How Technology Is Used In Insurance Industry?

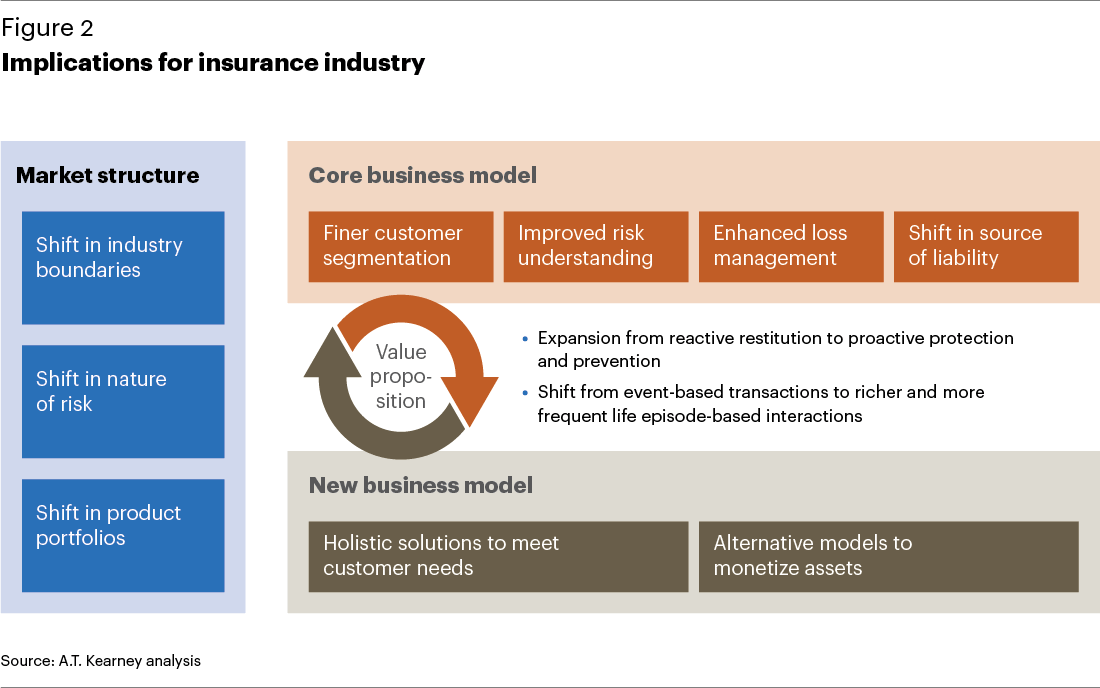

The insurance industry is increasingly using technology to streamline processes, reduce costs, and improve customer service. Technology is being used to streamline the entire process of processing insurance claims, from the initial filing to the final payment. Insurance companies are also using technology to offer more personalized services to their clients, such as online customer service portals and mobile apps. Additionally, technology is being used to detect and combat fraud in the insurance industry. Automated systems are being used to assess risk, detect suspicious activity, and protect policyholders from fraudulent claims. As technology continues to evolve, the insurance industry is poised to benefit from its use and continue to provide better services to their customers.

Overview of the Insurance Industry

The insurance sector is one of the most significant contributors to the global economy, with an estimated $5.1 trillion in annual premiums. This industry is a major player in the economy, as it protects people and businesses from financial risks. Insurance companies use technology to improve their processes and operations, resulting in improved customer service, better data protection, and more efficient claims handling.

From actuarial analysis to predictive analytics, technology is helping insurance companies make better decisions and stay competitive. Automation is being used to streamline administrative tasks, while machine learning and artificial intelligence algorithms are being deployed to detect fraud and automate the claims process. Additionally, the internet has enabled insurers to provide services online, making it easier for customers to compare prices and purchase policies.

The use of technology has made the insurance industry more efficient and has allowed companies to offer better services to their customers. By leveraging technology, insurers are able to provide more personalized services, resulting in improved customer experiences. Additionally, technology is also being used to identify and reduce risks, allowing companies to better protect themselves and their customers.

From managing customer data to optimizing claims processing, technology is an integral part of the modern insurance industry. By leveraging the latest advances in technology, insurers can provide better services and improved customer experiences. As technology continues to evolve, insurers will be able to provide more efficient services and better protect their customers from financial risks.

Benefits of Technology in the Insurance Industry

Insurance companies are increasingly turning to technology to improve their operations. By leveraging advances in technology, they are able to streamline processes, reduce costs, and improve customer service. Technology has had a positive impact on the insurance industry, and here are some of the key benefits.

First, technology has enabled insurers to reduce manual labor, saving time and money. Automation has allowed insurers to save on administrative costs and speed up processes, such as policy issuance and claims handling. Additionally, technology has allowed insurers to better manage risks and improve their underwriting processes.

Next, technology has enabled insurers to better assess and manage customer data. By utilizing analytics and data mining, insurers can gain insight into customer behavior and preferences. This can help them create customized products and services, better target customers, and improve customer service.

Finally, technology has enabled insurers to better interact with customers, providing customers with real-time access to their policies and allowing them to manage their accounts online. This has greatly improved customer service and enabled insurers to better engage with their customers.

Overall, technology has had a tremendous impact on the insurance industry. By leveraging technology, insurers have been able to reduce costs, improve customer service, and better understand customer behavior. By continuing to invest in technology, insurers can further improve their operations and stay ahead of the competition.

