What Are Three Examples Of Fintech?

Fintech, or financial technology, is an umbrella term for the various innovative technologies used in the financial services industry. It has revolutionized the way people access and use financial services, and includes mobile payments, digital banking, investment management, and cryptocurrency. Three examples of fintech include mobile payments, digital banking, and cryptocurrency. Mobile payments allow customers to make payments quickly and securely using their smartphones. Digital banking provides customers with an online banking experience with features such as online account management, direct deposits, and transfers. Cryptocurrency is a digital currency that is decentralized and secured through cryptography, making it a secure and private way to make payments and store value. All three of these examples of fintech have drastically changed the way people use financial services, making them more accessible and efficient.

Definition of Fintech

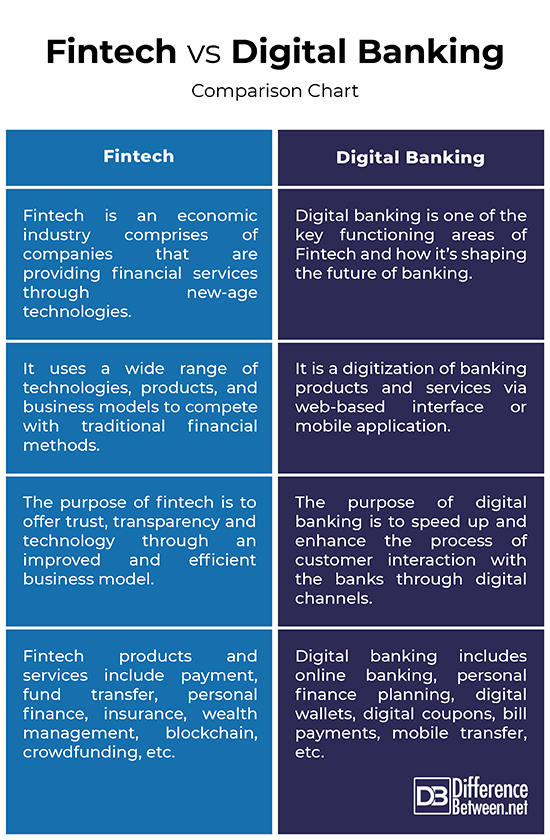

Fintech, or financial technology, is a term used to describe the rapidly growing industry that uses technology to innovate, disrupt, and improve upon traditional financial services. Fintech companies are transforming the way people access and use financial services by providing innovative new products, services, and solutions.

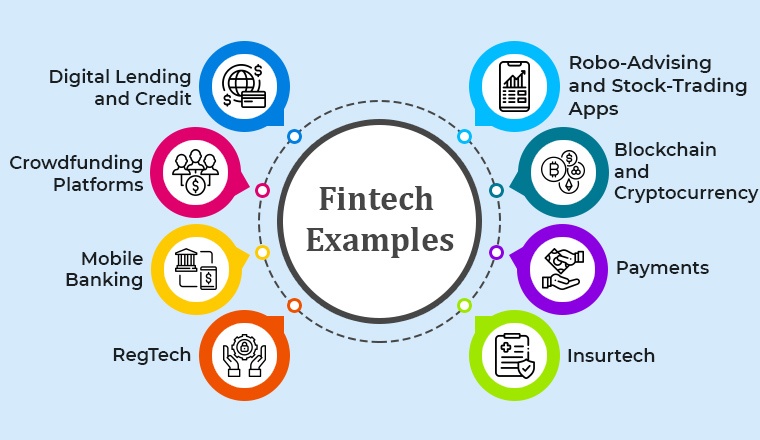

Examples of Fintech include digital banking, payments, investment, insurance, and more. Digital banking apps give users the ability to easily manage their finances on their phones or computers. Payments platforms such as PayPal, Venmo, and Apple Pay make it easy to send and receive money quickly and securely. Investment apps like Robinhood make investing more accessible and affordable than ever before. And insurance companies are leveraging technology to provide more tailored and personalized coverage.

The fintech sector is constantly evolving, with new applications and services being developed on an almost daily basis. It is an exciting and rapidly growing industry that has the potential to revolutionize the way people access and use financial services.

