Is Digital Banking Fintech?

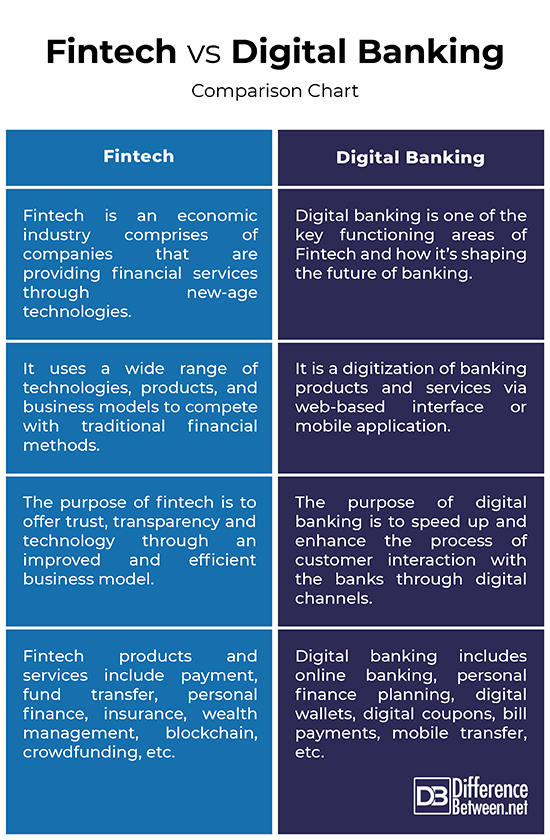

Digital banking is a type of fintech, or financial technology. Fintech is a broad term that encompasses several areas of finance-related technology, including digital banking, online payment, data analysis, and automated investment. Digital banking is the use of technology to facilitate financial services such as payments, transfers, and banking operations. This includes mobile banking, online banking, and other digital services, such as using a smartphone to make a payment or transfer funds. Digital banking is becoming increasingly popular as it offers convenience and speed when compared to brick-and-mortar banking. Additionally, digital banking can provide a more secure and efficient way to manage finances.

What is Digital Banking?

Digital banking is a way of managing finances through the use of technology. It is a convenient and secure way to access your financial information and make payments without needing to visit a physical branch. Digital banking uses the internet, mobile devices, and other digital technologies to provide services such as checking account balances, transferring money, paying bills, and more. With digital banking, users can access their accounts anytime and anywhere, making it easy to keep track of their finances. Digital banking is becoming increasingly popular as more and more people are embracing the convenience and security it offers.

Fintech, or financial technology, is a relatively new field that focuses on using technology to improve the financial services industry. Fintech companies use innovative technologies such as artificial intelligence (AI), blockchain, and big data to create innovative products and services that make it easier for people to manage their money. Fintech companies are revolutionizing the way people access and use financial services, and digital banking is one of the most popular applications of fintech. Digital banking solutions from fintech companies offer users the convenience of being able to access their accounts anytime and anywhere, as well as enhanced security measures. Digital banking is an example of how fintech is transforming the banking and financial services industry.

What is Fintech?

Fintech, short for Financial Technology, is a term used to describe the emerging technological advancements used to improve the efficiency and effectiveness of financial services. It is an umbrella term that encompasses a wide range of financial services, from mobile banking and digital currencies to artificial intelligence (AI) and machine learning (ML). Fintech is revolutionizing the way we bank, invest, and handle our finances, and its impact is felt across all aspects of the financial services industry.

Digital banking is a key element of modern fintech, providing customers with easy and convenient access to their financial resources. Digital banking allows users to manage their finances online, using their mobile device, tablet, or computer. With digital banking, customers can transfer money, pay bills, deposit checks, and manage their accounts without ever having to visit a physical bank branch. Digital banking is also more secure than traditional banking, as it is protected by the latest encryption and authentication technologies.

In conclusion, digital banking is an important part of the fintech revolution. By making banking more accessible and secure, digital banking is changing the way we interact with our finances. With digital banking, customers can manage their financial resources with ease, and benefit from the most up-to-date financial technology.

Traditional Banking

vs Digital Banking

The digital banking revolution has made a huge impact on the financial services industry, sparking a wave of technological advancements in the banking sector. Digital banking, also known as fintech, makes it easier for consumers to access banking services from their phones or computers, and it also provides the ability to access and manage banking transactions in real-time. But is digital banking really fintech?

To understand this question, it’s important to first understand the difference between traditional banking and digital banking. Traditional banking is based on physical branches and services, while digital banking is based on online services and technology. Traditional banking requires customers to visit the bank in person, while digital banking enables customers to access banking services from anywhere in the world, using a computer or mobile device.

Digital banking offers a number of advantages over traditional banking, such as lower costs, improved convenience, and faster transactions. Digital banking also enables customers to access and manage their finances in real-time, and provides access to a variety of financial products and services. Digital banking has enabled consumers to access a range of banking services without having to visit a physical branch, making it easier to access banking services from the comfort of their homes.

