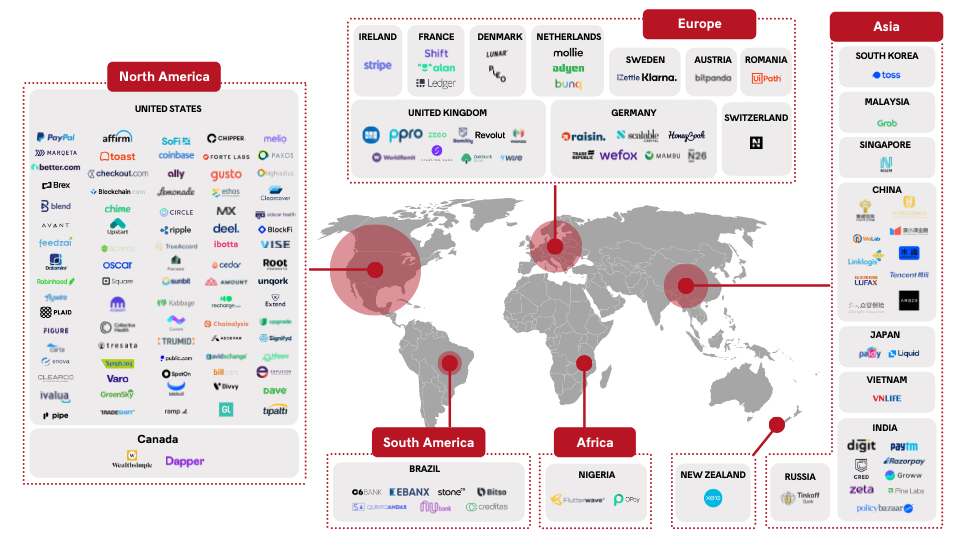

Market Landscape of Fintech

Fintech is a rapidly growing sector of the global financial services industry. As the ability to offer financial services online increases, so does the number of fintech companies. As a result, competition is becoming increasingly fierce, and the biggest fintech companies are those that are able to stay ahead of the game.

There are many different categories of fintech, including payments, banking, investments, insurance, and risk management. The top fintech companies are those that offer a combination of these services or specialize in one of them. In the payments sector, companies like PayPal, Stripe, and Square are some of the biggest players. In banking, companies like SoFi, Revolut, and Chime are leading the way. For investments, companies such as Acorns and Robinhood are becoming increasingly popular. In the insurance space, companies like Lemonade and Root are building solutions to make insurance more accessible. Finally, in risk management, companies like Plaid and Ava are making strides in the industry.

The market landscape of fintech is constantly shifting and it’s hard to predict who the biggest players will be in the future. Companies that are able to innovate and stay ahead of the competition will be the ones that remain successful. As technology advances, the biggest fintech companies will continue to be those that offer innovative solutions to their customers.

The Emergence of Biggest Fintech Companies

The financial technology (fintech) revolution has changed the landscape of the banking industry. Over the past decade, the growth of fintech has been exponential, with companies such as PayPal, Stripe, and Venmo becoming household names. With the emergence of these giants, it begs the question: what is the biggest fintech company?

The answer to this question isn’t as straightforward as one might think. While some of the most well-known fintech companies are widely recognized, there are many other players in the space that may not be as recognizable. To determine which company is the biggest, one must take into consideration a variety of factors such as market capitalization, revenue, and customer base.

One of the largest fintech companies is Ant Group. This Chinese-based company is the parent company of the popular digital payment platform Alipay. Ant Group has a market capitalization of over $200 billion and provides financial services to over 1 billion customers worldwide. Additionally, Ant Group has recently made strides towards becoming a digital bank, allowing customers to open virtual bank accounts and make payments with their Alipay app.

Another major player in the fintech industry is PayPal. This company has a market capitalization of over $150 billion and currently has over 300 million users. PayPal has been a key player in the digital payments space, offering customers the ability to pay for goods and services online and send money to others via its platform.

Ultimately, it is difficult to pinpoint exactly which fintech company is the biggest as it is a constantly evolving industry. There are many factors to consider when determining which company is the largest. However, it is clear that Ant Group and PayPal are two of the biggest players in the space and are likely to remain so for many years to come.

![Ranking of Largest Fintech Companies in 2022 [Full List] - CFTE](https://courses.cfte.education/wp-content/uploads/2021/11/Market-Valuation-of-Fintech-Unicorns-in-the-UK.png)

Key Factors Contributing to Fintech Companies’ Success

Fintech (financial technology) companies are revolutionizing the way global financial services are delivered. From digital banking to cryptocurrency trading, the industry is ever-evolving and growing at a rapid rate. To better understand the success of these companies, it’s important to consider the key factors that are contributing to their success.