Examples of Fintech

solutions are growing as the world is becoming more digitalized. Fintech, or financial technology, is a broad term that encompasses a variety of companies and technologies that are transforming the way the financial services industry operates. In this article, we’ll look at three prominent examples of Fintech solutions that are revolutionizing the finance industry, making it more accessible and efficient for everyone.

The first example of Fintech is digital banking. Digital banking allows users to access their banking accounts, manage their finances, and make payments directly from their smartphones or tablets. This type of Fintech solution eliminates the need for traditional banking, such as bank branches, and makes managing finances much easier. Digital banks are more secure than traditional banks, and they offer more features, such as budgeting tools, investment advice, and more.

The second example of Fintech is payment processing. Payment processing solutions make it easy for businesses to accept payments, streamline their financial operations, and reduce fraud. These solutions use advanced algorithms and analytics to securely process payments and protect users’ sensitive data. Fintech payment solutions have become increasingly popular with businesses, as they are faster and more secure than traditional payment methods.

The third example of Fintech is blockchain. Blockchain technology enables secure, peer-to-peer transactions without the need for third-party intermediaries. This technology is quickly becoming one of the most transformative Fintech solutions, as it has the potential to revolutionize the financial services industry. Blockchain offers users more control over their finances, reduces the cost of transactions, and increases transparency in the financial system.

These are just three examples of Fintech solutions that are transforming the finance industry. Fintech solutions are making the world of finance more accessible, efficient, and secure for everyone. With the advancements in technology, Fintech solutions are likely to continue to improve and become even more revolutionary.

The Benefits of Fintech

Fintech, or financial technology, is becoming increasingly popular as the world moves towards digitizing financial services. Fintech offers numerous advantages for businesses and individuals looking to maximize efficiency and make the most out of their financial operations. By leveraging the power of the internet, Fintech enables companies to offer innovative solutions and services that can help companies reduce costs, increase profits, and increase customer engagement. Three examples of Fintech are payment processing, wealth management, and cryptocurrency.

Payment processing is one of the most popular types of Fintech. Companies like PayPal and Venmo are leading the way in payment processing, allowing customers to complete transactions quickly and securely online. Additionally, these services often offer lower fees compared to traditional methods, making them extremely attractive to businesses and customers alike.

Wealth management is an area of Fintech that has seen a surge in popularity in recent years. Companies like Betterment and Wealthfront provide automated investment advice and portfolio management, often at a fraction of the cost of traditional wealth management services. These services use advanced algorithms to provide tailored advice and can be customized to fit the individual needs of each customer.

Finally, cryptocurrency is another type of Fintech that has been gaining traction in recent years. Cryptocurrency is a digital asset that utilizes cryptography to secure transactions and verify the transfer of funds. Bitcoin is the most popular type of cryptocurrency, but several others such as Ethereum and Ripple have also become popular. Cryptocurrency offers several benefits such as low transaction fees, quick and secure transactions, and decentralized control.

Fintech offers numerous advantages for businesses and individuals looking to take advantage of the latest technology and maximize efficiency. Payment processing, wealth management, and cryptocurrency are just a few examples of the myriad of services available through Fintech. With the right strategy, businesses and individuals can take advantage of Fintech to reduce costs, increase profits, and maximize customer engagement.

Potential Risks of Fintech

Fintech – or financial technology – is a rapidly growing industry that is transforming the way people access, store, and use financial services. However, as with any new technology, there are potential risks associated with fintech. These risks can range from cybersecurity threats to data privacy breaches to legal and regulatory issues. Understanding these risks is critical for anyone looking to utilize fintech.

One of the biggest risks of fintech is the potential for data privacy breaches. Since fintech companies are often handling sensitive customer data, including bank account information, it is essential that these companies have robust security protocols in place to protect the data. Additionally, customers should be aware of how their data is being used, stored, and shared.

There is also the risk of cyberattacks and other malicious activities. Hackers and other malicious actors are constantly looking for ways to gain access to fintech systems and steal customer data. It is therefore important for fintech companies to have strong cybersecurity measures in place to protect against these threats.

Finally, there is the risk of legal and regulatory issues. Fintech companies must adhere to a variety of laws and regulations, and failure to do so can result in hefty fines and other penalties. It is therefore important for fintech companies to be aware of the laws and regulations that apply to their business and ensure that they are in compliance.

