What Are The Top 5 Countries Leading In Fintech Innovation?

Fintech, or financial technology, is a rapidly growing sector of the global economy and one that is seeing significant investment and innovation. As the world becomes more digital, the need for financial services that are secure, efficient, and accessible has never been greater. As a result, the top 5 countries leading in fintech innovation are the United States, United Kingdom, China, India, and Singapore. Each of these countries has made significant strides in the fintech space, from developing new technologies and services to providing access to financial services to those who are underbanked or have limited access to banking services. In addition to this, these countries have created an environment conducive to fintech innovation, providing the necessary infrastructure, resources, and regulatory environment for the sector to flourish. As a result, these countries have become major players in the global fintech space and are continuing to drive innovation in the industry.

Overview of Fintech Innovation

The financial technology (fintech) industry is growing rapidly and is revolutionizing the way consumers and businesses interact with money. Fintech innovation is having a massive impact on the global economy, resulting in increased access to financial services, improved customer experience, and more secure transactions. With so much innovation happening in the fintech space, it is worth exploring which countries are leading the pack when it comes to fintech innovation.

The top 5 countries leading in fintech innovation are the United States, the United Kingdom, India, China, and Germany. Each of these countries has established itself as a leader in the fintech space, with each country having its own unique approach to fintech innovation.

In the United States, fintech has been driven by a combination of regulation, investment, and a culture of innovation. The US has been a leader in financial services regulation, and this has enabled startups to create new products and services that comply with the law while providing innovative solutions.

The United Kingdom is another leader in fintech innovation, thanks to the UK’s open banking legislation, which has enabled easier access to financial services for consumers. The UK has also been home to a number of successful fintech startups, such as Monzo, TransferWise, and Revolut.

In India, fintech innovation has been driven by the government’s push for financial inclusion. This has enabled more people to access financial services, resulting in increased financial literacy and improved access to credit.

China is also a leader in fintech innovation, thanks to the country’s large population and supportive government policies. China has been a leader in mobile payments, with mobile payments now accounting for more than half of all retail payments in China.

Finally, Germany has also been a leader in fintech innovation, thanks to the country’s strong banking sector and a culture of innovation. Germany has been home to a number of successful fintech startups, such as N26, Kreditech, and FinReach.

Overall, fintech innovation is a global phenomenon, with a number of countries leading the way in terms of innovation. The top 5 countries leading in fintech innovation are the United States, the United Kingdom, India, China, and Germany. Each of these countries has its own unique approach to fintech innovation, resulting in a variety of solutions and products that are driving the fintech revolution.

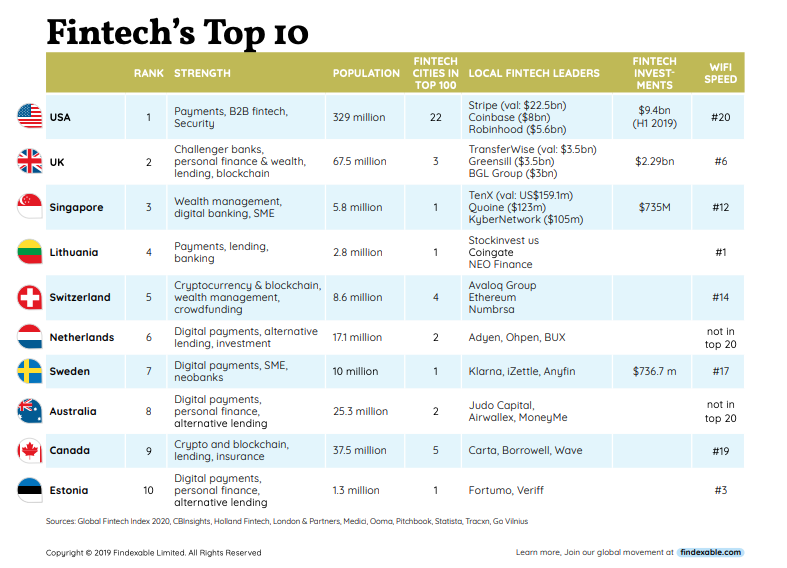

Country Rankings of Fintech Innovation

The world of financial technology (fintech) is ever-evolving and countries around the world are competing to be at the forefront of innovation. From banking to payments, cryptocurrencies to digital wallets, fintech has become an integral part of the global financial landscape. To help you get an understanding of the countries leading the way in fintech innovation, we’ve put together a list of the top 5 countries driving the industry forward.

