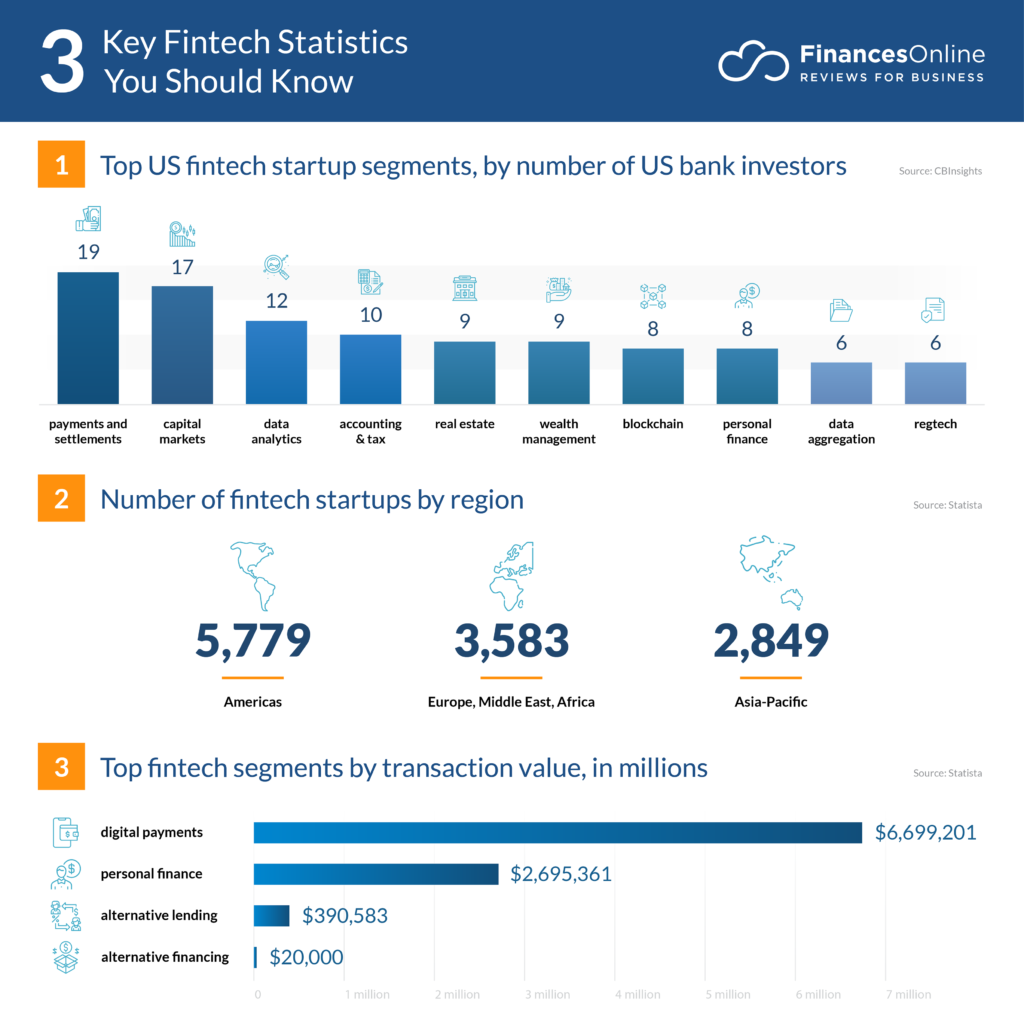

How Big Is The Fintech Sector?

Fintech, or financial technology, is a rapidly growing sector of the financial services industry that uses technology to offer solutions to traditional financial services. It includes digital payments, digital banking, peer-to-peer (P2P) lending, and crowdfunding. Fintech is transforming the financial services landscape by bringing in innovative solutions to solve real-world problems. It is estimated that the fintech sector could be worth up to $4 trillion by 2020. As the industry grows, so does its influence on the global financial services landscape.

