What Are The 5 Key Technologies In Fintech?

Fintech, or financial technology, is an industry that uses technology to improve financial services. It has grown rapidly in recent years, and there are now a number of key technologies that are enabling the development of innovative products and services. The five key technologies in fintech include artificial intelligence (AI), the blockchain, distributed ledger technology (DLT), machine learning, and cloud computing. These technologies are being used to make financial transactions more secure, efficient, and cost-effective, and to provide customers with better access to the financial services they need. Additionally, these technologies are enabling startups to create new products and services that can disrupt traditional financial services. As the use of these technologies continues to grow, the potential for new and improved services is only getting bigger.

Blockchain

, AI, Machine Learning, Big Data, and Cloud Computing.

Fintech, or financial technology, has been disrupting the financial industry for some time now. From streamlining processes to opening up new opportunities, fintech continues to revolutionize the way we manage our finances. But what are the key technologies driving this change? In this blog, we will take a look at five of the most important technologies in fintech: Blockchain, Artificial Intelligence (AI), Machine Learning, Big Data, and Cloud Computing.

Blockchain technology, the cornerstone of cryptocurrencies such as Bitcoin, is a distributed ledger that records and stores data across a network of computers. This allows for secure transactions without the need for a third-party intermediary. AI and Machine Learning are used to automate processes, such as credit scoring, by analyzing data and making decisions based on that analysis. Big Data is the collection and analysis of large datasets, allowing for more accurate forecasting and predictive modeling. Finally, Cloud Computing allows for the storage and processing of data in the cloud, which is more cost-effective and secure than traditional data centers.

These five technologies are the foundation of the fintech revolution, and they continue to open up new possibilities in the financial industry. By leveraging them, businesses can increase their efficiency, reduce costs, and provide better services to their customers.

Artificial Intelligence

, Blockchain, Robotic Process Automation, Data Analytics, and Machine Learning

Fintech is revolutionizing the way we manage our finances, and its potential for growth is boundless. As such, it is important to understand the key technologies that are driving this sector. From Artificial Intelligence (AI) to Blockchain and Machine Learning, here are the 5 key technologies that are shaping the future of fintech.

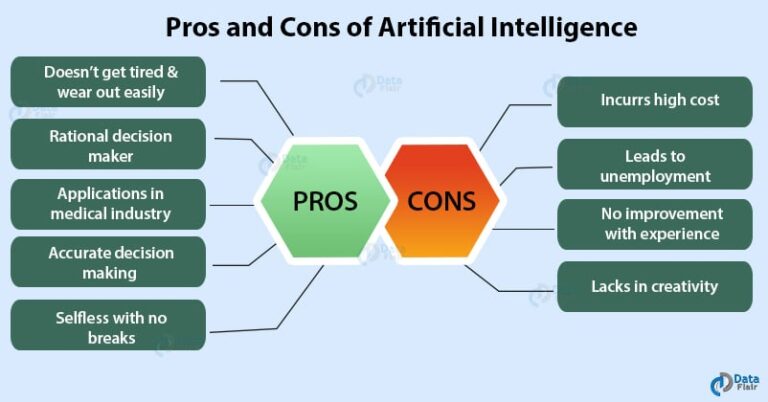

AI is transforming the way we interact with our money, with the technology enabling us to automate tasks that previously required manual labor. AI can also be used to identify patterns in financial data, helping to identify potential risks and opportunities.

Blockchain is also revolutionizing the financial sector, allowing for secure and transparent transactions. Its decentralised nature makes it ideal for a range of applications, including digital currencies and smart contracts.

Robotic Process Automation (RPA) is another key technology that is impacting fintech. RPA enables businesses to automate mundane tasks, freeing up resources and allowing them to focus on more valuable activities.

Data analytics is also playing a major role in the fintech sector. By analysing large data sets, businesses are able to better understand their customers and identify insights that can improve their operations.

Finally, Machine Learning (ML) is becoming increasingly popular in the fintech sector. ML is a form of AI that enables computers to learn from data and make decisions without explicit instruction. This technology can be used to identify trends in financial data, improve customer service, and detect fraud.

These 5 technologies are driving the growth of the fintech sector and are helping to revolutionize the way we manage our finances. As such, it is important to stay up to date on the latest developments in these areas in order to remain competitive.

Big Data Analytics

, Artificial Intelligence, Machine Learning, Blockchain, and Cryptocurrency

Fintech has taken the world by storm, transforming the financial landscape and revolutionizing the way money is managed and transferred. As technology continues to rapidly evolve, so does the financial sector, and five key technologies are driving this transformation. Big Data Analytics, Artificial Intelligence, Machine Learning, Blockchain, and Cryptocurrency are the five key technologies that are transforming the financial industry.

Big Data Analytics gives banks and financial institutions the ability to store, analyze, and interpret vast amounts of data generated from transactions and customer interactions. This technology enables financial institutions to better understand customer behavior and trends, as well as detect fraud and money laundering more efficiently.

