Is Fintech An E Banking?

Fintech, or financial technology, is an umbrella term used to describe the technology and innovation that is enabling the financial services industry to evolve and transform the way financial services are provided. Fintech is being used to improve the customer experience, increase access to financial services, and provide new services and products. It is also being used to improve operational efficiencies, reduce costs, and create an entirely new way of doing business. Fintech is revolutionizing the way banking is done, and e-banking is one of the ways that Fintech is changing the banking landscape. E-banking is the use of online banking services, including mobile banking, internet banking, and other electronic payment services, to access financial services and accounts. E-banking is growing rapidly, and is becoming increasingly popular with both customers and banks, as it offers customers access to their accounts anytime, anywhere, and provides banks with the ability to streamline their operations. As Fintech continues to evolve, e-banking will play an increasingly important role in the future of banking.

Section 1: What is Fintech?

Fintech, or financial technology, is an umbrella term used to describe the rapidly-evolving and ever-growing technological landscape of the financial services industry. It can be used to refer to new digital services, products, and processes that are transforming the way people access and use financial services. Fintech has the potential to revolutionize the banking and financial services industry, as it offers users more control over their finances, faster transactions, more efficient processes, and greater access to financial services.

At its core, Fintech is a combination of financial services and technology that allows for easier and faster access to financial services. Through Fintech, users can access banking services, insurance services, investments, and more, all from their fingertips. Fintech also offers users greater control over their finances, as they can manage their money with greater transparency and security than ever before. Additionally, Fintech can help users save time and money, as it reduces the need for manual processes, such as paperwork. Finally, Fintech can help users increase their financial literacy, as it provides access to educational resources and tools.

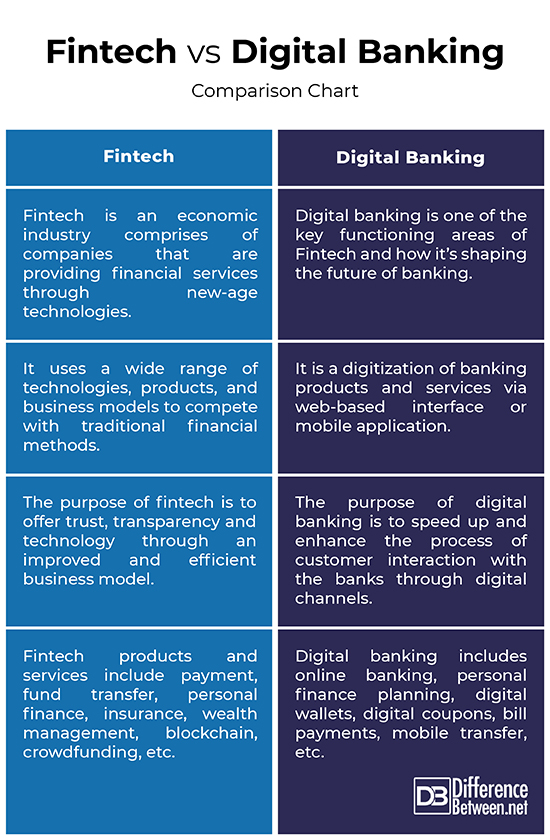

In essence, Fintech is an innovative way to access financial services and products, allowing users to take control of their finances and make more informed decisions. While Fintech is not the same as e-banking, the two can often be used in conjunction to offer users a greater range of financial services and products.

Section 2: The Benefits of Fintech

Financial technology, or fintech, is revolutionizing the banking and financial services industries. It is an emerging technology that is making banking more accessible, secure, and efficient. Fintech offers numerous benefits, including faster transactions, more secure payments, and greater consumer convenience.

