What Are The Key Elements Of FinTech?

FinTech, or financial technology, has become increasingly popular over the past decade, providing innovative solutions to traditional financial services. FinTech companies are disrupting the traditional financial services industry by providing digital solutions and services that are faster, more efficient, and more affordable. The key elements of FinTech include data-driven analytics, digital payments, artificial intelligence, blockchain technology, and cloud computing. By leveraging these elements, FinTech companies are able to provide services such as quick and secure payments, risk management, compliance, and customer service. FinTech is transforming the financial services space by creating a more efficient and cost-effective way to deliver financial services.

Definition of FinTech

FinTech, short for financial technology, is a rapidly growing industry that uses innovative technologies to deliver financial services. It has gained traction in recent years due to the development of digital technologies and the demand for more efficient and cost-effective financial services. FinTech is the use of technology to provide financial services, including services such as online banking, credit scoring, money transfers, investment management, and more. FinTech can also refer to the companies that are developing and deploying these technologies. Financial technology firms are often startups that are disrupting traditional banking processes.

FinTech companies are leveraging technology to provide a wide variety of services from automated financial advice and online payments to real-time money transfers and financial literacy tools. They are providing more convenient and secure services to customers. FinTech companies are also leveraging blockchain technology to provide a range of services such as digital currencies and smart contracts.

Overall, FinTech is an exciting new industry that is changing how we think about and interact with financial services. It is allowing us to access more efficient, cost-effective, and secure services. It is also helping to create new jobs and opportunities for entrepreneurs. As the FinTech industry continues to expand, it is important to understand the key elements of this revolutionary technology.

The Emergence of FinTech

The emergence of FinTech has been one of the most significant developments in the digital transformation of financial services in recent years. FinTech – an acronym for financial technology – is the term used to describe the use of technology to deliver financial services, products, and solutions. FinTech enables the digitization, automation, and optimization of traditional banking and financial services, such as payments, transfers, investments, and insurance. FinTech companies are disrupting traditional banking and financial services by providing more efficient, secure, and cost-effective solutions. FinTech companies are utilizing innovative technologies such as artificial intelligence (AI), blockchain, and cloud computing to provide customers with greater control over their finances. FinTech companies are also providing cheaper and more convenient services compared to traditional financial institutions, making them a preferred option for many customers. As a result, FinTech is changing the way financial services are delivered, and it is quickly becoming an integral part of the financial services landscape.

FinTech Services

have become an integral part of our lives today. They offer a variety of financial services, ranging from banking and payments to investments and financial advice. The key elements of FinTech are the technology, the services, and the regulations that govern them.

The technology behind FinTech is what makes it so revolutionary. It includes things like big data, artificial intelligence, machine learning, blockchain, cloud-based services, and mobile-first experiences. By leveraging these technologies, FinTechs can provide users with a more personalized and secure financial experience.

The services offered by FinTechs are often a combination of traditional financial products and new, innovative solutions. These services include digital banking, payments, transfers, investments, and financial advice. With these services, FinTechs are able to provide users with an easy-to-use platform that is tailored to their specific needs.

Regulations are the final piece of the FinTech puzzle. They provide a framework for the industry to operate within and ensure that users are protected. Regulations also require FinTechs to meet certain standards, such as data security and consumer protection. By following these regulations, FinTechs can provide users with a safe and secure financial experience.

In summary, the key elements of FinTech are the technology, the services, and the regulations that govern them. These elements are what make FinTech so revolutionary and provide users with a secure and personalized financial experience.

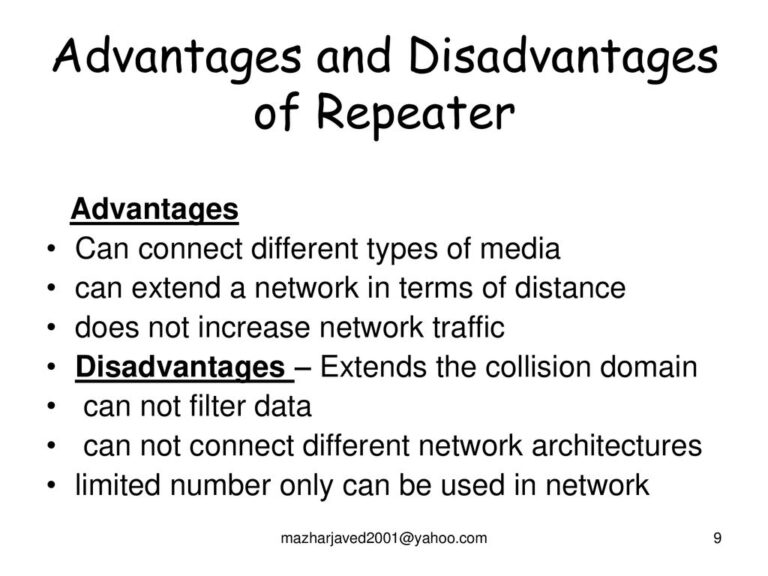

Advantages and Disadvantages of FinTech

In the digital age, FinTech (financial technology) is transforming the way we manage our finances. From mobile banking to online payments and cryptocurrency, FinTech has opened up a whole new world of financial opportunities. But what are the advantages and disadvantages of FinTech?

