What Is An Example Of Fintech?

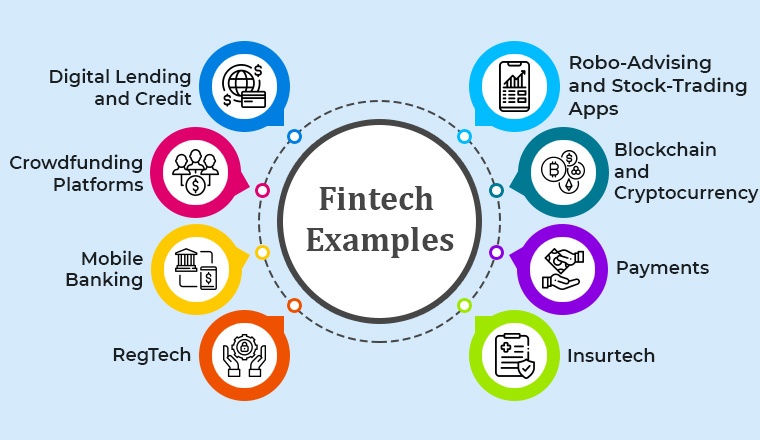

Fintech, or financial technology, is the term used to describe a variety of technological advances that are disrupting the traditional financial services industry. It encompasses a wide range of technologies, from mobile banking and digital payments to investment management and blockchain. Examples of fintech include online banking, mobile banking, payment processing, crowdfunding, peer-to-peer lending, online trading, robo-advisory, automated investment management, and blockchain technology. These technologies are revolutionizing the way people manage their finances and interact with financial institutions.

Definition of FinTech

FinTech, or financial technology, is the use of technology to improve existing financial services and promote financial inclusion. It includes the use of mobile banking, peer-to-peer payments, crowdfunding, digital payments, cryptocurrency, and more. FinTech is transforming how people access, use, and manage their money, and it is becoming more and more popular and widely accepted. FinTech has allowed for greater transparency and access to financial services than ever before, and it has enabled people to do more with their money, from investing to sending money to family. FinTech has given people the power to make their money work for them, and it is revolutionizing the way we think about and use financial services.

History of FinTech

FinTech, or Financial Technology, is a rapidly evolving industry that is transforming the way we manage our money. The term FinTech is a broad term used to describe the use of technology to improve financial services. FinTech has been around for centuries but the current boom in the industry began in the late 2000s with the advent of mobile payment systems. FinTech has changed the way we access and manage our finances, from mobile banking to digital payments and crowdfunding.

FinTech has its roots in the banking industry, with the earliest innovations arising in the late 18th century with the invention of the mechanical calculator and the first electronic funds transfer system. Over the next two centuries, FinTech grew steadily, with the introduction of the first online banking system in the 1980s and the growth of the internet in the 1990s. In the early 2000s, the introduction of mobile technology and the rise of online payment systems allowed FinTech to reach new heights.

Today, FinTech is one of the most dynamic and rapidly growing industries in the world. In 2020, global FinTech investments reached a record high of $48.4 billion, a significant increase from the $27.4 billion invested in 2019. FinTech companies are using technology to revolutionize traditional financial services, from digital banking services to investments and trading, and to create new financial products and services. With the FinTech industry continuing to grow and evolve, it will be interesting to see how the sector continues to shape the financial services industry in the coming years.

Types of FinTech Technologies

FinTech (financial technology) is an emerging industry that uses innovative technology to improve the delivery, usage, and access to financial services. It is a broad term that includes a variety of technologies, tools, and applications used to support the delivery of financial services. FinTech solutions can be used for a wide range of financial activities, from payments and money transfers to investments and insurance. The types of FinTech technologies range from simple mobile applications and online banking platforms to data-driven artificial intelligence (AI) systems and blockchain solutions.

Traditional banking and financial services are being disrupted by FinTech solutions. Mobile banking apps, online payments, automated investment platforms, and digital currencies are just a few examples of FinTech technologies that are revolutionizing the financial sector. FinTech solutions are also being used to create new business models and products that were not possible before. For instance, peer-to-peer (P2P) lending platforms use FinTech to facilitate the borrowing and lending of funds between individuals, bypassing traditional banks. Similarly, crowdfunding platforms use FinTech to enable individuals to invest in early-stage companies in exchange for equity.

The financial industry is rapidly evolving due to the rise of FinTech solutions. These technologies are making financial services more accessible, secure, and cost-efficient. As a result, they are becoming increasingly popular with consumers and businesses alike.