Definition of Fintech

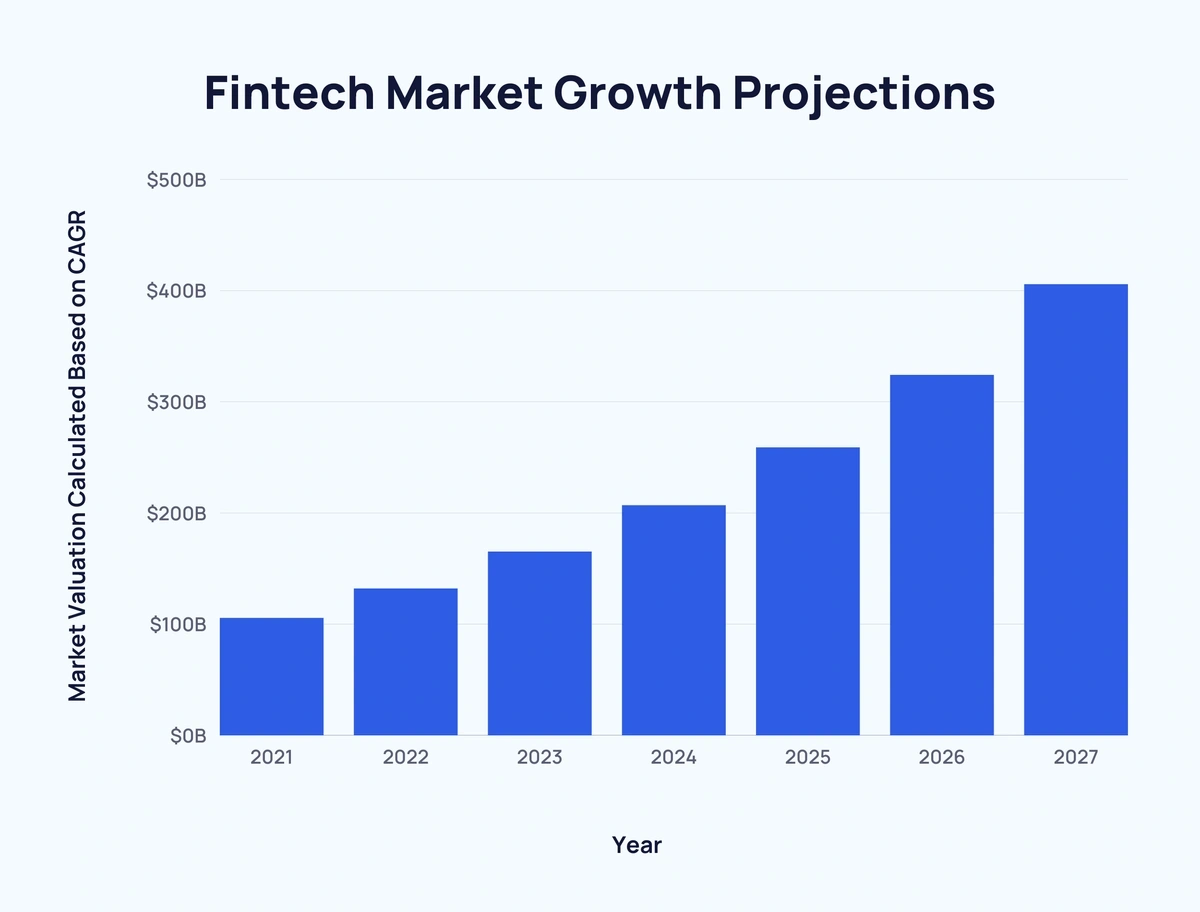

Fintech is a term used to describe the convergence of financial services and technology. It is an umbrella term for a variety of innovative technologies, including artificial intelligence, big data, blockchain, cloud computing, and machine learning, that are transforming the financial services industry. Fintech has revolutionized traditional banking and financial services by enabling digital payments, reducing transaction costs, improving financial literacy, and providing easier access to capital. By utilizing innovative technologies, fintech companies are able to provide financial services to a much larger consumer base than traditional banks and financial institutions. Fintech companies are also able to offer more personalized services that are tailored to the specific needs of their customers. This has allowed them to gain a competitive edge in the market and become one of the fastest growing industries in the world. The fintech sector is rapidly expanding and is estimated to be worth over $309 billion by 2022.

