How The Latest Technology Is Transforming The World Of Insurance?

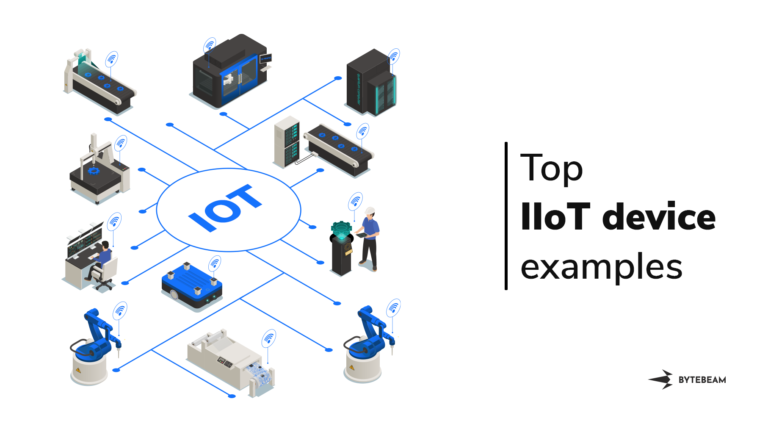

The world of insurance is undergoing a major transformation due to the introduction of the latest technologies. The use of artificial intelligence, machine learning, big data, and the Internet of Things (IoT) is revolutionizing the way insurers assess, underwrite, process, and manage risks. It is also helping them to identify and address potential problems more quickly and efficiently. For example, the use of intelligent bots and predictive analytics can help insurers to better understand customer behaviour and make more informed decisions. Additionally, the use of blockchain technology can help to reduce paperwork and streamline processes, while the use of connected devices can help to monitor and measure risk more accurately. All of these advancements are helping to create a more seamless and efficient insurance experience for customers, while also allowing insurers to make better and more informed decisions.