The primary advantage of FinTech is the convenience it offers. With access to digital banking, consumers can manage their finances from anywhere in the world in just a few clicks. As well, FinTech allows users to make payments quickly, securely, and at a fraction of the cost of traditional banking systems.

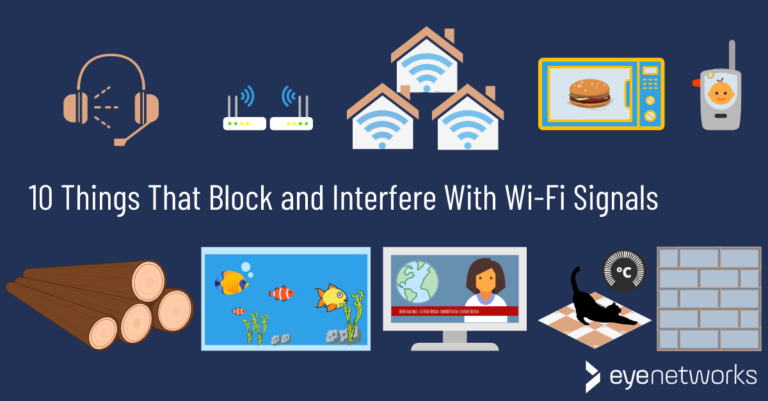

On the other hand, there are some potential drawbacks to FinTech. For instance, as with any technology, there is the risk of data breaches and other cyber security issues. Additionally, FinTech may not be suitable for certain types of financial transactions, such as large purchases or investments.

Ultimately, the benefits of FinTech far outweigh the risks. With its convenience, cost-effectiveness, and security, FinTech is revolutionizing the way we manage our finances. Before making a decision about whether or not to adopt FinTech, it’s important to weigh the advantages and disadvantages to get the most out of your financial decisions.

Regulations and Compliance

Fintech can be an ever-evolving industry, with different countries having different regulations and compliance standards. As such, it’s important for any fintech business to ensure they’re compliant with all applicable laws and regulations. This includes, but is not limited to, anti-money laundering, know-your-customer, and data privacy laws. Compliance with these regulations is crucial to ensure the legitimacy of the business, and to protect both the company and its customers from legal and financial risks. Additionally, having a strong compliance strategy can help fintech businesses remain competitive in an ever-changing landscape. It’s important for any fintech business to stay on top of the latest developments in regulations and compliance in order to remain compliant, and to ensure their customers are protected.

Future of FinTech

FinTech (Financial Technology) has revolutionized the way we access, use, and manage financial services. It has enabled us to take control of our financial health, making it easier to save, invest, and manage our money. As FinTech continues to evolve, it’s important to understand the key elements that make up this rapidly-growing industry.

FinTech includes a wide range of products and services, such as mobile payments, online banking, cryptocurrencies, financial management tools, and digital insurance services. All of these elements have the potential to revolutionize the way we manage our money and financial lives, making it easier to stay on top of our finances.

The future of FinTech is an exciting one. With the advent of artificial intelligence, blockchain technology, and other emerging technologies, the possibilities are endless. As new technologies are adopted, the potential for financial disruption increases, creating opportunities for businesses and individuals alike.

It’s important to stay on top of the latest developments in FinTech, as this will help you to make the most of the opportunities available. As FinTech continues to evolve, it’s important to be aware of the potential for disruption and the potential advantages that can be gained. With the right strategies in place, businesses can leverage the power of FinTech to help them succeed.

FAQs About the What Are The Key Elements Of FinTech?

Q1: What is FinTech?

A1: FinTech (or financial technology) is an umbrella term used to describe the technology and innovation that aims to compete with traditional financial methods in the delivery of financial services. FinTech has the potential to revolutionize the financial services industry by making financial services more accessible, efficient, and secure.

Q2: What are the main components of FinTech?

A2: The main components of FinTech include payment solutions, digital banking, data and analytics, artificial intelligence, blockchain technology, and financial inclusion.

Q3: How can FinTech benefit businesses?

A3: FinTech can help businesses by providing access to financial services that would have been otherwise unavailable. FinTech can also help businesses save time and money, streamline processes, reduce fraud, and increase customer satisfaction.

Conclusion

In conclusion, the key elements of FinTech are digitalization, automation, and data analytics. FinTech has emerged as an important tool for the financial services industry, and it is expected to continue to grow in importance in the years to come. FinTech provides the potential for increased efficiency, cost savings, and improved customer service. FinTech also offers the ability to provide access to financial services to traditionally underserved populations, which can have a positive impact on economic development. Finally, FinTech is an area of innovation that can drive new products and services to market quickly and efficiently.