How Technology Is Reshaping The Future Of Insurance?

The insurance industry is undergoing a rapid transformation in the face of technological advances that are reshaping the industry. From advancements in artificial intelligence (AI) and machine learning (ML) to increased data collection and analytics, technology is changing the way insurance is delivered. As a result, insurance companies are finding it difficult to keep up with the ever-changing landscape, making it crucial for them to embrace and invest in technology to remain competitive. By leveraging the power of technology, insurance companies can provide better services, faster claims processing, and improved customer experiences. In addition, technology can help to reduce accidental losses, prevent fraud, and manage risk more effectively. Technology is also helping to drive the development of new insurance products and services, such as usage-based insurance, pay-per-mile insurance, and on-demand insurance, that are changing the way people access and use insurance. As technology continues to evolve, it will continue to reshape the future of insurance and the industry as a whole.

The Benefits of Technology for the Insurance Industry

The insurance industry has been quick to recognize the potential of technology to increase efficiency and lower costs. With the integration of technology, insurance companies can now offer personalized services to their customers that were not previously possible. By leveraging data and analytics, insurance companies can better understand customer needs and provide tailored products that meet their needs. Additionally, the use of automation and AI has allowed insurance companies to streamline processes, reducing costs and improving customer service.

Technology has also opened up the insurance industry to new opportunities. For example, the development of blockchain technology has enabled the development of smart contracts, which can be used to facilitate the automation of insurance processes such as claims handling. Additionally, the use of machine learning and artificial intelligence has enabled insurers to better understand customer behavior and develop predictive models for pricing and risk management.

With the continued development of technology, the insurance industry is in a position to benefit from increased efficiencies and cost savings. In addition, customers have access to more personalized services and insurers have access to new opportunities to better serve their customers and remain competitive in the marketplace. As technology continues to evolve, the insurance industry is likely to continue to reap the benefits.

Adopting AI and Automation to Streamline Insurance Processes

The insurance industry is undergoing a dramatic transformation due to the introduction of artificial intelligence (AI) and automation. AI and automation are rapidly transforming the way insurers interact with their customers and process insurance claims. AI, machine learning, and automation are making it easier for insurers to provide more personalized and efficient services. AI and automation are also enabling insurers to streamline operational processes and reduce costs.

Using AI, insurers can identify patterns in customer behavior and accurately predict their risk profile. This allows insurers to customize their services and provide tailored products to meet the specific needs of their customers. AI-driven automation is also being used to automate insurance processes, reducing the time and effort associated with processing claims and other transactions. Automation is also being used to increase operational efficiency and reduce the cost of operations.

Insurers are also using AI to improve customer engagement and enhance customer experience. AI-driven automation is being used in chatbots to provide customers with real-time advice and help with their inquiries. Insurers are also using AI-driven analytics to gain insights into customer behavior and preferences, enabling them to better understand their customers and offer more personalized products and services.

The introduction of AI and automation is revolutionizing the insurance industry, transforming the way insurers interact with their customers and process claims. By leveraging AI and automation, insurers can gain a competitive edge in the market and improve customer engagement.

Leveraging Big Data to Improve Risk Management

The insurance industry is rapidly integrating technology into its operations to manage risk more efficiently. Big data is one of the key tools that insurers use to improve their risk management processes. Big data is the collection and analysis of large and complex sets of data that can provide insights into customer preferences, patterns, and behaviors. By utilizing predictive analytics and machine learning, insurers can identify potential risks and develop effective strategies to mitigate them. Furthermore, big data can help insurers identify opportunities for growth and cost savings. By leveraging data-driven insights, insurers can tailor their products and services to meet the needs of their customers, streamline their operations, and reduce costs. Big data can also help insurers identify fraud and reduce losses resulting from fraudulent activities. By leveraging big data, insurers can improve their operational efficiency and profitability.

Improving Customer Experience with Digitization

The insurance industry is rapidly evolving with the introduction of technology and digital solutions. Digitization is transforming the customer experience, making it more efficient and personalized. It enables customers to receive services faster and more conveniently, and allows insurers to better manage risk and provide better service. Digitization also enables insurers to better analyze data and use this information to more accurately assess risk and develop tailored policies for customers. AI and machine learning tools are providing insurers with insights into customer behavior and enabling them to better predict risk and offer personalized services. For example, AI-based chatbots can provide customers with automated advice and recommendations, helping them make more informed decisions about their insurance policies. Additionally, digitization is helping to improve customer service, as insurers can now leverage automation tools to simplify customer service tasks, allowing them to focus on more complex customer interactions. With the help of advanced technologies, insurers are able to provide a better customer experience and better manage their risks.

