Is Web3 A Fintech?

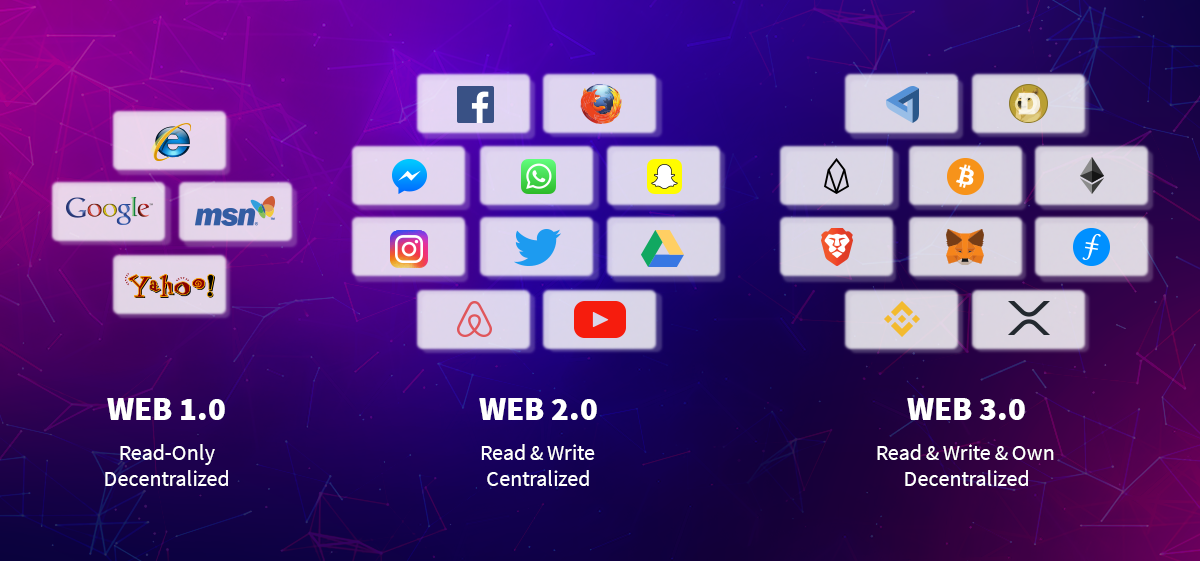

Web3 is a term used to describe the third generation of web development, which is focused on decentralization and automation. Web3 is a decentralized platform for the development of financial technology (fintech) applications and services. It enables users to interact with the Ethereum network and build decentralized applications. Web3 allows developers to create applications that can automate financial activities, such as money transfers, asset trading, and smart contracts. It also provides users with access to a variety of financial services, including loans, investments, and insurance. Web3 is a powerful tool for creating innovative fintech solutions that can revolutionize the way we manage our finances.

What is Web3?

Web3, also known as the Third Generation of the Web, is the latest evolution of the web. It is a decentralized technology that provides users with the ability to access data, applications, and services without relying on a centralized server. Web3 is built on the Ethereum blockchain, which has revolutionized the way we think about digital transactions, data storage, and online security. Web3 is also a new financial technology, known as fintech, which has been gaining traction in recent years.

Fintech is a broad term that encompasses a variety of innovative technologies used to provide financial services. It includes digital currencies and blockchain technologies, as well as artificial intelligence, machine learning, and big data analytics. Web3 is a perfect fit for fintech as it provides users with access to a secure, decentralized platform for making financial transactions. Additionally, Web3 enables users to create their own applications, manage digital assets, and create smart contracts.

Web3 is a powerful tool for creating financial services that are secure, transparent, and accessible to all. Its decentralized nature ensures that users are in control of their data and transactions, while its ability to facilitate applications and smart contracts makes it ideal for creating financial applications. Web3 is ushering in a new era of financial services that are more secure, accessible, and efficient. As such, Web3 is an important new fintech technology that is reshaping the global financial landscape.

What is Fintech?

Fintech is an emerging industry combining financial services and technology. It refers to the use of software and other technology to provide financial services, including banking, investments, payments, and insurance. It is revolutionizing the way people are managing their finances and is quickly becoming an integral part of the global financial system. Fintech is changing how people access financial services, making it easier and more secure. It is also spurring innovation in the financial services industry and creating new business models.

Web3 is a new technology that is becoming increasingly popular in the world of fintech. It enables users to access decentralized applications, or dApps, which can be used to make payments, invest, manage savings, and more. Web3 is providing users with a more secure and transparent way to access financial services. It is also helping to reduce the costs of financial transactions, making them more accessible to everyone. Web3 is fast becoming an important part of the fintech industry, revolutionizing how people interact with financial services.

How Does Web3 Interact with Fintech?

Web3, the latest technology built on blockchain, is rapidly becoming an integral part of the fintech industry. Web3 is a suite of decentralized applications, protocols, and networks that allow users to securely store, transfer, and use digital assets. As a result, Web3 has the potential to revolutionize the way we interact with fintech.

Web3 uses decentralization to remove the need for third-parties in financial transactions. This allows users to make transactions without relying on a central authority or intermediary. Additionally, Web3 provides users with access to financial services that are not available through traditional banking. For example, users can access loans, investments, insurance, and even crowdfunding opportunities without having to go through a bank.

