What Is FinTech Banking?

FinTech banking is a term used to describe the use of technology to enhance the delivery of financial services. FinTech banks use innovative technology to offer customers better, faster, and more efficient banking services than traditional banks. The technology used can range from mobile applications to advanced analytics and artificial intelligence, and it has revolutionized how banking has traditionally been done. FinTech banking has allowed banks to provide customers with a more personalized and seamless experience, as well as access to new products and services. Additionally, FinTech banks are typically more efficient and cost-effective than traditional banks, making them an attractive option for customers.

Definition of FinTech Banking

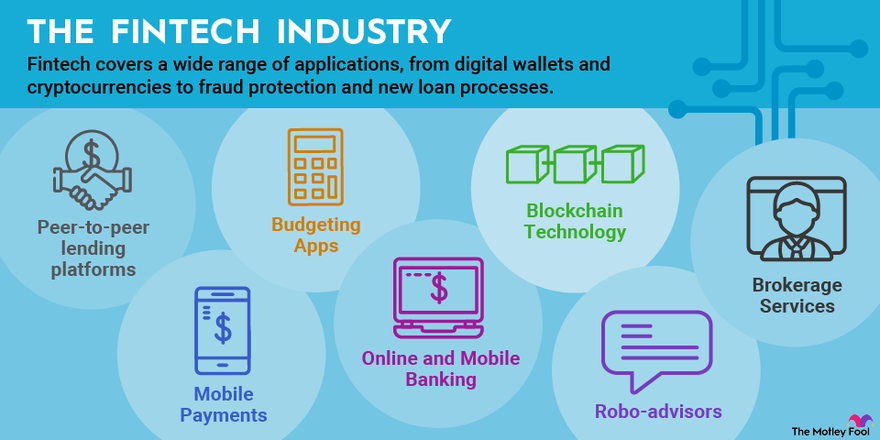

FinTech banking is a type of digital banking services and products that are powered by financial technology (FinTech) companies. These companies are using innovative technologies such as artificial intelligence (AI), blockchain, and machine learning to develop and offer banking services. FinTech banking services provide customers with a range of services from applying for and managing loans to making payments and investing. FinTech banking services are available through mobile apps, online banking portals, and other platforms. FinTech banking services are often more convenient, faster, and more secure than traditional banking services. FinTech banking also offers customers greater control over their finances and a range of new features such as real-time money transfers, budget tracking, and investment tools. With FinTech banking, customers can enjoy a more personalized and efficient banking experience.

