What Are Three Examples Of Fintech?

Fintech, or financial technology, is a rapidly growing industry that uses technology to improve the delivery, use, and access to financial services. It is revolutionizing the way people interact with money and financial services, and is making it easier for people to access financial products and services. Three examples of fintech are mobile banking, digital payment platforms, and peer-to-peer lending.

Mobile banking allows customers to access their bank accounts and financial services via their smartphones, laptops, and other mobile devices. Digital payment platforms such as PayPal and Venmo provide customers with convenient and secure methods of transferring funds online. Finally, peer-to-peer lending platforms such as Prosper and LendingClub, allow people to borrow and lend money to one another without the need for a traditional financial institution.

These are just a few examples of how fintech is changing the way people interact with and manage their money. The possibilities are endless, as new technologies and ideas continue to be developed and implemented.

Definition of Fintech

Fintech, short for financial technology, is an emerging sector of technology that is revolutionizing the way people manage their money. It is a rapidly growing industry that leverages digital infrastructure to provide financial services that are more efficient, secure, and cost-effective than traditional methods. Fintech can be used for a variety of applications, including payment processing, investing, borrowing, and saving.

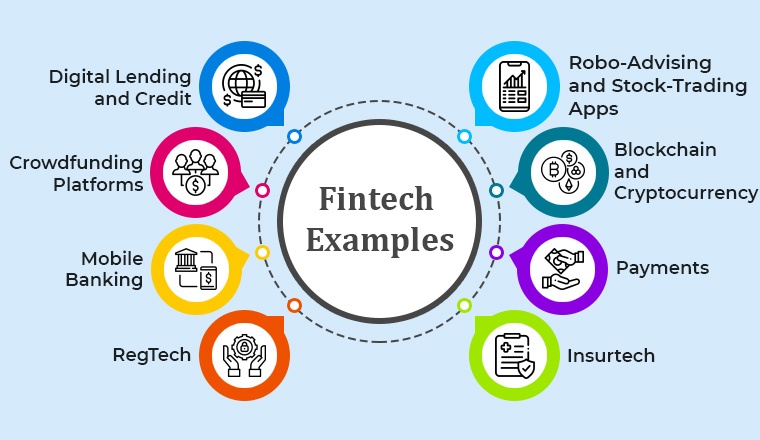

Examples of fintech include mobile banking, peer-to-peer lending, automated investment portfolios, cryptocurrency exchanges, and online trading platforms. Mobile banking apps allow users to access their banking information, transfer funds, and pay bills from their phones. Peer-to-peer lending services allow users to borrow and lend money without the need for a traditional bank. Automated investment portfolios allow users to invest in a customized portfolio of stocks, bonds, and other investments with minimal effort. Cryptocurrency exchanges allow users to buy, sell, and trade digital currencies like Bitcoin and Ethereum. Finally, online trading platforms enable users to buy and sell stocks, bonds, and other investments from the comfort of their own home.

Fintech is changing the way people manage their money, and these three examples are just a few of the many applications of this technology. With the increasing prevalence of fintech, it’s clear that the future of finance is digital.

Benefits of Fintech

Fintech, or financial technology, is a rapidly growing sector of the global economy. It has revolutionized the way that businesses and individuals access financial services, with the emergence of a wide range of innovative products and services. Fintech provides a number of benefits to users, including faster access to capital, improved transparency, increased efficiency, and improved security.

Fintech is used for a variety of purposes, from mobile payments to automated investment advice. Here are three examples of how fintech can be used to benefit users:

1. Mobile Payments: Mobile payments are becoming increasingly popular, due to their convenience and ease of use. Fintech companies have developed a range of mobile payment solutions, which allow users to quickly and securely make payments using their phones. These solutions are often integrated with existing banking services, making them even more convenient.

2. Automated Investment Advice: Fintech companies have developed a number of automated investment advice platforms, which provide users with personalized advice on how to invest their money. These platforms use algorithms to analyze the user’s risk tolerance and investment goals, and recommend the most suitable investments. Many of these platforms also offer automated portfolio rebalancing services, which help the user to maintain their desired level of risk.

3. Improved Security: Fintech companies have developed a range of security measures to protect users’ information. These include multi-factor authentication, encryption of data, and advanced fraud detection systems. These measures help to ensure that users’ data and transactions are secure, and reduce the risk of fraud.

Fintech has revolutionized the way that businesses and individuals access financial services, and provides a number of benefits to users. Mobile payments, automated investment advice, and improved security are just some of the ways that fintech can be used to benefit users.

Types of Fintech Solutions

Fintech, or financial technology, is rapidly transforming the way financial services are delivered. It includes a wide variety of digital products and services, from digital banking to payments and investments. This article will outline three examples of fintech solutions to provide a better understanding of the ways this technology is reshaping financial services.

First, digital banking is a key component of fintech. Online banking tools, such as mobile banking apps, allow customers to manage their finances on the go. These tools offer customers the ability to check their balance, transfer money, view transactions, and pay bills, all from the convenience of their smartphone or computer.

Second, payment solutions are another example of fintech. This includes solutions such as digital wallets, mobile payment systems, and digital payment networks. These solutions allow customers to easily and securely make payments for goods and services without the need for physical currency.

Finally, investments are the third example of fintech. Investment platforms allow individuals to easily invest in stocks, bonds, mutual funds, and other financial products. These platforms offer features such as automated portfolio management, real-time market data, and advanced analytics to help customers make informed decisions.

Overall, fintech is revolutionizing the way financial services are delivered. From digital banking to payment solutions and investments, these three examples demonstrate the potential of fintech to revolutionize the financial industry.