Moreover, Web3 technology is becoming increasingly popular with fintech companies as it allows for faster, more secure transactions. It also reduces the cost of processing payments, meaning that fintech businesses can offer their services at competitive prices. Furthermore, Web3 enables users to store and access their data securely, further increasing the security of fintech transactions.

In conclusion, Web3 is revolutionizing the way we interact with fintech. It provides users with access to services not available through traditional banking, faster and more secure transactions, and increased data security. It is no surprise that Web3 is quickly becoming a key part of the fintech industry.

Benefits of Web3 for Fintech

With the emergence of Web3, a new era of financial technology (fintech) has been ushered in. Web3 is a revolutionary technology that offers a more inclusive and secure way to manage and transact online, with a focus on decentralization, transparency, and privacy. With its broad range of applications, Web3 has great potential to revolutionize the financial technology sector, offering several potential benefits for fintech users.

For starters, Web3 allows for a more secure way to manage finances and transactions, as it is built on a secure, immutable blockchain infrastructure. This means that data and transactions are more secure and tamper-proof than traditional online banking systems. Furthermore, Web3 eliminates the need for third-party intermediaries, making it easier and faster to transfer funds between parties. In addition, Web3 offers users greater privacy and control over their finances, allowing them to keep their financial information safe.

In addition to its security and privacy benefits, Web3 also offers users access to a wide range of financial services and products. From lending and payments, to investments and insurance, Web3 enables users to access a variety of fintech services in a streamlined and secure manner. Furthermore, Web3 also provides users with access to new and innovative business models, such as decentralized finance (DeFi). This has the potential to revolutionize the way in which financial services are provided, allowing for greater efficiency and cost savings.

Overall, Web3 is a powerful technology that has the potential to revolutionize the fintech sector. By providing users with greater security, privacy, and access to a wide range of financial services and products, Web3 is an ideal solution for those looking to make the most of their money.

Challenges of Web3 for Fintech

The term Web3 is a relatively new concept, and its application to the world of fintech is only just beginning to be explored. As a result, the potential for Web3 to revolutionize the financial industry is still largely unknown. In this article, we will explore the challenges that Web3 presents for the fintech sector and discuss how these challenges can be addressed.

The first challenge lies in the technology itself. Web3 is a decentralized network and is not owned by any one entity. This means that the technology is still very vulnerable to attack and requires a great deal of trust in order for it to be used securely. Additionally, the technology is still in its infancy and is not yet as developed as other financial technologies.

The second challenge lies in the lack of understanding of Web3 among fintech companies. As the technology is still relatively new, many financial institutions are reluctant to invest in it until they understand how it works and what its potential benefits are.

The third challenge is the lack of regulation around Web3. Currently, there is a lack of clarity as to how the technology should be regulated and what the implications of using it are. This lack of clarity makes it difficult for financial institutions to trust the technology and invest in it.

Finally, the fourth challenge is the lack of an established infrastructure for Web3. Currently, there is no established infrastructure for the technology, which means that businesses have to develop their own solutions in order to use it. This lack of infrastructure can be costly and time-consuming for businesses, which can make it difficult for them to adopt the technology in the near future.

These challenges are just some of the obstacles that need to be addressed before Web3 can be fully integrated into the world of fintech. However, with the right strategies and investments, these challenges can be overcome and Web3 can be used to revolutionize the financial industry.

The Future of Web3 in Fintech

Web3 is a new technology that is revolutionizing the way we think about financial services. It is a decentralized platform that allows users to securely access financial data and perform transactions without relying on centralized institutions. Web3 is often referred to as the “Internet of Money” and is part of the larger FinTech ecosystem.

The potential of Web3 for financial services is vast, as it can offer secure, low-cost, and fast transactions without relying on a central authority. Web3 can also provide transparency and accountability to all users, making it a great tool for improving trust and reducing fraud in the financial sector.

In addition, Web3 could also enable real-time payments, which could be beneficial in a variety of industries. For example, it could help businesses streamline their payment processing, facilitate cross-border payments, and enable the deployment of new financial applications.

The future of Web3 in FinTech is bright, as it promises to revolutionize the way we handle our finances. With its secure, low-cost, and fast transactions, Web3 has the potential to become a key player in the FinTech industry. Moreover, its transparency and accountability could help build trust in the financial sector, while its real-time payments could help businesses become more efficient. All of these benefits make Web3 a technology that is set to revolutionize the FinTech industry.

FAQs About the Is Web3 A Fintech?

1. What is Web3?

Answer: Web3 is a decentralized platform built on the Ethereum blockchain that enables users to interact with decentralized applications (dApps). It is an open-source project that provides tools and protocols for developers to build distributed applications.

2. Is Web3 a fintech?

Answer: Yes, Web3 is a form of fintech as it provides the technology infrastructure for users to interact with distributed financial services. It enables users to send and receive digital assets, make payments, and utilize financial services on a distributed network.

3. What are the benefits of using Web3 for financial services?

Answer: Web3 offers numerous benefits for financial services, such as increased transparency, scalability, security, and cost savings. Additionally, it offers users access to a global network of developers and users, allowing them to interact with decentralized applications and services.

Conclusion

Web3 is a new type of technology that has the potential to revolutionize the way financial services are conducted. It has the potential to provide a secure, transparent, and efficient platform for financial transactions and services, allowing for the development of innovative products and services that can benefit both consumers and businesses. As a result, Web3 can be considered to be a form of financial technology or “fintech”.