China has established itself as a leader in fintech, with the country home to some of the world’s most innovative companies such as Ant Financial, Tencent and WeChat Pay. China also has a strong government support for fintech, with the government promoting the use of technology to provide financial services to those previously excluded from the financial system. India has also established itself as a leader in fintech, with the country’s digital payments industry seeing immense growth in the past few years. Companies such as Paytm and PhonePe have been instrumental in driving this growth.

The United States is also a major player in the fintech industry, with the US home to some of the world’s largest fintech companies such as Square, Stripe and PayPal. The UK is also a major player in the fintech industry, with the country home to a number of successful fintech startups such as Monzo and Revolut. Finally, Singapore is also a major player in the fintech industry, with the country home to some of the world’s most innovative fintech companies such as Grab and Razer.

These countries are leading the way in terms of fintech innovation, and it’s clear that the industry is only going to continue to grow in the coming years. By understanding the countries driving the industry forward, you can gain insights into the future of fintech and be well-prepared for the changes that are on the horizon.

The US in Fintech Innovation

The United States has long been known for its fintech innovation, and with good reason. It is home to some of the world’s most renowned financial technology companies, from the e-commerce giant Amazon to the payments giant PayPal. The US is also home to a wide range of startups, from the wealth management platform robo-advisor Betterment to the blockchain firm Ripple.

A major part of the US’s success in fintech innovation is the country’s commitment to research and development. The US government has invested heavily in the sector, creating an environment that fosters innovation and encourages competition between companies. In addition, US universities have long provided a breeding ground for new ideas and technology. This means that the country is always on the cutting edge of fintech, with new services and technologies being developed at a rapid pace.

The US also boasts a large and diverse financial services industry. This has allowed the country to develop a range of fintech services from traditional banks to digital-only solutions. This has created a competitive market, which has led to more innovation and better services for customers.

The US is also home to a thriving venture capital and accelerator scene, which has helped to fund some of the most innovative fintech startups in the world. This means that these startups have access to the necessary resources to develop their products and services and bring them to market.

Finally, the US has been a leader in the adoption of regulation that has helped to create an environment where fintech can thrive. This includes the introduction of the JOBS Act, which has helped to open up the market for crowdfunding and other alternative financing methods.

The US is undoubtedly one of the leading countries in the world when it comes to fintech innovation, and it looks set to remain so for many years to come.

The UK in Fintech Innovation

The United Kingdom (UK) is one of the leading countries when it comes to fintech innovation. It is home to some of the best and most innovative fintech companies in the world. This is no surprise, considering the UK is a hub for financial services and fintech and has a long-standing history of innovation in the sector. The UK’s fintech sector is estimated to be worth around £6.6 billion, and the country is home to over 2,500 fintech companies. The UK government has been supportive of the UK’s fintech sector by providing funding, tax breaks, and other incentives to promote the industry. This has enabled the UK to develop a strong base of fintech startups and innovative companies. The UK is also home to some of the world’s leading fintech companies, such as Funding Circle, Atom Bank, and Monzo. These companies are developing innovative solutions for the financial sector that are transforming how people interact with their finances. The UK is also a leader in the adoption of blockchain technology, with the country’s regulators embracing the technology and encouraging its use. The UK is also home to a vibrant fintech community, with events such as FinTech Connect and FinTech World Forum helping to bring together innovators in the sector. All in all, the UK’s fintech sector is a major driver of innovation and is leading the way in the global fintech industry.

