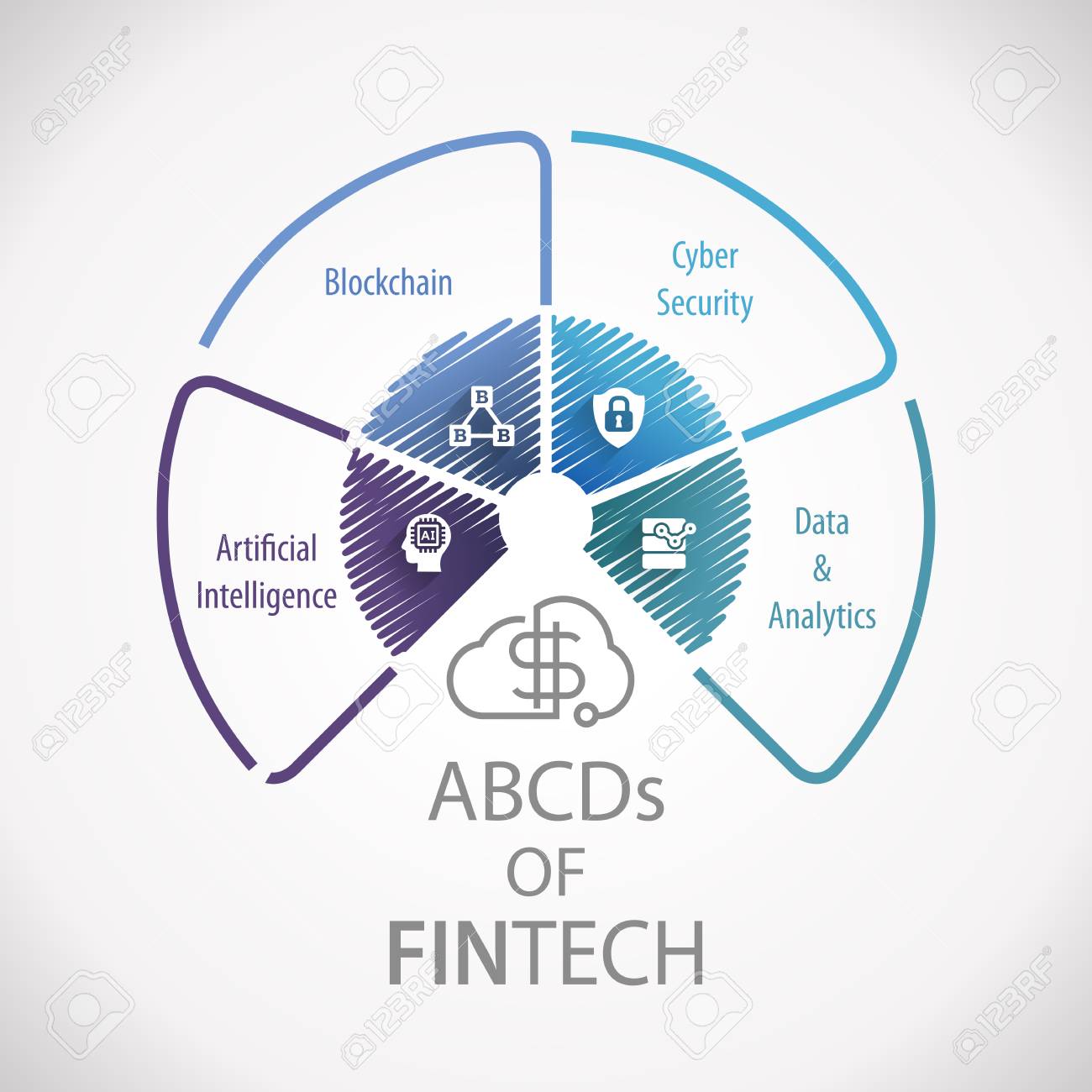

What Is The ABCD Of Fintech?

