How Is IoT Used In Insurance?

The Internet of Things (IoT) has revolutionized many industries, including insurance. IoT devices have enabled insurance companies to reduce costs, improve customer service, and make faster decisions. By leveraging sensors, connected devices, and analytics, insurance companies can collect data on their customers and their activities, helping them to better assess risk and provide more accurate pricing. Additionally, IoT can help insurance companies detect fraud and improve operational efficiency. For example, by using connected devices, insurance companies can monitor customer behavior in real-time and adjust pricing accordingly. Finally, IoT can also be used to automate certain processes, such as claims processing, to further improve operational efficiency. Ultimately, the use of IoT in insurance is enabling insurers to provide better service and better pricing to their customers.

Overview of IoT in Insurance

The Internet of Things (IoT) has revolutionized the way insurance companies operate. IoT has allowed insurers to gain actionable insights into customer behavior and risk exposure, leading to improved underwriting and risk management processes. By connecting and gathering data from millions of sensors, IoT-based systems provide insurance companies with real-time access to data, allowing them to better understand and predict customer behavior.

Insurance companies are using IoT to monitor customer behavior and assess risk more accurately. For example, insurers can use IoT-based sensors to detect driving patterns and identify customers who are more likely to be involved in accidents. This helps them identify high-risk drivers and adjust their premiums accordingly.

IoT-based solutions can also be used to monitor the safety of vehicles and buildings, helping insurers identify potential hazards and prevent losses. Insurance companies can use IoT-based systems to track the movement of goods and detect fraudulent claims. IoT can also be used to monitor the health of customers and predict medical conditions, enabling insurers to provide more accurate health insurance coverage.

IoT-enabled systems have the potential to revolutionize the insurance industry by providing insurers with real-time data and insights. By leveraging the power of IoT, insurers can gain better visibility into customer behavior and risk exposure, leading to improved underwriting and risk management processes.

Benefits of IoT in Insurance

The Internet of Things (IoT) is revolutionizing the insurance industry, allowing insurers to use data to create new products, services, and processes. IoT enables insurers to have a better understanding of their customers’ behaviors, as well as to monitor risk and generate predictive analytics. This is why the insurance sector is investing heavily in IoT technology and solutions, which can help create a more secure, reliable, and cost-effective insurance environment.

The insurance industry can use IoT to manage risk more efficiently, reduce operational costs, and offer more personalized services to customers. IoT can also enable better fraud detection, decrease data breaches, and improve customer experience. By using connected devices, such as wearables and home automation systems, insurers can collect data on customer behavior and habits to provide more accurate risk assessment.

Using IoT, insurers can also offer new products and services, such as pay-as-you-go insurance plans, and they can reduce the time and cost associated with claims management. IoT technology can also help insurers better manage their portfolios and improve customer engagement. With the help of connected devices and sensors, insurers can provide customers with remote access to their insurance policies, as well as the ability to pay premiums and file claims quickly and conveniently.

In short, the use of IoT in the insurance sector can help insurers better manage risk, reduce operational costs, and provide more efficient and personalized services to customers. It can also help insurers offer new products and services, improve customer engagement, and reduce the time and cost associated with claims management.

Challenges of Implementing IoT in Insurance

The Internet of Things (IoT) has been a game-changer for the insurance industry, allowing insurers to collect and analyze data in real-time and make decisions quickly and accurately. While the technology offers many benefits, implementing IoT in insurance is not without its challenges.

One of the main challenges of IoT in insurance is security. With data being collected and transferred from multiple devices, there is a risk of a data breach or unauthorized access. This can be addressed through encryption and other security measures, but it is still a concern for many insurers.

Another challenge is scalability. As the number of connected devices grows, it can be difficult for insurance companies to keep up with the demand. This can be remedied through cloud computing and other technologies, but it is still a major challenge.

Finally, cost is a major challenge for insurers when it comes to IoT. The technology and infrastructure required to implement IoT can be expensive, and insurers must weigh the costs against the potential benefits.

IoT in insurance has the potential to revolutionize the industry, but these challenges must be addressed before it can be fully implemented. Companies must invest in the right technology and infrastructure, as well as develop strong security measures, if they hope to take full advantage of the benefits of IoT in insurance.