Examples of Fintech

are everywhere, from digital banking to AI-driven investment advisors. With the rapid growth of the global financial technology sector, there are now more Fintech solutions than ever. To get a better idea of the types of Fintech solutions available, let’s take a look at three examples.

One example of Fintech is digital banking. This type of technology allows customers to access their accounts, make payments, and manage their finances in an online environment. With digital banking, customers can easily transfer funds from one account to another, set up automatic transfers, and pay bills online. Additionally, digital banking often offers users access to financial planning tools and other resources to help them make informed decisions.

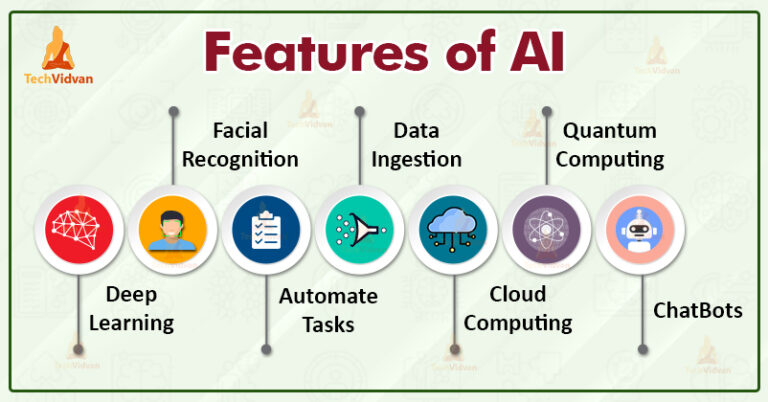

Another example of Fintech is artificial intelligence-driven investment advisors. These solutions use AI to provide customers with personalized investment advice based on their individual financial goals. AI-driven investment advisors can help customers create a customized plan to reach their goals, track their investments, and provide insight into the markets.

Finally, blockchain technology is another example of Fintech. This technology is used to securely record and store digital transactions, and it can be used to facilitate a variety of financial processes, including payments, contracts, and money transfers. It’s also becoming increasingly popular in the banking sector, as it provides greater security and transparency for customers.

These three examples illustrate just a few of the types of Fintech solutions available in the financial technology sector. Whether it’s digital banking, AI-driven investment advisors, or blockchain technology, the possibilities are endless for those looking to leverage the power of Fintech.

Challenges of Fintech

Fintech offers a range of solutions to financial institutions, but there are several challenges associated with it. The most common are the lack of regulatory oversight, the difficulty of maintaining a secure infrastructure, and the cost of deploying and maintaining a fintech platform.

The lack of regulatory oversight is one of the biggest challenges of fintech. Since the technology is relatively new, there are no established regulations in place to protect consumers from fraudulent activities. This means that financial institutions must take extra steps to ensure that their systems are secure and compliant with current laws and regulations.

Another challenge of fintech is the difficulty of maintaining a secure infrastructure. Since new technologies are constantly being developed, it can be difficult to keep up with the latest security measures. This means that financial institutions must dedicate significant resources to ensure that their systems are secure and up-to-date.

Finally, the cost of deploying and maintaining a fintech platform can be quite high. This is because of the complexity of the technology, the need for specialized staff, and the cost of integrating the platform with existing systems. As a result, financial institutions must evaluate their needs carefully before committing to a fintech solution.

Overall, fintech offers a range of solutions to financial institutions, but there are several challenges associated with it. By understanding these challenges and taking the necessary steps to address them, financial institutions can ensure that their fintech solutions are secure, compliant, and cost-effective.

Summary and Conclusion

Fintech has revolutionized the financial services industry, providing innovative solutions that are transforming the way companies and individuals access and manage financial data. From blockchain-based platforms that enable peer-to-peer transactions to AI-driven algorithms that power automated trading systems, fintech is transforming how financial services are provided. Three of the most prominent examples of fintech are digital payments, digital banking, and alternative lending. Digital payments are becoming increasingly popular as they offer a secure, fast, and affordable way to transfer money. Digital banking has revolutionized the way individuals interact with their financial institutions, making it easier to manage financial accounts and transfer money. Finally, alternative lending provides access to funds at competitive rates and more flexible terms than traditional lenders. As the financial services industry continues to evolve, fintech will remain at the forefront of innovation, providing solutions that will continue to shape the way individuals and companies access and manage financial data.

FAQs About the What Are Three Examples Of Fintech?

1.Q: What is Fintech?

A: Fintech, or financial technology, is the use of technology in the financial services industry to improve and automate processes such as payments, trades, and investments.

2.Q: What are some examples of Fintech?

A: Some examples of Fintech include peer-to-peer lending, cryptocurrencies, online banking, mobile payments, artificial intelligence, and blockchain technology.

3.Q: How can Fintech benefit me?

A: Fintech can help to make financial services more accessible and affordable for everyone, as well as providing more secure and efficient ways of managing money. It can also provide businesses with the ability to automate processes, reduce costs, and improve customer service.

Conclusion

Fintech is a rapidly growing sector of the financial industry that is revolutionizing the way banking services are accessed and used. Three examples of Fintech are digital banking, peer-to-peer lending, and cryptocurrency. Digital banking is a technology-driven approach to providing traditional banking services, such as deposits, loans, and payments. Peer-to-peer lending is a form of crowdfunding that allows borrowers to access capital from individual lenders. Cryptocurrency is a digital asset that can be used as a medium of exchange and is secured by cryptography. Fintech is quickly transforming the financial services industry, opening up new opportunities for customers to access and use banking services.