Fintech, short for financial technology, is the use of technology to help facilitate financial processes and services. The ABCD of Fintech is a framework of four areas of focus that define the overall Fintech landscape: Access, Borrowing, Deposits, and Payments. Access refers to the different ways people can access finance, such as through mobile apps, online banking, and peer-to-peer lending. Borrowing involves the loans and credit products people can use to supplement their income or finance a purchase. Deposits are the money people have stored in savings accounts or other products such as certificates of deposit. Finally, payments refer to all the different methods of paying for goods and services, such as credit cards, debit cards, and digital wallets. Together, these four areas make up the ABCD of Fintech and form the backbone of the ever-evolving financial landscape.

What is Fintech?

Fintech, short for financial technology, is the use of technology to provide financial services. It encompasses everything from online banking, mobile payments, and cryptocurrency, to investment platforms, crowd-funding, and insurance. Fintech is transforming the way we manage our money and make payments, making the process faster and more convenient, and providing more options for people.

The ABCD of Fintech stands for Accessibility, Big Data, Cybersecurity, and Disruption. Accessibility is about making financial services available to everyone, regardless of their location or financial situation. Big Data is the use of data to better understand consumer behavior and create tailored financial products. Cybersecurity is essential in protecting customer data and ensuring secure transactions. Finally, Disruption is the application of new technologies and business models that are revolutionizing the financial industry.

Fintech is changing the way we bank, invest, and manage our finances, making it easier and faster to access financial services. By understanding the ABCD of Fintech, we can all take advantage of the new opportunities that Fintech offers.

What does ABCD Stand for in Fintech?

Fintech is a rapidly evolving field that is having a dramatic effect on the way financial services are provided. As the technology and tools available to businesses and consumers evolve, the field of Fintech is changing the way people interact with money. One of the key terms that has become associated with this industry is ABCD – but what does it stand for?

ABCD stands for “Artificial Intelligence, Blockchain, Cryptocurrency, and Data.” These four technologies are driving many of the changes in the Fintech industry, providing businesses with powerful tools to manage their finances more effectively.

Artificial Intelligence (AI) is being used to automate many of the more tedious tasks associated with financial services, allowing businesses to better manage their resources and focus on more important tasks. Blockchain technology is providing a secure platform for transactions, while cryptocurrencies are providing an efficient means of transferring funds. Data is being used to analyze customer behavior and provide valuable insights into the best way to provide services.

Collectively, these four technologies are revolutionizing the way that Fintech is used, offering businesses and consumers more efficient and secure ways to manage their finances. As the technology continues to evolve, it’s likely that ABCD will become an even more integral part of the Fintech landscape.

What Are the Benefits of Fintech?

Fintech, which stands for financial technology, is a rapidly growing sector of the economy that is transforming the way businesses and individuals manage their finances. By leveraging the latest advances in technology, Fintech companies are making it easier for people to access financial products and services. This is providing greater convenience, more control over finances, and more options for investors.

One of the main benefits of Fintech is that it has made access to financial products and services more accessible than ever before. By utilizing digital systems, Fintech companies are able to provide access to a wider range of products and services to more people. This is helping to democratize the access to financial products by allowing individuals to choose products and services that are tailored to their specific needs.

Another benefit of Fintech is the ability to provide a more secure and efficient way to process payments. By utilizing advanced encryption technology, Fintech companies are able to provide a secure platform for sending and receiving payments. This reduces the risk of fraud and makes payments more efficient, which can save businesses time and money. Additionally, Fintech companies are also able to provide a range of other services such as investment advice, insurance, and lending.

Finally, Fintech is also helping to make the banking sector more efficient. By utilizing advanced analytics and machine learning, Fintech companies are able to provide banks with the ability to streamline their processes and make better decisions on financial matters. This can help banks reduce costs and improve their services, which will ultimately benefit their customers.

All in all, the ABCD of Fintech is providing a range of benefits that are transforming the financial sector and making it easier for individuals and businesses to access financial products and services. From increased access to more secure payments, to more efficient banking processes, Fintech is revolutionizing the way people manage their finances.

What Are the Challenges of Fintech?

Fintech (financial technology) is a rapidly growing sector, disrupting traditional financial services. With advancements in technology, fintech has enabled consumers to access a variety of financial services and products. As the sector continues to expand, there are a number of challenges that must be addressed.

