Do Banks Use Fintech?

Fintech, or financial technology, is a rapidly growing field that is transforming the way banks and other financial institutions do business. Banks use Fintech to increase efficiency, reduce costs, and offer better services to their customers. Banks are taking advantage of Fintech to streamline processes, automate risk management, improve customer experience, and generate new revenue. Fintech also provides banks with access to innovative technology such as artificial intelligence, machine learning, blockchain, and cybersecurity. Banks are leveraging Fintech to offer new products and services, improve customer service, and remain competitive in the marketplace.

What is Fintech?

Fintech, or Financial Technology, is a broad term used to describe the technology and innovations that are transforming the financial services industry. Fintech includes technologies such as mobile banking, blockchain, artificial intelligence, and machine learning. It has the potential to revolutionize the way the financial industry operates, from the way consumers access financial services to how financial institutions manage risk.

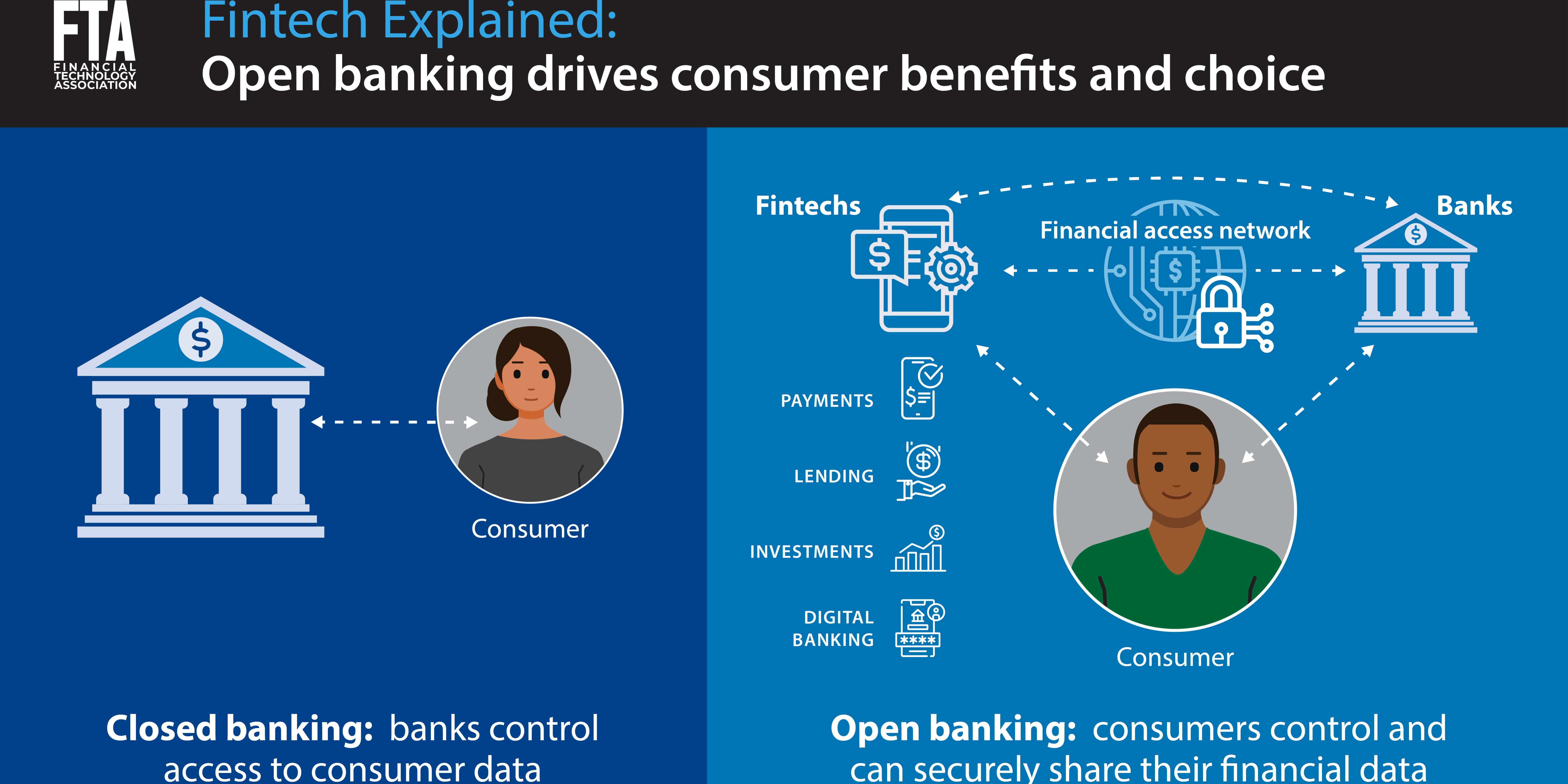

Banks are beginning to use fintech to streamline processes, increase the speed of transactions, reduce costs, and create new products and services. For example, banks are using mobile banking applications to allow customers to access their accounts and make payments securely from their phones. They are also using blockchain to securely store and transfer funds, and artificial intelligence to detect fraud and predict customer needs.

