Is BKash A Fintech Company?

BKash is a leading fintech company in Bangladesh, providing digital financial services to millions of people. Founded in 2011, BKash has since become the largest mobile financial service provider in Bangladesh, with over 25 million active users. BKash provides a secure, convenient, and affordable way for people to send and receive money, pay bills, and access other financial services. BKash has revolutionized the way people interact with money, and it is set to become an integral part of Bangladesh’s financial infrastructure.

What is BKash?

BKash is a leading mobile financial services provider in Bangladesh. It is a joint venture of BRAC Bank, US-based Money in Motion, the Bill & Melinda Gates Foundation, and International Finance Corporation. BKash is a digital payment platform that allows people to pay for goods and services using their mobile phones. It is one of the most used mobile payment services in the country, with more than 35 million customers.

BKash is a form of financial technology, or fintech, that seeks to revolutionize the way people access and use financial services. It allows people to make transactions quickly and easily without having to go to a bank or other physical location, making it more accessible and convenient. It also has a low cost of operation, making it an attractive option for those who seek to maximize their money.

BKash has been instrumental in providing access to financial services to millions of people in Bangladesh. It has enabled users to make payments, transfer money, save, borrow, and invest in a secure and convenient way. It has also opened up opportunities for merchants and businesses to accept payments electronically, leading to increased efficiency.

Overall, BKash is indeed a fintech company. It has made financial services more accessible and affordable, enabling millions of people in Bangladesh to benefit from the advantages of digital payments. It has revolutionized the way people access and use financial services, making it easier and more convenient to make payments and transfers.

What is FinTech?

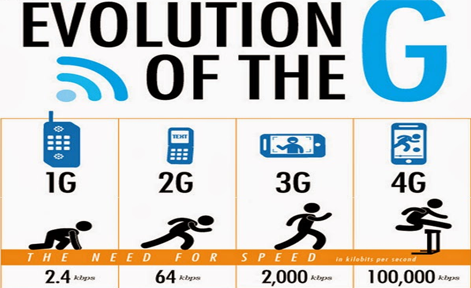

FinTech, or financial technology, is a term used to describe the innovative technology and services that are revolutionizing the financial services industry. It encompasses the use of software, data, analytics, and other digital tools to make banking, investing, and managing money easier and more efficient. FinTech companies often use cutting-edge technologies such as artificial intelligence, machine learning, blockchain, and big data to develop products and services that are faster, more secure, and less expensive than traditional financial services. BKash, a Bangladesh-based digital payments platform, is one example of a FinTech company that is using technology to make financial services more accessible and convenient. By leveraging digital payment technologies, BKash is helping to reduce the cost of financial services and making it easier for people in Bangladesh to access banking services, make payments, and manage their money. BKash is just one example of how FinTech is changing the financial services industry for the better.

How Does BKash Fit into the FinTech Landscape?

As the world of financial technology (fintech) continues to evolve, it is important to understand how each company fits into the larger landscape. BKash is a leading mobile financial service provider in Bangladesh, offering a range of services from money transfer, bill payment, and mobile banking. It is also considered a fintech company, as its services are designed to help customers manage their finances in a more efficient way.

BKash is a pioneer in the mobile banking sector, providing customers with an easy and convenient way to make payments and transfer money. Its services allow users to transfer money both within and outside Bangladesh. It also offers customers the ability to pay bills, book tickets, and more, all through their mobile phones.

BKash’s services are designed to provide customers with an efficient and secure way to manage their finances. Its services are powered by advanced technology, such as machine learning algorithms, to offer customers more precise and accurate payment solutions. BKash also offers its customers a range of loyalty and rewards programs, which further helps to build customer loyalty.

Overall, BKash is a key player in the fintech landscape, offering customers a range of services that are designed to make financial management more secure and efficient. With its use of advanced technology, BKash is helping to revolutionize the way customers manage their finances, making it easier and more convenient than ever before.

What Products and Services Does BKash Offer?

BKash, Bangladesh’s leading digital financial services platform, is a fintech company that provides a variety of payment and financial services to customers. From a range of convenient payment options to micro-savings and loans, BKash provides a wide range of products and services that enable consumers to manage their finances.

Customers can easily open a BKash account and use it to make payments, top-up mobile phones, transfer funds, and more. BKash also provides a range of financial services, including micro-savings, micro-loans, insurance, and investment products, which enable customers to better manage their finances.

To make payments, customers can use the BKash app, web, or SMS. The app is available on both Android and iOS devices, making it easy for customers to use the app on the go. Customers can also use BKash to pay utility bills, shop online, and make international payments.

BKash also offers a range of services to merchants and businesses, such as accepting payments, providing access to working capital, and digital marketing solutions. The platform also provides a range of tools and services to help merchants manage their finances, including accounting, inventory, and customer management.