Overall, while fintech offers many benefits, it is important to understand the potential risks associated with the technology. By taking the necessary steps to protect data, prevent malicious activities, and comply with the law, fintech companies can ensure that they are taking the right steps to protect their customers.

Current Trends in Fintech

Fintech, or financial technology, is a rapidly growing and evolving industry that has revolutionized the way we think about money and financial services. With advances in technology, the industry is constantly changing and developing new and innovative products and services. From cryptocurrency to online banking, fintech has revolutionized the way we manage our finances. In this article, we will explore three examples of fintech and discuss the current trends in the industry.

Mobile banking is one of the most popular and widely used forms of fintech. Mobile banking apps provide users with the ability to manage their finances on their phones, allowing them to deposit checks, transfer money, and pay bills from their devices. Mobile banking apps are becoming increasingly popular due to their convenience and ease of use. Additionally, many banks are now offering rewards programs and other incentives to encourage customers to use their mobile banking app.

Cryptocurrency is another example of fintech that has seen significant growth in recent years. Cryptocurrency, such as Bitcoin, is a digital currency that is not regulated by any government or central bank. Cryptocurrency transactions are secure, anonymous, and allow users to transfer funds quickly and easily. Despite the volatility of the market, cryptocurrency has become increasingly popular due to its potential for high returns.

Finally, artificial intelligence (AI) is being used in the fintech industry to provide customers with personalized financial advice. AI-powered platforms are able to analyze customer data and provide tailored advice that can help customers make the most informed decisions about their finances. Additionally, AI-powered platforms can be used to identify fraud and other financial risks, making them an invaluable part of the fintech industry.

Overall, the fintech industry is rapidly evolving and changing. Mobile banking, cryptocurrency, and AI are just a few examples of the innovative technologies being used in the industry. As technology continues to advance, the possibilities for fintech are endless.

What the Future Holds for Fintech

Fintech, or financial technology, is rapidly transforming the way the world does business. From mobile payments to cryptocurrency, Fintech is revolutionizing the way we handle and transfer money. But what are the three examples of Fintech that are leading the charge?

Mobile payments have been a major component of Fintech for years, allowing people to make purchases and transfer money with the tap of a finger. Mobile payments are becoming even more popular as companies like Apple and Google introduce contactless payment options that allow users to make payments with their phones.

Cryptocurrency is another example of Fintech that has taken off in recent years. Bitcoin and Ethereum are two of the most popular and widely used cryptocurrencies, allowing users to securely transfer money without a centralized bank or government institution. Cryptocurrency is becoming increasingly popular among consumers and businesses alike, as it offers a secure and decentralized way to send money.

Finally, artificial intelligence is playing a major role in Fintech today. AI-driven systems are being used to automate financial processes, such as loan applications, insurance claims, and stock trades. AI can also be used to analyze customer data and provide personalized recommendations to customers.

These are just three examples of the many Fintech solutions that are transforming the way the world does business. As technology continues to evolve, so too will the opportunities for Fintech solutions. It will be exciting to see what the future holds for Fintech and how it will continue to shape the way we do business.

FAQs About the What Are Three Examples Of Fintech?

Q1: What is Fintech?

A1: Fintech is short for financial technology, and it refers to the use of technology to provide financial services, products, and processes. This technology can range from mobile banking to cryptocurrencies to automated investment tools.

Q2: What are some examples of Fintech?

A2: Examples of Fintech include mobile payment solutions, digital wallets, digital currencies, automated investment tools, online banking, and more.

Q3: How can I benefit from Fintech?

A3: Fintech can help you save time and money by streamlining financial processes and providing new services and products. It can also help you make better financial decisions by providing transparent and up-to-date information.

Conclusion

Fintech is a rapidly growing industry that is revolutionizing the way financial services are delivered. Three examples of Fintech are crowdfunding, digital payments, and robo-advisors. Crowdfunding allows individuals to invest in projects and companies, digital payments facilitate quick and secure payments, and robo-advisors offer automated investment advice. Fintech is changing the way people access and use financial services, and the industry is expected to continue to grow in the coming years.