So, is digital banking really fintech? The answer is yes. Digital banking is transforming the financial services industry, and it is rapidly becoming the preferred method for accessing banking services. Digital banking is making banking more convenient, cost-effective, and secure, and it is paving the way for a new era of financial services.

The Role of Fintech in Digital Banking

Digital banking is a rapidly growing trend in the financial services industry that is changing the way banking is done. Fintech, or financial technology, is playing an increasingly important role in this trend. Fintech refers to the use of technology to facilitate financial services, such as payments, investments, and banking. Digital banking is essentially the combination of traditional banking and fintech. It involves the use of digital devices, such as mobile phones, tablets, and computers, to access bank accounts, transfer funds, and manage finances.

The use of fintech in digital banking has revolutionized the way consumers interact with their financial institutions. It has enabled banks to offer more personalized services, such as better payment options and more user-friendly interfaces. Additionally, fintech has allowed for greater efficiency in the transfer of funds, increasing the speed and accuracy of transactions. The rise of digital banking has also allowed banks to offer new financial products, such as cryptocurrency and digital wallets.

Fintech is essential to the success of digital banking. It has enabled banks to offer better services to customers, increase efficiency, and provide more innovative products. In the future, it is likely that fintech will continue to play an important role in digital banking, as more banks embrace the technology and take advantage of its potential.

Benefits of Digital Banking

Digital banking is becoming increasingly popular as a convenient and secure way to manage finances. It eliminates the hassle of going to a physical bank branch and allows users to access their account information and make payments from any device, anytime. Digital banking offers many benefits to users, including increased security, improved customer service, and access to real-time financial information. It also offers the potential for greater efficiency in banking operations, such as reduced costs and improved customer experience. Additionally, digital banking can help banks better manage risk and compliance. Digital banking can also provide access to innovative financial technology, such as digital wallets, blockchain technology, and artificial intelligence, which can provide users with greater control over their finances and access to new products and services. Ultimately, digital banking has the potential to revolutionize the banking industry and provide a more efficient and secure way to manage finances.

Challenges of Digital Banking

The emergence of digital banking and the growing role of fintech (financial technology) have caused a wave of disruption in the banking industry. This disruption has raised a number of challenges for banks and their customers, such as how to protect customer data, how to ensure the security of digital transactions, and how to navigate the changing landscape of banking regulations. In this blog post, we’ll explore the main challenges of digital banking and how fintech can help solve them.

One of the most pressing challenges is data security. As the banking industry moves away from physical locations and embraces digital services, it’s more important than ever for banks to protect customer data from cyber threats. The challenge is that digital banking systems must remain open and accessible for customers, putting them at risk of being hacked. Fintech companies have developed various security measures, such as multi-factor authentication and encryption, to help protect customer data from cybercriminals.

Another challenge is the need to comply with banking regulations. As digital banking services become more popular, banks must make sure they comply with applicable regulations. Fintech companies are helping banks navigate the ever-changing regulatory landscape by developing software and services that make it easier for banks to comply with regulations.

Finally, there is the challenge of ensuring the security of digital transactions. Banks must ensure that transactions are secure and that funds are transferred safely from one account to another. Fintech companies can help banks by providing secure payment gateways and other technologies that make it easier for banks to process transactions and protect customers’ funds.

In conclusion, digital banking and fintech have brought about a number of challenges for banks and their customers. Banks must ensure data security, comply with banking regulations, and ensure the security of digital transactions. Fortunately, fintech companies are helping banks address these challenges by providing secure payment gateways and other technologies.

FAQs About the Is Digital Banking Fintech?

1. What is digital banking?

Digital banking is a type of banking that allows customers to access their financial services through online or mobile platforms. Customers can manage their accounts, transfer funds, and even apply for loans and credit cards without ever stepping foot in a physical bank branch.

2. Is digital banking the same as fintech?

No, digital banking is different from fintech. Digital banking is a type of banking that uses digital technology to provide customers with financial services, whereas fintech is a broader term used to describe the use of technology to enhance financial services.

3. What are the benefits of digital banking?

Digital banking offers many benefits such as convenience, cost savings, increased security, and access to a wide range of services. Customers can manage their accounts from anywhere and anytime, and many digital banking platforms offer additional features such as real-time notifications of transactions and budgeting tools.

Conclusion

Yes, digital banking is a form of fintech. As technology continues to evolve, more and more financial services are being moved to digital platforms. This allows customers to easily access financial services and complete transactions from any device with an internet connection. Digital banking uses a variety of innovative technologies to make banking more efficient and user-friendly, such as artificial intelligence, biometrics, blockchain, mobile banking, and more. As digital banking continues to grow in popularity, it is clear that it is an important part of the ever-evolving fintech industry.