Overall, BKash is a fintech company that offers a wide range of products and services to both customers and businesses. With its easy-to-use platform and range of services, BKash is helping to revolutionize the way people manage their finances in Bangladesh.

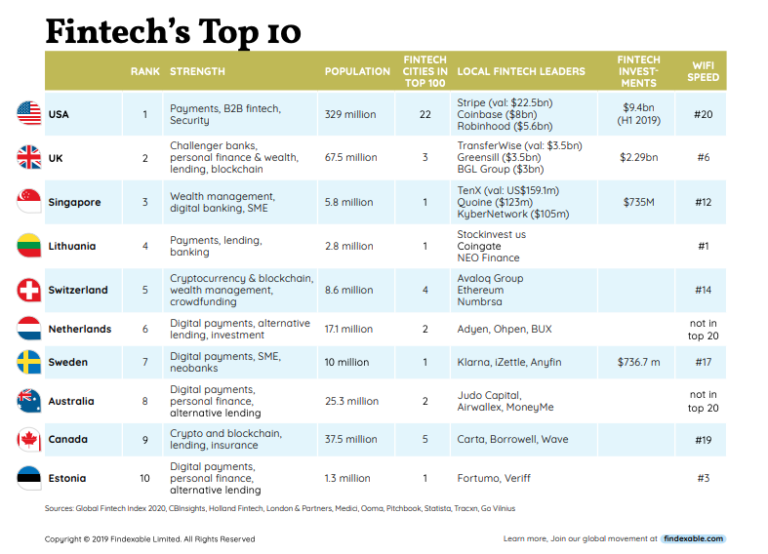

How Does BKash Compare to Other FinTech Companies?

BKash is one of the leading financial technology companies in Bangladesh, offering a wide range of services including mobile payments, money transfers, and digital wallets. This makes it an important player in the global fintech space. But how does BKash stack up against its competitors? This article will compare BKash to other prominent fintech companies in terms of features, user experience, customer service, and security.

Starting with features, BKash stands out for its wide range of services. It provides customers with more than just digital wallet services, such as money transfers, bill payments, and even insurance. These features make BKash a competitive option for customers looking for an all-in-one solution.

In terms of user experience, BKash has an intuitive interface that is easy to use. The company also offers a comprehensive customer service team that is available 24/7 for any questions or issues customers may have. This makes it a great choice for those who need help navigating the platform.

When it comes to security, BKash has a secure infrastructure with multiple layers of protection. The company also uses encryption technology to ensure that all customer data is kept safe and secure. This makes it a reliable and trusted option for customers to use.

Overall, BKash is a great choice for those looking for a comprehensive, secure, and user-friendly financial technology solution. With its wide range of services and reliable customer service, it is a great option for customers looking for a comprehensive financial service.

What Are the Benefits of Using BKash?

The world of fintech is rapidly evolving, and BKash is at the forefront of the revolution. A subsidiary of BRAC Bank in Bangladesh, BKash is a mobile financial service provider that enables users to make both online and in-store payments. With its vast user base and an ever-growing number of services, BKash has become one of the most popular fintech companies in Bangladesh. But what are the benefits of using BKash?

For starters, BKash offers an easy and convenient way to make payments. With a few clicks of a button, users can instantly transfer money to friends and family, make online purchases, pay bills, and even withdraw cash from ATMs. Plus, with its wide variety of services, BKash makes it easy to manage and track finances.

BKash also provides users with enhanced security and privacy. All payment transactions are encrypted and stored securely, and users can set up two-factor authentication for extra peace of mind. Additionally, BKash offers a low-cost way to transfer money abroad, making it an ideal choice for international money transfers.

Finally, BKash is committed to giving back to the communities it serves. Through its numerous charitable initiatives and partnerships, BKash has helped to lift thousands of people out of poverty and create economic opportunities for many others.

All in all, BKash is a perfect example of a fintech company that helps users manage their finances in an easy and secure way while also giving back to the communities it serves. With its wide range of services and its commitment to making a positive impact on the world, BKash is undoubtedly an exceptional fintech company.

FAQs About the Is BKash A Fintech Company?

1. What is BKash?

Answer: BKash is a mobile financial service provider in Bangladesh that allows users to send and receive money, pay bills, and more.

2. Is BKash a fintech company?

Answer: Yes, BKash is a fintech company that enables its users to access financial services securely and conveniently.

3. What services does BKash provide?

Answer: BKash provides services such as money transfers, bill payments, airtime top-up, and more.

Conclusion

Yes, BKash is a fintech company. BKash is a mobile-based financial service provider that enables users to send and receive money, pay bills, and purchase goods and services via a mobile phone. It is a subsidiary of BRAC Bank Ltd. and is Bangladesh’s leading digital financial services provider. BKash is committed to providing a secure and reliable platform for its customers to access financial services. BKash has also been recognized by the World Bank as one of the leading fintech companies in Bangladesh.