What Are The Six Fintech Entities?

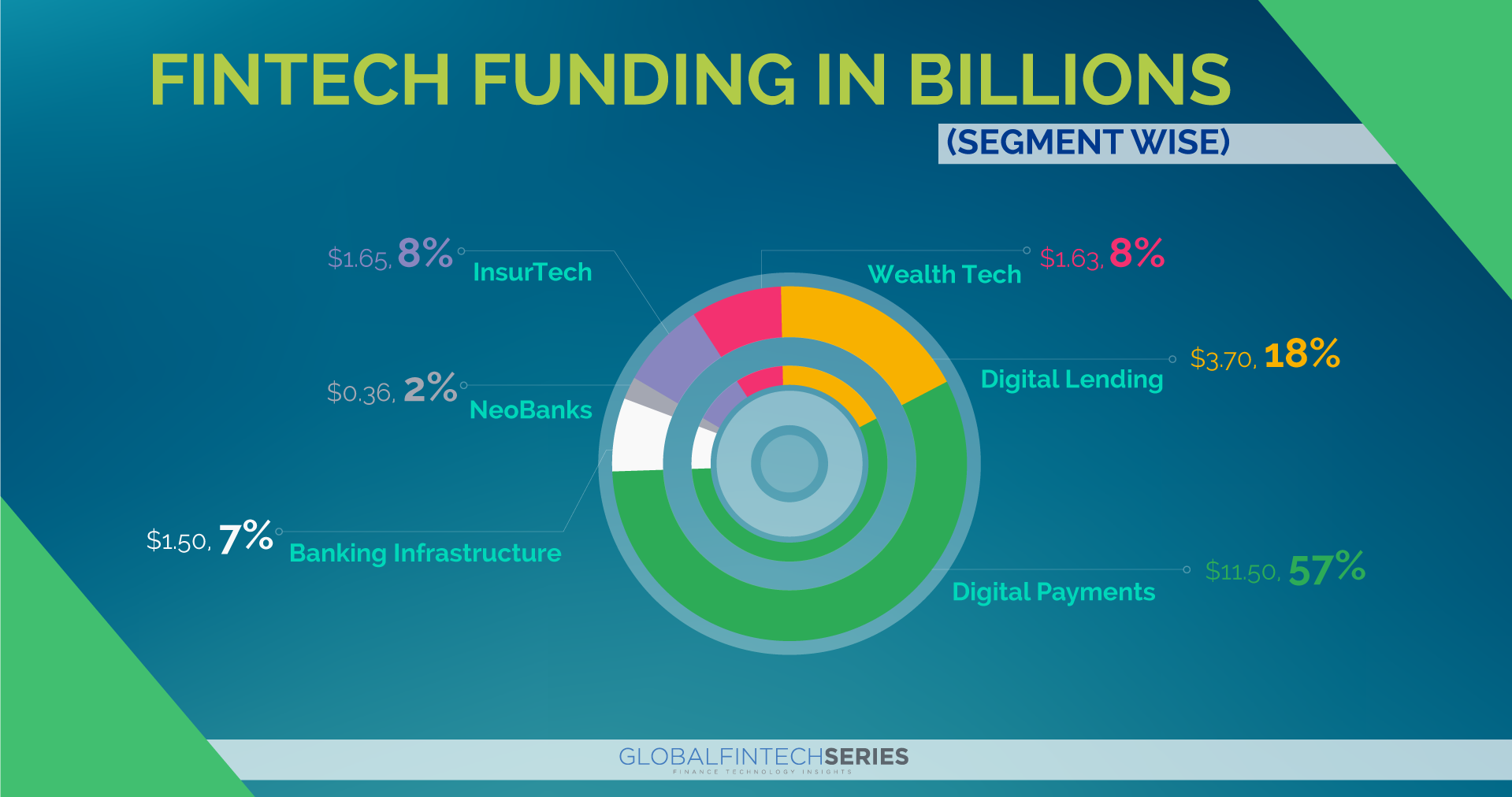

Fintech entities are financial technology companies that are changing the way financial services are delivered. The six major types of fintech entities include payment processors, digital banking, alternative lenders, investment platforms, financial advisory services, and insurance technology. Each type of fintech entity uses innovative technology to provide financial services that are more efficient, secure, and cost-effective than traditional banking services. Payment processors allow customers to send and receive money electronically, while digital banking provides customers with a range of digital banking services. Alternative lenders provide customers with access to loans and other forms of credit, while investment platforms allow individuals to manage their investments online. Financial advisory services provide customers with financial advice and guidance, while insurance technology helps customers shop for, purchase, and manage insurance policies. Fintech entities are changing the way financial services are delivered and have become an essential part of the financial services ecosystem.

Definition of Fintech Entities

Fintech is a term used to describe a wide range of technological innovations and services that are transforming the traditional financial services industry. Fintech entities are organizations, businesses, and platforms that offer financial services through the use of technology. These entities include banks, payment processors, investment managers, stock brokers, peer-to-peer lenders, and crowdfunding platforms.

Each entity has a unique role in the financial services industry. Banks provide traditional banking services such as savings accounts and loans. Payment processors provide payment processing services, such as credit cards and electronic funds transfers. Investment managers manage investment portfolios, stock brokers provide access to the stock markets, and peer-to-peer lenders provide loans to borrowers. Finally, crowdfunding platforms provide a platform for individuals and businesses to raise capital from the public.

Fintech entities are disrupting the traditional financial services industry by providing innovative solutions that are faster, more efficient, and more accessible than ever before. This disruption is driving down costs, increasing transparency, and creating new opportunities for businesses and individuals alike. As a result, fintech entities are becoming an integral part of the global financial system.

Examples of Fintech Entities

Fintech entities are the companies that are disrupting traditional financial systems and revolutionizing the way we manage our money. They are using the latest technology to create new products and services and to improve the customer experience. Six of the most popular Fintech entities are robo-advisors, digital wallets, peer-to-peer lending platforms, digital payments, blockchain technology, and artificial intelligence.

