Is Cryptocurrency A Fintech?

Cryptocurrency is a form of digital currency that is based on blockchain technology and exists outside of the traditional financial system. Cryptocurrency is often referred to as a form of fintech, or financial technology, as it uses cutting-edge technology to facilitate digital payments and transactions. It has become increasingly popular as an alternative to traditional currencies, and has opened up new possibilities for financial transactions and investments. Cryptocurrency can be used to buy goods and services, as well as to transfer money between individuals and organizations. It is also being used in a variety of other ways, including as a hedge against inflation and as a speculative instrument for investors. As cryptocurrency continues to evolve, it is likely to become an even more important part of the fintech landscape.

What is Cryptocurrency?

Cryptocurrency is a digital form of money that uses cryptography for security, and is created and managed through a decentralized network. Cryptocurrency is a medium of exchange, like regular money, but it is digital and uses encryption techniques to control the creation and transfer of funds, making it virtually impossible to counterfeit. Cryptocurrency is also known as virtual currency, digital currency, virtual money, or digital money. It can be used to purchase goods and services online, or exchanged for other digital currencies like Bitcoin or Ethereum. Cryptocurrency has become increasingly popular over the last few years, with many investors turning to it as an alternative investment option. With its decentralized nature, low transaction fees, and anonymity, it has gained traction with a wide variety of users. Cryptocurrency is a form of fintech, a new kind of financial technology that is revolutionizing the way money is being used, stored, and transferred. Cryptocurrency is ushering in a new era of financial inclusion and reshaping the world of finance.

How Does Cryptocurrency Work?

Cryptocurrency is a digital asset designed to work as a medium of exchange. It uses cryptography to secure and verify transactions, as well as to control the creation of new units of a particular cryptocurrency. It is not regulated or backed by any government or central bank, but instead operates on a decentralized network of computers that use blockchain technology to manage and record transactions. Cryptocurrency is often referred to as a form of fintech because it is a digital asset that is used to facilitate financial transactions.

Cryptocurrency works by using a decentralized ledger system called a blockchain. Every transaction is recorded on this ledger and is then distributed across the network of computers, making it virtually impossible to alter or delete. This ledger is publicly available and can be accessed by anyone on the network, making it a secure and transparent system. Transactions are also secured by cryptography, which uses complex algorithms to protect the data from being modified or tampered with.

Cryptocurrency is becoming increasingly popular as an alternative to traditional forms of payment, and many people are beginning to invest in it. For those wanting to get started with cryptocurrency, it is important to understand how it works and the risks associated with it. With the right knowledge and research, cryptocurrency can be a great way to diversify your investments and increase your financial portfolio.

What is Fintech?

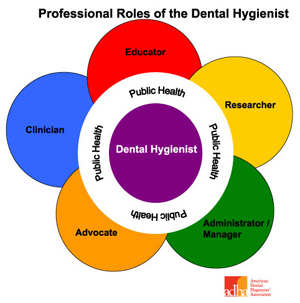

Fintech is a portmanteau of finance and technology and refers to the use of technology to deliver innovative financial solutions. It is an umbrella term for a wide range of financial services, including cryptocurrencies, digital payment systems, blockchain technology, and peer-to-peer networks. Fintech provides individuals and businesses with access to a variety of digital services that can make financial transactions simpler and faster. By leveraging technology, fintech companies are able to deliver improved services and better customer experiences.

Cryptocurrency is a form of digital currency that exists entirely on the blockchain. It is decentralized, meaning it is not controlled by any one institution, and transactions are secured through the use of cryptography. Cryptocurrency has been gaining traction over the past few years as a viable form of investment and payment. It is a form of fintech as it is a financial technology that is used to facilitate digital transactions. Cryptocurrency is becoming increasingly popular as an alternative to traditional methods of payment, and its use is expected to continue to rise in the future.

How Does Fintech Work?

Cryptocurrency, a digital form of money, has been making waves in the financial technology (fintech) world for some time. But what is fintech and how does it work? Fintech is an umbrella term used to describe the use of technology in the finance sector. It covers everything from digital payments, to money transfers, to investing and more. Fintech enables people to access financial services faster, easier, and more securely than ever before.

