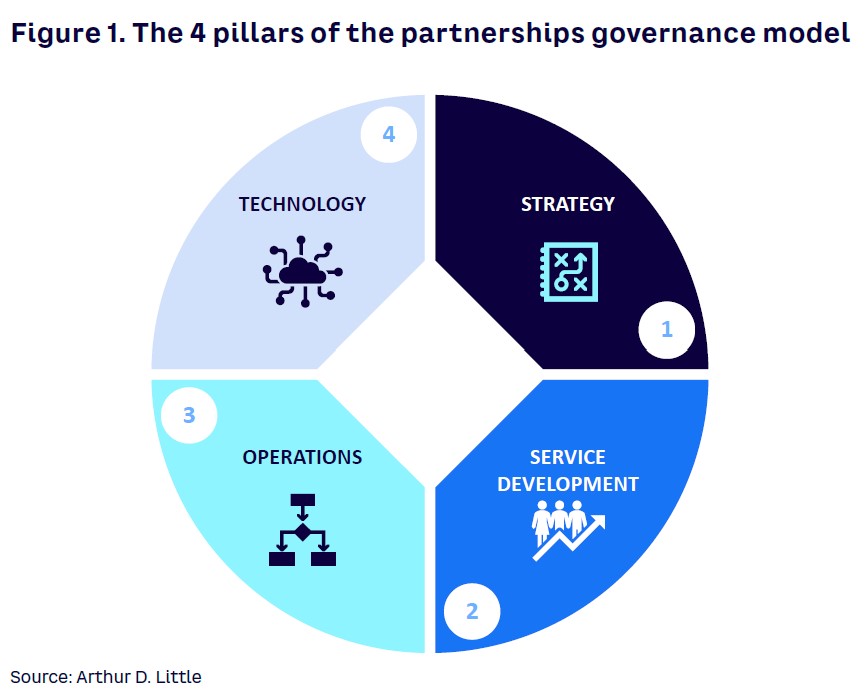

What Are The 4 Pillars Of Insurance?

Insurance is a form of risk management that covers a person or entity from unforeseen losses or damages. Insurance is a complex and ever-evolving industry, and it is essential to understand the four pillars of insurance to gain a better understanding of this essential service. The four pillars of insurance are the following: risk management, pricing and underwriting, claims management, and policy administration. Each of these pillars is essential in providing insurance coverage to individuals and businesses. Risk management is the process of identifying, assessing, and controlling the risks that an insured faces. Pricing and underwriting involve the calculation of insurance premiums, the assessment of the risk, and the selection of the most appropriate insurance coverage. Claims management involves the handling of claims and the investigation of any disputes. Finally, policy administration is the process of managing the policyholder’s coverage and providing customer service. All of these elements are essential in the functioning of an insurance plan.

Definition of Insurance

Insurance is a contractual agreement between two parties, where one party, the insured, pays a fee or premium to another party, the insurer, for protection against certain risks. Insurance is a form of risk management that allows individuals and businesses to manage their financial losses due to unexpected events. Insurance is available in many forms, such as health insurance, life insurance, automobile insurance, property and casualty insurance and business insurance. The four pillars of insurance are financial protection, risk management, peace of mind, and financial planning.

Financial protection is an important part of insurance, as it protects individuals and businesses from financial losses due to unexpected events. Risk management is another important part of insurance, as it helps individuals and businesses assess, manage, and control risks associated with their activities and operations. Insurance also provides peace of mind, as it ensures that individuals and businesses are financially secure in the event of an unexpected event. Finally, insurance also plays an important role in financial planning, as it helps individuals and businesses plan for their futures by providing them with a safety net in the event of an unexpected event.

Overview of the 4 Pillars of Insurance

Insurance is a critical component of financial planning, providing protection from unexpected losses. To better understand the importance of insurance, it is essential to understand the four pillars of insurance. These four pillars are the core of any insurance plan and provide the necessary framework for a solid financial foundation.

The first pillar of insurance is risk management. This involves the assessment of potential risks and the development of strategies to mitigate them. This includes the use of insurance policies to cover losses that may occur from damage or injury caused by an event.

The second pillar is financial planning. This includes budgeting and savings plans for the future. Financial planning also includes the selection of appropriate insurance policies to provide protection against financial losses.