Robo-advisors are automated investment platforms that provide personalized advice and portfolio management services. They use algorithms to select and manage investments, and they often charge lower fees than traditional financial advisors. Digital wallets, such as Apple Pay and Google Pay, allow users to store and manage their money online. Peer-to-peer lending platforms, such as Lending Club and Prosper, connect borrowers and lenders directly, thus bypassing the traditional banking system.

Digital payments, such as PayPal and Venmo, allow customers to send and receive money quickly and securely. Blockchain technology, such as Bitcoin and Ethereum, is a distributed ledger technology that allows users to store and transfer data securely and transparently. Finally, artificial intelligence (AI) is being used by Fintech companies to improve customer service, automate processes, and analyze customer data.

These six Fintech entities are revolutionizing the financial industry and providing customers with more convenient and cost-effective ways to manage their money. They are making it easier for customers to save, invest, and make payments, and are providing opportunities for investors to access new markets. As Fintech continues to evolve, it is important to stay up-to-date on the latest developments and trends.

Benefits of Using Fintech Entities

Fintech entities are a great way to make financial transactions more efficient and secure. They provide access to a wide range of services and products, including payments, investments, loans, and insurance. Financial technology companies provide an innovative approach to traditional financial services, allowing consumers to access and manage their finances quickly and securely. They offer a number of advantages, such as reduced costs, improved customer experience, and improved security.

Using Fintech entities can help consumers save time and money. These entities often offer low fees and faster processing times compared to traditional financial services. Moreover, Fintech entities can provide access to a wider range of financial products and services, such as investing, loans, and insurance. By using these services, consumers can better manage their finances and make better financial decisions.

Fintech entities also provide improved security for financial transactions. These entities often use advanced encryption technology to protect consumer data and provide secure transactions. Additionally, Fintech entities are often regulated by government organizations, such as the Financial Conduct Authority, which ensures that consumers are protected from fraud and other financial crimes.

Overall, using Fintech entities provides a number of advantages for consumers. These entities offer access to a range of services and products, low fees, faster processing times, improved customer experience, and improved security. All of these benefits make Fintech entities an attractive option for consumers looking to manage their finances more efficiently.

