How ICT Is Used In Banking?

Information and communication technology (ICT) has revolutionized the banking industry, providing more secure, convenient, and efficient ways of delivering banking services. ICT is used in banking to improve customer service, enhance security, streamline internal operations, and reduce costs. Banks are now able to offer services such as online banking, mobile banking, automated teller machines (ATMs), and contactless payments. ICT is also used for back-end processes such as risk management, customer relationship management (CRM), and analytics. Banking organizations are able to leverage ICT to better understand customer behavior, offer personalized services, and make more informed decisions. ICT is enabling banks to gain a competitive edge in the market and remain relevant in today’s digital world.

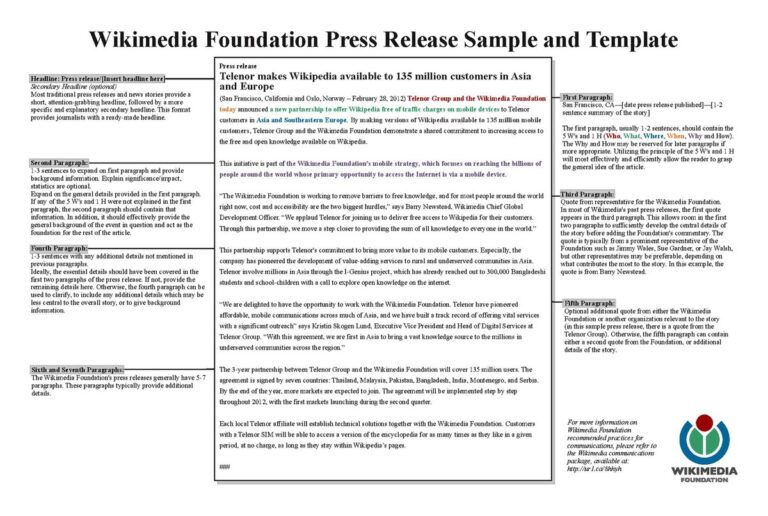

Overview of ICT in Banking

ICT, or Information and Communication Technology, has become an integral part of the banking industry. Banks rely on ICT systems to manage their operations, secure customer data and transactions, and provide customers with digital services. In this article, we will explore how ICT is used in banking, the advantages and disadvantages of ICT, and the future of ICT in banking.

ICT is used in banking to streamline operations, increase efficiency, and enhance customer service. Banks use ICT systems to process payments, manage customer accounts, secure data, and track transactions. For example, automated teller machines (ATMs) allow customers to withdraw money without visiting a physical branch. Banks also use ICT systems to provide customers with digital services such as online banking and mobile banking.

ICT provides many advantages to the banking industry, including cost savings, increased security, and improved customer service. ICT systems reduce the need for manual labor, allowing banks to save money on labor costs. ICT systems also increase security by encrypting customer data and tracking transactions. Finally, ICT systems make it easier for customers to access banking services, improving customer service.

While ICT provides many advantages, there are also some disadvantages. ICT systems require a significant investment of time and money, and they can be difficult to maintain. Additionally, ICT systems are vulnerable to cyber-attacks, making it important for banks to invest in cybersecurity measures.

The future of ICT in banking is promising. Banks are continuing to invest in ICT systems, and new technologies such as blockchain and artificial intelligence are being used to improve operations and enhance customer service. As technology continues to evolve, ICT will continue to play an important role in the banking industry.

Advantages of ICT in Banking

Technology has revolutionized the financial services industry in recent years, and nowhere is this more evident than in the banking sector. Information and Communications Technology (ICT) has improved the efficiency and accuracy of banking processes, revolutionizing the way customers access their accounts, pay bills, and transfer funds. ICT has also enabled banks to introduce innovative products and services and streamline their operations, resulting in increased customer satisfaction and better business outcomes.

One of the major advantages of ICT in banking is that it has made financial transactions more secure and reliable. By introducing advanced encryption and security protocols, banks have been able to protect their customers’ data and transactions from unauthorized access. Furthermore, ICT has enabled banks to offer their customers an array of digital services, such as online banking, mobile banking, and contactless payments. This has improved customer convenience and access to banking services.

Another advantage of ICT in banking is that it has enabled banks to reduce operational costs. By automating various processes and introducing advanced analytics tools, banks have been able to reduce the time and effort required to process transactions. This has enabled banks to offer competitive interest rates and other financial services, resulting in better business outcomes.

Finally, ICT has enabled banks to improve customer experience by introducing customer relationship management (CRM) systems. By using CRM, banks have been able to better understand customer needs and preferences and develop personalized services. This has resulted in increased customer satisfaction and loyalty.

In conclusion, ICT has revolutionized the banking sector by introducing advanced security protocols, digital services, automation, and CRM systems. These technologies have enabled banks to improve their operations, reduce costs, and enhance customer experience. As ICT continues to evolve, it is likely that its impact on banking will become even greater in the future.

Disadvantages of ICT in Banking

In the modern age, Information and Communications Technology (ICT) has become a core component of the banking industry. ICT allows for faster, more efficient and secure banking services, yet there are certain disadvantages associated with its use. These drawbacks include increased security threats, higher operational costs, and the complexity of the systems.

Security threats are one of the primary disadvantages of ICT in banking. Cybercrime and data breaches are major threats and can cause serious financial losses for banks and their customers. ICT also increases operational costs as it requires a large investment in hardware, software, and personnel training. Additionally, the complexity of ICT systems can lead to the development of errors, which can cause delays and disruptions in banking services.

