How To Use AI In Insurance Industry?

Artificial intelligence (AI) is gaining traction in the insurance industry, providing powerful insights to help insurance companies better serve their customers and increase profits. AI can help insurance companies make better decisions, identify fraud faster, and automate processes. AI can also help insurers reduce costs, improve customer experience, and create more personalized services. In this article, we will discuss the various ways in which AI can be used in the insurance industry, and how insurance companies can benefit from its use. We will also look at some of the challenges that come with using AI in the insurance industry.

Overview of AI and its Potential in Insurance Industry

The insurance industry is quickly embracing artificial intelligence (AI) to revolutionize how insurers interact with customers, identify new opportunities, and streamline processes. By leveraging AI technologies such as machine learning, natural language processing, and predictive analytics, insurers can make more accurate decisions, reduce manual labor and automate mundane tasks. AI has the potential to identify customer needs and preferences in real-time, enabling insurers to provide more tailored and personalized products and services. Additionally, AI-based systems can help insurers analyze large datasets to detect hidden trends and patterns, providing insights that can be used to improve customer experience, optimize pricing strategies, and reduce risk. AI can also be used to automate claims handling and fraud detection, improving efficiency and reducing administrative costs. Ultimately, AI can help insurers create a competitive edge in the market.

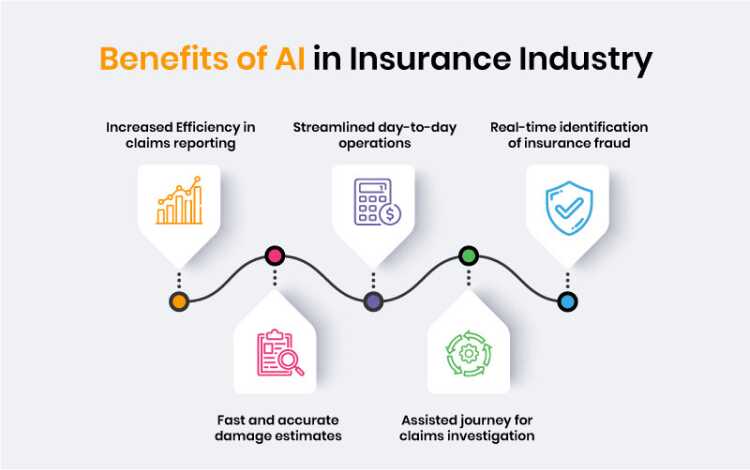

Benefits of AI in Insurance Industry

AI technology has revolutionized the insurance industry, making it easier for companies to better understand customer needs and preferences. AI-based automation can help streamline processes and reduce costs, while also providing insurers with the ability to analyze large amounts of data quickly and accurately. AI-driven analytics can be used to identify new trends and improve customer experience. AI can also help insurers improve pricing accuracy and reduce fraud and risk. AI-driven decisions can be used to customize policies and provide tailored advice and recommendations to customers. With AI-driven solutions, insurers can provide a better customer experience and improved customer engagement while also increasing operational efficiency. AI is a powerful tool for insurers to optimize operations, reduce costs and improve customer service.

Challenges of Implementing AI in Insurance Industry

The insurance industry is increasingly turning to artificial intelligence (AI) to help streamline operations and improve customer experience. While this technology holds tremendous potential, it also presents a unique set of challenges. AI-based systems are complex, and insurance companies need to be aware of the potential risks and pitfalls associated with implementing this technology.

One of the key challenges is the need for extensive data sets. AI-based systems are only as good as the data they are given, and insurers need to ensure they have large, high-quality data sets to feed their system. Additionally, AI-based systems are vulnerable to bias and errors, and insurance companies need to carefully monitor their systems to ensure accuracy.

Another challenge is the cost of implementing and maintaining AI-based systems. These systems are expensive to build and maintain, and insurance companies need to be prepared to make significant investments in order to get the most out of their AI-based systems.

Finally, there is the issue of regulation. Insurance companies need to be aware of the legal and regulatory requirements associated with the use of AI, and be prepared to comply with these requirements.

Overall, while AI holds tremendous potential for the insurance industry, there are a number of challenges associated with its implementation. Insurance companies need to be aware of these challenges and take steps to ensure they are prepared to handle them.