Overview of FinTech Banking

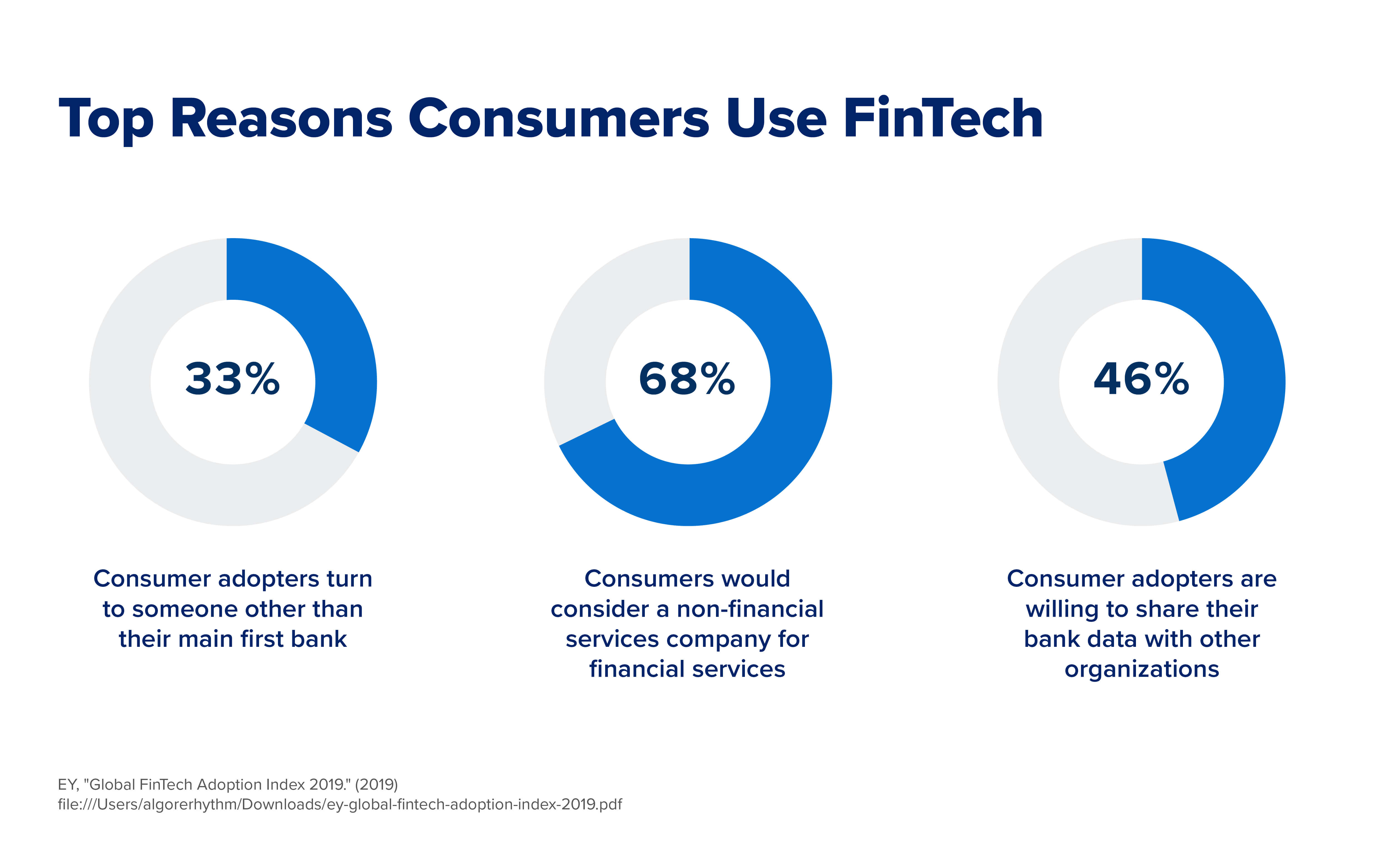

FinTech banking is an innovative form of banking that combines a number of digital, financial, and technological tools to help streamline traditional banking services. This type of banking is quickly becoming the preferred method of banking for many people due to its convenience and cost-effective nature. FinTech banking offers a variety of services, including online accounts, mobile app access, digital payments, and automated asset management. It can also provide customers with access to a variety of financial products, such as peer-to-peer lending, cryptocurrency, and investment opportunities. FinTech banking is rapidly growing in popularity due to its ability to offer customers the convenience and accessibility they need while providing them with the tools they need to make smarter financial decisions. It is also becoming increasingly popular due to its cost-effectiveness, as many FinTech banking services are offered at a fraction of the cost of traditional banking services. As FinTech banking continues to grow in popularity, more people are beginning to turn to this type of banking in order to take advantage of its benefits.

Benefits of FinTech Banking

FinTech banking is a new wave of banking that has revolutionized the way we interact with our banking services. This technology has allowed banks to offer customers faster, more efficient, and secure banking services than ever before. FinTech banking has enabled customers to access their accounts, manage their finances, and complete transactions all in one place. In addition, FinTech banking has made it easier for customers to access financial products and services, such as loans and investments, through online platforms.

The benefits of FinTech banking are numerous. FinTech banking makes it easier to manage finances, as customers can access their accounts and make transactions in one place. FinTech banking also provides customers with access to a variety of financial products and services, such as loans and investments, without the need for a physical bank branch. Furthermore, FinTech banking enables customers to save time and money, as transactions can be completed quickly and securely online. Finally, FinTech banking offers customers more control over their finances, as they can keep track of their accounts and transactions in real-time.

Challenges of FinTech Banking

FinTech banking is revolutionizing the way we bank. This technology-driven approach to banking is bringing new opportunities and challenges to the financial services industry. Financial institutions must rapidly adapt to keep up with the changing times.