The ABCD of fintech stands for access, cost, data, and regulation. Access to financial services is a challenge, with many consumers still not on-boarded due to lack of financial literacy. Furthermore, the cost of providing financial services is high, with high infrastructure costs and personnel expenses. Data is a key factor in fintech, with the need to capture, analyze, and interpret data for better insights. Lastly, regulation is a key challenge, with the sector needing to comply with various regulations and consumer protection laws.

As the fintech sector continues to evolve, it is important to recognize and address the challenges that come with it. From access to data, to cost and regulation, the sector must be able to provide consumers with the best financial products and services. With the right strategies and technologies, the ABCD of fintech can be successfully addressed.

What Are the Implications of Fintech for the Future?

Fintech, or financial technology, is a booming industry that is transforming the way financial services are being delivered. As the industry continues to grow, it is important to understand the implications of fintech for the future. By understanding the ABCD of fintech, one can gain insight into the future of the industry and how it will shape the economy.

The ABCD of fintech stands for Automation, Blockchain, Cybersecurity, and Data Analytics. Automation is the use of technology to automate manual processes, such as the creation of digital identities, credit scoring, and loan origination. Blockchain is a distributed ledger technology that enables peer-to-peer transactions with greater security and transparency. Cybersecurity focuses on protecting digital assets and data from malicious attacks. Finally, data analytics is the process of collecting, analyzing, and interpreting data to gain insights and inform decisions.

These four components are the foundation of fintech and are shaping the future of the industry. Automation is reducing the cost of providing services, while blockchain is making transactions more secure. Cybersecurity is protecting against cyberthreats, and data analytics is helping to make better decisions. Together, these four components are revolutionizing the way financial services are being delivered.

The implications of fintech are far-reaching. It is increasing access to financial services, creating new opportunities for entrepreneurs, and providing more secure and transparent transactions. It is also transforming the way banks and other financial institutions operate, with more data-driven decisions and automated processes. The future of fintech is bright, and as the industry continues to evolve, it will bring about many new and exciting opportunities.

What Are the Best Practices for Implementing Fintech?

Fintech is a rapidly growing industry that is revolutionizing the way financial services are provided. As such, it is important for organizations to understand the best practices for implementing fintech solutions. In this article, we will discuss the ABCD of fintech – the four key steps for successfully implementing a Fintech solution.

The first step is to Assess the current situation. This involves looking at the current financial processes and technologies, and understanding the opportunities and challenges of introducing a new fintech solution. After assessing the situation, organizations should then Build the right team. A team of experts from various disciplines is necessary to ensure the solution is implemented correctly.

Next is to Configure the technology. This involves selecting the right fintech solution for the organization’s needs and ensuring it is properly configured for maximum efficiency and effectiveness. The fourth step is to Deploy the solution. This involves making sure the fintech solution is tested thoroughly, and ensuring the organization’s staff is trained and ready to use it.

By following these steps, organizations can ensure that their fintech solution is properly implemented and delivers the desired results. With the right team, technology, and process in place, organizations can reap the benefits of fintech and take their financial operations to the next level.

FAQs About the What Is The ABCD Of Fintech?

Q1: What is the ABCD of Fintech?

A1: The ABCD of Fintech stands for Artificial Intelligence (AI), Blockchain, Cloud Computing, and Data Analytics. These are the four key components that make up the foundation of Fintech.

Q2: How do these four components work together?

A2: AI, Blockchain, Cloud Computing, and Data Analytics all work together to enable a more efficient and secure financial system. AI is used to automate and streamline processes, blockchain is used to ensure data security, cloud computing is used to store and access data, and data analytics is used to gain insights and make predictions.

Q3: What are the benefits of Fintech?

A3: Fintech has the potential to revolutionize finance by streamlining processes and enhancing security. It can make the financial system more efficient and cost-effective, enable more secure transactions, and provide more accurate predictions about the future of the market.

Conclusion

The ABCD of Fintech is a helpful tool to understand the different aspects of the fintech industry. It stands for Artificial Intelligence, Blockchain, Cryptocurrency, and Digital Payments. These four components make up the foundation of the fintech industry, and understanding each one is essential for any business or individual looking to leverage the power of fintech. With the ABCD of Fintech, businesses can better understand the implications of each component and make more informed decisions about their financial future.