How Does Fintech Make Money?

Fintech, or financial technology, is a rapidly growing industry that is revolutionizing the way people access financial products and services. Fintech companies use technology to provide financial services and products to consumers and businesses with greater ease, speed, and efficiency. Fintech is quickly changing the way people manage their money, with new types of online banking, payment processing, and investment services becoming available. Fintech companies make money by charging fees for their services, collecting interest, and through investments in financial markets. Fintech companies have grown significantly over the past few years, and they are now playing a major role in how people manage their finances.

What is Fintech?

Fintech, short for financial technology, is a rapidly emerging field that combines financial services and technology to create innovative solutions that are transforming the financial services industry. Fintech solutions often focus on providing consumers with improved access to financial services, more efficient processes, and more transparency. From online banking to cryptocurrency, the possibilities for financial technology are expanding rapidly. But how does fintech make money?

Fintech companies generally make money by charging fees for their services. This may include transaction fees, subscription fees, or a combination of both. For instance, many fintech companies offer services such as online banking, investments, loans, and payments. All of these services come with fees that are charged to the customer. Additionally, some fintech companies offer services that are supported by advertising, which generates revenue for the company.

Fintech companies can also make money by leveraging the underlying technology they use. For instance, some fintech companies have developed algorithms that allow them to identify financial patterns and trends. This technology can then be sold to financial institutions or used to create new products and services.

Overall, fintech companies make money by charging fees for their services, leveraging their technology, and selling products and services. By providing customers with innovative solutions, fintech companies are transforming the financial services industry.

The Different Types of Fintech Business Models

Fintech is an umbrella term for any tech-driven financial services and products. It describes a whole range of financial services, from digital payments to investments and trading. Fintech companies, or startups, make money through a variety of business models, each of which serves a unique purpose.

Subscription-based services are popular with fintech companies, allowing them to charge customers a regular fee for a set of services. This fee can be a one-off, monthly, or yearly payment. Companies such as Revolut, N26 and Monzo have adopted this model to offer customers access to their services.

Meanwhile, fintech firms may also make money through transaction-based models. This involves charging businesses or customers a fee for using the platform to make payments, transfer money, or purchase products and services. It is a popular model for companies such as PayPal and Stripe, who take a percentage of the transaction as their fee.

Peer-to-peer (P2P) lending is another way fintech startups make money. In this model, borrowers are directly connected to lenders. The fintech company acts as an intermediary, taking a small fee for connecting the two parties. Companies such as LendingTree and Prosper use this model to facilitate loans.

Finally, fintechs may also make money through advertising and referrals. This involves partnering with other companies and receiving a commission for referring customers. Companies such as Acorns and Stash use this model to generate revenue.

All these business models provide a way for fintech companies to make money. As technology continues to develop, new fintech business models are emerging, allowing startups to find innovative ways to monetize their services.

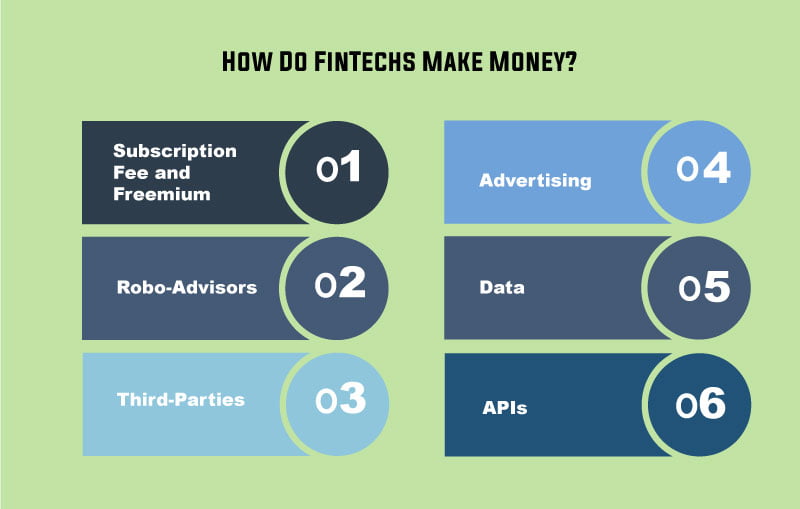

How Do Fintech Companies Make Money?

Fintech companies provide people with the ability to take financial matters into their own hands. They’re making it easier for individuals to save, invest, and manage their money in a variety of ways. But how do these companies make money? To understand this, it’s important to understand the different ways fintech companies make money, which includes subscriptions, transaction fees, advertising, and more.

Subscriptions are a popular way for fintech companies to make money, as users pay a monthly or yearly fee to access certain products and services. Transaction fees are another popular way for fintech companies to make money, as they charge a fee for every transaction that takes place in their system. Advertising is also a common source of income for fintech companies, as they can generate revenue from companies who want to advertise their products or services. Finally, fintech companies can make money from data, by selling information to third-parties or using it to create new products and services.

These are just a few of the ways that fintech companies make money. By understanding the different options available, it’s easy to see how fintech companies can be successful and profitable.

