Is FinTech A 4.0 Industry?

FinTech, or Financial Technology, is a rapidly growing industry that encompasses the use of technology for financial services and transactions. It is a blend of financial services, software, algorithms, and data analysis to provide a more efficient and cost-effective way to conduct financial activities. It has the potential to revolutionize the way financial services are delivered, creating an entirely new industry of financial technology. FinTech is often referred to as the 4.0 industry – the fourth industrial revolution – as it is transforming the way financial services are conducted and delivered. With the growth of digital banking and online payments, FinTech has become an integral part of the global financial system. FinTech companies are leveraging technology to develop innovative and disruptive solutions, creating opportunities for businesses and consumers alike. FinTech has the potential to revolutionize the banking industry, creating more efficient and cost-effective ways to conduct transactions and manage finances.

What is FinTech?

FinTech, short for Financial Technology, is a term used to describe the growing field of technology-based financial services. It is the use of innovative technology to deliver financial services, such as data analysis, online payments, and digital banking. FinTech companies are leveraging data and technology to improve the traditional financial services industry by making it easier, faster, and more efficient. FinTech is transforming the financial services industry and is becoming an integral part of the 4.0 economy.

FinTech companies are leveraging new technologies such as artificial intelligence, blockchain, and cloud computing to revolutionize and disrupt the traditional financial services sector. By leveraging these technologies, FinTech companies are able to provide more efficient and cost-effective services to their customers. FinTech companies are also able to provide new financial services such as peer-to-peer lending, online payments, and digital banking.

The FinTech industry is changing the way financial services are delivered and is playing an increasingly important role in the 4.0 economy. By leveraging advanced technologies and digital platforms, FinTech companies are able to deliver faster, more efficient, and more cost-effective financial services. FinTech is not only transforming the traditional financial services sector but is also creating new opportunities for businesses to innovate, grow, and succeed.

The Impact of FinTech on Financial Services

FinTech, short for Financial Technology, is a rapidly growing industry that has been gaining traction in recent years. It is a combination of financial services, software, and technology that provide innovative solutions to financial challenges. While many traditional financial services organizations have been unable to keep up with the emerging technology, FinTech companies are leveraging data and analytics to create innovative new products and services.

The impact of FinTech on financial services has been significant. FinTech companies are providing customers with faster, more secure, and more convenient services. They are also providing financial institutions with new ways to process payments and manage customer relationships. FinTech companies are also providing financial institutions with new ways to access capital, reduce risk, and increase efficiency.

In addition to the advantages that FinTech offers to financial services, it is also helping to drive financial inclusion. FinTech companies are providing access to financial services in previously underserved markets, such as rural and low-income communities. This is opening new opportunities for economic growth and development in these areas.

The FinTech industry is certainly a 4.0 industry. It is revolutionizing the way financial services are delivered and transforming the financial services industry. By providing innovative solutions to financial challenges, FinTech companies are helping to improve financial services and create a more inclusive and equitable financial system.

The Benefits of FinTech for Consumers

The rise of FinTech (Financial Technology) has revolutionized the way we manage our finances. It has allowed us to make payments faster, access loans more easily, and monitor our investments more closely. But, what does FinTech 4.0 mean for consumers? In this blog post, we’ll explore how FinTech 4.0 can benefit consumers in terms of convenience, cost savings, and improved financial security.

Convenience is one of the key advantages of FinTech 4.0 for consumers. FinTech 4.0 makes it possible to do a range of financial tasks quickly and easily, from setting up automated payments to tracking investments in real-time. This can save consumers a great deal of time and effort, allowing them to focus on more important matters.

Cost savings are another major benefit of FinTech 4.0 for consumers. FinTech 4.0 can help reduce the cost of processing payments and transactions, as well as provide access to lower-cost loan products. This can ultimately help consumers save money on their monthly expenses.

Finally, FinTech 4.0 can help improve financial security for consumers. FinTech 4.0 offers a range of advanced security features, including biometric authentication, encrypted data storage, and two-factor authentication. These features help protect consumers from identity theft, fraud, and other malicious activities.

In conclusion, FinTech 4.0 offers a range of benefits for consumers, including convenience, cost savings, and improved security. So, if you’re looking for a way to make your financial life easier and more secure, consider embracing FinTech 4.0.

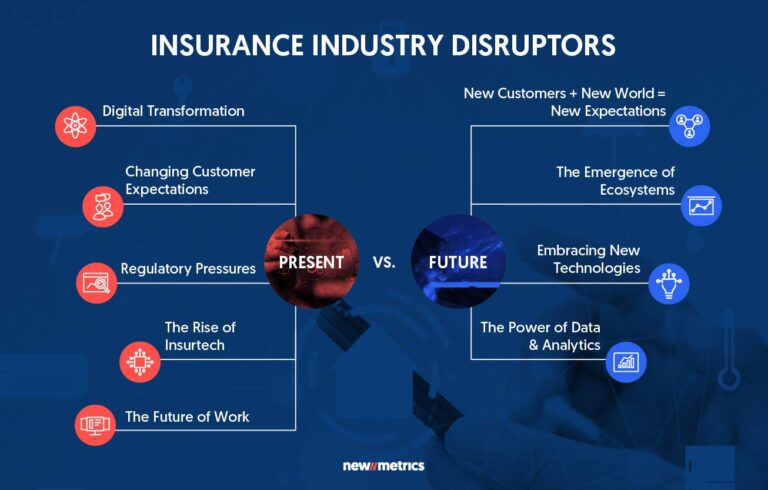

The Challenges Facing the FinTech Industry

The financial technology (FinTech) industry has seen incredible growth over the past decade, becoming a major player in the global economy. But as the sector continues to expand, there are several challenges that must be addressed in order for it to remain competitive and maintain its 4.0 status.

