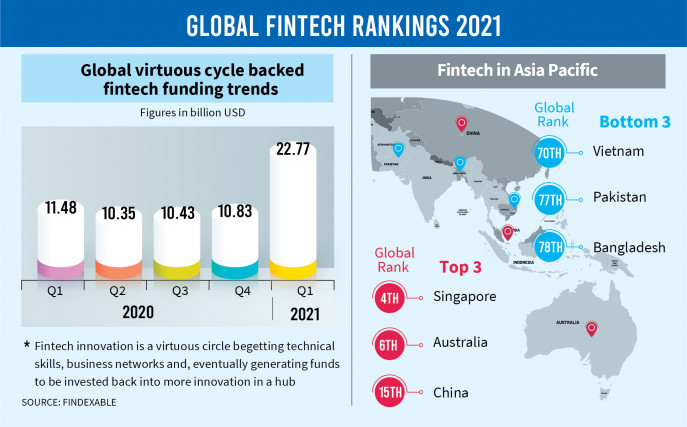

How Many Fintechs Are There In Bangladesh?

Fintechs have become increasingly popular in Bangladesh and around the world. In Bangladesh, Fintechs are playing an important role in driving economic growth, providing innovative financial services, and ultimately improving the lives of citizens. The number of Fintechs in Bangladesh has been increasing steadily since 2015, and as of 2020, there are over 300 Fintechs operating in the country. These Fintechs are providing a range of services such as mobile payments, digital banking, online trading, digital wallets, and more. This indicates the increasing importance of Fintechs in Bangladesh and their potential to create a more inclusive, efficient, and secure financial system.

Overview of Financial Technology in Bangladesh

Bangladesh has seen rapid growth in financial technology (fintech) in recent years. Fintechs are companies that use technology, often in combination with traditional financial services, to provide innovative financial services to consumers. As the Bangladeshi economy has grown, so too has the number of fintechs in the country. According to the Bangladesh Bank, there are currently more than 500 fintechs operating in Bangladesh.

Fintechs in Bangladesh offer a range of services, including mobile banking, payments, insurance, and money transfers. This has enabled millions of people to access financial services without having to go through the traditional banking system. The fintech industry is still in its infancy in Bangladesh, but it is growing quickly. As fintechs continue to innovate and invest in technology, the number of fintechs in the country is expected to continue to increase.

The Bangladeshi government has taken steps to foster the growth of the fintech industry. In 2017, the government established the Bangladesh Fintech Forum to promote the development of fintechs in the country. The forum has helped to create an enabling environment for fintechs by providing resources, guidance, and support. In addition, the government has also implemented regulations to ensure that fintechs operate in a safe and secure manner.

Overall, the fintech industry is poised for growth in Bangladesh in the coming years. With the right government policies, investments, and support, Bangladesh could become a global leader in fintech. The country has the potential to revolutionize the financial services industry and create new opportunities for its citizens.

The Fintech Ecosystem in Bangladesh

Bangladesh’s Fintech ecosystem is an ever-evolving one and the number of Fintechs is growing rapidly. The nation is quickly becoming a hub for financial technology, with more and more companies offering innovative solutions. This is due to the country’s openness to technology and the government’s commitment to creating an enabling environment for the burgeoning sector.

Currently, the total number of fintechs in Bangladesh stands at around 150, with the most popular being digital wallets, payment gateways, microfinance, digital banking, and other financial services. These companies are using advanced technologies such as blockchain, artificial intelligence, machine learning, and big data to provide a range of services, including lending, payments, insurance, and wealth management.

The Bangladesh government has taken numerous initiatives to foster innovation in the fintech sector. It has introduced several regulatory reforms to facilitate the development of the ecosystem, including the Fintech Sandbox, which allows the testing of innovative products and services in a controlled environment. Additionally, the government has launched a range of incentive programs to encourage the growth of the sector, such as tax holidays, capital grants, and access to financing.

