What Are The Digital Technologies In Insurance Industry?

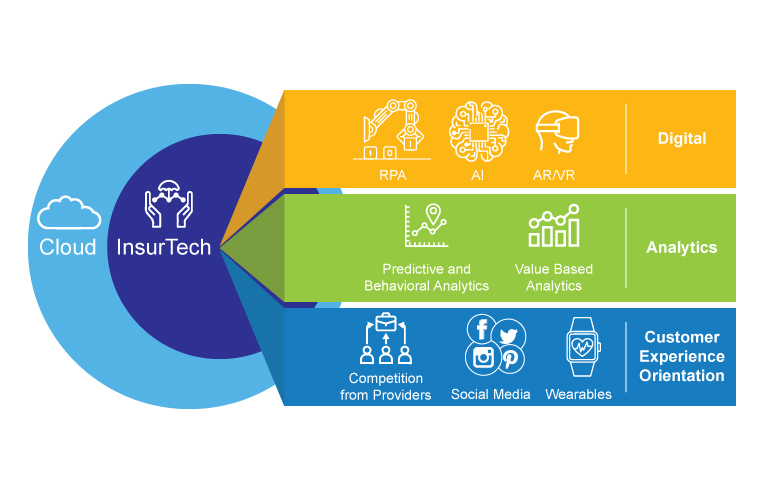

The digital revolution has transformed the insurance industry in a number of ways. Digital technologies are playing an increasingly important role in the way insurance is sold, managed, and serviced. From improving customer engagement to streamlining operations, digital technologies are making the insurance industry more efficient, competitive, and customer-centric. Examples of digital technologies used in the insurance industry include artificial intelligence, data analysis, big data, cloud computing, predictive analytics, blockchain, and mobile applications. These technologies are being used to improve customer experience, automate processes, and reduce costs. As the digital revolution continues to unfold, the insurance industry will continue to evolve and become more efficient and customer-oriented.

Overview of Digital Technologies in Insurance

The insurance industry is rapidly adapting to advances in digital technology in order to remain competitive and stay ahead of the curve. Digital technologies such as artificial intelligence (AI), cloud computing, the internet of things (IoT), blockchain, and data analytics are transforming the way insurance companies operate. By leveraging these technologies, insurers can gain valuable insights into customer data, automate mundane tasks, reduce operational costs, and provide better customer experiences.

AI is helping insurers make more accurate decisions by automating claims processing and helping detect fraud more quickly. Cloud computing is enabling insurers to store customer data securely and access it from anywhere. IoT is helping insurers monitor customer behavior and generate real-time insights. Blockchain is providing a secure network for data exchange and claims processing. Finally, data analytics is giving insurers the ability to gather data from multiple sources and use it to better understand customer needs and preferences.

Digital technologies are transforming the insurance industry and providing insurers with the tools they need to deliver better customer experiences. By leveraging these technologies, insurers can gain a competitive edge and capitalize on the opportunities presented by the digital world.

Benefits of Adopting Digital Technologies in Insurance

Industry

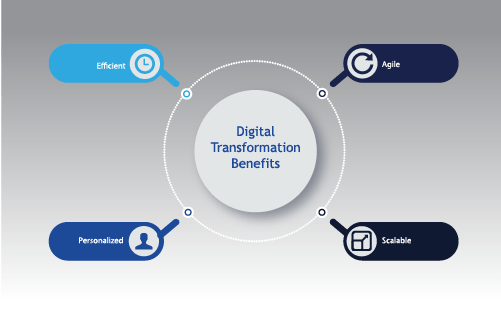

The insurance industry is in the midst of a digital transformation – and for good reason. By utilizing the latest digital technologies, insurers can improve customer experience, streamline operations, and stay ahead of the competition. Digital technologies are driving innovation in the insurance industry, from automated services to data analytics. Here are some of the key benefits of adopting digital technologies in the insurance sector:

1. Increased Efficiency – Automated processes, AI-driven chatbots, and self-service portals can reduce the need for manual labor and help insurers streamline their operations. This can help companies save costs and reduce processing time.