By taking advantage of fintech, banks can gain a competitive edge and provide customers with a more personalized banking experience. Fintech has the potential to revolutionize the way banks do business, and it is clear that the banking industry is embracing the technology to stay ahead of the curve.

How Banks Utilize Fintech

The use of financial technology (fintech) by banks is rapidly on the rise, and it’s not hard to see why. Fintech offers banks a variety of services, from online banking and payments to digital currency and money management. Banks are increasingly embracing fintech to stay competitive in the digital age and to meet customer demands.

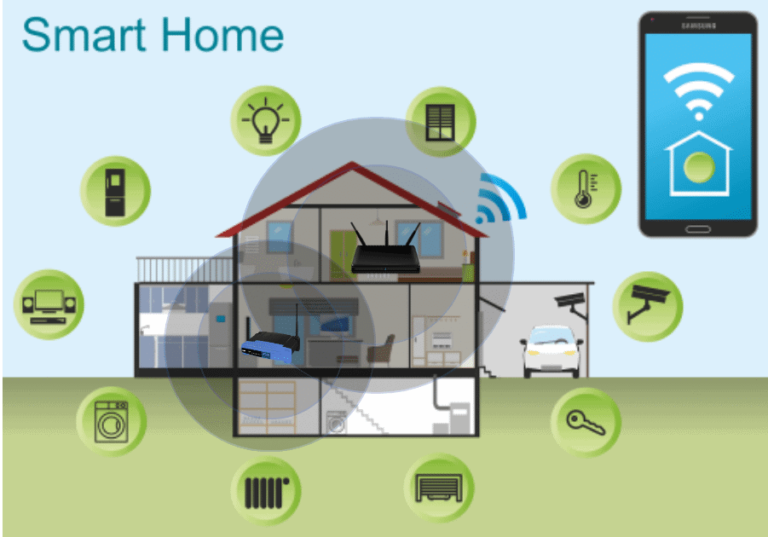

Banks use fintech to create more efficient processes, reduce costs, and provide better services to customers. For instance, they use fintech to provide digital services such as mobile banking, online payments, and digital wallets. Banks also use fintech to automate mundane tasks such as customer onboarding, fraud detection, and risk management. This not only improves efficiency but also reduces the need for manual labor.

Fintech also helps banks to stay ahead of the competition. By using fintech, banks can quickly develop new products and services to meet changing customer needs. They can also use fintech to increase customer engagement and loyalty by providing personalized services.

The use of fintech is also helping banks to become more secure and compliant. Banks are using fintech to reduce fraud and money laundering risks, improve customer data protection, and ensure compliance with regulatory requirements.

Overall, the use of fintech is helping banks to remain competitive, reduce costs, and provide better services to customers. Banks are increasingly embracing fintech to stay ahead of the competition and ensure customer satisfaction.

Benefits of Fintech for Banks

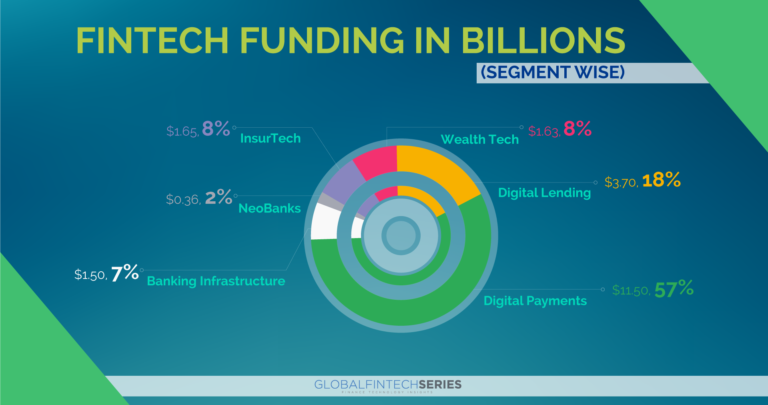

Banks have long been in the business of providing financial services to customers. In recent years, however, fintech has emerged as a new way for banks to provide those services more efficiently and cost-effectively. Fintech is the use of technology to improve financial services, such as banking, payments, investments, and insurance. By utilizing fintech, banks are able to automate processes, deliver better customer service, create new products, and reduce costs.

The benefits of fintech for banks can be seen in terms of customer experience, improved operational efficiency, and cost savings. Banks that use fintech can streamline processes, reduce manual errors, and automate labor-intensive tasks such as loan applications and account opening. This can lead to improved customer service, faster processing times, and lower overall costs. Additionally, banks can use fintech to create new products and services that were previously impossible, such as automated investment advice and digital wallets.

In addition, banks can use fintech to increase security by leveraging biometrics, blockchain, and artificial intelligence. This can help them protect customer data and prevent fraud. Banks can also use fintech to improve customer engagement and loyalty by providing personalized services such as customer segmentation and personalized offers.