In conclusion, Bangladesh’s Fintech ecosystem has grown significantly in recent years and the number of Fintechs is only expected to rise in the near future. With the combination of the government’s initiatives and the innovative solutions provided by Fintechs, the sector is poised for rapid growth.

Regulations and Policies Surrounding Fintechs in Bangladesh

The financial technology (Fintech) industry has been booming in Bangladesh in recent years, with the number of Fintechs in the country steadily increasing. The growth of the sector has been spurred by the country’s supportive regulatory and policy environment, which has enabled the development of innovative technology-driven financial services. In this article, we will explore the regulations and policies surrounding Fintechs in Bangladesh, and how they are driving the sector’s growth.

The Bangladesh Bank, the country’s central bank, has taken a proactive stance towards Fintechs, setting up a separate department to supervise and regulate the sector. The bank has also issued guidelines that provide a framework for Fintechs to operate within. These regulations include rules relating to capital requirements, customer onboarding, risk management, and data privacy.

The government also provides incentives to encourage Fintechs to set up operations in the country. These include tax breaks, reduced fees for setting up a business, and access to funds from venture capital firms. Additionally, the government has set up a Digital Payment Fund to fund research and development projects related to digital payments.

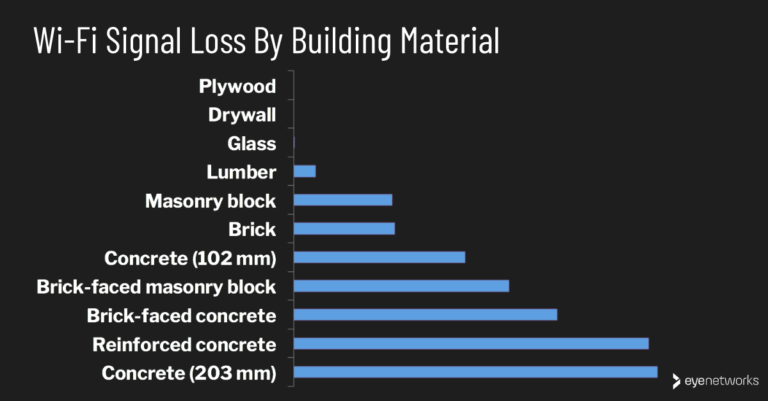

The growth of the Fintech industry in Bangladesh is being further fueled by the country’s booming digital infrastructure. With the availability of high-speed internet and mobile banking services, more people have access to financial services than ever before. This has enabled Fintechs to reach a wider customer base and offer more services to customers.

The regulations and policies surrounding Fintechs in Bangladesh have enabled the industry to flourish, and the sector continues to experience rapid growth. With the government’s continued support and the availability of digital infrastructure, the number of Fintechs in the country is likely to continue to rise in the coming years.

Current Landscape and Market Size of Fintechs in Bangladesh

The fintech industry is booming in Bangladesh, and the country’s market size is estimated to be worth more than $2.6 billion. According to the latest reports, there are over 400 fintech startups operating in Bangladesh, including banks, payment service providers, and digital banking services. This is a significant increase from a few years ago, when the number of fintechs was less than 250.

With the growth of the fintech industry, Bangladesh has become a major hub for fintechs. The country is currently home to a wide range of fintech solutions, such as mobile banking, digital payments, digital credit, and cryptocurrency. Additionally, the fintech industry has seen a surge in investments, with venture capital firms investing more than $1 billion in fintech startups in 2020 alone.

Bangladesh’s government has also taken steps to support and promote the growth of the country’s fintech industry. The government has implemented various initiatives and regulations to ensure that the fintech industry is well regulated and compliant with local laws. Moreover, the government has also set up a dedicated Fintech Hub to facilitate the growth of the industry.

Overall, the fintech industry in Bangladesh is thriving and is expected to continue to grow in the coming years. With the support of the government, the industry is well-positioned to reach its full potential. As more fintechs enter the market, the industry is likely to become even more competitive, offering more advanced and innovative solutions to users.

