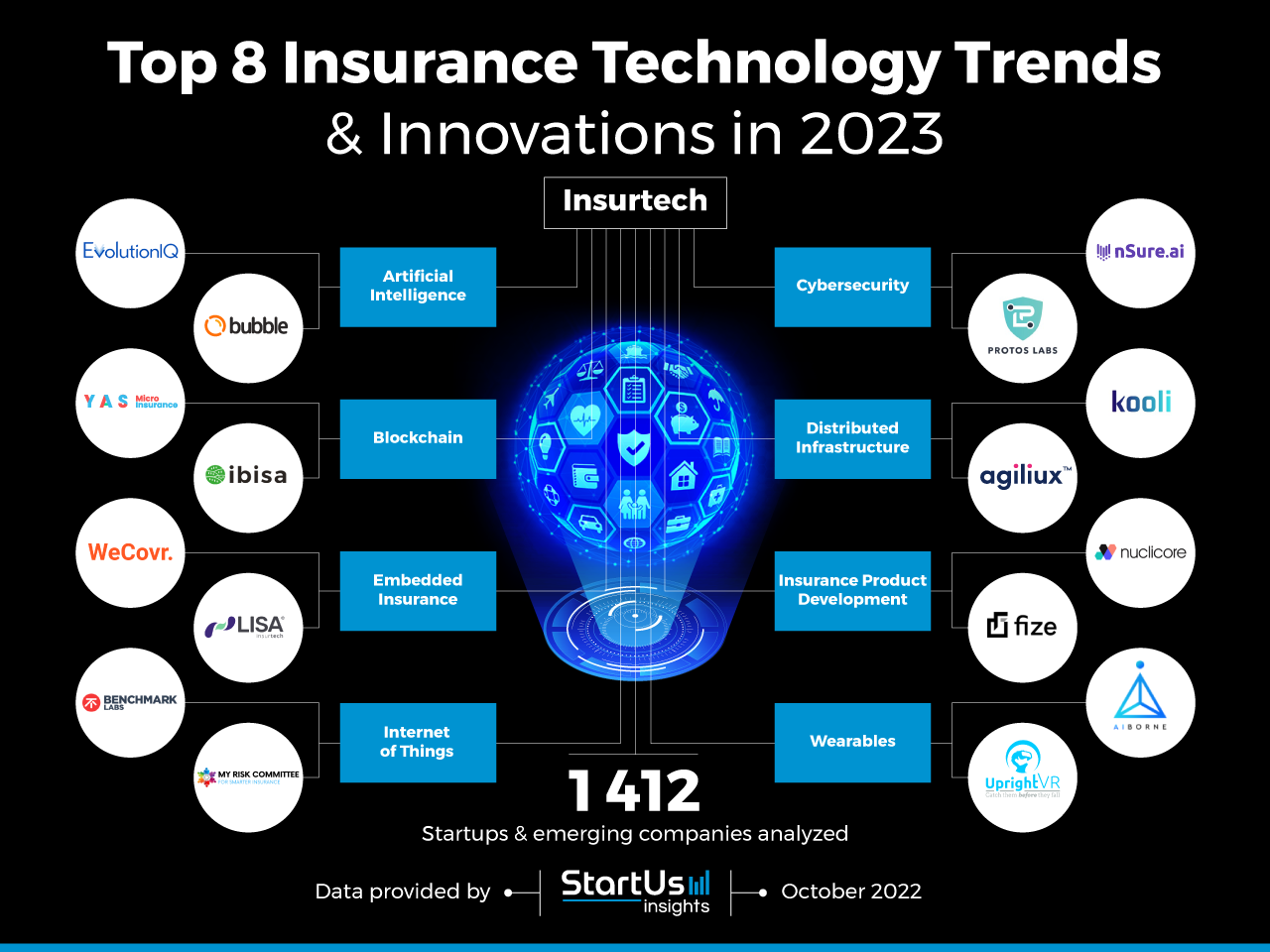

What Are The Technological Innovations In The Insurance Industry?

The insurance industry is an ever-evolving sector that continues to be shaped by technological innovations. These innovations have enabled insurers to better manage risks, provide better customer service, and offer more competitive products. Some of the key technological advancements in the insurance industry include the use of artificial intelligence, machine learning, blockchain technology, digital customer experience, and automated underwriting. These technologies are helping insurers to better understand their customers, provide tailored products, and improve efficiency. The insurance industry is also taking advantage of the internet of things, big data analytics, and predictive analytics to make more informed decisions and provide better outcomes for their customers.