One major factor in the success of fintech companies is the use of cutting-edge technology. These companies are leveraging the latest advancements in data analytics, artificial intelligence, and machine learning to create innovative products and services, such as automated savings and investment tools, real-time payments, and digital currencies.

Another key factor in the success of fintech companies is their ability to adapt quickly to changing market conditions. These companies are able to quickly develop and launch new products and services in response to customer needs and industry trends. This agility gives them a competitive advantage over traditional financial institutions.

Finally, the industry is being driven by venture capital investment. Fintech companies have access to large amounts of capital which allows them to experiment with new ideas and technologies. This investment has enabled the industry to grow at an unprecedented rate.

Fintech companies are revolutionizing the financial services industry and are set to continue to do so in the coming years. By understanding the key factors that are driving their success, we can get a better understanding of the biggest fintech companies and the future of the industry.

Challenges Facing Fintech Companies

In the digital age, traditional financial services are being disrupted by fintech companies that offer quicker, more convenient services. Fintech companies are transforming the financial landscape with innovative technology, but they must also overcome significant challenges to succeed. As the biggest fintech companies continue to expand, they must confront a variety of obstacles in the areas of regulation, consumer trust, and competition.

Regulatory compliance is a major challenge for fintech companies. In order to stay in business, they must adhere to the laws and regulations of the countries in which they operate. This can be particularly difficult in countries with outdated or complex financial regulations, such as the United States. Additionally, fintech companies must be wary of potential legal action from competitors, as well as customers who may be dissatisfied with their services.

Building consumer trust is also a major challenge for fintech companies. In a digital world where cyber security threats are ever-present, customers are increasingly wary of sharing their personal information. Fintech companies must work hard to prove they can be trusted with customers’ data, as well as their money. This requires robust security measures, clear and transparent policies, and an emphasis on customer service.

Finally, fintech companies must contend with increasing competition. As more and more companies enter the fintech industry, it is becoming increasingly difficult for companies to differentiate themselves from the competition. Companies must develop innovative products and services to stay ahead of the competition, while also keeping costs low.

Overall, the biggest fintech companies must confront a variety of challenges in order to stay competitive. From navigating complex regulations to gaining customer trust, fintech companies must be prepared to face these obstacles and emerge stronger than ever.

Potential Future of Fintech Companies

Fintech companies have become a major force in the financial industry over the past decade. Fintech firms offer a wide range of services, from payments and financial advice to loan origination and investment management. With the emergence of new technologies and changing consumer demand, the future of fintech is likely to be even more exciting.

The biggest fintech company today is likely Ant Financial, an affiliate of the Chinese tech giant Alibaba. Ant Financial has a wide range of services and products, including mobile payments, wealth management, and credit scoring. It is also the world’s largest online payment platform, with more than 450 million active users.

The future of fintech is likely to be even more interesting as new technologies such as artificial intelligence, machine learning, and blockchain become more prevalent. With these advancements, fintech companies can offer more personalized services and create more customized products. As the industry continues to grow, we can expect to see more companies emerge as market leaders.

At the same time, traditional banks will also continue to play an important role in the fintech sector. Banks are likely to partner with fintech firms to develop innovative solutions and products that will improve customer experience and keep up with changing customer needs.

The future of fintech is both exciting and uncertain. Companies need to stay on top of the latest trends and technologies in order to remain competitive. As new players enter the market, it will be important for companies to differentiate themselves by offering innovative products and services. The biggest fintech company of the future is likely to be the one that can most effectively use technology to create unique customer experiences.

FAQs About the What Is The Biggest Fintech Company?

Q1: What is Fintech?

A1: Fintech, short for financial technology, is the use of innovative technology to provide financial services. Fintech companies are typically startups that use technology to create new and improved financial products and services for consumers and businesses.

Q2: What is the biggest Fintech company?

A2: Ant Financial is the largest Fintech company in the world. It is an affiliate of the Chinese tech giant Alibaba Group and provides a variety of online financial services including payment processing, wealth management, credit scoring, and small business loans.

Q3: How does Fintech benefit consumers?

A3: Fintech is making financial services more accessible, efficient, and secure. Consumers now have more options for managing their finances while enjoying lower fees, faster processing times, and improved security. Fintech also enables more people to access financial services who might not have had access before, such as those in developing countries.

Conclusion

The biggest Fintech company in the world is Ant Financial. It is a Chinese company that was founded in 2014 and has grown rapidly ever since. It provides financial services such as payments, lending, wealth management, and insurance. Ant Financial has become the world’s largest fintech company by market capitalization and is now one of the most influential players in the global financial services industry. It is expected that the company will continue to grow and develop innovative solutions to improve the way people interact with their finances.