Is Apple A Fintech Company?

Apple Inc. is one of the world’s largest and most successful technology companies, with products ranging from smartphones and tablets to computers and music players. While the company is primarily known for its hardware and software products, it has also begun to venture into the world of financial technology (fintech). Apple has released a number of financial products and services, including Apple Pay, Apple Card, and Apple Cash, that allow users to manage their money more easily. As such, it can be argued that Apple is indeed a fintech company, as it provides financial services to its customers. However, it is important to note that Apple does not offer the same services as traditional financial institutions, such as banks and investment firms. Apple’s fintech products are designed to give users more control over their finances, rather than to compete with established financial institutions.

Definition of a Fintech Company

A Fintech company is defined as a business that leverages technology to provide innovative financial services, products, and solutions. This can include anything from mobile banking and payments to digital currencies and investment management. With the emergence of new technologies, such as blockchain and artificial intelligence, Fintech companies are able to provide services to customers with greater speed, accuracy, and efficiency than traditional financial institutions.

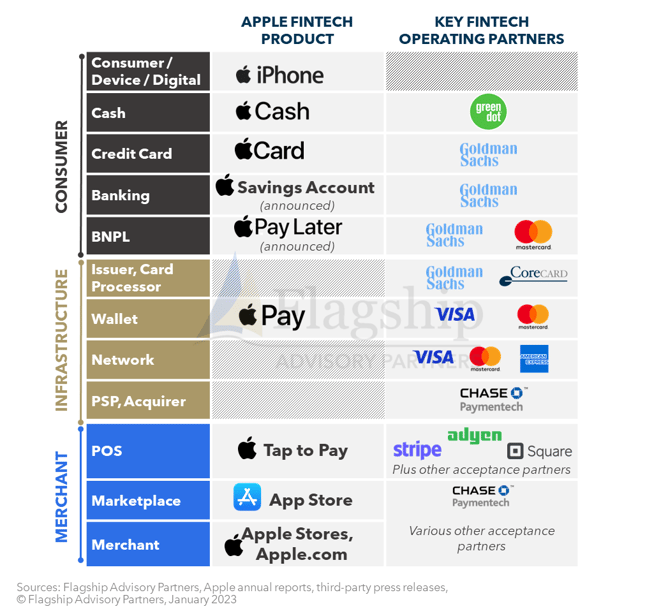

Apple has become a major player in the Fintech space, offering a variety of services including Apple Pay, Apple Card, and Apple Cash. Apple Pay allows customers to securely purchase items with their phones, while Apple Card offers a physical credit card with a variety of rewards. Apple Cash allows customers to quickly and easily transfer money with their iPhone.

In addition to these services, Apple also has its own mobile payment platform, Apple Pay. This platform allows customers to securely pay for goods and services using their phones. It also has an accompanying mobile wallet which allows customers to store and use their Apple Card.

Apple’s foray into the Fintech space has been met with enthusiasm from customers and investors alike. With its suite of products and services, Apple has become a leader in the Fintech space. It remains to be seen whether Apple can continue to innovate in the space and keep up with the competition.

Apple’s Current Involvement in FinTech

Apple has been making waves in the FinTech industry for some time now, and it’s easy to see why. With their innovative products, industry-leading software, and vast financial resources, it’s no surprise that Apple has been making strides in the financial technology sector. From their recent partnerships with Goldman Sachs and Mastercard to their Apple Card and Apple Pay services, Apple is well on its way to becoming a major player in the FinTech space.

Apple’s Apple Card is a credit card that comes with a variety of features, such as no annual fees, a rewards program, and no foreign transaction fees. Apple also offers Apple Pay, which allows customers to make payments using their Apple devices. Apple has also developed a variety of tools and apps to help customers manage their finances, such as its budgeting app, and its investment platform, Apple Invest.

In addition to these products, Apple has also invested heavily in financial technology startups, such as the digital payments company Square, the peer-to-peer payments platform Venmo, and the cryptocurrency wallet app Coinbase. These investments show that Apple is not only investing in its own products, but it is also investing in the future of FinTech.

Overall, it is clear that Apple is investing heavily in the FinTech sector and is quickly becoming a major player in the industry. With its innovative products and services, and its partnerships with major financial institutions, Apple is well on its way to becoming a major player in the world of FinTech.

Apple’s Potential to Become a FinTech Company

Apple is one of the most innovative tech companies in the world and has been for many years. The company has disrupted the tech industry with products like the iPhone, iPad, and Apple Watch, and its foray into financial services could be the next big thing. With the release of Apple Card, Apple Pay, and Apple Cash, the company has already made a foray into the world of FinTech. But what is the potential for Apple to become a true FinTech company?