Overview of Technological Innovations in Insurance

Industry

The insurance industry is rapidly evolving, integrating cutting-edge technologies to improve customer service and operational efficiency. From artificial intelligence (AI) and blockchain to robotics process automation (RPA) and the Internet of Things (IoT), technologies are driving massive changes across the industry. AI-driven technologies such as predictive analytics are changing how insurers assess customer needs and develop personalized products. Automation is enabling faster and more efficient customer service. Blockchain is revolutionizing how insurers process and store information, and IoT is helping insurers better understand customer behavior. These technological advances are transforming the way insurers do business and how they interact with customers. This article will discuss the various technological innovations in the insurance industry and how they are impacting the industry. It will also discuss the potential opportunities that insurers can tap into with these technologies.

Automation and Machine Learning in Insurance

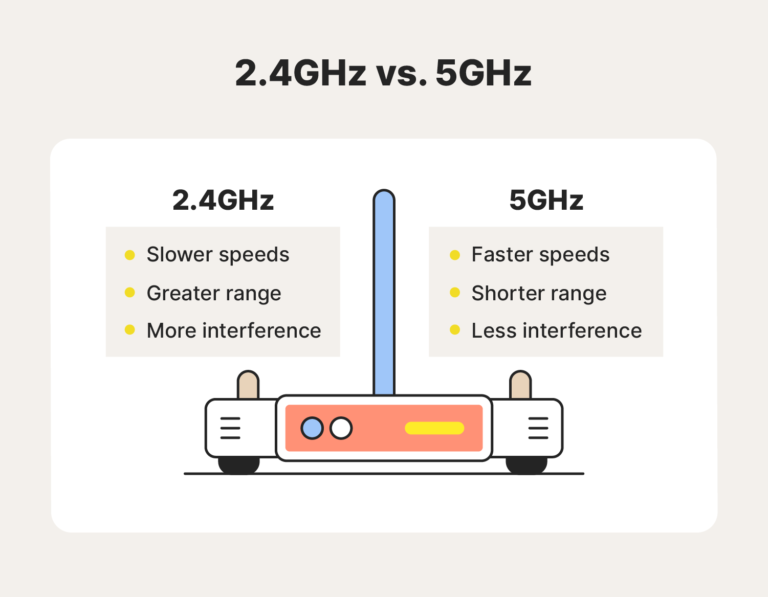

The insurance industry is one of the sectors that has embraced technological advancements over the years. Automation and machine learning are two of the most popular advancements in the insurance industry. Automation is the process of using computer systems and algorithms to perform tasks that would traditionally be done by humans. Automation can be used to streamline processes and increase efficiency. Machine learning is the use of computers and algorithms to identify patterns in data and draw conclusions. This technology can be used to identify potential customers and assess risk more accurately.

By using automation and machine learning, insurance companies are able to make faster decisions, reduce human errors, and provide more personalized services to their customers. Automation and machine learning also help insurance companies to improve customer service by providing more accurate and timely information. They can also help to identify fraudulent claims and detect fraudulent activities.

Overall, automation and machine learning are helping the insurance industry to become more efficient and provide more personalized services to their customers. This is helping to improve customer satisfaction and loyalty, while also helping to reduce costs.

Data Analytics in Insurance

The insurance sector is a highly competitive industry and insurance companies are always searching for new ways to remain competitive. One of the most revolutionary technological innovations in the insurance industry is data analytics. Data analytics is a powerful tool that helps insurance companies identify the best solutions for their customers, allowing them to accurately price their products and services for maximum profitability. Data analytics also provides insights into customer behavior and preferences, allowing companies to tailor their products and services to meet customer needs. Additionally, data analytics can help insurers detect fraud, monitor risk, and identify emerging trends in the market. As insurers increasingly invest in data analytics capabilities, the industry is likely to experience significant changes in how it operates and interacts with customers. Data analytics is revolutionizing the insurance industry and is a powerful tool for companies to remain competitive in the changing landscape.

:max_bytes(150000):strip_icc()/insurtech.asp-final-d0c67eaba6084fd1a115a21cb55768ab.png)

Blockchain and Smart Contracts in Insurance

The insurance industry is rapidly evolving, with technological innovations transforming it in more ways than one. Among the most revolutionary technologies making waves in the industry is blockchain and smart contracts. Blockchain is a digital ledger technology that provides a secure, distributed platform for the storage and transfer of data. Smart contracts are self-executing contracts that are stored on a blockchain and automate the execution of transactions.

The application of blockchain and smart contracts in the insurance industry is revolutionizing the way data is stored and transactions are executed. Smart contracts are eliminating the need for manual intervention in the execution of insurance contracts, streamlining processes, and reducing the amount of paperwork. Blockchain technology is providing secure and reliable data storage, allowing insurers to store and share customer information quickly and securely.

Smart contracts and blockchain technology are ushering in a new era of transparency and data security in the insurance industry. Insurers are now able to provide customers with unprecedented control over their data, as well as access to real-time updates on their policies. This technology is also enabling insurers to better manage risk and reduce fraud.