Global Impact of Fintech

The fintech sector is having a major global impact. It is revolutionizing the banking and financial services sectors, making it easier for customers to access financial services, faster and more conveniently. Fintech has been embraced in many countries, with the United States, UK, Canada, and Singapore leading the way. Fintech is also rapidly gaining traction in Europe, Latin America, and Asia.

Fintech has been instrumental in the growth of the global economy, providing access to financial services for individuals and businesses alike. For example, fintech companies have enabled individuals in developing countries to securely send and receive payments, and access other services such as loans and investments. Additionally, businesses have been able to take advantage of the rapid growth of the sector and the emergence of new technologies, such as blockchain, to provide innovative services to their customers.

The growth of the fintech sector has been significant, with the global market estimated to be worth over $309 billion by 2022. This growth is expected to be driven by the increasing demand for digital payment solutions, the growing use of artificial intelligence and machine learning, and the emergence of new technologies such as blockchain.

The global impact of fintech is clear. It has enabled individuals and businesses to access financial services faster and more conveniently, and has created new opportunities for growth and innovation. As the sector continues to expand, there is no doubt that it will continue to have a major impact on the global economy.

Different Types of Fintech

The Fintech sector is huge and rapidly expanding. It is a rapidly growing industry with the potential to revolutionize the way we access, manage and invest our money. It is no wonder that Fintech is now one of the hottest industries in the world. But, what exactly is Fintech?

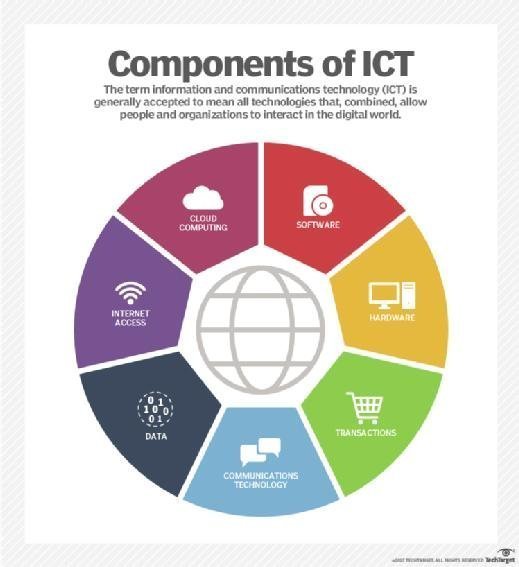

Fintech is a term used to describe the digitalization of financial services. This includes a wide range of services, from mobile payments to digital banking, digital currency and investment platforms. Different types of Fintech can be broken down into three categories: financial services, technology, and infrastructure.

Financial services refer to the products and services offered by banks, credit unions, and investment firms. These include checking accounts, loans, credit cards, and wealth management services. Technology is a broad category and includes things like artificial intelligence, blockchain, and machine learning. Infrastructure refers to the technology that makes it possible for financial services to be delivered securely and reliably, such as cloud computing and data storage solutions.

Fintech is transforming the way we interact with money and the financial sector. Businesses are leveraging new technologies in order to provide faster, more efficient, and more secure financial services. Consumers are now able to access financial services with ease, and businesses are able to offer their customers better experiences.

Fintech is a rapidly growing industry and it is enabling the financial sector to become more accessible and more secure. With the rise of new technologies, the Fintech sector is set to continue to expand and evolve. It is an exciting time for the financial sector and one that will bring many more changes and innovations in the years to come.

Growth of the Fintech Industry

The financial technology (fintech) industry is transforming the way we manage our finances. It’s becoming increasingly popular with more and more people relying on digital tools and solutions to manage their money. But how big is the fintech sector and what does it look like today?

