What Is An Example Of Fintech In Bangladesh?

Fintech in Bangladesh is the use of technology to deliver financial services. It includes services such as online payments, mobile banking, internet banking, electronic fund transfers, and digital wallets. Fintech in Bangladesh is particularly important because it helps reduce costs, simplify processes, and increase access to financial services for many of the country’s underserved and unbanked population. Some of the most prominent examples of fintech in Bangladesh include bKash, Rocket, and mCash. These services enable users to easily transfer money, receive payments, and pay bills using their mobile phones. Fintech is playing an increasingly important role in Bangladesh’s economy and has the potential to drastically improve the financial inclusion of the country’s population.

Overview of Fintech in Bangladesh

The digital revolution has changed the way people interact with financial services, and Bangladesh is no exception. Bangladesh has been an early adopter of Fintech, embracing digital solutions to improve financial inclusion and drive growth. In this article, we’ll take a closer look at Fintech in Bangladesh and explore the various ways it’s impacting the country’s financial ecosystem.

Fintech in Bangladesh is primarily focused on mobile payment solutions, banking services, and investments. Mobile payment solutions, such as bKash, have revolutionised the way people pay for goods and services in Bangladesh, with millions of users now relying on digital payment systems to buy goods and services. Banking services, such as DFS (Digital Financial Services) have enabled people to access financial services, even those living in remote areas that lack access to traditional banking services.

Finally, Fintech in Bangladesh is also being used to facilitate investments. For example, startups such as Upstox are leveraging technology to provide investors with access to the stock market, offering commission-free trading and low-cost investment options. Additionally, Fintech solutions are also being used to develop digital insurance products, providing customers with access to a range of insurance policies that are tailored to their needs.

Overall, Fintech in Bangladesh is driving financial inclusion and helping to create a more efficient and secure financial ecosystem. With more Fintech solutions entering the market, Bangladesh is well-positioned to become a leader in the digital financial revolution.

Impact of Fintech on the Economy

of Bangladesh

Bangladesh is now embracing the idea of Fintech to improve the country’s economic performance. Fintech has become increasingly popular in Bangladesh over the last few years, as the country’s financial sector is rapidly growing. Fintech is the use of innovative technology to provide financial services to customers and organizations. It includes payment processing, digital banking, and other digital financial services.

Fintech has had a positive impact on the economy of Bangladesh. One of the main benefits is the increased access to financial services. Fintech companies have made it easier for people to access banking services without having to physically go to a bank. This has enabled many people in rural areas to access financial services that were previously unavailable to them. It has also enabled the country to grow its economy, as people have more access to capital and credit.

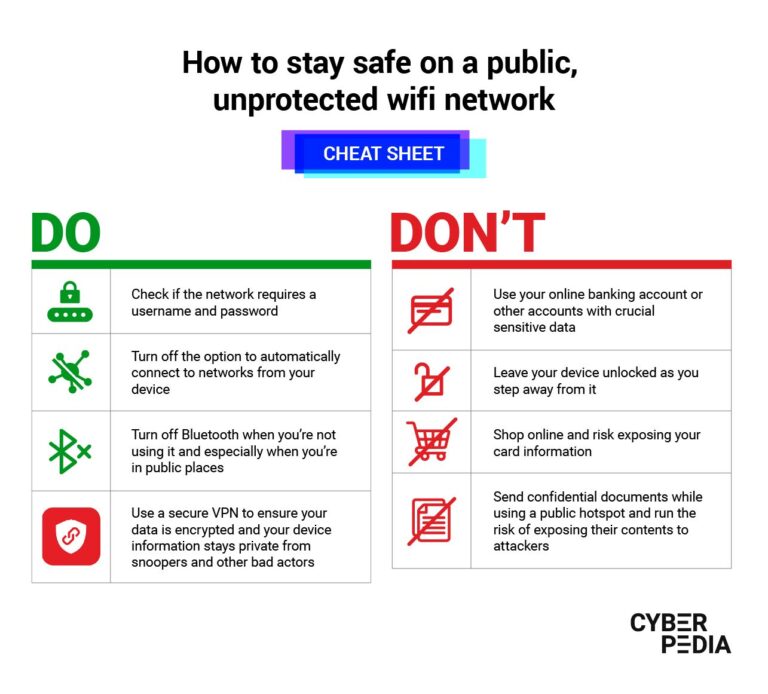

Another benefit of Fintech in Bangladesh is the improved security it provides. By using digital banking services, customers can avoid the risk of fraud and identity theft. As a result, they can be more confident in their financial transactions. Additionally, Fintech companies have also made it easier for businesses to access capital and credit, which can help them grow and expand.

Finally, Fintech has enabled the country to become more competitive in the global marketplace. By providing innovative and efficient financial services, Bangladesh can compete with other countries in the world. This can help the country attract foreign investors and create more jobs.

All in all, Fintech has had a positive impact on the economy of Bangladesh. It has enabled more people to access banking services, improved security, and increased competition in the global marketplace. By embracing new technologies, Bangladesh can continue to develop its economy and improve the lives of its citizens.

Fintech Regulations in Bangladesh

Bangladesh is gradually emerging as a leader in the fintech sector. The country has implemented a wide range of regulations to facilitate the growth of fintech companies. The Bangladesh Bank, the country’s central bank, has set out a regulatory framework that provides a clear and transparent investment environment for fintech firms.