At its core, fintech is all about leveraging new technology to make financial transactions and services more efficient. For example, fintech can automate manual processes, reduce paperwork, and streamline complex operations. It can also provide users with more personalized experiences, such as tools for budgeting and investing. In addition, fintech can provide greater transparency into financial activities, allowing users to make more informed decisions.

Cryptocurrency is a great example of how fintech is revolutionizing the financial industry. Cryptocurrency is decentralized, meaning it is not controlled by any central authority. This gives users a certain level of freedom and autonomy that traditional financial services don’t offer. Cryptocurrency also offers faster transactions and lower fees than traditional banking.

Ultimately, cryptocurrency is an important part of the fintech revolution, and its role in the financial world is only going to grow. By leveraging the power of fintech, cryptocurrency can open up a world of possibilities and offer users an unprecedented level of control over their finances.

Connecting Cryptocurrency and Fintech

Cryptocurrency and Fintech have become increasingly intertwined in today’s digital world. Fintech is the integration of technology and finance, and cryptocurrency is the digital asset that is secured by cryptography, making it nearly impossible to counterfeit or double-spend. Crypto has become a go-to payment solution for digital transactions, while Fintech provides the technology to facilitate these transactions.

The relationship between cryptocurrency and Fintech is symbiotic. Cryptocurrency provides an efficient and secure way to make payments, while Fintech offers the technology to make these transactions possible. Together, the two enable a faster, more secure payment system for digital transactions. Additionally, cryptocurrency is often used to store and transfer wealth, while Fintech provides the necessary infrastructure.

Cryptocurrency and Fintech have become essential to the success of each other. Cryptocurrency has enabled the speedy and secure transfer of funds, while Fintech has made the technology to do so much more accessible to the public. As cryptocurrency and Fintech continue to evolve, the possibilities are endless for how they can be used in the future. From trading, investing, and payments, to tracking and verifying transactions, cryptocurrency and Fintech can be used to make financial services easier, faster, and more secure.

The Benefits of Cryptocurrency in Fintech

The rise of cryptocurrency has created a new wave of financial technology, or fintech. Cryptocurrency has transformed the way we transact, view, and manage our finances. With the ability to securely transfer value across the Internet, it has enabled a new level of efficiency and streamlined financial operations.

Cryptocurrency has become a powerful tool for fintech as it eliminates the need for third-party financial intermediaries, which can cause delays in the transfer of funds. This has created an environment in which businesses and individuals can quickly move value without having to worry about third-party involvement.

Cryptocurrency has also opened up new opportunities in the world of fintech. With its decentralized nature, it allows businesses to conduct transactions on a global scale without having to worry about the involvement of third-party institutions. This eliminates the need to use traditional financial institutions, which can be costly and inefficient.

Cryptocurrency also provides a secure and reliable way to store financial data. With its encryption technology, it is impossible for hackers to access sensitive financial information. This creates a level of security that traditional financial services cannot provide.

Overall, cryptocurrency has become an integral part of fintech. It is an efficient, secure, and cost-effective way to manage and transfer money, and it has enabled businesses and individuals to take advantage of the global financial system. Cryptocurrency is quickly becoming the preferred choice for fintech transactions, and its use is likely to increase in the coming years.

FAQs About the Is Cryptocurrency A Fintech?

Q1. Is Cryptocurrency a form of Fintech?

A1. Yes, Cryptocurrency is considered a form of Fintech due to its use of technological advancements to facilitate the exchange of digital assets.

Q2. Is Cryptocurrency legal?

A2. Cryptocurrency is legal in most countries, however, its legal status and regulations vary by jurisdiction.

Q3. What is the difference between Cryptocurrency and traditional currencies?

A3. Cryptocurrency is a digital asset that is not backed by a government or central bank, while traditional currencies are backed by a government or central bank and can be exchanged for goods and services. Additionally, Cryptocurrency transactions are largely anonymous and decentralized, while traditional currency transactions are typically regulated and monitored.

Conclusion

In conclusion, Cryptocurrency is an increasingly popular form of digital money that is based on the blockchain technology and is considered a form of Fintech. Cryptocurrency is being used for various applications such as global payments, asset trading, and fund transfers. The technology offers a degree of security, transparency, and anonymity that is not found in traditional financial systems. It is safe to say that Cryptocurrency is a form of Fintech that is here to stay.