What Is Considered To Be Fintech?

Fintech, or financial technology, is a term used to describe the use of technology in the financial sector. It is an emerging industry that has grown substantially in recent years and is used to provide innovative solutions to financial institutions and individuals. Fintech can be used to make financial processes more efficient and accessible, and it includes a variety of technologies such as mobile payments, digital currencies, blockchain, artificial intelligence, and big data. Fintech can be used to improve banking services, facilitate digital payments, and provide access to financial services to those who were previously unable to access them. The industry is rapidly evolving and is set to revolutionize the way we manage our finances.

Definition of Fintech

Fintech, short for financial technology, is an umbrella term used to describe any technological innovation in the financial sector. It includes the use of software and other technology to facilitate and automate financial services and processes. This includes everything from mobile banking, digital payments, online investments, and crowdfunding, to automated financial advice, blockchain technology, and data analytics. Fintech is quickly transforming the way people interact with and use financial services, and is revolutionizing the way financial institutions do business. By making financial services more accessible, efficient, and secure, fintech is creating more opportunities for individuals and businesses alike.

Types of Fintech

Fintech, short for financial technology, is a broad term used to describe technology-driven solutions in the financial services sector. Fintech can encompass a wide variety of services and products, ranging from payment processing solutions to business intelligence tools. It can also refer to platforms and applications that provide financial services to consumers.

Fintech can be divided into four main categories: retail banking, corporate banking, payments and remittances, and investments and trading. Retail banking includes services such as online banking, mobile banking, peer-to-peer lending, and personal finance. Corporate banking includes services such as enterprise resource planning (ERP) systems, enterprise risk management (ERM) systems, and fraud detection systems. Payments and remittances include services such as payment processing, money transfers, e-commerce, and mobile payments. Investments and trading include services such as algorithmic trading, robo-advisors, and cryptocurrency trading.

The use of technology in the financial services sector is becoming increasingly important, as it helps to streamline processes and improve efficiency. Fintech is also a key driver of innovation, as it allows financial service providers to create new products and services that meet customer needs. As more businesses and consumers embrace the use of technology in the financial sector, the demand for fintech solutions and services is expected to continue to grow.

Benefits of Fintech

Fintech is the buzzword of the decade. It is the term used to describe the use of technology to provide financial services and products. Fintech has revolutionized the way we do business and has become an integral part of the financial services industry. Fintech offers a number of benefits to businesses and consumers alike. Here are some of the key benefits of fintech:

1. Lower Cost: Fintech has drastically reduced the cost of providing financial services and products. By leveraging technology, businesses are able to save time and money, allowing them to pass on the savings to their customers.

2. Speed & Efficiency: Fintech has improved the speed and efficiency of financial services and products. By using automated processes and digital solutions, transactions can be completed in minutes rather than days.

3. Accessibility: Fintech has made financial services and products more accessible to the masses. By making these services and products available online, individuals who may not have access to traditional banking services can now access financial services and products.

4. Improved Security: Fintech has improved the security of financial services and products. By using advanced technologies, financial institutions can ensure that transactions are secure and protect their customers’ data.

These are just a few of the benefits of fintech. With its ability to reduce costs, improve speed and efficiency, increase accessibility, and enhance security, fintech has become an integral part of the financial services industry.

Challenges of Fintech

Fintech, short for financial technology, is a rapidly growing industry, providing innovative solutions for the financial services sector. However, with the rapid growth of the industry, there are several challenges that need to be addressed. In this blog, we will explore the challenges of fintech, and how they can be addressed.

One of the biggest challenges of fintech is the need for regulatory oversight. As the industry grows, regulators must ensure that the services provided are safe and secure for consumers. Additionally, regulators need to ensure that the services provided do not create a risk for the financial system. This requires the development of regulations that are both comprehensive and responsive to the changing needs of the industry.

Another challenge of fintech is the need for consumer protection. As fintech services become more prevalent, consumers need to be aware of the risks associated with them. This requires the development of education and consumer protection measures that ensure consumers understand the risks associated with using fintech services.

Finally, one of the biggest challenges of fintech is the need for data security. As fintech services become more advanced, data security becomes increasingly important. This requires the development of robust data security systems that protect consumer data from theft or misuse.

Overall, while fintech offers many innovative solutions for the financial services sector, there are several challenges that need to be addressed. These include the need for regulatory oversight, consumer protection, and data security. By addressing these challenges, the fintech industry can continue to grow and provide innovative solutions for the financial services sector.