2. Improved Customer Experience – Digital technologies help insurers deliver a more personalized customer experience. From personalized product recommendations to automated services, digital technologies can help insurers meet customer expectations.

3. Enhanced Data Analytics – Insurers can leverage data to identify trends, improve decision-making, and measure performance. By using advanced analytics, insurers can better understand customer behavior and develop better strategies.

4. Increased Innovation – Insurers can use digital technologies to develop new products and services that better meet customer needs. The use of digital technologies can also help insurers stay ahead of the competition and gain a competitive edge in the market.

By embracing digital technologies, insurers can capitalize on the potential of the digital world and gain a competitive edge in the insurance industry. Digital technologies can help insurers reduce costs, improve customer experience, and stay ahead of the competition.

Challenges of Implementing Digital Technologies in Insurance

Insurance companies are rapidly embracing digital technologies to streamline their operations. From improving customer experience to reducing costs, the use of digital technology is transforming the insurance industry. However, implementing digital technologies in the insurance industry is not without its challenges.

One of the main challenges of implementing digital technologies is the need to update legacy systems. Many insurance companies rely on outdated technology due to the complexity and cost of upgrading their systems. This can make it difficult for them to take advantage of modern technologies.

Another challenge of implementing digital technologies is the need to comply with the regulations of the insurance industry. Insurance companies must comply with the laws and regulations of the relevant jurisdiction to remain compliant. This can be a difficult and expensive process for companies.

Furthermore, the implementation of digital technologies can be complex and time consuming. Many insurance companies lack the necessary expertise and resources to successfully implement digital technologies. This can lead to delays in the implementation process and a potential loss of customers.

Finally, the security of digital technologies is a major concern for insurance companies. Companies must ensure that their systems are protected against cyber-attacks and data breaches. This requires the implementation of strong security measures, which can be costly and time consuming.

In conclusion, implementing digital technologies in the insurance industry presents a number of challenges. Insurance companies must overcome these challenges in order to take full advantage of the benefits of digital technologies.

Examples of Digital Technologies Used in Insurance

Industry

Insurance is a highly competitive industry, and digital technologies have changed the way insurers do business. From leveraging the power of analytics to increasing customer engagement, digital tools have become a must-have in the insurance space. In this article, we will discuss some of the digital technologies insurers are using to stay ahead of the competition and stay competitive.

One of the most popular digital technologies used in insurance is data analytics. Insurers are using analytics to gain insights into customer behavior and risk management. Analytics can help insurers identify trends, assess customer needs, and determine the best pricing models. With the help of predictive analytics, insurers can also identify new opportunities and develop targeted strategies.

Another popular digital technology used in insurance is artificial intelligence (AI). AI enables insurers to automate many of their processes such as underwriting, claims processing, and customer service. AI-enabled bots can also help insurers streamline their operations, make better decisions, and improve customer experience.

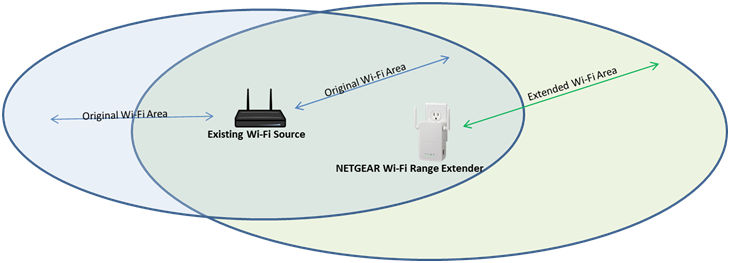

Finally, many insurers are leveraging the power of the cloud to store and access data. Cloud-based solutions are gaining traction in the insurance industry due to their scalability, cost efficiency, and improved security. Insurers can use the cloud to store customer data, automate processes, and provide better customer service.