Challenges of Using Fintech Entities

Fintech entities are a new and rapidly evolving technology that is transforming the financial services industry. With the emergence of these new players, financial institutions are now faced with the challenge of adapting their business models to keep up with the changing landscape. As the use of fintech entities becomes more widespread, financial institutions must consider the potential risks associated with them. This includes the risk of data security and privacy, compliance with regulatory requirements, and the potential for fraud or money laundering. Additionally, financial institutions must consider the cost of integrating fintech solutions into their existing systems and processes, and the potential impact on customer experience. Understanding the challenges of using fintech entities is critical for financial institutions in order to ensure a safe and secure environment for their customers.

Regulatory Implications of Fintech Entities

Fintech, or financial technology, is quickly becoming one of the most popular industries in the world. As a result, there are six distinct types of fintech entities that are offering a variety of services and products. These entities include banks, payment companies, crowdfunding platforms, alternative lending institutions, wealth management companies, and financial advisors. Each of these entities has their own regulatory implications and the potential to disrupt the financial services industry.

Banks are heavily regulated and must comply with the regulations of the country they are operating in. Payment companies are also subject to the same regulations and must adhere to the rules and regulations of the country they are operating in. Crowdfunding platforms, however, have fewer regulations and are not subject to the same compliance requirements as banks and payment companies.

Alternative lending institutions are also heavily regulated and must comply with the laws of the country they are operating in. Wealth management companies must also adhere to the regulations of the country they are operating in and must maintain high standards of customer service. Lastly, financial advisors are subject to the regulations of the country they are operating in, as well as the regulations of the financial services industry.

In conclusion, each of the six fintech entities has its own set of regulatory implications. Banks, payment companies, crowdfunding platforms, alternative lending institutions, wealth management companies, and financial advisors must all adhere to the regulations of the country they are operating in. Furthermore, each of these entities has the potential to disrupt the financial services industry and shape the future of fintech.

Looking Ahead: The Future of Fintech Entities

The FinTech industry is rapidly changing and growing, with new and innovative entities entering the market every day. With the growth of the industry, it’s important to stay up-to-date on the latest developments. What are the six most popular and widely used Fintech entities? Understanding them can help to inform your own financial decisions and strategies.

The six main Fintech entities are digital banks, money transfer services, peer-to-peer lending, digital payment services, automated investment services, and digital currencies. Digital banks provide traditional banking services, such as checking and savings accounts, credit cards, and loan products, but without the need for physical branches. Money transfer services, such as PayPal or Venmo, allow users to quickly send money digitally. Peer-to-peer lending is a type of loan where borrowers and lenders connect directly, without the need for a middleman. Digital payment services, such as Apple Pay or Google Wallet, allow users to pay for goods and services with their phones. Automated investment services, such as Wealthfront or Betterment, allow users to invest in stocks and other assets with minimal effort. Finally, digital currencies, like Bitcoin, Ethereum, and Litecoin, are digital forms of money that are not backed by governments or banks.

These Fintech entities allow for faster, easier, and more efficient financial transactions than ever before. As the industry continues to evolve, it will be interesting to see which new entities emerge and how they impact the way we manage our finances.

FAQs About the What Are The Six Fintech Entities?

1. What are the six fintech entities?

The six fintech entities include Banks, Credit Unions, Payment Processors, Wealth Management Companies, Insurers, and Financial Advisors.

2. What types of services do the six fintech entities provide?

The six fintech entities provide a variety of services such as mobile banking, online payments, online investments, online insurance, and financial advice.

3. What are the benefits of using the six fintech entities?

The six fintech entities allow customers to access a wide range of financial services from the convenience of their own home. Additionally, customers can also benefit from lower fees, more transparency, and better customer service.

Conclusion

In conclusion, the six fintech entities are digital payments, crowd funding, alternative lending, robo-advisory, wealth management, and blockchain. Each of these entities has the potential to revolutionize the financial industry, offering faster, more efficient, and more secure ways to send and receive payments, lend money, and manage wealth. As the technology behind these entities continues to evolve, they will become a more integral part of the financial landscape.