What Are The Products Of Fintech?

Fintech, or financial technology, is an emerging industry that uses technology to provide financial services to individuals and businesses. It is a rapidly growing sector of the economy, with the potential to revolutionize the way we manage money and financial transactions. Fintech products include a wide range of services, such as online banking, mobile payments, digital wallet systems, peer-to-peer (P2P) lending, robo-advisors, artificial intelligence (AI) powered investments, cryptocurrency, and more. Fintech can also be used to improve customer experience, reduce costs, and increase convenience for financial institutions and their customers. The products of Fintech are helping to transform the financial services industry, and are becoming increasingly popular among consumers.

Definition of Fintech

Fintech, or financial technology, is a rapidly growing field that applies modern technology to financial services and products. Fintech has revolutionized the way we manage our finances by offering modern solutions for everyday financial needs, from payments, to banking, to investing. Fintech products range from mobile payment applications to digital banking services, to automated investing platforms. These products provide consumers with easy access to financial solutions that are both secure and convenient.

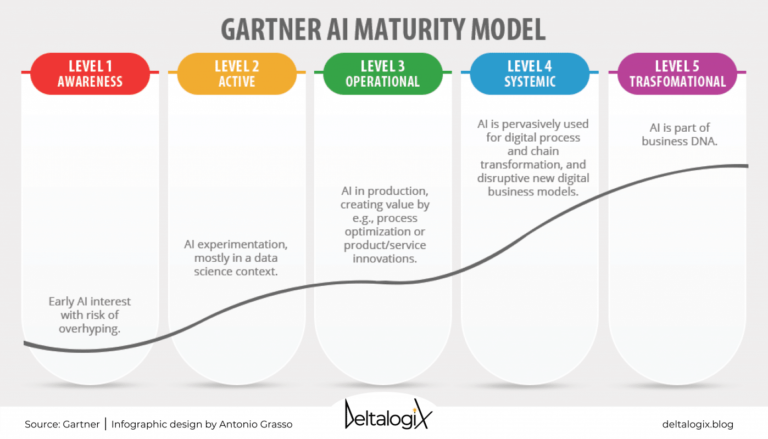

At its core, Fintech is focused on creating innovative products and services that make managing finances easier and more efficient. This includes providing digital solutions for payments, banking, investing, and other financial services. By using cutting-edge technologies such as blockchain, artificial intelligence, and machine learning, Fintech products are able to provide users with secure, convenient, and cost-effective solutions.

Fintech has allowed consumers to access a greater range of financial services and products than ever before. Through the use of advanced technologies, Fintech has also enabled users to make more informed financial decisions. From helping users save time and money to facilitating a more secure and transparent financial system, Fintech products are revolutionizing the way we manage our finances.

Overview of Fintech Products

Fintech products are revolutionizing the way we interact with our finances. From products that make it easier to save money, to those that make it easier to access credit, Fintech products are changing the way we approach financial services. So, what are the products of Fintech?