These are just a few examples of the digital technologies insurers are using in the insurance industry. Digital technologies are changing the way insurers do business, and it’s important for insurers to stay up to date on the latest trends and technologies to remain competitive.

Impact of Digital Technologies on Insurance Industry

The insurance industry has gone through a major transformation in recent years as technology continues to disrupt the traditional insurance business model. Digital technologies have revolutionized the way that insurance companies engage with customers, streamline operations, and create new revenue streams. From cloud-based analytics to AI-driven predictive models, digital technology is having a profound impact on the insurance industry.

One of the most significant changes is the shift in customer engagement. Insurance companies are leveraging digital technology to create personalized experiences and build deeper relationships with customers. This shift has enabled insurers to respond more quickly to customer needs, resulting in improved customer retention and satisfaction.

Insurance companies are also using digital technology to reduce operational costs. Automated processes and cloud-based systems have helped streamline operations, leading to increased efficiency and cost savings. In addition, digital technologies are being used to enhance risk management and fraud detection capabilities, allowing insurers to reduce risk and maximize profitability.

The use of digital technology is also opening up new opportunities for insurers. Digital technology is enabling insurers to develop innovative products and services, as well as tap into new markets. It is also enabling insurers to create new partnerships and develop new business models, helping them stay competitive in an ever-changing landscape.

Overall, digital technology is playing an important role in the insurance industry. With the right strategies and investments in place, digital technology can help insurers deliver better experiences to customers, reduce costs, and open up new opportunities for growth.

Future of Digital Technologies in Insurance

Industry

The insurance industry is in the midst of a digital transformation, and the future looks brighter than ever. Digital technologies are revolutionizing the industry, with many insurers now offering products and services that are accessible online. Companies are using advanced analytics to better understand customer needs and preferences, while digital platforms are making it easier for customers to compare and purchase products. As the industry continues to evolve, digital technologies are expected to continue to play an increasingly important role in the insurance industry.

Digital technologies are allowing insurers to offer more personalized experiences to customers. They are also providing insurers with opportunities to increase operational efficiency and reduce costs. Automation and machine learning are helping to streamline processes, while data analytics are providing insights into customer behaviors and trends. AI-driven bots are helping insurers better understand customer needs and provide better customer service.

The emergence of digital technologies has also opened up new opportunities for insurers to innovate and create products tailored to customer needs. Insurers are now able to quickly develop and launch products that meet customer demands, as well as offer more customized solutions. Furthermore, the use of digital technologies has enabled insurers to reach out to customers in more meaningful ways, such as through personalized emails and targeted ads.

Digital technologies are revolutionizing the insurance industry and transforming the way in which insurers do business. As the industry continues to evolve, insurers must embrace digital technologies to remain competitive and remain ahead of the curve. The future of digital technologies in the insurance industry is sure to be an exciting one.

FAQs About the What Are The Digital Technologies In Insurance Industry?

Q1. What are the different digital technologies used in the insurance industry?

A1. Digital technologies used in the insurance industry include cloud computing, automation, analytics, artificial intelligence, blockchain, and the Internet of Things (IoT).

Q2. How can digital technologies help insurers?

A2. Digital technologies can help insurers better understand customer needs and preferences, reduce fraud, automate administrative tasks, streamline processes, and provide a better customer experience.

Q3. What are the challenges associated with digital technologies in the insurance industry?

A3. The challenges associated with digital technologies in the insurance industry include high implementation costs, data security and privacy risks, and the need for specialized skills to operate and manage digital systems.

Conclusion

The digital revolution has completely transformed the insurance industry. Digital technologies such as AI, predictive analytics, cloud computing, blockchain, and telematics have allowed insurers to automate processes, customize products, and enhance customer experience. By leveraging these technologies, insurers are able to offer more customized and cost-effective services to customers, ultimately leading to greater customer satisfaction. With the emergence of new technologies, the insurance industry is set to become even more competitive and innovative in the future.