In conclusion, blockchain and smart contracts are revolutionizing the insurance industry, providing a secure, efficient, and transparent platform for the storage and transfer of data, as well as the execution of transactions. This technology is providing insurers with unprecedented control over their data, as well as better risk management and fraud prevention.

Artificial Intelligence in Insurance

The insurance industry has seen a significant transformation in recent years, largely driven by the emergence of new technologies. Artificial Intelligence (AI) is one such technology that has been embraced by the industry, revolutionizing the way insurers conduct business. AI is a form of computer technology that enables machines to learn from experience, adjust to new data, and respond to user interactions. By leveraging AI, insurance companies are able to automate processes, perform complex data analysis, and improve customer service. AI is also helping insurers detect fraud, gain insights into customer behavior, and improve risk management. AI-driven systems can quickly and accurately process data, helping companies identify trends and patterns that can be used to provide personalized recommendations and tailor products to meet customer needs. AI also helps insurers identify which customers are more likely to make claims, allowing them to adjust their pricing accordingly. Overall, AI is having a major impact on the insurance industry, driving innovation and helping to create a more efficient and customer-centric experience.

Cybersecurity and Fraud Prevention in Insurance

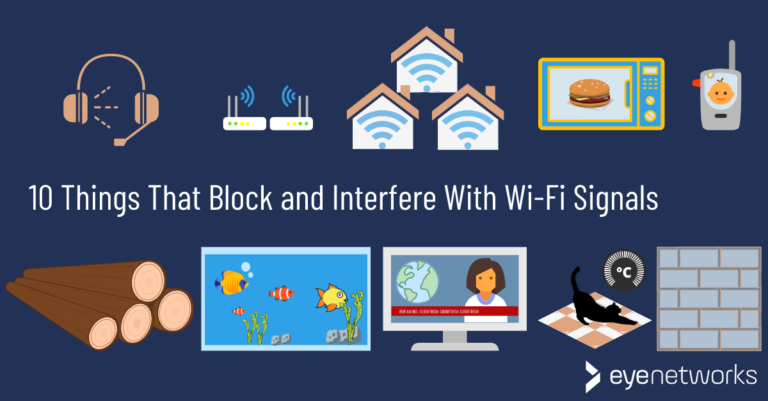

As technology advances, insurance companies need to stay ahead of the curve. Cybersecurity is a major concern for the industry, and fraud prevention is essential in protecting customer data. As a result, insurance companies are increasingly relying on technological innovations to protect the data they store and process. These technologies include advanced machine learning algorithms, artificial intelligence, biometrics, blockchain, and encryption technologies.

Machine learning algorithms are being used to detect fraud and suspicious behavior, while artificial intelligence and biometrics are used to verify customer identity. Blockchain technology is being used to securely store and share data, while encryption methods are used to protect customer information from hackers.

These developments are helping insurance companies operate more securely and efficiently. They can now better protect customer data, reduce losses due to fraud, and improve customer service. As technology continues to evolve, insurance companies will need to remain proactive in order to stay ahead of the curve and protect their customers.

FAQs About the What Are The Technological Innovations In The Insurance Industry?

1. What advancements are being made in the insurance industry to make it easier for customers?

Answer: Insurance companies are utilizing cutting-edge technology such as automation, machine learning, artificial intelligence, and mobile apps to improve the customer experience. Automation can streamline processes, reduce manual errors, and improve accuracy, while machine learning and AI can provide more accurate pricing and personalized service. Mobile apps can make it easier for customers to manage their policies, submit claims, and access their policy documents.

2. What role does technology play in helping insurance companies reduce risk?

Answer: Insurance companies are using technology such as telematics, predictive analytics, and data mining to better understand and calculate risk. Telematics can track driving behaviors and offer incentives for safer driving. Predictive analytics can identify patterns and behaviors that could lead to potential claims. Data mining can uncover correlations between variables that can help insurers better understand and manage risk.

3. How do insurers use technology to better manage and analyze customer data?

Answer: Insurers are leveraging technology such as big data, analytics, and cloud computing to gain insights from customer data. Big data and analytics can help insurers better understand customer behavior, identify trends, and improve their pricing models. Cloud computing allows insurers to store and analyze customer data more efficiently and securely, and can also help them better understand customer needs.

Conclusion

The insurance industry has come a long way in terms of technological innovation. From automation and artificial intelligence to machine learning and blockchain technology, the industry is quickly adapting to the latest technological advancements. This allows insurers to provide better services to customers, streamline operations and reduce costs. Technology has also enabled insurers to reach out to more customers, analyze larger and more complex data sets, and provide better customer service. The insurance industry is continuing to innovate and evolve, and it is likely that these advancements will continue to shape the industry in the years to come.