What Is Insurance Technology?

Insurance technology, often referred to as insurtech, is the use of technology to improve the delivery of insurance products and services. It involves the use of software, mobile applications, data analytics, cloud computing, and other digital technologies to streamline insurance processes, enhance customer experience, and increase operational efficiency. Insurance technology can be used to automate processes such as underwriting, claims processing, and policy management. It can also be used to provide customers with more personalized insurance offerings and to ensure more accurate pricing.

Definition of Insurance Technology

Insurance technology (InsurTech) is a term used to describe the application of technology to the insurance industry. It includes the use of digital tools and applications to improve the efficiency, accuracy, speed, and cost of providing insurance services. It also encompasses the development of innovative products and services, such as digital insurance policies, digital claims, and automated underwriting systems. InsurTech has revolutionized the way insurers deliver services to customers, allowing them to provide better, faster, and cheaper services. InsurTech is transforming the traditional insurance industry, allowing for more cost-effectiveness, customer focus, and efficiency. By utilizing InsurTech, insurers can create frictionless customer experiences, decrease operating costs, and improve customer retention.

Types of Insurance Technology

Insurance technology, or InsurTech, is an emerging field of technology that is making waves in the insurance industry. InsurTech is a combination of traditional insurance practices, digital technologies, and innovative solutions that are transforming the way insurance companies operate. InsurTech is revolutionizing the insurance industry by introducing new processes, products, and services that are improving customer experience, increasing operational efficiency, and reducing costs.

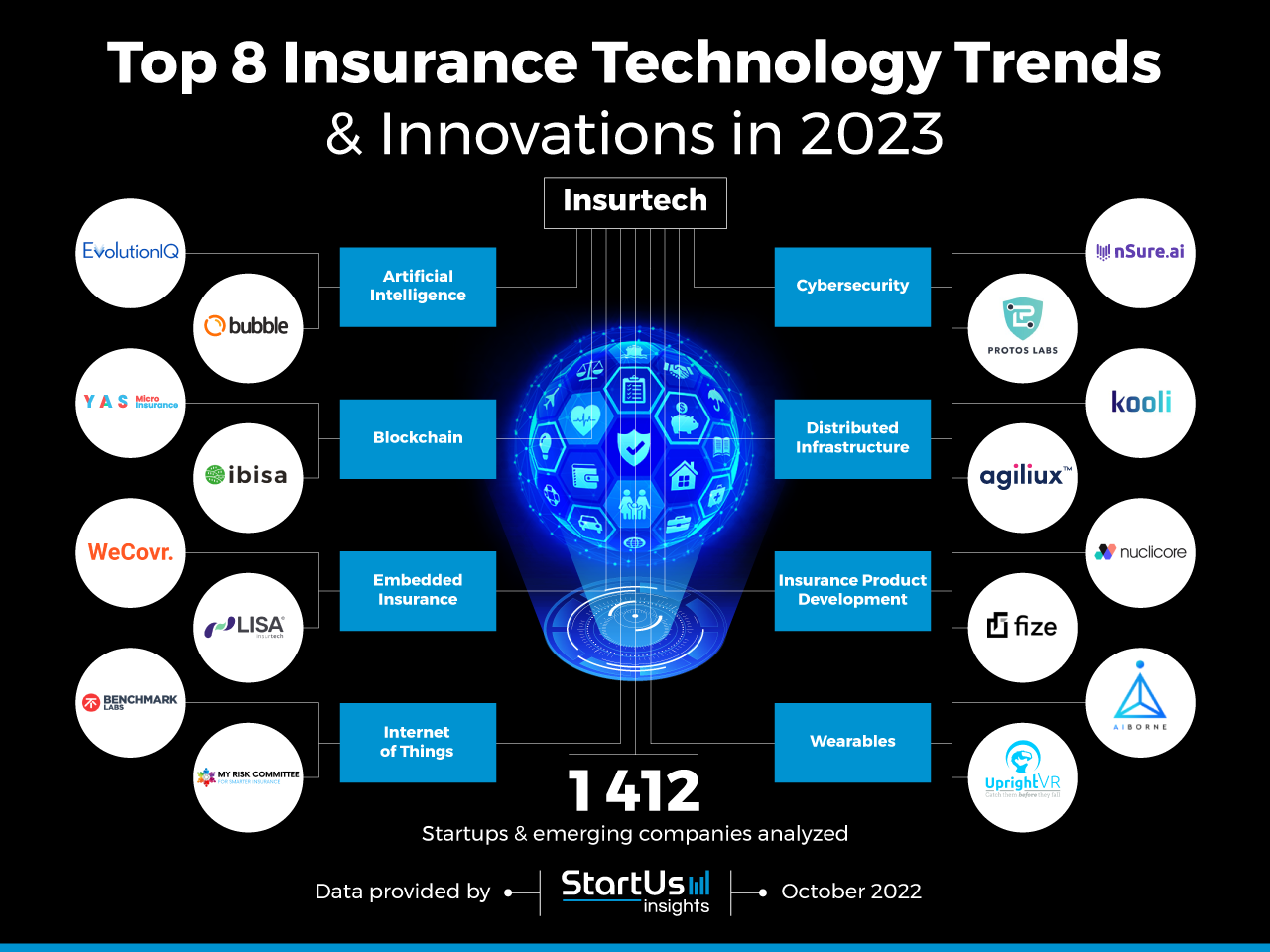

InsurTech applications range from customer-facing solutions like digital billing and automated claims processing, to back-end technologies such as machine learning, data analytics, and blockchain. InsurTech also includes innovative products and services such as usage-based insurance, on-demand insurance, and peer-to-peer insurance. All of these tools and solutions are designed to make the insurance industry more efficient, cost-effective, and customer-centric.