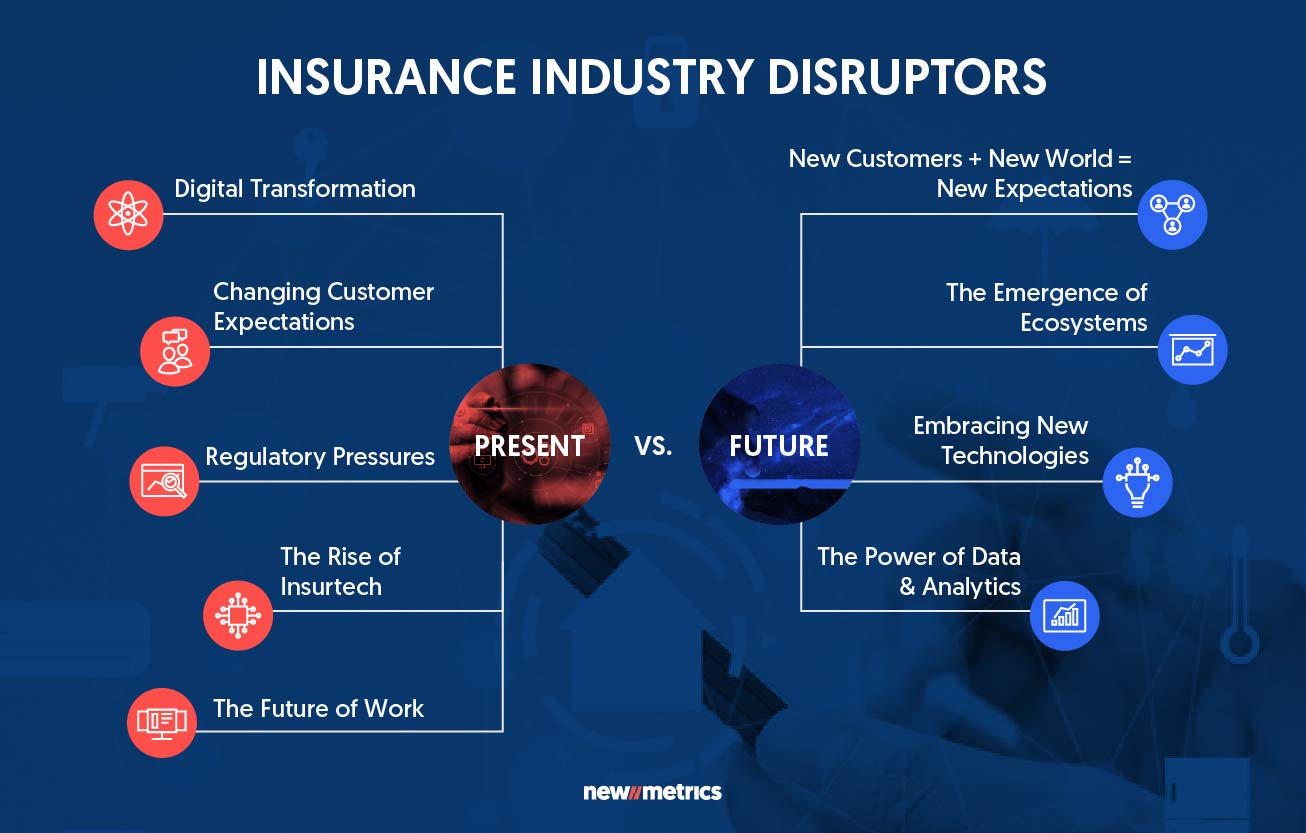

The Need for Digitization in the Insurance Industry

The insurance industry is witnessing a revolution brought about by the latest cutting-edge technology. In the past, insurance firms were lagging behind when it came to digital transformation, but now, the industry has embraced the wave of digitization, and this is transforming the way they operate. Insurance companies are now leveraging big data, artificial intelligence, and the internet of things to improve customer experience, streamline processes, and increase efficiency. They are utilizing advanced technologies such as predictive analytics and machine learning to improve customer engagement, personalize services, and automate tedious tasks. Moreover, blockchain technology is enabling them to offer better security and transparency. This is helping them to reduce costs and increase customer loyalty. Overall, the latest technology is transforming the world of insurance, paving the way for a more secure and connected future.

Benefits of Adopting the Latest Technology

in Insurance

The world of insurance is changing rapidly. As technology advances, insurers are finding new ways to use it to their advantage. By embracing the latest technology, insurance companies are able to provide better customer service, reduce costs, and increase their efficiency. By leveraging the power of technology, insurers can provide better customer service by offering more accurate and up-to-date information to customers. Additionally, they can reduce costs by automating processes and reducing the need for manual labor, increasing their efficiency and profitability. Furthermore, insurers can increase their customer base by expanding into new markets, such as online and mobile insurance, and providing customers with more convenient and personalized services. Finally, insurers can better manage risk by using predictive analytics and data-driven decision-making to improve their underwriting and pricing models. By taking advantage of the latest technology, insurers can remain competitive and provide customers with better service, lower costs, and improved risk management.

Challenges of Utilizing the Latest Technology

The insurance sector is constantly evolving, and the latest technology is transforming the way insurance policies are managed and administered. From automated claims processing to predictive analytics, the latest technology is revolutionizing the insurance industry. While the potential is immense, there are certain challenges associated with the implementation of these technologies.

One of the most significant challenges is the cost of implementation. Businesses must invest in the right technology and infrastructure to ensure the success of their insurance operations. Businesses must also invest in training and development for their staff to keep up with the latest developments in the industry. Additionally, businesses must also ensure that the technology they implement is secure and compliant with relevant laws and regulations.

Another challenge is the difficulty of customer adoption. The acceptance of the new technology and the adoption of its features can be a challenge, as customers may not be familiar with the new technology and its features. Companies must also ensure that their customer service is up to par with the latest technology, as customers may not be comfortable with the new platform.

Finally, businesses must also consider the potential regulatory issues associated with the implementation of the latest technology. Companies must ensure that their technology meets the relevant regulations and laws, as the implementation of technology can have a significant impact on customer rights and privacy.

Overall, the challenges of implementing the latest technology in the insurance sector can be significant, but the potential benefits are immense. The right implementation strategy, combined with proper training and customer service, can help businesses make the most of the latest technology.

Exploring Different Types of Insurance Technology

Insurance technology, or InsurTech, is the use of technology to improve the efficiency of the insurance industry. It involves the use of innovative solutions and tools to automate processes, enhance customer experience, reduce costs, and improve the overall customer experience. InsurTech covers a wide range of areas, such as policy administration, underwriting, claims processing, fraud prevention, and customer service.