In recent years, the fintech sector has experienced massive growth. According to data from Statista, the global fintech market size is estimated to be worth over $309 billion by the end of 2021. This is a staggering increase from the $127 billion reported in 2017. Moreover, the global fintech market size is expected to reach $1.2 trillion by 2027.

The growth of the fintech sector is being driven by a variety of factors. For instance, the rise of digital banking, the increasing popularity of mobile payment solutions, and the increasing adoption of artificial intelligence (AI) and machine learning (ML) technology in finance are all playing a role. Moreover, the development of new and innovative technologies such as blockchain are also having a positive impact on the industry.

Overall, the fintech sector is growing at an unprecedented rate and it’s showing no signs of slowing down anytime soon. With more and more people relying on digital solutions to manage their finances, the fintech industry is set to continue to grow in the years to come.

Challenges Facing the Fintech Sector

The fintech sector is a rapidly growing industry with tremendous potential, but it is not without its challenges. From regulatory issues to cyber security threats, there are a number of obstacles that must be overcome in order for the sector to reach its full potential.

Regulatory issues are one of the biggest challenges facing the fintech sector. Many countries have complex regulations that make it difficult for fintech companies to operate. In some cases, these regulations might even be contradictory, making it difficult for companies to comply with them. This can be a major obstacle for fintech startups trying to get off the ground.

Another challenge facing the fintech sector is cyber security. With the increasing prevalence of online transactions and data storage, fintech companies must ensure that their systems are secure and that customer data is protected. This can be a difficult task, as hackers are constantly looking for new ways to breach security systems.

The fintech sector is also facing challenges from traditional financial institutions. Banks and other financial institutions are beginning to move into the fintech space, which can put pressure on smaller companies who are trying to compete. This can create an uneven playing field, with larger companies having an advantage over smaller ones.

These are just a few of the challenges facing the fintech sector. Despite these obstacles, the sector is still growing at a rapid pace, and there are many opportunities for companies to succeed. By understanding the challenges and taking steps to mitigate them, fintech companies can continue to grow and thrive.

Future of Fintech

The future of fintech is looking brighter than ever. With the rapid developments in technology, fintech is set to revolutionize the financial services industry in the coming years. Fintech has already had an enormous impact on the banking sector, and it is expected to continue to grow and expand into other financial fields. Fintech companies are creating new opportunities for consumers, allowing them to access financial services and products in innovative ways. In addition, fintech companies are bringing new competitive pressures to the banking industry, forcing traditional banks to respond by improving their own services.

Fintech is also creating new jobs and opportunities for entrepreneurs. As more people become aware of the potential of fintech, developers, engineers, and other professionals are turning to the sector. In addition, fintech is providing access to new financial products and services, empowering consumers and businesses in ways that were not previously possible.

The potential of fintech is vast, and the sector is rapidly expanding. With the right tools, strategies, and investments, fintech companies can become leading players in the financial services industry. As fintech continues to grow, it is important that both consumers and businesses recognize the potential of the sector and embrace the changes that it brings.

FAQs About the How Big Is The Fintech Sector?

1. What is the size of the global fintech sector?

Answer: According to Statista, the global fintech sector is estimated to reach approximately $309.98 billion in 2021.

2. What types of services do fintech companies provide?

Answer: Fintech companies provide a wide range of services including digital banking, mobile payments, peer-to-peer lending, money transfers, financial advice, and more.

3. How is the fintech sector growing?

Answer: The fintech sector is growing rapidly with investments in the sector increasing significantly each year. According to CB Insights, global venture capital investments into fintech companies reached $43.3 billion in 2019, up from $30.9 billion in 2018.

Conclusion

The fintech sector is growing rapidly and is now a major player in the global financial services industry. It is estimated that the global fintech market is worth more than $2.3 trillion and is expected to reach over $4 trillion by 2024. Fintech companies are providing innovative solutions to traditional finance problems, and they are disrupting the way financial services are delivered. Fintech is revolutionizing the finance industry and creating opportunities for new and existing businesses. With growing investments in the sector from both private and public sectors, the fintech sector is set for further growth in the coming years.