Trends and Opportunities in Bangladesh’s Fintech Market

Bangladesh is a fast-growing market for financial technology, or fintech, with an estimated number of more than 200 fintechs operating in the country. Fintech companies in Bangladesh are playing an increasingly important role in the financial sector, as they provide innovative solutions to financial problems that traditional banks and financial institutions are not able to address. This article examines the current trends and opportunities in Bangladesh’s fintech market, and how the number of fintechs has been growing over the years.

The fintech sector in Bangladesh has seen significant growth in recent years as more and more entrepreneurs and investors recognize the potential of the sector. Many of these fintechs are focusing on providing digital payments solutions, digital banking, and remittances services. The government has also taken several initiatives to promote the growth of fintechs in the country, making it easier for them to operate and providing incentives for investors.

The number of fintechs in Bangladesh is expected to continue to grow in the coming years, and the sector is becoming increasingly competitive. This presents both opportunities and challenges for the fintechs in the country. On the one hand, the competition will force them to innovate and develop more efficient and effective solutions, while on the other hand, it will also increase the pressure on them to remain profitable.

To stay ahead in the fintech market, companies in Bangladesh need to focus on developing innovative solutions to meet the needs of their customers. They also need to invest in digital infrastructure and ensure that their solutions are secure and compliant with the relevant regulations. Additionally, they must ensure that their services are accessible to all potential customers, regardless of their location or financial status.

In conclusion, the growth of fintechs in Bangladesh is a positive development, as it provides innovative solutions to financial problems and creates new opportunities for entrepreneurs and investors. However, companies must remain competitive and continue to innovate in order to remain successful.

Challenges Facing Fintechs in Bangladesh

Bangladesh is quickly becoming a hub for FinTechs, with many new startups emerging in the market. However, there are several challenges that these startups face in order to gain traction and success. In order to understand the current state of FinTechs in Bangladesh, it is important to take a look at the challenges they are facing.

One of the biggest hurdles for FinTechs is the lack of access to financial services. Many in the country, especially in rural areas, are unable to access bank accounts and other financial services. This creates a barrier for FinTech startups who need to be able to provide services to the people.

Another challenge facing FinTechs in Bangladesh is the lack of regulation. There is a lack of clarity regarding the legal and regulatory framework for FinTechs in the country. This can make it difficult for startups to receive the necessary approvals and licenses, as well as to ensure that they are compliant with the law.

Finally, FinTechs in Bangladesh also face the challenge of limited financial literacy. Many people in the country are not familiar with how to use financial services, which can be a barrier for FinTechs. It is important for them to be able to educate and inform people about their services in order to gain traction and success.

Overall, FinTechs in Bangladesh face a number of challenges. However, with the right regulatory framework in place and the right education, these startups have a great opportunity to succeed in the market. With the right support, FinTechs in Bangladesh can help to improve access to financial services and create a more inclusive financial system.

FAQs About the How Many Fintechs Are There In Bangladesh?

1. What is the total number of fintechs in Bangladesh?

Answer: According to recent reports, there are currently over 100 fintechs operating in Bangladesh.

2. What types of services do Bangladeshi fintechs offer?

Answer: Bangladeshi fintechs offer a wide range of services, including mobile banking, digital payments, digital wallets, digital lending, and insurance services.

3. Are all of the fintechs in Bangladesh regulated by the Bangladesh Bank?

Answer: No, not all fintechs in Bangladesh are regulated by the Bangladesh Bank. Some are regulated by other government bodies, while some operate under their own self-regulatory framework.

Conclusion

In conclusion, there is no exact answer to the question of how many fintechs are there in Bangladesh. While the exact number of fintechs is difficult to determine, Bangladesh’s fintech sector is growing rapidly and is becoming an important part of the country’s economy. With the country’s financial sector becoming increasingly digitalized, the number of fintechs operating in Bangladesh is likely set to increase in the coming years.