With the rise of digital banking, there are several new challenges that financial institutions must face. The first is security. With the increasing prevalence of cyber-attacks, financial institutions must prioritize security to protect customer data. They must also implement the latest technology and processes to ensure secure transactions and data storage.

Moreover, financial institutions must also be aware of the changing regulatory landscape. As new laws and regulations come into force, financial institutions must be agile and adaptive to stay compliant. This requires financial institutions to invest in the right resources and technologies to ensure regulatory compliance.

Finally, financial institutions must also be aware of the competitive landscape. With the emergence of new FinTech companies, traditional banks must stay ahead of the competition. To do this, they must focus on delivering superior customer service and developing innovative products and services.

Overall, FinTech banking brings both opportunities and challenges to financial institutions. While there are significant challenges to face, financial institutions must adapt and innovate to remain competitive in this ever-changing landscape.

Examples of FinTech Banking

FinTech banking is the use of technology to deliver financial services. It has revolutionized the way people manage their money, making financial services more accessible and efficient. FinTech banking is transforming the banking industry by providing new ways for people to manage their finances.

FinTech banking is used by banks, credit unions, and other financial institutions to offer online banking services. These services include online bill payment, mobile banking, peer-to-peer payments, and more. FinTech banks may also offer additional services such as cryptocurrency trading, investment management, and insurance. FinTech banking is revolutionizing the way people access and use financial services.

FinTech banking has been embraced by many people, as it provides them with more control over their financial life. It allows people to save time and money, reducing the need to visit a bank branch and wait in line. FinTech banking also helps to increase financial literacy, as users can learn more about their finances through online banking and other services.

FinTech banking is revolutionizing the way people access and use financial services. Examples of FinTech banking include mobile banking apps, online payments, peer-to-peer transfers, cryptocurrency trading, and more. These services make it easier for people to manage their finances and access financial services. FinTech banking is the way of the future and is bringing many benefits to customers.

Regulation of FinTech Banking

FinTech banking, also known as financial technology banking, is the use of technology to provide banking services. The technology is used to provide banking services to individuals, small businesses, and large companies. FinTech banking has been made possible by advancements in technology in the banking sector. However, it is also important to note that it is regulated by the government.

Regulation of FinTech banking is important to ensure that the banking industry remains secure and efficient. Government entities such as the Federal Reserve, the Office of the Comptroller of the Currency, and the Financial Industry Regulatory Authority all have a role to play in regulating the financial technology sector. These entities are responsible for setting standards, enforcement of laws, and providing guidance for financial technology companies.

In addition to the government, FinTech banking is also regulated by the private sector. Private sector organizations such as the Financial Services Roundtable, the Consumer Financial Protection Bureau, and the National Association of Federal Credit Unions all have a role to play in setting standards and providing guidance for FinTech banking. These organizations provide a forum for financial technology companies to discuss issues, share best practices, and learn from each other.

Overall, the regulation of FinTech banking is important to ensure that the banking industry remains secure and efficient. Government and private sector organizations are both actively involved in setting standards and providing guidance for financial technology companies. This helps to ensure that the banking industry remains secure and efficient for all stakeholders.

FAQs About the What Is FinTech Banking?

1. What are the benefits of FinTech banking?

A: FinTech banking offers a range of benefits to customers such as faster and easier payments, improved security, better customer service, improved access to financial services, and more competitive products.

2. What technology is used in FinTech banking?

A: FinTech banking relies on a range of technologies such as artificial intelligence, blockchain, data analytics, cloud computing, and mobile banking.

3. Is FinTech banking safe?

A: FinTech banking is generally considered to be secure and reliable. Many FinTech banks use the latest encryption technologies and other security measures to keep customer data safe and secure.

Conclusion

FinTech banking is a new and rapidly growing sector of financial services that leverages advanced technology to provide faster, more efficient and cost-effective banking services. It is transforming the way we interact with and use financial products and services, from how we make payments to how we borrow and save money. FinTech banking is not only making banking faster and easier, but it is also providing customers with more options and greater access to financial services. As this technology continues to improve, it will continue to improve the banking experience for customers and businesses alike.