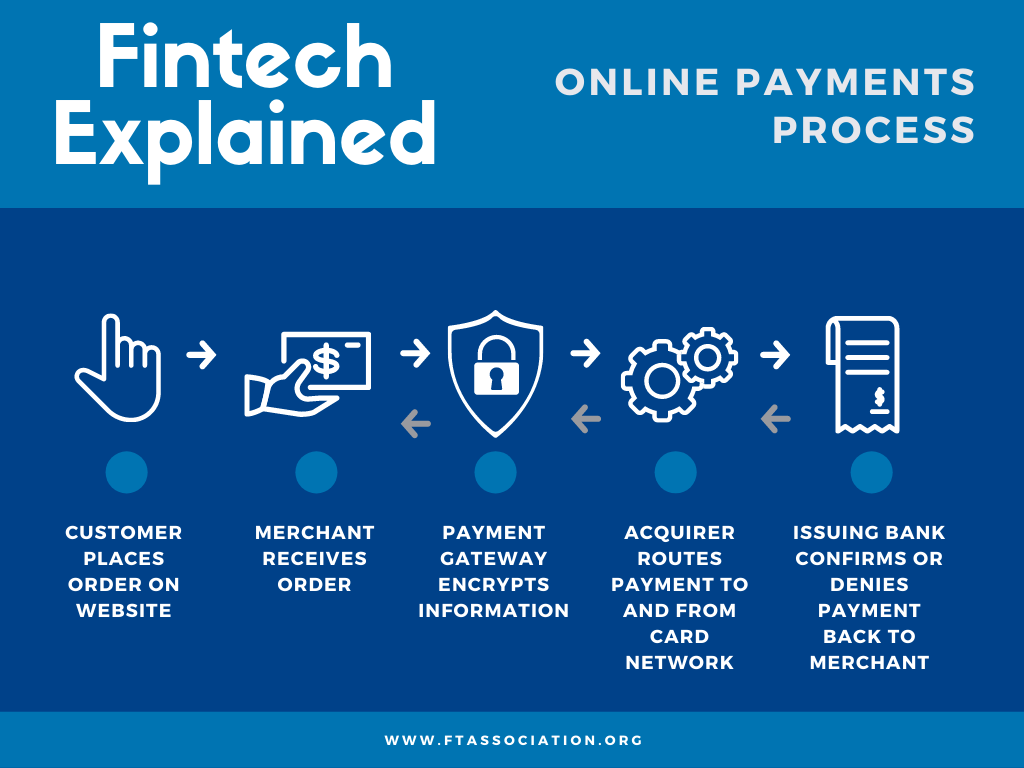

One of the most significant benefits of fintech is that it can help banks and financial services companies reduce costs by automating manual processes, such as customer onboarding and payments processing. Automation also makes it easier for customers to access banking services, as they can do so from any device with an internet connection. Additionally, fintech is helping banks and financial services companies to better understand their customers’ needs, as it can provide them with data-driven insights.

Fintech also makes financial products and services more secure. It uses advanced encryption technology to protect customer data and transactions from fraud and identity theft. Additionally, fintech can make it easier for customers to protect their accounts by providing them with secure authentication options.

Overall, fintech is revolutionizing the banking and financial services industries. It is making banking more accessible, secure, and efficient, while also reducing costs and providing customers with more secure payment options. As fintech continues to evolve, it is likely that more banks and financial services companies will begin to adopt this technology in order to stay competitive and provide their customers with the best possible experience.

Section 3: Challenges Facing Fintech

The emergence of Fintech has revolutionized the banking landscape, offering cutting-edge technology and innovative services to customers. Despite this, there are still a number of challenges that the sector faces that could potentially limit its growth and development. These challenges include customer trust, regulatory uncertainty, data privacy, and the need for increased investment in technology and infrastructure.

Customer trust is an issue for Fintech, as customers are often hesitant to trust a technology-led service with their financial data. This can be addressed through improved education and transparency, as well as an emphasis on security and data protection.

Regulatory uncertainty is another challenge for Fintech, as the sector is still in its infancy and is subject to a variety of regulatory regimes. To address this, Fintech firms should actively engage in the policymaking process and work with regulators to ensure that their operations are compliant.

Data privacy is also a key concern for Fintech, as customers often worry about how their data is being used and stored. To address this, Fintech firms should ensure that their data is secure and that customer data is only used for the purpose for which it was collected.

Finally, Fintech firms need to invest in technology and infrastructure to ensure that their services remain competitive. This requires significant investment in both hardware and software, and may require partnerships with other technology firms.

Overall, Fintech is a rapidly growing sector with the potential to revolutionize the banking landscape. However, to ensure its success, Fintech firms need to be aware of the challenges they face and actively work to address them.

Section 4: How Fintech Compares to Traditional Banking

Fintech, or financial technology, is a rapidly growing industry that has disrupted the banking industry in many ways. While fintech and traditional banking can be seen as competitors, they have many similarities as well.

Fintech companies provide many of the same services that banks do, such as loans, payments, and investment advice. However, fintech companies are often more agile and innovative than their traditional counterparts. For example, many fintech companies offer mobile and online banking services, allowing customers to access their funds from anywhere in the world.