Insurance technology is quickly becoming an integral part of the insurance industry, and the trend is expected to continue as the industry continues to evolve. By leveraging advanced technologies such as artificial intelligence, machine learning, and blockchain, insurance companies can unlock new opportunities and improve customer experience. InsurTech is an exciting and rapidly growing field, and its potential to revolutionize the insurance industry is immense.

Benefits of Insurance Technology

Insurance technology, or InsurTech, is the use of new technologies and processes to make the insurance industry more efficient. It combines the latest technology with traditional insurance practices to create innovative solutions that streamline the insurance process. InsurTech offers a variety of benefits to both insurance companies and customers, including improved customer experience, cost savings, and better risk management.

For insurance companies, InsurTech solutions provide the opportunity to cut costs and increase efficiency. These solutions can automate mundane tasks, such as processing claims, which saves time and money. Additionally, InsurTech can help insurers better manage risk by using advanced data analysis and predictive modeling tools. This can result in better pricing and more accurate risk assessments.

Customers also benefit from InsurTech. Insurance companies can use InsurTech to provide faster service and improve their customer service. InsurTech can make it easier for customers to get quotes, buy policies, and make payments. Additionally, InsurTech can provide customers with access to real-time, personalized data about their policies and coverage, allowing them to make informed decisions about their insurance needs.

Overall, InsurTech offers a variety of benefits to both insurance companies and customers. With InsurTech, insurance companies can increase efficiency and reduce costs, while customers can experience faster service and better insights into their policies. In the future, InsurTech will continue to revolutionize the insurance industry, providing innovative solutions that make the insurance process more efficient and effective.

Challenges of Insurance Technology

Insurance technology, also known as InsurTech, is a rapidly growing sector of the tech world. It is a combination of the latest advances in technology, such as artificial intelligence and blockchain, with the traditional practices of the insurance industry. The potential of InsurTech is immense, but it also presents its own set of challenges. In this article, we will explore the challenges that InsurTech poses to the insurance industry and how they can be addressed.

One of the primary challenges of InsurTech is the lack of trust. Many insurance companies are reluctant to entrust their data to new technologies, as they are unsure of their capabilities. This lack of trust can be addressed by providing more transparency into how the technology is used and how it can be secured. Additionally, companies should invest in training and education about the technology so that their employees can understand how it works and how it can benefit the company.

Another challenge of InsurTech is the complexity of the technology. InsurTech is a rapidly evolving field and new technologies are being developed all the time. It can be difficult to keep up with the latest developments and ensure that the technology is properly implemented. Companies should invest in training and education about the technology, as well as hiring experts to help them understand and implement the technology.

Finally, InsurTech needs to be properly integrated into existing systems. Many insurance companies have legacy systems that are difficult to integrate with new technologies. Companies should invest in developing a plan for integrating the technology into their existing systems, as well as finding experts who can help them do so.

InsurTech is a rapidly growing field that presents its own set of challenges. Companies should invest in training and education about the technology, as well as finding experts to help them implement it. Additionally, they should develop plans for integrating the technology into their existing systems. With the right strategies in place, insurance companies can take advantage of the potential of InsurTech and benefit from the latest advances in technology.

The Future of Insurance Technology

Insurance technology, or InsurTech, is rapidly changing the way the insurance industry works. This innovative technology has led to the emergence of a wide range of products and services designed to make the lives of customers and insurers easier. From automated risk assessment and claims processing to the use of predictive analytics to understand and improve customer experience, InsurTech is providing new opportunities to increase efficiency and reduce costs. As the technology continues to evolve, insurance companies are investing heavily in the development of innovative solutions, making it one of the most dynamic and exciting fields in the industry today. InsurTech is revolutionizing the way insurance companies operate and interact with their customers, paving the way for an even more efficient insurance industry in the future.

Conclusion

Insurance technology is a rapidly growing sector, allowing insurers to reduce costs and improve customer satisfaction. IT-enabled products and services are transforming the insurance industry by automating processes, streamlining operations, and enabling insurers to offer personalized, data-driven insurance products. With the right IT solutions, insurers can increase efficiency, reduce the risk of fraud, and become more competitive in the marketplace. In addition, technology has enabled insurers to provide customers with more tailored services and products, resulting in improved customer satisfaction. Insurance technology is revolutionizing the insurance industry, and the trend shows no signs of slowing down.

FAQs About the What Is Insurance Technology?

1. What types of technology are used in insurance?

Answer: Insurance technology involves the use of various software and hardware systems to manage insurance processes such as underwriting, claims processing, policy administration, and customer service.

2. How is insurance technology used to reduce costs?

Answer: Insurance technology can be used to automate processes and reduce manual tasks, leading to cost savings. Additionally, technology can be used to facilitate a more efficient customer experience, leading to fewer customer service inquiries and lower costs.

3. What are the advantages of using insurance technology?

Answer: Insurance technology can provide a more efficient and cost-effective way of handling insurance processes. It can also improve accuracy and reduce errors, leading to fewer delays and improved customer service. Additionally, technology can be used to provide more personalized experiences to customers, leading to improved customer loyalty.

Conclusion

Insurance technology (Insurtech) is an emerging field that seeks to use technology to improve the efficiency, accuracy, and affordability of the insurance industry. Insurtech is an important part of the growing digital insurance revolution, which is driven by the need to provide better customer experience and increase efficiency. Insurtech can bring many benefits to insurance companies and their customers including improved customer service, faster claims processing, increased accuracy in data collection, and improved fraud detection. Insurtech is an exciting and rapidly growing field that promises to revolutionize the insurance industry in the years to come.