The Challenges Fintech Companies Face

Fintech companies are revolutionizing the way financial services are delivered and consumed, and the industry has seen explosive growth in the last few years. But as the sector matures, many of these companies are now facing a new set of challenges. Fintech companies must not only figure out how to make money, but also how to compete with established financial institutions and remain profitable in the long term.

One major challenge for fintech companies is the need to prove their worth and build trust with customers. While traditional financial institutions have decades of experience in the industry, fintech companies have only been around for a few years. This means that fintech companies must work hard to build trust with customers and demonstrate the value of their products and services.

Another challenge faced by fintech companies is the need to innovate and stay ahead of the competition. Fintech companies must continually develop new products and services that are better than what is offered by traditional financial institutions. This is no easy task and requires fintech companies to be agile and quick to respond to market needs.

Finally, fintech companies must also be aware of the regulatory environment and ensure that they are compliant with local, state, and federal laws. This can be a challenge, as fintech companies are often operating in uncharted waters and must navigate a complex and ever-changing regulatory landscape.

In order to succeed, fintech companies must be able to overcome these challenges and find sustainable ways to make money. This means that fintech companies must be creative, agile, and forward-thinking in order to remain competitive and profitable in the long run.

The Benefits of Fintech for Consumers

Fintech has revolutionized the financial sector and provided a range of benefits to consumers. This new technology offers customers access to more affordable banking and lending services, improved convenience, and greater transparency. It also allows consumers to take control of their finances and make better decisions.

Fintech has opened up the financial market to a wider range of customers, including those who may not have been able to access traditional services. With the use of fintech tools such as mobile banking, peer-to-peer lending, and automated investing, customers can now manage their finances more efficiently.

Fintech makes the financial sector more efficient and cost-effective, which benefits consumers in the form of lower fees and better interest rates. It also allows customers to access a wider range of financial services, such as loan origination, payments, and insurance.

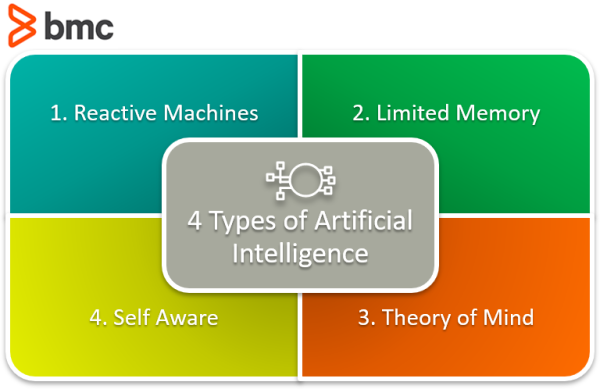

Fintech also helps customers make more informed decisions by providing them with data-driven insights into their financial situation. By leveraging big data and artificial intelligence, fintech companies can offer customers personalized financial advice.

The benefits of fintech to consumers are clear: better services, greater convenience, and improved financial decision-making. Fintech is here to stay, and it is only going to become more widespread in the years to come.

The Future of Fintech

Fintech is a rapidly growing sector of the financial services industry that is revolutionizing the way we manage our money. The technology-driven solutions offered by fintech companies are revolutionizing the way we interact with our finances. As fintech becomes more popular, more businesses are turning to this innovative technology to increase their revenues. But how exactly does fintech make money?

Fintech companies make money by charging fees for the services they provide. These fees can be charged in a variety of ways, from transaction fees to subscription fees. Depending on the business model of the fintech company, these fees can be charged on a one-time basis or as a recurring monthly or yearly fee. Fintech companies can also make money by offering value-added services such as financial advice, financial planning, and investment services.

Fintech companies also make money through partnerships and affiliations. These partnerships allow fintech companies to access new markets and offer their services to more customers. Additionally, these partnerships often create opportunities for fintech companies to receive payments directly from customers, allowing them to increase their revenue.

The future of fintech is bright, with more companies joining the industry each day. The opportunities to make money with fintech are only increasing, as the technology continues to evolve and expand. With the right strategies and partnerships, fintech companies can continue to increase their revenue and expand their reach. The future of fintech is sure to be an exciting one.

FAQs About the How Does Fintech Make Money?

Q1: What is Fintech?

A1: Fintech stands for financial technology, and it is a term used to describe an array of new technologies and services that are used to automate and improve financial services and processes.

Q2: How does Fintech make money?

A2: Fintech companies make money by providing financial services such as payments, loans, investments, and money transfers. They also use data to provide analytics, risk management, and other services to financial institutions.

Q3: What are the benefits of using Fintech?

A3: The benefits of using Fintech include cost savings, improved efficiency, better customer service, and access to new markets. Fintech also increases competition in the financial services industry by providing new and innovative solutions.

Conclusion

In conclusion, Fintech companies are able to make money through a variety of methods. These include charging fees for services, taking a share of profits generated from investments, and providing access to cutting-edge technology. By utilizing these strategies, Fintech companies are able to remain competitive and profitable in the ever-evolving financial landscape. As technology continues to innovate and advance, Fintech companies will continue to expand their services and revenue streams.