The Bangladesh Bank has created a dedicated Fintech Regulatory Framework (FRF), which outlines the rules and regulations for fintech firms. The framework includes guidelines on licensing and registration, risk management, and data protection. It also clarifies the legal status of fintech firms and their relationship with the central bank.

The Bangladesh Bank has also introduced a digital payment policy that allows for the use of digital payments and mobile banking. This policy has enabled the country to become a leader in digital payments, with more than 90% of mobile banking transactions taking place in Bangladesh.

The Bangladesh Bank has also created a sandbox platform, called the “Fintech Innovation Hub”, which allows fintech companies to test and launch their products in the country. This platform helps to ensure that fintech firms are compliant with the regulations and also enables the Bangladesh Bank to monitor the activities of fintech firms.

The Bangladesh Bank has taken a proactive approach towards the development of the fintech industry in the country. The country’s commitment to the development of the sector is evident in the introduction of the Fintech Regulatory Framework and the digital payment policy. This has enabled the country to become a leader in the fintech sector, providing a supportive and transparent investment environment for fintech firms.

Popular Fintech Companies in Bangladesh

The exploding Fintech industry in Bangladesh is revolutionizing the way financial services are handled in the country. The sector is growing rapidly and is estimated to be worth over $9 billion by the end of 2021. Numerous companies are entering the Fintech space in Bangladesh and making a huge impact on the market. Some of the most popular Fintech companies in Bangladesh include bKash, SureCash, and Nagad.

bKash is a mobile-based financial services platform that enables users to transfer money, pay bills, and purchase goods and services. It also offers savings and loan products, as well as insurance products that are exclusive to Bangladesh. SureCash is a financial services company that provides digital banking solutions to rural and unbanked communities in Bangladesh. It offers mobile banking, loan services, and payment processing solutions. Nagad is a digital payment service that allows users to transfer money, pay bills, and purchase goods and services. It also offers digital banking services and insurance products.

These three Fintech companies are leading the industry in Bangladesh and are helping to propel the country into a new era of financial inclusion. By leveraging the latest technology, these companies are providing people with access to financial services that were previously unavailable. With the continued growth of Fintech in Bangladesh, more innovative services are sure to come.

Challenges of Fintech in Bangladesh

Fintech is a rapidly growing sector in Bangladesh, but the country still faces a number of challenges in terms of its adoption. Among the most significant is the lack of consumer trust in the industry, as many individuals are still unfamiliar with the concept of financial technology. Additionally, the lack of clear regulations and the difficulty of implementation are additional obstacles that must be overcome before the sector can reach its full potential. Furthermore, there is a lack of access to financial services in rural areas, which limits the ability of fintech to reach its full potential. Finally, low levels of financial literacy among the population mean that fintech products and services must be designed in a way that is easy to understand and use.

These challenges must be addressed in order for fintech to become a viable option in Bangladesh. To do so, the government must create a regulatory framework that can ensure consumer protection while also encouraging innovation. Additionally, financial literacy programs must be made available to the public in order to ensure that individuals are able to make responsible financial decisions. Finally, programs must be designed to bring financial services to rural areas in order to ensure that everyone has access to the benefits that fintech can provide.

Future of Fintech in Bangladesh

The future of Fintech in Bangladesh is looking bright and promising. Bangladesh is one of the fastest-growing economies in the world, and fintech is a key part of this growth. Fintech is known for its ability to provide innovative solutions to financial services, such as digital payments, banking, and insurance. With the launch of the Bangladesh Fintech Forum, the country is now set to take advantage of the digital transformation.

Bangladesh’s potential for fintech growth lies in its large population and the increasing demand for financial services. The country is home to numerous fintech startups, with some of the biggest players being bKash, bKash Academy, and Agrani Bank. These companies are leading the way in terms of innovation, providing products and services that are helping to make the banking and payments systems more efficient and secure.

Moreover, the Bangladesh government is taking steps to foster innovation and create an environment where fintech startups can flourish. The Bangladesh Bank is introducing regulations to support fintech companies, while the government is also providing funding and other incentives to help them grow. Additionally, the government is investing in infrastructure, such as the Bangladesh Payment System, to facilitate digital payments.

Overall, the future of fintech in Bangladesh is looking bright. With the right government support and an ever-growing population, the country is poised to become a leader in the fintech industry. With innovative solutions and secure payments systems, Bangladesh is sure to become a major player in the digital economy.

FAQs About the What Is An Example Of Fintech In Bangladesh?

1. What types of fintech services are available in Bangladesh?

Answer: Popular fintech services available in Bangladesh include mobile banking, digital payments, online banking, digital wallets, peer-to-peer lending, and cryptocurrency exchanges.

2. What are the benefits of using fintech services in Bangladesh?

Answer: The use of fintech services in Bangladesh can provide users with increased convenience, faster and more secure transactions, improved customer experience, and access to financial services for those who may not have access to traditional banking services.

3. Are there any regulations in place for fintech services in Bangladesh?

Answer: Yes, the Bangladesh Bank has issued specific regulations for fintech services, including guidelines for digital payments, mobile banking, and digital wallets.

Conclusion

Fintech in Bangladesh is a rapidly growing sector, as the country is committed to technological advancement and financial inclusion. Fintech solutions such as mobile banking, digital payments, and digital credit have become increasingly popular in Bangladesh, with numerous startups and established companies providing innovative services. These solutions enable customers to make payments, transfer money, and access financial services from their mobile devices, increasing access to financial services and providing greater convenience. With the increasing demand for fintech solutions in Bangladesh, the sector is expected to grow exponentially in the coming years.