Examples of Fintech

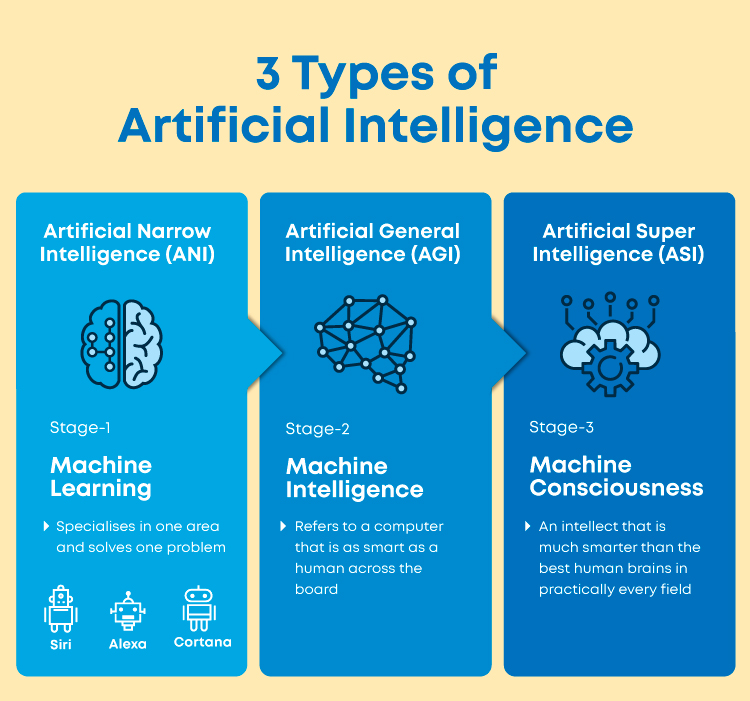

Fintech, or financial technology, is a broad term that encompasses a wide range of services and products. It is an ever-evolving field that leverages technology to make financial services more efficient, secure, and accessible. Examples of fintech can include peer-to-peer lending, mobile payments, digital wallets, blockchain, and artificial intelligence (AI).

Peer-to-peer (P2P) lending is a form of fintech that allows individuals to borrow and lend money without the need for a traditional financial institution. P2P lending enables borrowers to access competitive rates and lenders can earn passive income on their investments.

Mobile payments have quickly become a popular form of fintech. Mobile payment technology allows users to make payments directly from their mobile device. This technology eliminates the need for carrying cash, making it a convenient way to pay for goods and services.

Digital wallets are another form of fintech that is gaining traction. Digital wallets allow users to store their payments information in one secure location. They also provide users with easy access to their bank accounts and credit cards without the need to remember multiple passwords.

Blockchain is a form of distributed ledger technology that is used in fintech. It is a secure, digital ledger that records and stores financial transactions in an immutable format. Blockchain technology allows for faster, more secure transactions and can be used to facilitate digital payments.

Finally, AI is quickly becoming an integral part of fintech. AI is used to automate processes, improve customer service, and provide predictive analytics. AI can also help automate fraud detection and risk management processes.

These are just a few examples of the many ways that fintech is transforming the financial services industry. As technology continues to evolve, so will the world of fintech.

Regulation of Fintech

Fintech, or financial technology, is a quickly growing sector that has the potential to revolutionize the financial services industry. As this sector expands, it is important to consider the role that regulation plays. Currently, much of the regulation of fintech falls under the purview of traditional banking and finance regulations, but as the sector evolves, thoughtful regulation will be required.

Regulation of fintech can be complicated as the sector spans a number of different industries, including banking, insurance, and investments. In addition, fintech can take the form of payment processors, online lending, and cryptocurrency exchanges. Each of these has its own set of regulations that must be followed.

Regulation of fintech also has the potential to affect how the sector develops. For example, stringent regulations may limit the development of new technologies or discourage innovators from entering the space. On the other hand, a lack of regulation may lead to a lack of consumer protection, making it difficult for consumers to make informed decisions.

Ultimately, regulation of fintech is an important issue that will need to be addressed in order to ensure the continued growth and development of the sector. As the sector continues to evolve, governments and regulators will need to work together to ensure that the right balance is struck between protecting consumers and encouraging innovation.

FAQs About the What Is Considered To Be Fintech?

Q1. What is Fintech?

A1. Fintech is a portmanteau of “financial technology”, and it refers to the use of technology to make financial services more efficient. It includes a wide variety of services, such as online banking, mobile payments, digital currencies, crowdfunding, and more.

Q2. How does Fintech impact the financial industry?

A2. Fintech has made it easier and more efficient for businesses and individuals to access financial services. It has also enabled the development of new products and services, such as peer-to-peer lending, robo-advisors, digital currencies, and more. The use of Fintech has dramatically changed the way financial services are delivered.

Q3. What are some examples of Fintech?

A3. Some examples of Fintech include online banking, mobile payments, digital currencies, crowdfunding, peer-to-peer lending, robo-advisors, and more. Fintech is constantly evolving, and new products and services are being developed all the time.

Conclusion

In conclusion, fintech refers to the use of technology to provide financial services to companies, consumers and investors for the purpose of facilitating and improving their financial activities. Fintech has grown significantly over the past decade due to its ability to make financial services more efficient, accessible and secure. Fintech can be used to improve the speed, accuracy and transparency of financial transactions, as well as to improve customer service and provide access to new and innovative products. Fintech is transforming both the financial services industry and the way in which customers access and use financial services.