Benefits of FinTech

Fintech, or financial technology, is revolutionizing the way the world manages and uses money. FinTech encompasses a wide variety of technologies, including mobile payments, blockchain, artificial intelligence, and cloud computing. This technology is making it easier and more efficient for people to access financial services. It is also helping to reduce costs associated with traditional banking and financial services.

In addition to making financial services more efficient and accessible, FinTech also has many other benefits. For instance, FinTech is helping to reduce fraud and financial crime by providing more secure and reliable ways to transfer and store money. It is also providing access to financial services to those who would not normally have it, such as those living in developing countries. Additionally, FinTech is speeding up the banking process by providing quicker and more efficient ways to transfer money.

Finally, FinTech is also helping to reduce the costs associated with traditional banking and financial services. By using innovative technologies, such as blockchain and AI, banks and other financial institutions can reduce the amount of time and money spent on manual tasks, such as verifying transactions. This is resulting in lower fees for customers, which is providing more affordable financial services to those who need it.

Overall, FinTech is revolutionizing the way the world manages and uses money. It is providing numerous benefits, such as improved security, increased access to financial services, and reduced fees. As FinTech continues to develop, it is likely that more and more people will benefit from its advantages.

Challenges of FinTech

The global financial services industry is increasingly being disrupted by the emergence of FinTech. FinTech (financial technology) is the use of software and other technology to provide financial services. This includes anything from online banking to trading platforms, financial literacy programs, and even cryptocurrency. As this technology becomes more widely available, it presents both opportunities and challenges to traditional financial institutions and consumers alike.

One of the biggest challenges of FinTech is the potential for cybercrime. As financial services become increasingly digital, it can be easier for criminals to access sensitive data. FinTech companies must employ robust cybersecurity measures to protect their customers’ information. Additionally, regulators are increasing their oversight of FinTech companies to ensure compliance with data privacy laws.

Another challenge of FinTech is the potential for disruption to existing financial institutions. As more customers turn to digital platforms for their financial needs, traditional banks may struggle to compete. In addition, FinTech companies can be more agile and efficient in providing services, potentially preventing traditional banks from innovating.

However, the challenges of FinTech can also present opportunities. FinTech companies are better suited to meet the needs of digital natives, such as millennials and Generation Z. By leveraging the latest technologies, they can provide more personalized, convenient services than traditional banks. Additionally, FinTech can provide access to financial services to underserved populations, such as those in rural and low-income areas.

FinTech is a rapidly evolving technology, and its potential application in the financial services industry is still being explored. As the industry continues to grow, it is important to recognize both the opportunities and challenges of FinTech.

FinTech’s Role in the Future of Financial Services

As the world of finance continues to evolve, FinTech has emerged as a major disruptor in the financial services industry. FinTech is an umbrella term that encompasses a wide range of technology-driven financial products and services, from online banking and payments processing to investments and insurance. FinTech has enabled the delivery of more efficient, secure, and cost-effective financial services than ever before. As the industry continues to expand and grow, banks and other financial institutions are increasingly turning to FinTech to meet the growing demands of their customers.

FinTech is not only transforming the way financial services are delivered, but it is also changing how financial services are used. As more people become comfortable with online banking and payments, they are increasingly expecting to use these services to access products and services from a variety of providers. This has led to the emergence of a new breed of financial services companies that are leveraging the power of technology to provide innovative and cost-effective solutions to customers. These companies are often referred to as ‘neobanks’, as they are not traditional banks but instead, provide their services through a digital platform.

The rise of FinTech is also transforming the way financial services are regulated and governed. Financial regulators are now expanding their purview to include the oversight of FinTech companies, introducing new regulations to protect consumers and ensure the safety and security of the financial system. As the industry continues to evolve, we can expect the role of FinTech to become increasingly important in the future of financial services.

FAQs About the What Is An Example Of Fintech?

1. What is the most common example of Fintech?

Answer: The most common example of Fintech is online banking, where customers can manage their accounts, transfer money, and pay bills online.

2. Are there other examples of Fintech?

Answer: Yes, there are other examples of Fintech such as mobile payments, peer-to-peer lending, robo-advisor services, cryptocurrency, and more.

3. How does Fintech make banking easier?

Answer: Fintech makes banking easier by providing customers with an easier and more convenient way to manage their finances. Fintech also helps to reduce costs, increase security, and help financial institutions become more efficient.

Conclusion

Fintech is an umbrella term for new technologies and innovations that are transforming the traditional financial services industry. Examples of fintech include mobile banking, blockchain, artificial intelligence, and cloud computing. These technologies are allowing financial institutions to offer more efficient, cost-effective, and secure services to their customers. With the continued development of fintech, the financial services industry is quickly evolving and creating new opportunities for businesses and consumers alike.