Is Facebook A Fintech?

Facebook is an online social media platform that has been around since 2004. In recent years, the company has been exploring opportunities in financial technology (fintech) with the introduction of its digital payment platform, Facebook Pay. Facebook Pay enables users to send and receive money, make payments for goods and services, and manage their finances. The platform is also integrated with other financial services, such as Venmo and PayPal, making it easier for users to manage their finances in one place. Facebook is also exploring the possibility of launching its own cryptocurrency, Libra, which is set to be released in 2021. By entering the fintech space, Facebook has opened up new opportunities for users to manage their finances and make payments online.

What is Facebook?

In recent years, Facebook has emerged as a major player in the world of financial technology (fintech). Facebook, the world’s largest social media platform, has been slowly but surely evolving into a powerhouse for payments, investments, and more. From its launch in 2004, Facebook has seen its user base expand to 2.7 billion monthly active users, making it one of the most powerful platforms for fintech. The platform has been used to facilitate payments, investments, and more, and Facebook is now looking to create its own currency, Libra. Facebook has long been a leader in the world of digital payments, and its foray into fintech is sure to have far-reaching implications for the industry. With its vast user base and financial resources, Facebook has the potential to revolutionize the way people interact with their money. As the technology continues to evolve, the possibilities for fintech are virtually endless.

What is Fintech?

Fintech, short for financial technology, is an evolving industry that uses technology to facilitate banking and financial services. The industry is rapidly changing, as new advancements in digital technology and artificial intelligence are being used to develop innovative solutions for financial management and payments. Fintech has become increasingly popular in recent years, as more people are turning to digital solutions for their money management needs.

Facebook is one of the major players in this industry and has been making significant investments in fintech. To understand how Facebook is becoming a fintech company, it’s important to first understand what fintech is and how it works. Fintech solutions use algorithms, automation, and artificial intelligence to analyze large amounts of data and make decisions about financial transactions. This technology provides users with more efficient and secure financial services.

Facebook has been investing heavily in fintech, launching products such as Facebook Pay, a payment platform, and Facebook Marketplace, an online marketplace for buying and selling. Facebook is also developing new technologies such as AI-powered chatbots and blockchain-based solutions for banking and payments.

With its investments in fintech, Facebook is positioning itself as a major player in the industry and is likely to continue to become a major force in the fintech space. As the industry grows and evolves, Facebook’s investments in fintech will become increasingly important.

How is Facebook Involved in Fintech?

Facebook has been at the forefront of innovation for some time now, and its latest foray into the world of fintech is no exception. By introducing a range of new financial services, Facebook has set out to revolutionize the way we manage our money. From peer-to-peer payments to cryptocurrency, Facebook is making fintech more accessible than ever before.

Facebook recently launched Facebook Pay, a new payment service that allows users to easily send and receive money. The service is available on Facebook, Messenger, Instagram, and WhatsApp, making it easier than ever to pay for goods and services. Facebook also recently announced a partnership with MasterCard to offer users a co-branded debit card. The card can be used to make purchases anywhere MasterCard is accepted and to access funds in their Facebook Pay balance.

Facebook has also made a big push into the world of cryptocurrency. The company recently announced plans to launch a new digital currency, called Libra, which is expected to be integrated into the Facebook platform. Libra will allow users to send money quickly and securely, without the need for a bank account.

Facebook’s foray into fintech is an exciting development for those who have long believed in the potential of digital money. By providing users with more convenient and secure ways to send and receive money, Facebook could revolutionize the way we think about personal finance. By leveraging the power of their platform, Facebook could very well become a significant player in the world of fintech.

Advantages of Facebook’s Involvement in Fintech

As the world edges ever closer to a digital-first future, Facebook’s influence in the fintech space has become increasingly pertinent. It is no surprise then, that Facebook’s foray into the financial technology sector has been met with equal parts enthusiasm and skepticism. The advantages of Facebook’s involvement in fintech are manifold.

The social media behemoth enjoys a large user base, which gives it a distinct advantage in terms of accessibility when compared to traditional financial institutions. This means that users can easily and quickly access and use services such as payments and investments without needing to leave the Facebook platform.

Facebook’s involvement in fintech also allows users to access a wide variety of financial services without having to jump through the hoops of a traditional bank or financial institution. This includes services such as money transfers, loans, investments, and more.

Another advantage of Facebook’s involvement in fintech lies in its ability to provide users with a secure and reliable payment platform. Facebook’s payment platforms use cutting-edge technology and encryption to ensure that users’ data and finances remain secure at all times.