China in Fintech Innovation

As the world’s second-largest economy, it is no surprise that China is at the forefront of fintech innovation. Over the last decade, the country has seen an explosion in the number of fintech startups and investments, and the government has been eager to promote the industry. With the emergence of mobile payments and other digital financial services, China has become the most advanced market for fintech. According to the China Internet Network Information Center, the number of mobile payment users in the country has grown to 1.13 billion in 2020, up from 800 million in 2018.

The Chinese government has also been actively encouraging and facilitating fintech innovation. It has introduced a number of policies and regulations to promote the development of the industry, such as the “Guiding Opinions on Promoting the Development of FinTech”. Additionally, the government has launched several initiatives to support fintech, such as the “Fintech Supervision and Management System” and the “Fintech Innovation Alliance”.

The country is also home to some of the world’s most innovative fintech companies, such as Ant Financial, Tencent, and Baidu. These companies have developed innovative technologies, such as AI, blockchain, and cloud computing, to create new financial services and products. They have also invested heavily in research and development, allowing them to stay ahead of the competition. As a result, these companies have become some of the most successful fintech companies in the world.

The rapid growth of China’s fintech industry has had a positive impact on the global economy. The country’s fintech companies have been able to offer innovative financial services to consumers and businesses in other countries, allowing them to access financial services that were previously unavailable. Additionally, the success of China’s fintech companies has inspired other countries to develop their own fintech industries.

In conclusion, China is one of the world’s leading countries in fintech innovation. The country has seen an impressive growth in the number of fintech companies and investments, and the government has been actively encouraging the industry’s development. Additionally, the country is home to some of the most innovative fintech companies in the world, and their success has had a positive impact on the global economy.

Japan in Fintech Innovation

In recent years, Japan has made impressive strides in the field of fintech innovation. With its robust economy, advanced technology, and forward-thinking government, Japan has become a leading player in the global fintech landscape. In 2018, Japan was the third-largest fintech market in Asia, and its growth is expected to continue.

The Japanese government has been a major driver of fintech innovation, providing incentives for startups and investing in research and development. The government has also implemented policies to promote the use of digital payments and financial technology. It has also established a regulatory sandbox to enable experimentation and innovation.

The country is home to a number of large fintech companies, including Softbank, Line Corporation, and Rakuten, which are all working to develop new financial services and solutions. Additionally, the country boasts a strong venture capital ecosystem and a thriving startup culture, making it an attractive destination for fintech entrepreneurs.

Japan has also become a hub for research and development in the field of blockchain technology. Companies such as NTT Data, Nomura Research Institute, and SBI are investing heavily in blockchain applications. The Japanese government is also supporting the development of blockchain technologies, which is likely to further drive innovation in the country.

Overall, Japan is in an ideal position to become a global leader in fintech innovation. With its strong economic fundamentals, supportive government policies, and vibrant startup scene, Japan is well-positioned to make a big impact on the global fintech landscape.

FAQs About the What Are The Top 5 Countries Leading In Fintech Innovation?

1. What is Fintech Innovation?

Fintech innovation is the use of technology to improve financial services, such as banking, investing, payments, and insurance.

2. What are the top 5 countries leading in Fintech innovation?

The top 5 countries leading in Fintech innovation are the United States, China, the United Kingdom, India, and Australia.

3. How have these countries achieved their success in Fintech innovation?

These countries have achieved their success in Fintech innovation by leveraging their strong technology infrastructure, encouraging collaboration between the public and private sectors, and fostering an environment of innovation and entrepreneurship.

Conclusion

In conclusion, Fintech innovation is a rapidly growing industry that is constantly evolving and changing. The top 5 countries leading in Fintech innovation are the United States, China, India, the United Kingdom, and Singapore. Each of these countries has unique advantages that make them ideal for Fintech innovation, such as their large populations, advanced technology infrastructure, and supportive government policies. By leveraging these advantages, these countries have become global leaders in Fintech innovation and are setting the stage for the future of the industry.