This question is becoming increasingly relevant, particularly as Apple continues to develop its financial services. Apple has the advantage of its vast user base, which would give it a significant foothold in the FinTech market. The company also has the resources to develop new technologies and products that could revolutionize the industry. Additionally, Apple has a long history of successful partnerships with the banking and financial services industry, which could help it to build strong relationships with FinTech companies.

Ultimately, the potential for Apple to become a true FinTech company depends on its ability to leverage its existing resources and partnerships to develop innovative financial products. With its vast user base, strong relationships with banks, and well-established brand, Apple has the ability to become a major player in the FinTech space. It remains to be seen whether the company will capitalize on this potential, but it could be an exciting development for the industry.

Challenges Apple Will Face if it Becomes a FinTech Company

Apple is no stranger to disruption and pioneering new technologies, yet it has yet to make a major move into the FinTech space. If Apple were to become a FinTech company, it would be entering an already crowded and competitive market filled with established players. Here are some of the challenges Apple would face if it were to become a FinTech company.

The first challenge Apple would face is gaining consumer trust. Despite its strong brand and loyal customer base, Apple would have to earn the trust of consumers when it comes to their financial data. Building trust requires a secure platform and reliable customer service, which Apple would need to provide in order to be successful in the FinTech space.

Another challenge Apple would face is the cost of setting up and running a FinTech business. FinTech is a highly regulated industry, and Apple would need to invest in compliance and security measures to ensure their systems are up to date and secure. Furthermore, Apple would need to invest in technology and talent to stay ahead of the competition.

Finally, Apple would need to find a way to differentiate itself from the competition. With so many established FinTech companies dominating the market, Apple would need to offer something unique to stand out. This could include offering innovative products or services that existing FinTech companies don’t have, or providing a better customer experience.

Ultimately, Apple’s success in the FinTech space would depend on its ability to overcome these challenges. By addressing the trust, cost, and differentiation issues, Apple could become a major player in the FinTech market.

The Potential Benefits of Apple Becoming a FinTech Company

Apple is no stranger to innovation. The tech giant has revolutionized the way we communicate, consume music, and shop online. But could Apple be poised to do the same in the world of finance? Apple is rumored to be exploring the possibility of becoming a fintech company, and if successful, the potential benefits could be immense.

For one, Apple’s entry into the fintech space could spur competition and drive down costs for users. With the introduction of Apple Pay, the company has already made it easier for consumers to securely make payments using their Apple devices. By becoming a fintech company, Apple could create even more innovative products and services that could improve the financial lives of consumers.

In addition, Apple’s entrance into the fintech space could open up a number of opportunities for businesses. Apple could create new channels for companies to reach potential customers, as well as offer fintech solutions that could help businesses streamline their operations and save money.

Finally, Apple’s foray into fintech could also benefit the industry as a whole. Apple’s reputation for innovation and security could help customers feel more comfortable with new technology, and its entrance into the space could encourage more companies to explore fintech solutions.

Overall, the potential benefits of Apple becoming a fintech company could be tremendous. If successful, the company could revolutionize the way we manage our finances, reduce costs for users, and open up a world of opportunity for businesses.

Conclusion

Apple may not be a traditional fintech company, but it certainly has an impressive presence in the financial technology sector. The company has been steadily expanding its product offerings and services related to payments, financial services, and investments. Apple’s foray into this market has enabled it to become one of the most recognized names in the industry. Its hardware, software, and services have enabled it to provide customers with a wide range of financial services, such as its Apple Card and Apple Cash. What’s more, the company is also exploring the possibility of launching more financial products and services. Apple’s growing presence in the fintech sector is undeniable and its potential to become a major player in this space is becoming increasingly apparent. As the company continues to expand its offerings and services, it’s only a matter of time before it is considered a true fintech giant.

FAQs About the Is Apple A Fintech Company?

1. What is a fintech company?

A fintech company is a financial technology company that provides services related to banking, payments, investments, insurance, and other financial services.

2. Is Apple a fintech company?

No, Apple is not a fintech company, but it does offer financial services such as Apple Pay and Apple Card.

3. Does Apple provide any other services related to financial technology?

Yes, Apple offers a range of technologies such as the Apple Wallet, Apple Cash, and Apple Pay Cash to help customers manage their money.

Conclusion

In conclusion, Apple is not a fintech company. However, the company does offer a variety of financial services, such as Apple Pay, the Apple Card and Apple Cash, that make it a significant player in the fintech space. As Apple continues to innovate and expand its financial services, it will become an increasingly important player in the fintech industry.