Introducing Innovative Insurance Products and Services

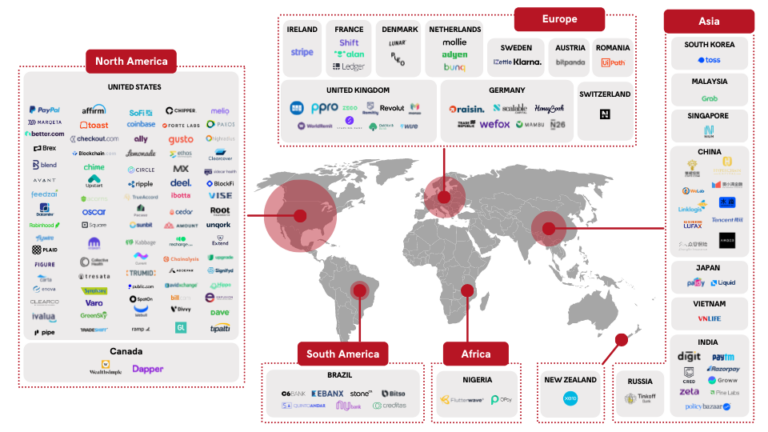

The insurance industry is no stranger to technological advances. As the world becomes increasingly digital, new products and services have emerged that are transforming the insurance industry. From automated underwriting to automated claims processing, technology is playing an increasingly important role in how insurers manage their businesses.

Innovative insurance products and services are being developed to meet the needs of customers in the digital age. Insurers are leveraging analytics and machine learning to offer more customized products and services to their customers. They are also leveraging automation and self-service tools to make the process of shopping for and buying insurance easier and more efficient.

Digital distribution channels are also becoming more popular, enabling customers to purchase insurance products online from the comfort of their own home. Insurers are also leveraging mobile technology to offer customers more convenient access to their policies.

Insurers are also leveraging the power of the internet of things to develop new products and services. Wearable devices, home automation systems, and other connected devices are being used to monitor customer usage and activity and offer real-time feedback and advice to customers.

The insurance industry is in the midst of an exciting transformation. By introducing innovative products and services, insurers are able to meet the changing needs of their customers and create more value for their businesses. Technology is playing an increasingly important role in reshaping the future of insurance and creating a more connected, customer-centric industry.

The Challenges of Adopting Technology in the Insurance Industry

The insurance industry is facing an unprecedented challenge of how to embrace the technological revolution. With the emergence of new technologies, such as artificial intelligence, blockchain, and the Internet of Things, the insurance industry is being transformed. As insurance companies attempt to keep up with the evolving landscape, they are faced with a number of challenges, such as how to implement these technologies into their business models, how to manage the data, and how to manage the cost of these new technologies.

The challenge of implementing these technologies is compounded by the fact that the insurance industry is highly regulated. This means that the adoption of new technologies must be done in a way that complies with all relevant regulations. In addition, the insurance industry has been slow to adopt new technologies due to the complexity of the industry and the long-term nature of the business.

The challenge of managing the data generated from these new technologies is also a major concern for the industry. As the volume of data increases, insurance companies must find effective ways to store and analyze it. This requires a huge investment in data infrastructure and expertise, which can be costly.

Finally, the cost of implementing these technologies is another major challenge for the insurance industry. With the emergence of new technologies, insurance companies must invest in the necessary infrastructure and resources to make the most of these technologies. This can lead to increased costs, which must be managed carefully.

Overall, the insurance industry is facing a number of challenges as it strives to adopt new technologies. From managing the data to compliance and cost, the industry must find ways to overcome these challenges in order to remain competitive in the rapidly changing landscape.

FAQs About the How Technology Is Reshaping The Future Of Insurance?

1. What technologies are being used to reshape the future of insurance?

AI, machine learning, automation, the Internet of Things, and big data are all technologies being used to reshape the future of insurance. These technologies enable insurers to better understand customer needs, automate processes, and provide personalized coverage.

2. How will technology affect the way insurance is sold in the future?

Technology will make insurance more accessible and easier to purchase. Customers will be able to purchase policies and customize coverage online with greater ease and speed. Additionally, insurers will be able to use advanced analytics to gain insights into customer behavior and develop more tailored products.

3. What benefits will technology bring to the insurance industry?

Technology will bring many benefits to the insurance industry. It will enable insurers to reduce costs, increase efficiency, and provide better customer service. Additionally, technology will allow insurers to provide more accurate and personalized coverage to customers, as well as to better manage and mitigate risk.

Conclusion

The future of insurance is changing rapidly with the advent of new technologies. Insurers are now able to gather more detailed information about their customers, enabling them to better assess risk and provide more tailored coverage. Additionally, new technologies such as artificial intelligence and blockchain are being utilized to streamline processes and make it easier for customers to access and manage their policies. As these technologies continue to develop, the insurance industry will be able to offer more efficient and comprehensive coverage for consumers, while also reducing costs and increasing profits.