Is Fintech A Bank?

Fintech is not a bank, but it is a disruptive technology that is revolutionizing the way financial services are delivered. Fintech, or financial technology, is a term used to describe a broad range of technological innovations and services that are transforming the way that financial services are delivered. It includes technologies such as mobile banking, digital wallets, online payments, and artificial intelligence-driven risk assessment algorithms. Fintech is changing the way that people access and use financial services, making them more convenient, secure, and accessible. Fintech is also empowering businesses and organizations to access and manage their financial resources in new ways. While Fintech is not a bank, it is an important player in the financial services industry, offering innovative solutions and services to customers.

Definition of Fintech

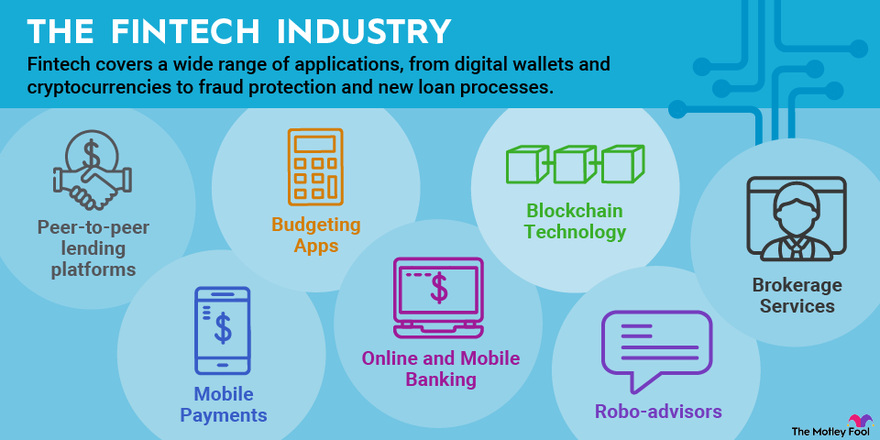

Fintech, short for financial technology, is the use of technology to provide financial services. It encompasses a wide range of companies, from startups to established firms, that use technology to offer shoppers and businesses more efficient and convenient ways to access financial services. Fintech companies provide services such as payments, loans, investments, and insurance, just like banks. However, their use of technology helps them provide these services more quickly and cheaply than traditional financial institutions. Fintech companies may also offer innovative services such as cryptocurrency trading and digital wealth management. Fintech is revolutionizing the way people access and use financial services, making it easier and faster for them to manage their finances.

What Fintech Does

Fintech is a rapidly emerging industry which is transforming the way we interact with our finances. Fintech stands for financial technology and it includes a wide range of services such as payments, investments, loans, and money transfers. It is a rapidly changing landscape that is redefining the way we access and manage our money. Fintech companies are utilizing technology to disrupt traditional financial services by providing better options, faster access, and lower fees.

Fintech products can include anything from mobile payment apps to peer-to-peer lending platforms and digital banking services. With the rise of artificial intelligence and machine learning, fintech services are becoming increasingly sophisticated. It is also becoming more accessible to individuals and businesses alike.

Fintech companies are also partnering with established banks to provide better services. This is beneficial for both parties, as banks are able to leverage the latest technology to offer their customers more options and convenience, while fintech companies can tap into the established network of banks and customers.

Fintech is no longer just a buzzword – it is now a major force in financial services. As technology continues to improve, fintech will continue to revolutionize the way we access and manage our finances. It is an industry to watch as it continues to innovate and shape the future of finance.

How Fintech Differs from Traditional Banking

Fintech is a rapidly growing industry that is drastically changing the way people manage their finances. While it may appear that Fintech is a bank, it is important to understand that Fintech is a technology-driven financial service provider, and not a traditional bank. While Fintech and traditional banks share some similarities, there are several key differences between the two that make them distinct from one another.

One of the main differences between Fintech and traditional banking is the use of technology. Fintech relies heavily on the use of technology to provide financial services, such as mobile banking, peer-to-peer payments, and online investments. Traditional banks, on the other hand, focus more on physical locations and manual processes, such as opening branches and processing transactions.

Another key difference between Fintech and traditional banking is the regulatory environment. Traditional banks are heavily regulated by government agencies and must comply with strict regulations. Fintech, on the other hand, is largely unregulated, which allows it to be more agile and innovative.

Finally, Fintech and traditional banking offer different types of products and services. Fintech companies typically offer products and services that are more tailored to the needs of consumers, such as budgeting software, online investment platforms, and cryptocurrency exchanges. Traditional banks, however, offer more traditional products, such as savings accounts, loans, and credit cards.

Overall, Fintech and traditional banking have their own unique advantages and disadvantages, and it is important to understand the differences between the two before making a financial decision. While Fintech may appear to be a bank, it is important to recognize that it is a technology-driven financial service provider, and not a traditional bank.

The Benefits of Fintech

Fintech, or financial technology, is quickly becoming a popular choice for those looking to invest their money. By utilizing the latest in technological advancements, fintech offers a variety of advantages for those looking to diversify their financial portfolios. From low fees to a massive variety of potential investments, fintech has a great deal to offer.

One of the biggest benefits of fintech is its low fees. Many traditional financial institutions charge high brokerage fees, which can significantly reduce the rate of return on investments. Fintech, however, typically charges lower fees, allowing investors to keep more of their profits.