Finally, ICT systems can be vulnerable to human error. A simple typo or a lack of understanding of the system can cause costly mistakes. Furthermore, ICT is not a ‘one-size-fits-all’ solution, so banks need to be aware of the potential limitations and challenges of using ICT in their operations.

Overall, while ICT provides numerous benefits, it also comes with certain drawbacks. Banks need to be aware of the potential risks associated with ICT in order to ensure that their operations remain secure and efficient.

Security Considerations for ICT in Banking

The use of Information and Communications Technologies (ICT) in banking has become increasingly prevalent in recent years, providing convenience and financial efficiency to customers. However, while ICT can provide significant benefits, it also poses a unique set of security concerns for banks and customers alike. In order to maximize the benefits of ICT in banking, it is important to understand the security considerations associated with its use.

One of the primary security concerns associated with ICT in banking is the risk of data breaches. Banks must ensure that customer data is kept secure and protected from unauthorized access. This is especially important given the potential financial and reputational damage that can result from a data breach. Banks should also ensure that their ICT systems are regularly updated to protect against security vulnerabilities.

Another security consideration for ICT in banking is the risk of identity theft. Banks must ensure that customers’ personal information is kept secure and that no one is able to access it without authorization. Banks should also use measures such as two-factor authentication to help protect customer accounts from unauthorized access. Additionally, banks should take steps to prevent phishing attacks, which can be used to gain access to customer accounts.

Finally, banks need to consider the risk of system outages or malfunctions. Banks should ensure that their ICT systems are regularly monitored and maintained to ensure that they are running optimally and that any potential issues can be quickly identified and addressed.

By understanding the security considerations associated with ICT in banking, banks can take steps to ensure that their systems are secure and their customers’ data is protected. This will help to maximize the benefits of ICT in banking and ensure that customers have a safe and secure banking experience.

Examples of ICT in Banking

The banking industry is increasingly relying on Information and Communications Technology (ICT) to improve consumer experience, increase efficiency, and reduce costs. ICT enables the banking industry to improve its services in several ways, from streamlining processes and providing secure transactions to offering customers a more personalized experience.

One example of ICT in banking is the use of mobile banking platforms, which allow customers to access their accounts and perform banking activities such as making payments, transferring funds, and checking their balance from their smartphones. Mobile banking also allows banks to provide customers with additional services like budgeting tools and financial advice.

Another example of ICT in banking is the use of blockchain technology, which is used to securely store customer information and process banking transactions. Blockchain technology provides banks with an immutable and secure ledger, which helps to reduce fraud and improve customer security.

The use of biometric technology is also becoming increasingly common in the banking industry. Banks are using biometric technology to verify customer identities and to secure financial transactions. Biometric technology, such as facial recognition and fingerprint scanning, is also used to improve customer authentication, which helps to reduce fraud and improve the customer experience.

Finally, banks are increasingly relying on artificial intelligence (AI) to improve customer experience and reduce operational costs. AI can be used to automate mundane tasks, such as customer service inquiries, and to provide customers with personalized financial advice.

Overall, the banking industry is using ICT to improve customer experience, reduce operational costs, and ensure the security of customer data. From mobile banking platforms to blockchain technology and artificial intelligence, ICT is transforming the banking industry and helping banks to provide better services to their customers.

Future Outlook for ICT in Banking

The banking sector has been rapidly evolving over the past decade, driven by technological advances in information and communication technology (ICT). Banks are increasingly embracing ICT to improve customer experience and reduce costs. From cloud-based banking solutions to big data analytics, ICT is transforming the financial services landscape. Looking ahead, the future of ICT in banking is likely to be shaped by further advances in technology.

Emerging technologies such as blockchain and artificial intelligence (AI) are expected to revolutionize the banking sector. Blockchain technology has the potential to reduce costs and improve the security of transactions while AI can be used to automate tasks, improve customer experience, and identify fraud. Moreover, banks are also exploring the use of virtual and augmented reality for customer engagement.

In the near future, the use of ICT in banking will be more widespread. Banks are expected to embrace technologies such as cloud computing, mobile applications, and digital payments. By leveraging ICT, banks can provide customers with a more personalized banking experience, improve efficiency, and reduce costs.

Overall, the future of ICT in banking looks bright. With the help of advances in technology, banks can become more competitive and provide better services to customers. However, banks must remain vigilant and ensure that their systems are secure and up to date in order to protect customers’ data. By embracing the potential of ICT, banks can remain at the forefront of the industry.

FAQs About the How ICT Is Used In Banking?

1. What types of ICT are used in banking?

ICT technologies used in banking include software applications such as mobile banking, online banking, and ATMs; databases and data warehouses; security and authentication technologies; and networks and communication systems.

2. How does ICT help banks improve customer service?

ICT helps banks improve customer service by allowing them to provide customers with more convenient and secure services such as online banking, mobile banking, and ATMs. ICT also helps banks improve customer service by allowing them to quickly and accurately process transactions and provide customers with timely information about their accounts.

3. How does ICT help banks increase efficiency?

ICT helps banks increase efficiency by automating many of the processes involved in banking, such as processing transactions and providing customers with account information. ICT also helps banks reduce operational costs by allowing them to better manage their resources and by providing them with access to more accurate data about their customers.

Conclusion

In conclusion, ICT is a powerful tool in the banking industry. It has greatly increased the speed, accuracy, and efficiency of banking processes. It has also enabled banks to offer more services to customers and to better manage their finances. ICT is proving to be a valuable asset for banks in their efforts to remain competitive and provide customers with the best possible services.