Overall, fintech provides banks with a wide range of benefits, from improved customer service and cost savings to increased security and customer engagement. Banks that leverage fintech can gain a competitive edge over those that don’t, and remain ahead of the curve in the ever-evolving financial services industry.

Challenges of Fintech for Banks

Banks have been a cornerstone of modern finance for centuries, and although their role has changed, they still remain the main source of financial services. However, with the rapid advancement of technology, the financial sector is being disrupted by Fintech companies, and banks are facing the challenge of adapting to this new trend. Fintech has the potential to revolutionize the banking sector by introducing new services such as mobile payment systems, online banking, and automated investment services. Banks must embrace these changes if they want to stay competitive.

The main challenge facing banks is how to incorporate Fintech into their existing business models. Banks must evaluate the risks associated with using Fintech and develop strategies to mitigate those risks. Banks must also assess the cost-benefit analysis of investing in Fintech. Additionally, banks must consider how to ensure that their customers are comfortable with the use of Fintech. This requires banks to provide adequate training and support to their customers.

Overall, banks must be willing and able to use Fintech if they want to remain competitive in the financial sector. Banks must understand the risks associated with Fintech and develop strategies to mitigate those risks. Banks must also evaluate the cost-benefit analysis of investing in Fintech, as well as providing adequate training and support to their customers. With the proper approach, banks can effectively leverage the advantages of Fintech while minimizing the risks.

Examples of Banks Using Fintech

As banks and financial institutions continue to look for ways to become more efficient, reduce costs, and improve customer experience, many are turning to fintech to help. Fintech, or financial technology, is a term used to describe the use of technology to provide financial services and products. Banks are using fintech in a variety of ways, from creating mobile banking apps to streamlining the loan application process. Here are some examples of banks using fintech:

1. Mobile Banking Apps: Many banks now offer mobile banking apps, allowing customers to quickly and securely access their accounts from their smartphones. These apps often provide additional services, such as balance transfers, payments, and account alerts.

2. Automated Loan Applications: Banks are now using automated loan applications, which use algorithms to assess a customer’s creditworthiness and make recommendations on loan terms. This helps to reduce processing times and make it easier for customers to get the loans they need.

3. Digital Payments: Banks are also using digital payments technology to provide customers with faster and more secure payment methods. This technology includes digital wallets, mobile banking apps, and contactless payment cards.

4. Investment Advice Tools: Banks are now using tools to provide customers with personalized investment advice. These tools use algorithms to analyze customer data and make personalized investment recommendations.

By leveraging the power of fintech, banks are able to provide better services and products to their customers while also increasing efficiency and reducing costs. Fintech is becoming an increasingly important part of the banking industry, and it is likely that banks will continue to use fintech solutions in the future.

Future of Banks and Fintech

Banks and financial institutions are continuously evolving and adapting to the changing demands of the modern world. With the rise of fintech, both banks and fintech companies are working together to create a better financial system. Banks are leveraging the power of fintech to offer more efficient services to their customers, while fintech companies are providing banks with access to their innovative technologies.

Fintech is transforming the way banks do business. With the help of advanced technologies like AI, machine learning, and blockchain, banks are able to provide more personalized services to their customers. Banks are also able to use fintech to reduce costs, enhance security, and develop more efficient services.

At the same time, fintech companies are providing banks with access to cutting-edge technologies, allowing them to stay competitive in the ever-changing financial landscape. Fintech companies are also providing banks with access to alternative data sources, which can help them make better decisions and understand their customers better.

The future of banks and fintech is bright. Banks are leveraging the power of fintech to provide more efficient services to their customers, while fintech companies are providing banks with access to their innovative technologies. Both banks and fintech companies are working together to create a better financial system.

FAQs About the Do Banks Use Fintech?

Q1. What is Fintech?

A1. Fintech, short for financial technology, is the use of technology to improve financial services and processes. It often involves the use of software, mobile applications, machine learning, and other digital tools to improve the efficiency and accuracy of financial services.

Q2. How Do Banks Use Fintech?

A2. Banks use fintech to provide customers with better, more efficient services. Banks may use fintech to streamline processes, such as loan applications, payments, and money transfers. Banks may also use fintech to offer customers more personalized services, such as investment advice, budgeting tools, and automated savings programs.

Q3. Are Banks Taking Advantage of Fintech?

A3. Yes, banks are increasingly taking advantage of fintech to improve their services. Banks are investing in fintech to make their services more efficient and provide customers with better experiences. Banks are also partnering with fintech companies to develop new products and services, such as artificial intelligence-powered fraud detection systems.

Conclusion

In conclusion, banks are increasingly using fintech to provide customers with more innovative products and services. Fintech is becoming an integral part of the financial services industry, and banks are leveraging this technology to increase efficiency and customer satisfaction. Banks are also investing in fintech startups to gain access to new technology and to expand their services. Fintech offers great potential for banks to provide customers with new and innovative services and to increase their profits.