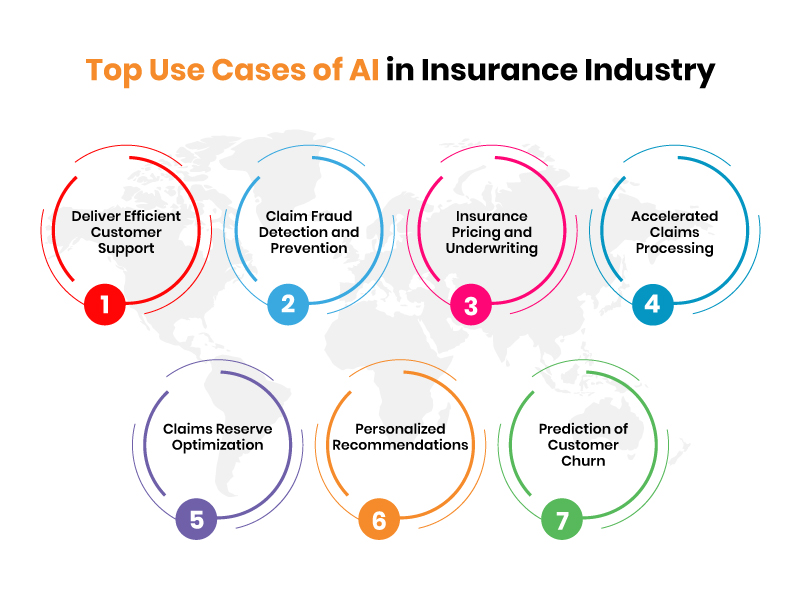

Examples of AI Use Cases in Insurance Industry

The insurance industry is an ever-evolving sector, and the advent of artificial intelligence (AI) has revolutionized the way insurers manage their operations. AI-driven technologies are transforming the industry, from automating mundane tasks to providing superior customer experiences. AI is proving to be a game-changer in insurance, offering multiple use cases and applications that are helping insurers streamline their processes, optimize operations, and enhance customer service.

From automated underwriting and risk assessment to fraud detection and customer segmentation, AI-powered solutions are significantly improving the performance of insurers. For example, AI-driven technologies can be used to identify potential risks and adjust premiums accordingly, enabling insurers to protect their customers from losses. AI can also be used for marketing purposes, enabling insurers to identify their target audience and deliver the most suitable products to them.

AI-based chatbots are also proving to be a great help in the insurance industry. Chatbots can answer customer queries in real-time, reducing the need for manual intervention. They can also help insurers to streamline the claim process and improve customer satisfaction.

Overall, AI has a great potential to revolutionize the insurance industry, enabling insurers to improve their services and increase their profits. By leveraging AI-based technologies, insurers can provide better customer experiences, reduce operational costs, and stay competitive in the long run.

Best Practices for Implementing AI in Insurance Industry

Artificial Intelligence (AI) has the potential to revolutionize the insurance industry. By automating mundane tasks, reducing operational costs, and providing better customer experiences, AI can help insurers deliver value to their customers while streamlining their operations. But, as with any new technology, implementing AI in the insurance industry requires careful planning and consideration. To that end, here are some best practices for successfully implementing AI in the insurance industry.

First, it is important to understand the areas where AI can be most effective. AI can be used to automate processes such as claims processing, customer service, fraud detection, and policy management. It can help insurers reduce costs while also providing better customer service and more accurate risk assessment.

Second, insurers should develop a strategy that outlines the specific areas where AI can be used to improve business operations. This should include an analysis of the costs associated with developing and deploying AI solutions, as well as any potential risks and benefits.

Third, insurers should ensure that their AI solutions are compliant with applicable regulations and laws. This includes ensuring that any data used for AI solutions is collected and stored securely.

Fourth, insurers need to invest in the development of AI expertise. This includes training existing employees on AI technologies and hiring new talent with experience in AI development.

Finally, insurers should focus on creating user-friendly experiences with their AI solutions. This includes designing intuitive user interfaces, providing clear documentation, and making customer service staff available to help customers with any problems they may have.

By following these best practices, insurers can successfully implement AI in their operations and create new opportunities for growth and competitive advantage.

Final Thoughts on AI in Insurance Industry

Insurance companies are increasingly turning to AI technology to reduce costs, increase efficiency, and improve customer service. AI-driven solutions can help insurers better manage and analyze customer data, automate processes, and automate decision-making. AI can also be used to detect fraud, detect unusual claims, and automate the claim processing process. AI-driven solutions can also be used to create personalized experiences for customers by using customer data to create tailored products. AI is also helping insurers to create more accurate and personalized products to better serve their customers. AI can also be used to help create more accurate pricing models and customize customer experiences.

AI is an invaluable tool for insurance companies, as it can help them to reduce costs, increase efficiency, and improve customer service. However, companies should be aware of the potential risks and regulations that come with AI, and should make sure they are fully compliant. Companies should also be aware of the potential for data breaches and other security issues, and should have appropriate safeguards in place. As AI technology continues to evolve, insurance companies should continue to explore the potential benefits and challenges of using AI to improve their operations.

FAQs About the How To Use AI In Insurance Industry?

Q1. What is the most common way to use AI in the insurance industry?

A1. The most common way to use AI in the insurance industry is to automate certain processes such as customer service, underwriting, and claim handling. AI can also be used to analyze customer data and provide more tailored and personalized products.

Q2. How can AI help improve the customer experience?

A2. AI can be used to provide customers with a more personalized experience, such as automated customer service and personalized product recommendations. AI can also be used to speed up claim processing and decision making.

Q3. What are the challenges of using AI in the insurance industry?

A3. The main challenge of using AI in the insurance industry is ensuring the accuracy of the data used. AI algorithms must be trained with accurate data to produce accurate results, so it is important to ensure that the data is accurate and up-to-date. Additionally, the ethical considerations of using AI must be taken into account.

Conclusion

The use of AI in the insurance industry is a rapidly growing trend, with many advantages that can make the process of underwriting and claims handling more efficient and cost-effective. With the ability to access and analyze large amounts of data, AI can be used to help insurers better understand customer needs and provide more personalized services. AI can also be used to improve fraud detection and reduce costs associated with manual underwriting processes. AI has the potential to revolutionize the insurance industry, and it is important to stay up to date on the latest developments and best practices for implementing AI into insurance companies.