Finally, Facebook’s involvement in fintech also provides businesses with access to a wide range of financial services, such as payments, investments, and more. This allows businesses to maximize their profits and increase their customer base without having to worry about the complexities of traditional financial institutions.

Overall, Facebook’s involvement in fintech provides users and businesses with a wide range of advantages, from increased accessibility to enhanced security. While it remains to be seen what the future holds for Facebook’s involvement in the fintech space, the advantages of its involvement are clear.

Challenges of Facebook’s Involvement in Fintech

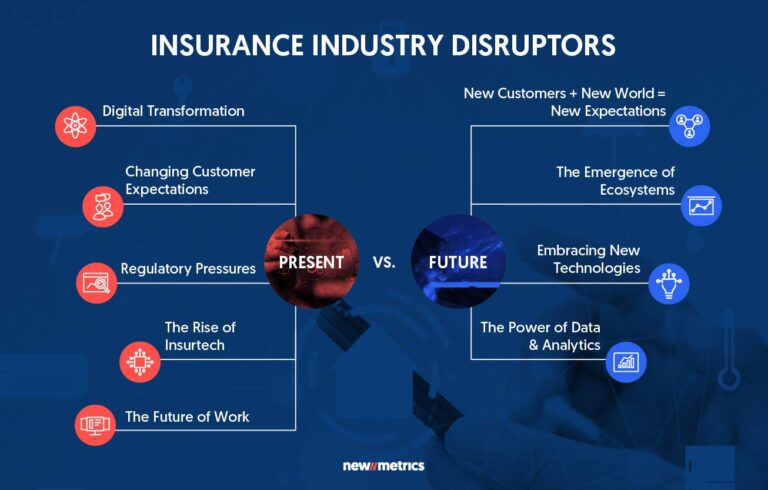

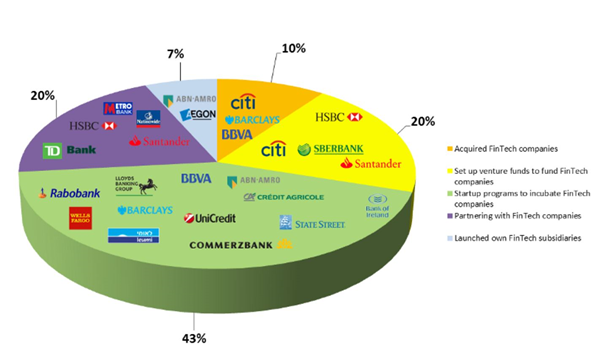

Facebook has recently announced its plans to enter the world of fintech. There are several challenges that it faces in this endeavor. Firstly, the tech giant will need to comply with a number of regulations, both from a local and global perspective. Secondly, it will need to ensure customer safety and data protection, as these are essential components of fintech. Thirdly, it will need to find ways to differentiate itself and create a competitive advantage over existing banking and financial services companies. Finally, it will need to develop a comprehensive fintech ecosystem, which could include partnerships and collaboration with existing fintech players in order to ensure its success. All of these challenges will require foresight and planning, but if Facebook is able to address them, it could open up a new and exciting world of fintech services for its users.

Conclusion

Social media giant Facebook has been increasingly involved in the fintech space. From its Libra cryptocurrency to its various fintech partnerships, it’s clear that the company is looking to make a big splash in the industry. While some may question whether Facebook can be considered a fintech, it’s clear that the company is making strides in the field, and its presence is only likely to increase in the near future. With the ever-evolving nature of fintech, Facebook may soon become a major player in the industry, and the company’s efforts could eventually lead to major changes in how people interact with their finances.

FAQs About the Is Facebook A Fintech?

1. Is Facebook a fintech company?

Yes, Facebook is a fintech company. Facebook has been investing heavily in its financial technology products and services, such as its payments platform, Libra, and its cryptocurrency, Calibra.

2. What services does Facebook offer as a fintech?

Facebook offers a range of financial services, such as peer-to-peer payments, remittances, and loan applications. Additionally, Facebook has partnered with a number of banks and financial institutions to offer users access to a range of financial products.

3. Is Facebook regulated by financial regulators?

Yes, Facebook is regulated by a wide range of financial regulators, such as the Financial Conduct Authority in the UK, the European Central Bank, and the US Securities and Exchange Commission. Facebook is also subject to laws and regulations related to data protection and privacy.

Conclusion

Based on the evidence, it is clear that Facebook is indeed a fintech company. Through its initiatives such as Libra, Facebook is looking to revolutionize payments and money transfers. It is also looking to expand its reach to the world of financial services with Calibra, its digital wallet. Therefore, it is safe to say that Facebook is a fintech company at its core.