What Is Fintech Used For?

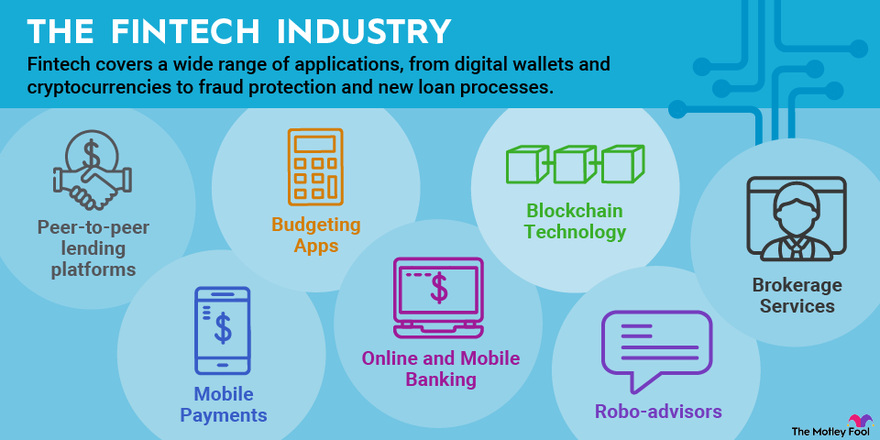

Fintech, short for financial technology, is the use of technology to improve, automate, and streamline the financial services industry. Fintech is used to provide more efficient, cost-effective, and secure financial services to businesses and individuals. It has revolutionized the way people make payments, invest, borrow, and manage money. Fintech is used for a variety of purposes, including online banking, digital payments, online lending, crowdfunding, robo-advisors, and cryptocurrency trading. Fintech is becoming increasingly popular as it makes financial services more accessible and helps to reduce the cost of traditional financial services.

Overview of Fintech

Fintech, short for financial technology, is an emerging industry that uses technology to provide financial services. It combines software, algorithms, and the internet to streamline the delivery of traditional financial services such as lending, insurance, payments, and investments. Fintech enables financial institutions and customers to access financial services in a more efficient, cost-effective, and secure manner than ever before.

Fintech is used for a variety of financial services including banking, lending, payments, investments, and insurance. Through the use of technology, companies like Square, Stripe, and PayPal have revolutionized the way people make payments, while companies like Wealthfront, Betterment, and Robinhood are providing more accessible and affordable investments for everyone. Fintech is also being used to power lending, with companies like Kabbage and Affirm providing quick and easy access to credit for consumers and small businesses. Finally, insurance companies are leveraging technology to offer more personalized and cost-effective coverage options.

From empowering faster payments to providing more accessible investments, fintech has helped revolutionize the financial services industry. The technology is allowing companies to offer more personalized services while simultaneously reducing costs and increasing access to financial services for everyone.

Benefits of Fintech

Fintech, or financial technology, is an ever-evolving industry that has revolutionized the way we manage our finances. From streamlined mobile banking to automated investment tools, fintech has dramatically improved the accessibility and convenience of financial services. In addition to making banking easier, fintech also offers some unique benefits that can be leveraged by both individual and business customers.

One of the most notable benefits of fintech is its ability to reduce costs. By automating mundane financial tasks, fintech solutions can help to reduce operational costs and increase efficiency. Additionally, fintech can help to reduce risk by providing customers with more accurate data and improved insights. Fintech solutions also provide customers with more control over their finances, allowing them to track their finances in real-time and make more informed decisions.

Another benefit of fintech is its ability to provide customers with access to a variety of financial products and services. Fintech companies can provide customers with access to investments, insurance, loans, credit cards, and more, all at the click of a button. Additionally, fintech companies can offer customers services that traditional banks cannot, such as peer-to-peer lending and digital currency exchanges.

Finally, fintech can help to streamline the process of managing finances. By automating mundane tasks and providing customers with more control over their finances, fintech can help customers save time and effort. Additionally, fintech can provide customers with more personalized financial advice, helping them to make better decisions and achieve their financial goals.

In short, fintech offers a range of benefits that can help both individuals and businesses manage their finances more efficiently and effectively. With its ability to reduce costs, provide access to a variety of financial products and services, and streamline the process of managing finances, fintech is the way of the future.

Types of Fintech

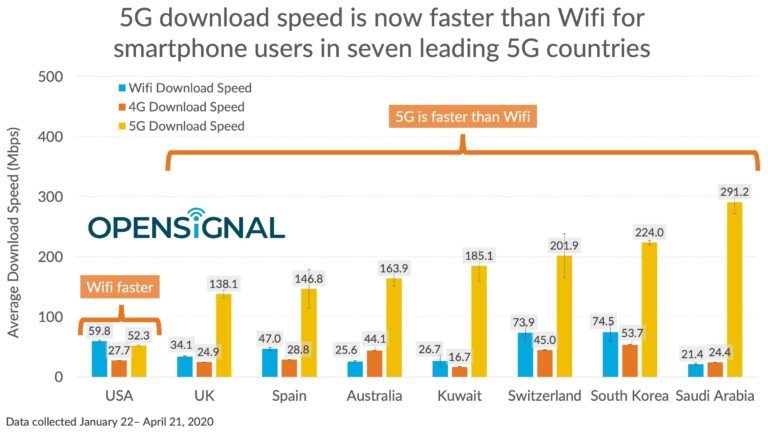

Fintech encompasses a wide variety of technologies used for financial services. While there is no single definition of Fintech, it generally refers to the use of technology to improve existing financial services, support the development of new products and services, and automate and streamline processes in the financial system. Fintech is being used in a wide variety of areas, including banking, payments, asset management, lending, and insurance.