The third pillar is claim management. This involves the filing, processing, and payment of claims. It also includes the investigation and resolution of disputes between policyholders and insurance companies.

The fourth pillar is customer service. This includes the provision of advice and assistance to policyholders. It also includes the resolution of customer complaints and the implementation of corrective actions.

These four pillars of insurance provide the foundation for any insurance plan. Understanding the importance of these pillars and how they work together to provide protection will help policyholders make informed decisions about their insurance needs.

Pillar 1: Risk Assessment

Insurance is essential for mitigating the financial risks associated with accidents, property damage, and other unpredictable events. Risk assessment is the first step in the insurance process, and it involves evaluating the probability of an event occurring, the expected cost of the event, and the potential impact on the business or individual. By assessing all of these factors, insurance companies can determine the best way to provide the necessary coverage and determine the appropriate premium. Risk assessment also takes into account the individual’s lifestyle and other factors that could increase the likelihood of an event occurring. By understanding the risks associated with a particular situation, insurance companies can provide the most appropriate coverage.

Pillar 2: Risk Transfer

Insurance is an essential part of any financial plan, and it is important to understand the four pillars of insurance. The second pillar is Risk Transfer. Risk transfer is the process of transferring the financial risk of a loss from one party to another. This is the principle behind insurance, as the insured party pays a premium to the insurance company, which assumes the risk of a potential loss. Risk transfer is also commonly referred to as “risk shifting” or “risk shifting and pooling.” Risk transfer is important in insurance because it allows individuals and businesses to protect themselves from potential losses. It also helps to spread out the potential losses among many individuals or businesses, making it easier for insurers to pay out claims in the event of a loss. Risk transfer is a key part of the insurance industry and it is essential to understand how it works.

Pillar 3: Risk Financing

Risk Financing is the third pillar of insurance and involves the transfer of risk from an individual or organization to a third-party. This can be done through a variety of methods, such as deductibles, self-insurance, and reinsurance. Risk financing is an important component of risk management, as it allows an individual or organization to shift the financial burden of a potential loss to a third-party. By transferring the financial burden of a loss, an organization can reduce its financial losses and protect its assets. Risk financing is also important in helping to manage the costs associated with insurance coverage, as it can reduce the amount of money that must be paid out in the event of a claim.

Pillar 4: Risk Management

The fourth pillar of insurance is risk management. Risk management is the process of identifying, analyzing, and responding to risks to an organization’s finances, operations, and reputation. It involves identifying potential risks, assessing their impact, and developing strategies to minimize or eliminate them. Risk management is an important part of any successful business, as it helps protect the business from unexpected losses. Risk management also helps businesses make informed decisions about how to allocate resources and reduce exposure to potential risks. It is a complex process, requiring an approach that is tailored to the organization’s needs. Risk management professionals must have a deep understanding of the business, its operations, and the environment in which it operates. They must also be able to develop strategies to effectively mitigate risks while maximizing profitability. By utilizing risk management strategies, businesses can ensure that their operations are as safe and secure as possible.

FAQs About the What Are The 4 Pillars Of Insurance?

1. What are the 4 pillars of insurance?

The 4 pillars of insurance are risk management, underwriting, claims management, and customer service.

2. What role does risk management play in the 4 pillars of insurance?

Risk management is the process of identifying, analyzing, and mitigating potential risks associated with an insurance policy. It involves assessing the risk before providing coverage, assessing the risk of the policyholders, and setting premiums that reflect the risk.

3. What role does underwriting play in the 4 pillars of insurance?

Underwriting is the process of evaluating an insurance policy request and deciding whether or not to accept it. This involves assessing the risk of the policyholder, setting premiums that reflect the risk, and determining the terms and conditions of the policy.

Conclusion

The 4 Pillars of Insurance are Risk Assessment, Risk Transfer, Risk Financing, and Risk Control. Each pillar is essential to the overall success of an insurance program, and understanding how they interact is key to creating a successful insurance policy. Risk Assessment helps identify the risks associated with a particular situation or hazard, Risk Transfer helps to mitigate the financial burden of the risk by transferring it to an insurer, Risk Financing helps to cover the cost of the insurance policy, and Risk Control helps to minimize or eliminate the risk altogether. All four of these pillars work in tandem to create a comprehensive insurance policy that is beneficial to both the insurer and the insured.