Another advantage of fintech is the wealth of investment options it provides. With traditional financial institutions, investors often have access to a limited number of options. Fintech, however, offers a wide range of investments, from traditional stocks and bonds to cryptocurrency and peer-to-peer lending. This greater variety of investments allows investors to diversify their portfolios and maximize their returns.

Finally, fintech offers sophisticated analytics tools to track investments and identify new opportunities. Using real-time data and advanced algorithms, these tools can provide investors with valuable insights into their investment activities. This makes it easier to make informed decisions and manage investments more effectively.

Overall, fintech offers a variety of benefits for investors, from low fees to a wide selection of investments and sophisticated analytics tools. It is no wonder it is quickly becoming a popular choice among those looking to diversify their financial portfolios.

Potential Risks of Fintech

Fintech, or financial technology, has grown in popularity in recent years as an alternative to traditional banking. Many individuals and businesses are turning to fintech platforms for their banking needs, as they offer a range of services including lending, payments, and investments. While fintech can offer advantages, there are potential risks to consider before using it.

One potential risk of fintech is a lack of regulation. Fintech companies are not subject to the same regulations as traditional banks, which can leave users vulnerable to fraud and other financial crimes. Additionally, fintech companies may not have the same level of customer service and support as traditional banks, leaving customers without adequate resources if they have an issue.

Another risk of fintech is security. Fintech companies may not have the same level of security as traditional banks, leaving users’ data and accounts vulnerable to hacking and other malicious activities. Additionally, some fintech companies may not have adequate data protection measures in place, leaving customers vulnerable to data breaches.

Finally, some fintech companies may not be as reliable as traditional banks. Fintech companies may lack the stability and financial resources of traditional banks, making them less reliable and more prone to failure. Additionally, some fintech companies may not have sufficient resources to cover losses or refund customers in the event of a dispute.

Overall, while fintech can offer advantages, it is important to be aware of the potential risks before using it. It is important to research the fintech company thoroughly and understand their terms and conditions before making any transactions. Additionally, it is important to use secure passwords and two-factor authentication to protect accounts and data.

Future of Fintech

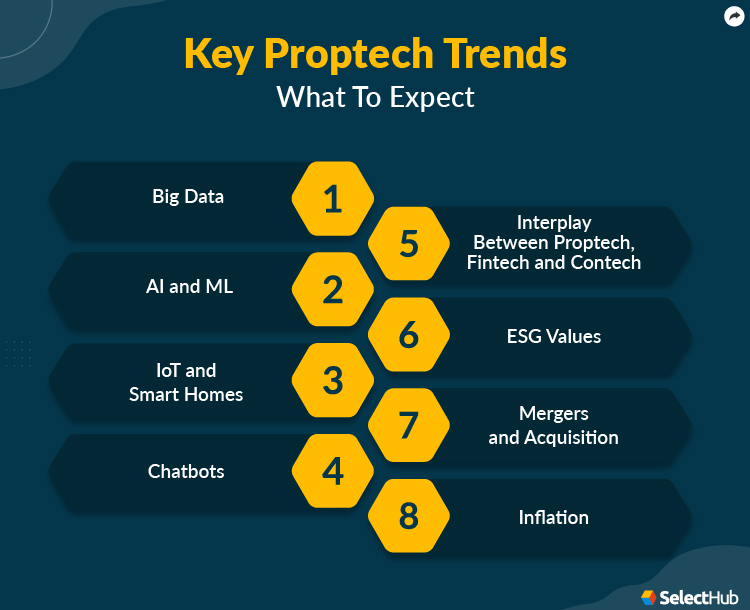

The financial technology industry, commonly known as Fintech, is one of the most rapidly growing industries in the world. In recent years, Fintech has become a major player in the banking sector, transforming how consumers interact with their financial providers. While Fintech is not a bank itself, it has changed the way many financial institutions operate, providing customers with greater access to innovative products and services.

Fintech’s influence on the banking sector is expected to continue to grow in the years ahead, as the industry embraces new technologies, such as artificial intelligence and blockchain. By leveraging these technologies, Fintech can offer customers more personalized products and services, such as real-time payments, automated investing, and more. As a result, banks and other financial institutions are increasingly turning to Fintech to stay competitive in an ever-changing landscape.

The future of Fintech is rapidly evolving, and its impact on the banking industry is likely to be profound. Fintech is providing banks with the ability to offer more efficient services and products, while customers are gaining access to more advanced and personalized financial solutions. As Fintech’s influence continues to grow, it is likely that banks and financial institutions will continue to embrace the technology in order to remain competitive and profitable in the long-term.

FAQs About the Is Fintech A Bank?

1. What is Fintech?

Fintech is a term used to describe the development of new financial technologies and services. It includes a wide range of products and services such as payment processing, financial advisory services, insurance, loans, investments and more.

2. Is Fintech a type of bank?

No, Fintech is not a type of bank. Fintech is a broad term used to describe the development of new financial technologies and services. Banks may use Fintech services, but they are not the same thing.

3. How does Fintech benefit customers?

Fintech can provide customers with more convenience, security, and access to financial services. It can help customers save time and money by streamlining the process of transferring money, making payments, and accessing financial services. Fintech can also help customers make better financial decisions by providing them with data-driven insights.

Conclusion

In conclusion, Fintech is not a bank but rather a financial technology company that provides banking and financial services, such as payments, investments, and loans. Fintech companies can provide services that are similar to those offered by banks, but they do not hold deposits or offer traditional banking services. Fintech companies are heavily regulated by state and federal agencies, and customers of these services should research their provider carefully before signing up for a service.