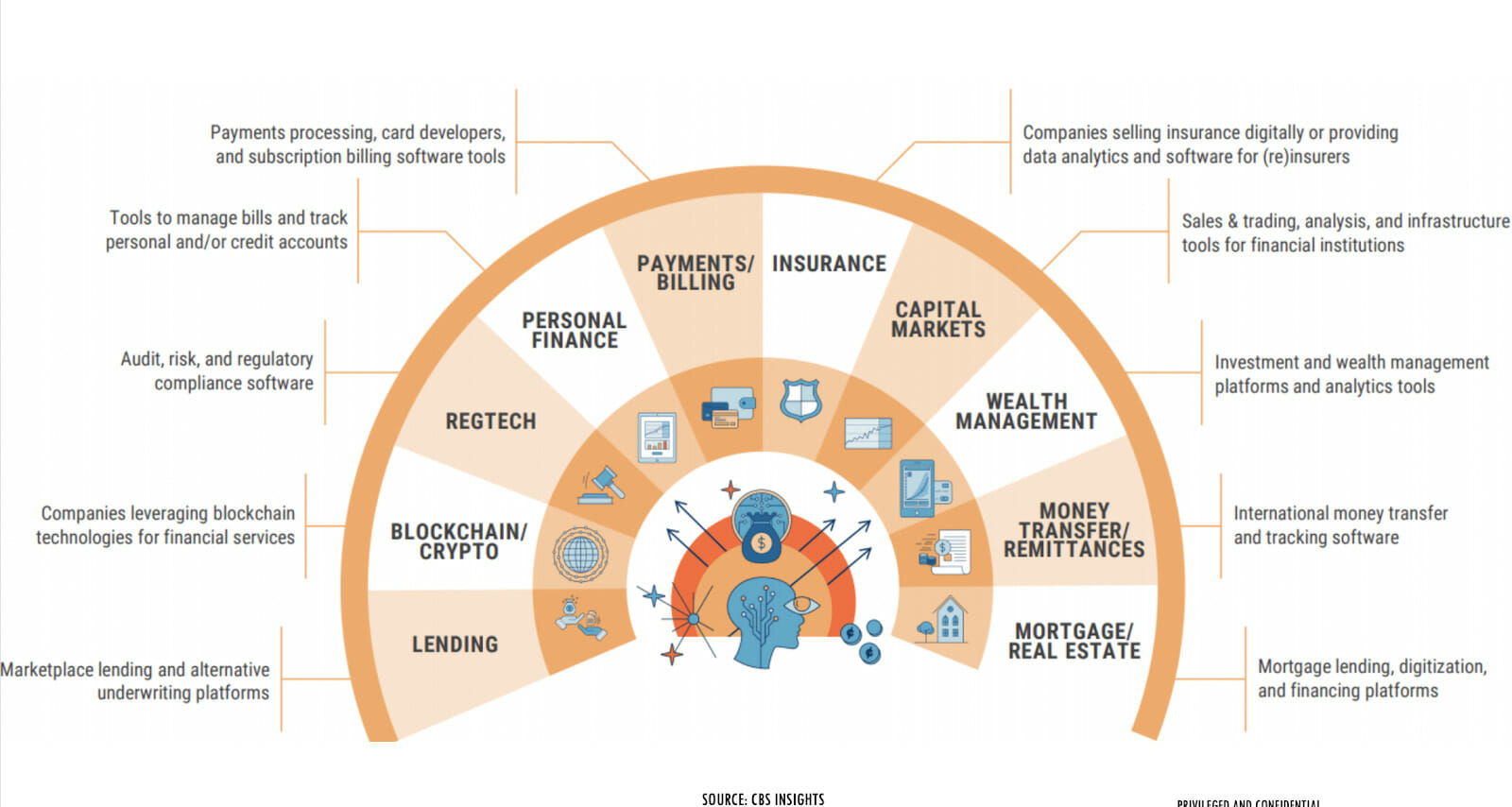

The products of Fintech vary, but they generally fall into three categories: payment solutions, lending and borrowing solutions, and investment solutions. Payment solutions include mobile wallets, digital payments, debit cards, and even automated cash machines. These products allow customers to pay for goods and services quickly and securely. Lending and borrowing solutions offer ways to access credit and loans, often without the need for a traditional bank or lender. Investment solutions are designed to help customers save money and make investments in a secure and efficient manner.

Fintech products also make it easier for customers to understand their financial situation. They often include features such as budgeting tools, financial advice, and credit score monitoring. This helps customers to better manage their finances and make informed decisions about their money.

Overall, Fintech products provide customers with more control over their finances, as well as more options when it comes to accessing credit and services. As the industry continues to grow, we can expect to see even more innovative products emerge that make it easier to manage our money.

Payments and Money Transfers

Fintech has revolutionized the way people handle their finances, and payments and money transfers are no exception. With the help of innovative technology, customers can now send money across borders quickly and securely. Services like Venmo, PayPal, and TransferWise are just a few examples of how fintech has made it easier to send money to family and friends.

These services provide users with the flexibility to transfer money with low fees, fast transfer times, and enhanced security. For instance, TransferWise operates with an innovative multi-currency account system, allowing users to send money to more than 50 countries without the hassle of exchanging currency. Meanwhile, Venmo and PayPal have made it easier to transfer money within the US, providing a convenient and secure way to pay friends and family.

In addition to payments and money transfers, fintech also offers a range of other products for customers to benefit from. Some of these include digital wallets, investments, loans, and more. This has enabled users to access a variety of financial services from the comfort of their own homes and has made it easier to stay on top of their finances. As fintech continues to evolve, there is no telling what new products and services will become available in the near future.