In banking, Fintech is used to improve the customer experience, automate processes, and reduce costs. For example, banks can use Fintech to make online banking easier and more secure, develop virtual customer service agents, and automate back-end processes such as loan approval.

In payments, Fintech is used to streamline the payment process. For example, Fintech can enable digital payments such as mobile wallets, contactless payments, and cryptocurrency. It can also be used to improve fraud prevention measures, automate reconciliation processes, and enable real-time payments.

In asset management, Fintech is used to provide better and faster investment advice. For example, Fintech can enable automated trading, robo-advisors, and algorithmic portfolio management.

In lending, Fintech is used to make the process of applying for and receiving loans more efficient. For example, Fintech can enable online applications, automated credit checks, and faster loan disbursal.

Finally, in insurance, Fintech is used to improve the customer experience by automating the insurance process. For example, Fintech can enable automated underwriting, real-time risk assessment, and better customer service.

Overall, Fintech is being used in a wide variety of areas to improve the financial services industry. By streamlining processes, improving customer experience, and reducing costs, Fintech is transforming the financial services industry.

Fintech Applications

are revolutionizing the way financial services are delivered and consumed. Fintech, or financial technology, is a broad term that encompasses a variety of technological solutions designed to make banking, paying, and investing easier, faster, and more secure. Examples of fintech include mobile banking apps, cryptocurrency, online lending platforms, and automated investment services. Fintech solutions have made financial services more accessible to the masses, while also providing a host of benefits to banks, lenders, and investors.

Fintech applications enable financial institutions to improve the customer experience, reduce operational costs, and increase their revenue. For consumers, fintech can provide access to tailored financial products, faster payment processing, and a more secure banking experience. Banks and lenders are able to benefit from faster loan processing, improved customer service, and more accurate risk management. Meanwhile, investors are able to reap the advantages of automated portfolio management, more transparent pricing, and access to a wider range of investment opportunities.

The possibilities of fintech are virtually limitless, and its applications continue to expand with every passing day. From mobile payments to cryptocurrency, fintech is revolutionizing the way we interact with money. This technology is making it easier for consumers to manage their finances, access tailored financial services, and maximize their investments. Financial institutions, meanwhile, are using fintech to streamline their operations, increase their profitability, and provide their customers with a faster, better, and more secure banking experience.

Challenges of Fintech

Fintech is the combination of financial services and technology, and it has been gaining traction as a viable alternative to traditional banking and financial services. But as with any new technology, there are potential challenges associated with fintech. From data privacy and security concerns to a lack of regulation, there are many potential issues that must be addressed in order for fintech to be successful.

Data privacy and security are of paramount importance when it comes to fintech, as it is dealing with sensitive financial information. Companies must ensure that their data is stored securely, and that all transactions are encrypted. Additionally, customer information must be safeguarded against potential identity theft and fraud.

Another challenge of fintech is the lack of regulation. As fintech is still in its early stages, there are not yet any formal regulations or laws governing its use. This can lead to a lack of trust in the system, and can open the door to potential exploitation by malicious actors.

Finally, fintech companies are often competing with traditional financial services. This can lead to a lack of adoption, as customers may be more comfortable with traditional banking services. This can lead to a situation where fintech companies struggle to find customers and struggle to remain competitive.

Overall, fintech can be a great alternative to traditional banking and financial services, but it must be done correctly. Companies must ensure adequate data security and privacy protocols are in place, and that there is sufficient regulation governing its use. Additionally, fintech companies must be able to compete with traditional banking services in order to remain viable. With the right strategies in place, fintech can be a great success.

The Future of Fintech

Fintech, or financial technology, is an ever-evolving field that has been transforming traditional banking and financial services. It is a rapidly growing industry that has the potential to revolutionize the way financial services are delivered. Fintech is an emerging technology that consists of a range of products and services such as mobile banking, peer-to-peer lending, digital payments, data analytics, automated investing, and blockchain.

Fintech has the potential to revolutionize the financial services industry by providing more accessible, affordable, and secure financial services. It has already significantly impacted the banking industry, with the development of digital wallets, mobile banking, and digital payments. Fintech has also enabled financial institutions to leverage data analytics to gain insights into customer behavior and develop more targeted products and services that meet their needs.

As the Fintech industry continues to grow, it is expected to become increasingly disruptive, introducing new products and services that will replace traditional banking products. This will enable financial institutions to offer more personalized services and create more efficient processes, while also providing better security for customers. Fintech will also help to reduce the cost of financial services, making them more accessible to a wider range of people.

The future of Fintech looks bright, as more organizations are investing in the technology and leveraging the benefits it offers. As the industry continues to grow and develop, it is expected to continue to revolutionize the way financial services are delivered. Fintech will undoubtedly continue to have a significant impact on the banking industry, as organizations look to the technology to gain a competitive advantage.

FAQs About the What Is Fintech Used For?

1. How does fintech help businesses?

Answer: Fintech is used by businesses to streamline the way they manage their finances. This includes automating payments, processing transactions quickly and securely, and providing access to customer data.

2. How does fintech benefit consumers?

Answer: Fintech provides consumers with access to financial services and products at more competitive rates as well as more convenience. This includes faster access to loans, higher security for online payments, and more personalized experiences.

3. What are the risks associated with fintech?

Answer: As with any technology, there are risks associated with fintech. These include cyber security risks, privacy concerns, and the potential for fraud. It is important to take the necessary steps to protect yourself and your data when using fintech services.

Conclusion

Fintech is used for a variety of purposes, ranging from enabling digital payments and money transfers to providing access to financial services such as loans and investments. Fintech is transforming the way traditional financial services are delivered, making them more accessible and convenient for customers. Fintech is also helping to create more efficient and secure financial services, while also providing new opportunities for businesses to innovate. As the use of fintech continues to grow, it is likely that more financial services will be available in the future.