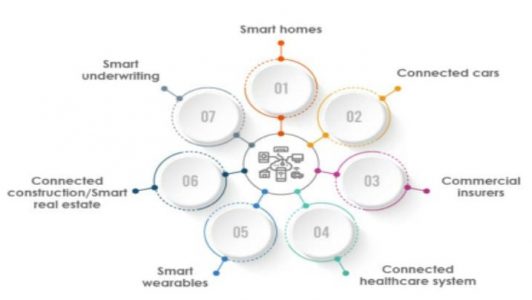

Examples of IoT Used in Insurance

The Internet of Things (IoT) has revolutionized the way we interact with the world around us and it is now being used in the insurance industry as well. IoT is being used to improve insurance services, reduce costs, and increase customer engagement. From wearables and smart home devices to drones and connected cars, there are countless examples of how IoT is being used in the insurance industry.

Wearable devices like fitness trackers and smartwatches are being used to measure factors such as activity levels and heart rate to provide customers with better health and life insurance policies. Smart home devices, such as smoke detectors and home security systems, can alert insurance companies of any potential risk and help them provide better coverage. Drones are being used to inspect damage after a natural disaster or to assess the risk of a potential policy. Connected cars can provide insurers with more accurate data on driving habits, which can help them better price policies.

These are just a few of the ways that IoT is being used in the insurance industry. As the technology continues to advance, the possibilities for how it can be used to improve insurance services will only increase. With IoT, the insurance industry has the potential to become more efficient, more cost effective, and more customer-centric.

Future of IoT in Insurance

The Internet of Things (IoT) is increasingly being used in the insurance industry as insurers look to leverage its power for improved customer experience, better risk management, and cost savings. IoT devices, such as sensors, can be used to collect data on customer behavior, risk exposure, and other relevant information. This data can then be used to create better and more accurate insurance policies, as well as to reduce risk. Additionally, IoT devices can be used to monitor customer behavior, enabling insurers to provide more tailored policies and services.

The potential of IoT in the insurance industry is huge, and its use is only beginning to be realized. IoT can be used to provide more personalized insurance policies, streamline the claims process, and identify fraud faster. It can also be used to monitor customer behavior and provide real-time insights into risks and opportunities. With the help of IoT, insurers can better understand their customers, anticipate their needs, and provide a more personalized and effective customer experience.

The use of IoT in insurance has the potential to revolutionize the industry. By leveraging the power of IoT, insurers can improve customer experience, reduce risk, and drive cost savings. The future of insurance is looking increasingly bright, and IoT will be the driving force behind it.

Conclusion

Insurance is one of the industries that have been most significantly impacted by the advent of the Internet of Things (IoT). Through connected devices, insurance companies are able to offer customers more personalized coverages and better risk management. IoT also helps insurers to reduce costs, improve customer experience, and create new products and services. IoT-enabled insurance products have already been launched and their use is expected to increase in the coming years. By leveraging the data generated by connected devices, insurers will be able to offer more comprehensive and tailored policies, as well as provide customers with better customer service. In short, IoT has enabled insurers to become more efficient, more cost-effective, and better equipped to meet customer needs.

FAQs About the How Is IoT Used In Insurance?

1. What are the benefits of using IoT in the insurance industry?

Answer: The use of IoT technology in the insurance industry offers several benefits, such as improved risk assessment and premium setting, streamlined claims processing, improved customer experience, and enhanced fraud detection.

2. How is data collected and used in IoT-enabled insurance?

Answer: Depending on the type of policy, IoT-enabled insurance can collect data from sensors, wearables, or other connected devices to assess risk, set premiums, and process claims. This data is analyzed to provide insights that can help insurers better understand their customers and make better decisions.

3. What types of insurance can benefit from the use of IoT?

Answer: IoT technology can be used to improve the effectiveness and efficiency of many types of insurance, such as health insurance, life insurance, auto insurance, homeowners insurance, and employee benefits insurance.

Conclusion

The Internet of Things (IoT) has revolutionized the Insurance industry by providing a more efficient, cost-effective way of monitoring and managing risk. IoT enabled insurance companies to monitor customer behavior and gather real-time data which can help them to better assess risk and offer competitive and personalized insurance plans. IoT also enables insurers to quickly respond to customer needs and provide quick claims processing. With the help of IoT, insurance companies can now offer a more reliable and seamless customer experience.