Types of Technology Used in the Insurance Industry

Insurance is a complex business, and technology plays an integral role in helping insurers manage their operations more efficiently. From customer service to fraud detection, technology is helping insurers stay ahead of the competition and deliver better services to customers. In this article, we’ll explore the different types of technology used in the insurance industry and how they are helping insurers manage their business better.

Insurers use a wide range of technologies such as analytics, machine learning, artificial intelligence, blockchain, and cloud computing to improve their operations. Analytics helps insurers to identify trends in customer behavior, predict customer preferences, and use customer data to create tailored insurance products. Machine learning and artificial intelligence help insurers automate processes, quickly identify fraud, and streamline customer service. Blockchain technology helps insurers securely store customer data and facilitate the efficient transfer of funds. Finally, cloud computing can help insurers store customer data securely, provide real-time data access, and improve scalability.

Technology is playing an increasingly important role in the insurance industry, and insurers are leveraging its power to improve operational efficiency and deliver better customer service. By embracing the right technology, insurers can stay ahead of the competition and better manage their operations.

Challenges of Using Technology in the Insurance Industry

The insurance industry has been revolutionized by the use of technology. By providing a more efficient and cost-effective way to process claims and manage customer data, technology has transformed how the insurance industry operates. However, the use of technology in the insurance industry is not without its challenges. Security, cost, and customer service are just some of the issues that arise when using technology in the insurance industry.

Data security is a major concern for the insurance industry. Insurance companies must ensure that customer data is protected from unauthorized access and that sensitive information is not compromised. In addition, the use of technology can increase costs associated with insurance companies, as they must invest in the technology to keep up with the competition. Furthermore, customer service can suffer as technology replaces face-to-face contact with customers.

For insurance companies to remain competitive, they must be able to navigate the challenges associated with the use of technology. Companies must invest in the right technology to ensure data security and reduce costs, while still providing excellent customer service. Companies must also consider the changing needs of their customers and adjust their technology accordingly. By addressing these challenges, insurance companies can ensure their success in the ever-evolving insurance industry.

Examples of Technology Used in the Insurance Industry

Technology has revolutionized the insurance industry, from the way customers purchase policies to the way companies manage their day-to-day operations. Insurance companies are increasingly turning to technology to streamline processes and maximize efficiency. Here are some of the main ways technology is being used in the insurance industry.

1. Automation: Automation is the cornerstone of how technology is used in the insurance industry. Automation technology allows companies to automate mundane and repetitive tasks, such as policy renewals, claim processing, and customer service queries. Automation reduces the amount of time and effort required to process transactions, resulting in faster services and increased customer satisfaction.

2. Predictive Analytics: Predictive analytics is the use of data mining techniques to predict future events. Insurance companies use predictive analytics to better understand customer behavior and identify trends that can be used to inform decisions.

3. Artificial Intelligence: Artificial intelligence (AI) is being used in the insurance industry to automate processes and improve customer service. AI systems can be used to detect fraud, identify high-risk customers, and process claims more efficiently.

4. Internet of Things (IoT): IoT technology is increasingly being used in the insurance industry to monitor customer behavior and identify potential risks. This data can then be used to create more tailored policies and provide more accurate quotes.

The above are just a few examples of how technology is used in the insurance industry. By leveraging technology, insurance companies can drive efficiency, reduce costs, and provide better services to their customers.

Conclusion

The insurance industry is always adapting and changing, and the introduction of technology only makes the industry stronger. Technology has allowed insurance companies to improve their customer experience, increase security, streamline processes, and provide more accurate and affordable coverage. Technology is here to stay, and it will continue to be an integral part of the insurance industry for years to come. While there are challenges to be faced in terms of privacy, data security, and compliance, the positives far outweigh the negatives. Technology has allowed insurance companies to become more efficient, innovative, and customer-centred, and these qualities will be invaluable to the success of the insurance industry in the future.

FAQs About the How Technology Is Used In Insurance Industry?

Q1. How does technology help insurers make decisions?

A1. Technology helps insurers make decisions by providing them with data-driven insights to assess risk and accurately price insurance products. Insurers can use AI, machine learning, and predictive analytics to gain insights into customer behavior and trends in the insurance industry. This helps them make informed decisions on policy pricing, claims processing, and customer service.

Q2. What type of technology is used in the insurance industry?

A2. The insurance industry utilizes a variety of technologies such as cloud computing, big data, analytics, mobile apps, artificial intelligence, blockchain, and the Internet of Things (IoT). These technologies help insurers access large amounts of data which can be used to make decisions quickly and accurately.

Q3. How can technology help insurers reduce costs?

A3. Technology can help insurers reduce their costs in a variety of ways. For example, automation can reduce the amount of time required for administrative tasks, such as claims processing. Additionally, AI and machine learning can be used to detect fraud and anomalies quickly, helping to reduce costs associated with erroneous payments. Lastly, data-driven insights can help insurers identify and manage risks more efficiently, resulting in lower costs.

Conclusion

The insurance industry has embraced technology in a big way, and this has allowed them to provide better customer service and improved efficiency. Technology has allowed them to automate processes, streamline communication, and collect data more accurately. It has also enabled them to target customers more effectively, analyze risk better, and provide more personalized services. As technology continues to evolve, the insurance industry will be better equipped to meet the needs of their customers and reduce costs.