Fintech companies also often have lower fees than traditional banks, as they don’t have to pay for costly brick-and-mortar locations. Additionally, they are often faster and more efficient at processing transactions, making them more attractive to customers.

At the same time, traditional banks have advantages over fintech companies. For instance, banks are often better at managing risk, as they have access to more capital and are better equipped to handle large-scale financial crises. Additionally, banks have more experience dealing with customers and are better able to provide personalized advice.

While fintech and traditional banking have their differences, they also have many similarities. Ultimately, both are valuable resources for customers looking to manage their finances.

Section 5: The Future of Fintech

and E Banking

The rise of fintech and e banking has been remarkable over the past decade. As digital banking technology becomes ever more sophisticated, it’s clear that these two industries are becoming intertwined. As financial institutions and tech companies collaborate to develop new digital solutions, the lines between fintech and e banking are increasingly blurred. The future of these industries looks to be an exciting one, with an array of innovative solutions and services being developed to meet the needs of customers.

As digital banking continues to evolve, traditional banks will need to stay competitive by offering more advanced and personalized services. Fintech companies, on the other hand, will need to focus on providing more value-added services that can differentiate them from their competitors. As the two industries continue to merge, we can expect to see even more collaboration between banks and tech companies.

The future of fintech and e banking is also being shaped by the emergence of new technologies. Artificial Intelligence, blockchain, and advanced analytics are just some of the technologies that are transforming the way financial services are delivered. And as these technologies become more widely adopted, more efficient and secure banking solutions are likely to emerge.

Ultimately, the future of fintech and e banking is likely to be one of increased collaboration, innovation, and competition. By leveraging the latest technologies, financial institutions and tech companies have the potential to create powerful solutions that can revolutionize the way we manage our finances.

Section 6: Regulatory Challenges for Fintech

The term fintech, or financial technology, is becoming increasingly prevalent in the banking and finance industries. The term refers to companies and solutions that use technology to improve the delivery of financial services. While fintech may be a relatively new concept, it is quickly gaining traction among banks and other financial institutions. In fact, many financial institutions are now embracing fintech as a means to enhance their customer experience and increase efficiency. However, with this growth comes a number of regulatory challenges.

One of the most significant regulatory challenges for fintech companies is the need for compliance with existing laws and regulations. As a result, companies must ensure that their products and services are compliant with relevant laws and regulations in order to remain operational. This includes paying attention to the rules and regulations set forth by the Federal Reserve, the Bank Secrecy Act, and other federal and state laws. Additionally, companies must remain vigilant in abiding by anti-money laundering requirements and other financial regulations.

Another challenge is the need to adhere to cybersecurity protocols. As more financial institutions embrace fintech solutions, the risk of cyber-attacks increases. To reduce the risk of cyber-attacks, fintech companies must ensure that their systems are secure and up to date with the latest security protocols. This includes implementing multi-factor authentication, encryption, and other measures to protect consumer data.

Finally, companies must remain aware of the changing regulatory landscape. As the technology evolves, so do the regulations governing it. Therefore, companies must stay up to date with any new regulatory developments that may impact their operations.

In summary, the growth of financial technology brings with it a number of regulatory challenges. Companies must ensure compliance with existing laws and regulations, implement strong cybersecurity protocols, and stay abreast of any changes in the regulatory landscape. By taking these steps, fintech companies can remain competitive in an ever-changing landscape.

FAQs About the Is Fintech An E Banking?

1. What is Fintech?

Fintech is a portmanteau of “financial technology” and is used to describe any technological innovation in the financial sector. This includes mobile banking, digital payments, cryptocurrency, and other forms of new technology.

2. Is Fintech an e-banking solution?

No, Fintech is not an e-banking solution. Fintech is a broad term used to describe any technological innovation in the financial sector, while e-banking is a specific type of banking that is conducted over the internet.

3. How does Fintech benefit customers?

Fintech can benefit customers by making banking and financial services more accessible and convenient. It can also provide customers with improved security, faster payments, and better insights into their financial data.

Conclusion

Fintech is an innovative and revolutionary way to do banking, and is quickly becoming the preferred method for many people. It offers convenience, security, and a wide range of services. It is an excellent choice for anyone who wants access to their finances online. Fintech is a great way to do banking, and it has the potential to revolutionize the way people handle their money.