The insurance industry has been revolutionized by the emergence of InsurTech, due to its ability to automate processes and reduce costs, as well as its potential to improve customer experience. Automation of processes has allowed for more efficient customer service, faster processing of claims, and more accurate risk assessment, resulting in improved customer satisfaction. In addition, the use of InsurTech has enabled insurers to access more data on customers, allowing them to better tailor policies and services to meet their needs.

The introduction of InsurTech has also enabled insurers to provide more personalized services to their customers. By providing more sophisticated analytics and predictive capabilities, InsurTech has enabled insurers to better understand customer needs and preferences, resulting in more tailored policies and services for their customers.

In conclusion, the introduction of InsurTech has revolutionized the insurance industry, allowing for more efficient and effective processes, improved customer experience, and more personalized services. With the continued development of InsurTech, the insurance industry will continue to evolve, providing better services to its customers.

Redefining the Relationship Between Clients and Insurance Providers

The insurance industry is in the midst of an exciting transformation, thanks to the latest advances in technology. From artificial intelligence (AI) to the Internet of Things (IoT), the insurance industry is finding innovative ways to use these tools to manage risk and better serve their customers. This is completely reshaping the relationship between insurance providers and their clients.

Insurers are now able to use AI to analyze vast amounts of data and create personalized policies that are tailored to clients’ needs. By leveraging predictive analytics, companies are able to provide real-time feedback and advice to customers and quickly respond to their inquiries. IoT is also being used to monitor customer behavior and provide more accurate risk assessment. This helps insurers provide more accurate rates and better customer service.

Furthermore, with the rise of digital channels, insurers are able to reach a wider audience and provide more tailored services. This is allowing them to provide a more personalized experience to their customers. Through the use of digital channels, insurers are also able to streamline the process of filing claims and make the process more efficient.

The latest technology is creating a new relationship between clients and insurance providers. Insurers are better able to understand their customers’ needs and provide more customized services. This is allowing them to provide better value for their customers and create a stronger customer-insurer relationship.

Exploring the Future of Insurance Technology

Insurance technology, or InsurTech, is revolutionizing the way we think about insurance. It’s making the process of obtaining, managing, and using insurance coverage easier and more efficient than ever before. As exciting as the advancements in technology are, it can be difficult to understand how they’ll affect the industry. In this blog post, we’ll explore how the latest technology is transforming the world of insurance and how it will shape the future of the industry.

We’ll look at how the latest technologies such as automated solutions, mobile applications, and data analytics are making it easier to purchase insurance coverage, manage claims, and provide more personalized services to customers. We’ll also discuss the implications of these changes on the insurance industry, including how it could lead to increased competition, improved customer experience, and cost savings. Finally, we’ll consider the challenges of implementing these new technologies and how insurers can prepare to take advantage of the opportunities presented by InsurTech.

FAQs About the How The Latest Technology Is Transforming The World Of Insurance?

1. How is the latest technology making insurance more affordable?

Answer: The latest advances in technology are making the insurance industry more efficient and cost-effective. Automation of processes, cloud computing, and mobile applications are helping to reduce costs across the board. This means that insurance companies are able to pass on the savings to their customers in the form of lower premiums.

2. What are some of the most common ways that technology is transforming the insurance industry?

Answer: Some of the most common ways that technology is transforming the insurance industry include the use of predictive analytics, automated underwriting, big data analysis, and digital marketing. These advancements are making it easier for insurance companies to assess risks and provide appropriate coverage in a timely manner.

3. How can consumers benefit from the latest technology in the insurance industry?

Answer: Consumers can benefit from the latest technology in the insurance industry by having access to improved customer service, more personalized coverage, and greater transparency. Thanks to advances in technology, customers can now access their insurance policies quickly and conveniently, allowing them to make more informed choices.

Conclusion

The world of insurance is rapidly changing with the introduction of the latest technology. Insurers are able to reduce costs and improve customer service through the use of sophisticated software, automated processes, and analytics. This technology is allowing insurance companies to increase their efficiency, as well as provide more personalized service to their customers. Additionally, it is allowing them to better manage risk and develop new products and services, allowing them to better serve their customers. As technology continues to evolve, the insurance industry will continue to benefit from these advancements and be able to offer better coverage, lower rates, and more personalized service.