One of the biggest issues facing the FinTech industry is the lack of customer trust. With the rapid growth of digital banking, customers may be wary of trusting their financial information to a third-party. Furthermore, financial institutions must also ensure that their products and services comply with stringent government regulations.

Another challenge is the need for greater collaboration between traditional banks and FinTech companies. While FinTech is shaking up the traditional banking system, banks and FinTech companies can benefit from working together. This could involve banks leveraging the technology used by FinTech companies to offer better services to customers, or the two sides collaborating to develop new products and services.

Finally, FinTech companies must also ensure that they are adequately protected from cyber threats. As the industry continues to grow, so too does the risk of cyber-attacks, which can have devastating consequences for both companies and customers.

FinTech is a rapidly growing industry and one that is here to stay. However, if the industry is to remain a 4.0 sector, the challenges outlined above must be addressed. To ensure the long-term success of the sector, all stakeholders must work together to create a secure and reliable environment for customers and businesses alike.

The Opportunities Created by FinTech

The FinTech industry has revolutionized the way we access, transact, and manage our finances. FinTech, or financial technology, is a relatively new 4.0 industry, providing innovative solutions to traditional banking and financial services. With the emergence of FinTech, there has been an abundance of new opportunities created for both businesses and individuals across the globe.

FinTech has enabled businesses to streamline their operations and reduce the cost of transactions. Through the implementation of cutting-edge technologies, businesses have the ability to minimize their costs and maximize their profits. FinTech companies have also created new and efficient payment solutions which allow businesses to transact securely and quickly.

Individuals have also benefitted from FinTech. Through personal finance software and applications, individuals can manage their finances more effectively and access credit quickly. FinTech also provides individuals with the opportunity to invest in the stock market, giving them the ability to diversify their portfolio and grow their wealth.

The potential of the FinTech industry is huge and the opportunities it has created are vast. As the industry continues to evolve, more and more innovative solutions will be created, opening up new doors for businesses and individuals alike. It is clear that FinTech is a 4.0 industry that is here to stay.

How FinTech is Adapting to the 4

.0 Revolution

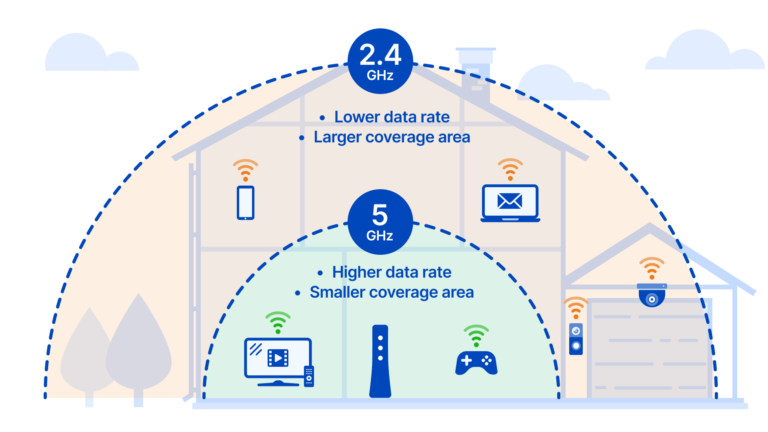

FinTech (financial technology) is rapidly gaining momentum as a key player in the fourth industrial revolution. As technology continues to evolve and disrupt traditional financial services, FinTech companies are innovating to stay ahead of the curve and meet the needs of the modern consumer. From enabling mobile payments to leveraging AI-powered analytics, FinTech is at the forefront of the 4.0 revolution.

FinTech companies are utilizing cutting-edge technologies to create products and services that meet consumer demand. By leveraging data-driven insights and predictive analytics, FinTech companies are able to identify and understand customer needs quickly and accurately. This allows them to develop innovative solutions that offer value, convenience, and speed. Further, FinTech companies are leveraging machine learning and artificial intelligence to automate processes and create personalized services.

In addition, FinTech is also enabling more secure and efficient payment systems. By leveraging blockchain technology, FinTech companies are able to create secure payment systems that reduce fraud and protect user data. This is allowing consumers to make payments with greater confidence and security.

Overall, FinTech is playing a key role in the 4.0 revolution. By leveraging cutting-edge technologies and data-driven insights, FinTech companies are creating innovative products and services that meet customer needs. This is leading to more secure and efficient payment systems, as well as personalized services and experiences. In short, FinTech is ushering in the 4.0 revolution and revolutionizing the way we do business.

FAQs About the Is FinTech A 4.0 Industry?

1. What is FinTech 4.0?

FinTech 4.0 is the next wave of technological innovation within the financial services industry. It is the application of advanced technologies such as artificial intelligence, blockchain, big data analytics, cloud computing, and the Internet of Things to deliver more efficient and customer-centric financial services.

2. What are the benefits of FinTech 4.0?

FinTech 4.0 will bring significant benefits to the financial services industry, including improved security, faster processing times, increased customer satisfaction, better data analysis, and improved regulatory compliance.

3. How can I use FinTech 4.0 to benefit my business?

FinTech 4.0 can help businesses reduce costs, increase efficiency, and improve customer experience. Companies can use FinTech 4.0 to automate processes, access insights from big data analytics, and use artificial intelligence to better understand customer needs.

Conclusion

FinTech is undoubtedly a 4.0 industry. Its use of cutting-edge technology to disrupt traditional financial services has revolutionized the way in which people manage their finances. It has also enabled individuals and businesses to access a range of financial services that were previously out of reach. FinTech is a key part of the Fourth Industrial Revolution and has the potential to revolutionize the financial services industry even further.