Investments and Wealth Management

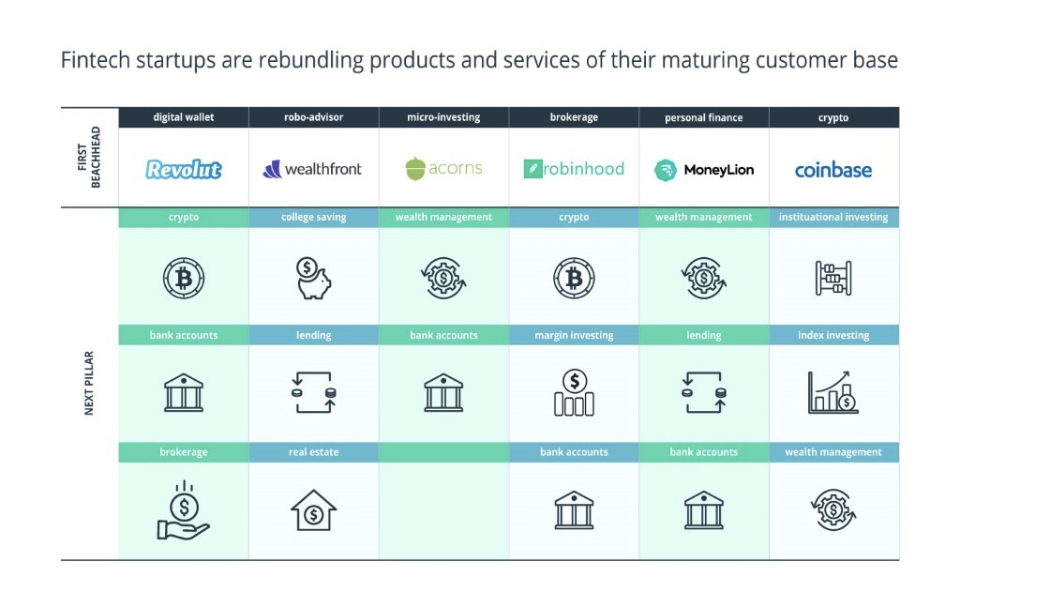

Fintech’s investments and wealth management products are increasingly becoming popular amongst consumers, as they provide a convenient way for people to manage their personal finances. Fintech products in this space include automated investment platforms, robo-advisors, and innovative financial products such as cryptocurrencies and blockchain technology.

Robo-advisors are a type of automated investment platform that uses algorithms to build and manage a portfolio of investments based on the user’s goals and risk tolerance. They are becoming popular amongst investors looking for a hands-off approach to investing, as they provide a simpler, faster, and more affordable way to invest than traditional methods.

Cryptocurrencies, such as Bitcoin, are digital currencies that are not controlled by any government or central bank. They are decentralized and operate using blockchain technology, which is a secure and transparent system for verifying and recording transactions. Cryptocurrencies have become a popular investment option due to their potential for rapid growth and high returns.

Finally, blockchain technology is a revolutionary digital ledger system that has the potential to revolutionize the finance industry. It is a secure and transparent way to record, store, and transfer information, and it can be used to create new and innovative financial products, such as smart contracts and cryptocurrencies.

In summary, Fintech has a wide range of investments and wealth management products, including automated investment platforms, robo-advisors, cryptocurrencies, and blockchain technology. These products offer a convenient and cost-effective way for consumers to manage their finances and potentially make a profit.

Insurance and Risk Management

Fintech, or financial technology, has revolutionized the way we manage our finances, offering a wide variety of products and services. One of the major products of fintech is insurance and risk management. With fintech, customers can manage their insurance policies, compare prices, and purchase policies quickly and conveniently.

Insurance and risk management products offered by fintech companies can include life insurance, health insurance, auto insurance, property insurance, and more. Fintech companies also offer products like annuities, which provide customers with a guaranteed income stream and financial security. Additionally, fintech companies provide products that can help customers manage their risk, such as hedge funds and derivatives.

Fintech has revolutionized the insurance and risk management industry, making it easier for customers to purchase policies, compare prices, and manage their insurance portfolio. Customers now have access to more options and can make informed decisions about their financial security. As the industry continues to evolve, new products will be introduced, such as cyber insurance, which can help protect customers from cyber threats and data breaches.

The products of fintech have made insurance and risk management more accessible and affordable than ever before. Whether customers are looking for life insurance, health insurance, auto insurance, or any other type of policy, fintech companies have the products and services they need. With the help of fintech, customers can make informed decisions about their financial security and manage their risk.

Regulatory and Compliance Solutions

Fintech, or financial technology, is a rapidly-growing industry that is transforming the way financial services are delivered and consumed. Fintech offers a range of innovative products that are designed to simplify, streamline, and automate financial processes. One of the most important products of fintech are regulatory and compliance solutions.

Regulatory and compliance solutions are designed to enable financial institutions to stay on top of the ever-changing regulatory environment. These solutions can help organizations ensure they comply with applicable laws, regulations, and guidelines. They can also help organizations identify and address potential risks and vulnerabilities.

Regulatory and compliance solutions typically take the form of software applications that track and monitor regulatory changes, identify discrepancies in existing regulations, and provide guidance on how to address those discrepancies. They can also provide automated updates when new regulations are added or existing regulations are modified.

In addition to helping organizations stay compliant, regulatory and compliance solutions can also provide valuable insights into customer behavior and preferences, allowing organizations to better tailor their offerings to meet customer needs. By providing these insights, organizations can optimize their product offerings and ensure they remain competitive in the market.

Overall, regulatory and compliance solutions are an important element of fintech, providing organizations with the tools they need to remain compliant and up to date with the latest regulatory requirements. By leveraging these solutions, organizations can stay ahead of the curve and remain competitive in the ever-evolving fintech landscape.

FAQs About the What Are The Products Of Fintech?

1. What is Fintech and how does it help businesses?

Fintech is the use of technology to provide financial services. It helps businesses by streamlining payments, improving customer experience, offering alternative financing options, and increasing financial security and transparency.

2. What products does Fintech offer?

Fintech offers a wide range of products, such as payment processing, online banking, digital currency, financial analytics, investment management, and more.

3. Is Fintech secure?

Yes, Fintech uses the latest security measures to ensure the safety of your financial information. They also utilize encryption technology to protect your data from unauthorized access.

Conclusion

In conclusion, Fintech offers a wide range of products and services that cater to the needs of both consumers and businesses. Its products can range from payment processing and e-wallets to digital banking services and cryptocurrency products. Fintech has become an increasingly popular industry due to its ability to offer innovative financial solutions for the modern world.