Artificial Intelligence (AI) is a technology that uses algorithms to automate tasks, such as customer service and credit scoring. AI can help financial institutions increase efficiency, reduce costs, and identify and prevent fraud.

Machine Learning (ML) is a subset of AI that uses algorithms to learn and improve over time. ML can analyze data more effectively than traditional methods and can be used to predict customer behaviors.

Blockchain is a distributed ledger technology that enables secure, transparent, and immutable transactions. It enables financial institutions to securely store and transfer data and assets, as well as conduct transactions with increased security and efficiency.

Cryptocurrency is a digital currency that utilizes blockchain technology to enable secure and anonymous transactions. Cryptocurrencies are gaining traction as a viable alternative to traditional currencies.

These five key technologies are revolutionizing the financial industry, and they will continue to shape the future of fintech. For financial institutions, understanding and leveraging these technologies is essential for staying ahead of the competition and delivering innovative products and services to their customers.

Open Banking

, AI, Blockchain, Cloud Computing and Big Data are the 5 key technologies driving the future of Fintech.

The rise of Fintech has been one of the most significant developments in the world of finance in recent years. This new technology has brought with it the potential to revolutionize the way financial services are delivered and accessed. By utilizing the latest in technology, Fintech companies are able to provide services that are more efficient, secure and cost-effective than traditional banking systems.

At the heart of Fintech are five key technologies: Open Banking, AI, Blockchain, Cloud Computing and Big Data. Each of these technologies is enabling Fintech companies to provide innovative and sophisticated financial services.

Open Banking allows for the secure sharing of financial data among multiple parties and provides customers with greater control over their finances. AI is powering the development of advanced predictive models that can aid in risk assessment, fraud detection and customer segmentation. Blockchain technology is revolutionizing the way that financial transactions are processed and secured. Cloud Computing is providing Fintech companies with the scalability and flexibility they need to expand their services. Finally, Big Data is being used to better understand customer behavior, anticipate future trends and develop new products.

By leveraging these five key technologies, Fintech companies are able to deliver improved services to their customers and create new opportunities for financial institutions. It is clear that these technologies will continue to shape the future of Fintech for years to come.

Cybersecurity

, Artificial Intelligence, Blockchain, Cloud Computing, and Big Data are the five key technologies which are driving the financial technology industry.

The world of finance is rapidly evolving, and financial technology (fintech) is at the forefront of this revolution. Fintech is the use of technology to deliver financial services, and the technologies driving the movement are rapidly changing. Cybersecurity, Artificial Intelligence (AI), blockchain, cloud computing, and big data are five of the most prominent technologies in the fintech space.

Cybersecurity is an essential part of any fintech system, protecting users from cyberattacks and data breaches. AI is being used to automate many aspects of fintech processes, such as loan approvals and fraud detection. Blockchain is used to create digital currencies, store and transfer data, and facilitate transactions securely. Cloud computing offers users access to data and applications in the cloud, rather than on their own computers. Finally, big data enables fintech firms to analyze vast amounts of data quickly and accurately to gain insights and make decisions.

These five technologies are at the heart of the fintech movement, enabling firms to offer innovative and secure financial services. As the industry continues to evolve, these technologies will be essential for delivering the best possible user experience and driving growth.

Cloud Computing

Fintech is rapidly evolving with newer technologies and innovations coming into play. One of the most important technologies that is enabling this transformation is cloud computing. Cloud computing is a type of computing that relies on sharing computing resources over the internet instead of having local servers or personal devices to handle applications. By leveraging cloud computing, financial institutions are able to access high-performance applications, data storage, and analytics, as well as numerous other services. This drastically reduces the need for physical IT infrastructure and provides more flexibility and scalability to businesses. Furthermore, cloud computing is often more cost-effective than traditional IT infrastructure. As cloud computing continues to evolve, it will become increasingly important for financial institutions to adopt cloud-based solutions in order to remain competitive.

FAQs About the What Are The 5 Key Technologies In Fintech?

Q1: What are the five key technologies in Fintech?

A1: The five key technologies in Fintech include blockchain, artificial intelligence (AI), machine learning, cloud computing, and data analytics.

Q2: How do these technologies help improve financial services?

A2: These technologies help improve financial services by providing greater security and transparency, reducing costs, enabling faster access to data, and helping to identify and manage fraud.

Q3: How can businesses use Fintech to their advantage?

A3: Businesses can use Fintech to their advantage by leveraging the technologies to create innovative products and services, reduce costs, improve customer experience, and gain a competitive edge.

Conclusion

The five key technologies in fintech are cloud computing, artificial intelligence, blockchain, big data, and open banking. These technologies have revolutionized the financial services and banking industry, allowing for faster, more secure, and cost-effective processes. These technologies have enabled businesses to remain competitive in a digital economy and create innovative solutions to better serve their customers. As the technology continues to evolve, more use cases and possibilities for fintech will continue to emerge.